[orc]The government has published an infographic that makes certain claims about financial inclusion and insurance. Here is a fact check of these claims.

The government has published an infographic that makes certain claims about financial inclusion and insurance. This infographic is published on the 48-months portal of the government. Here is a fact check of these claims.

What is the Jan Dhan Yojana and how is it performing?

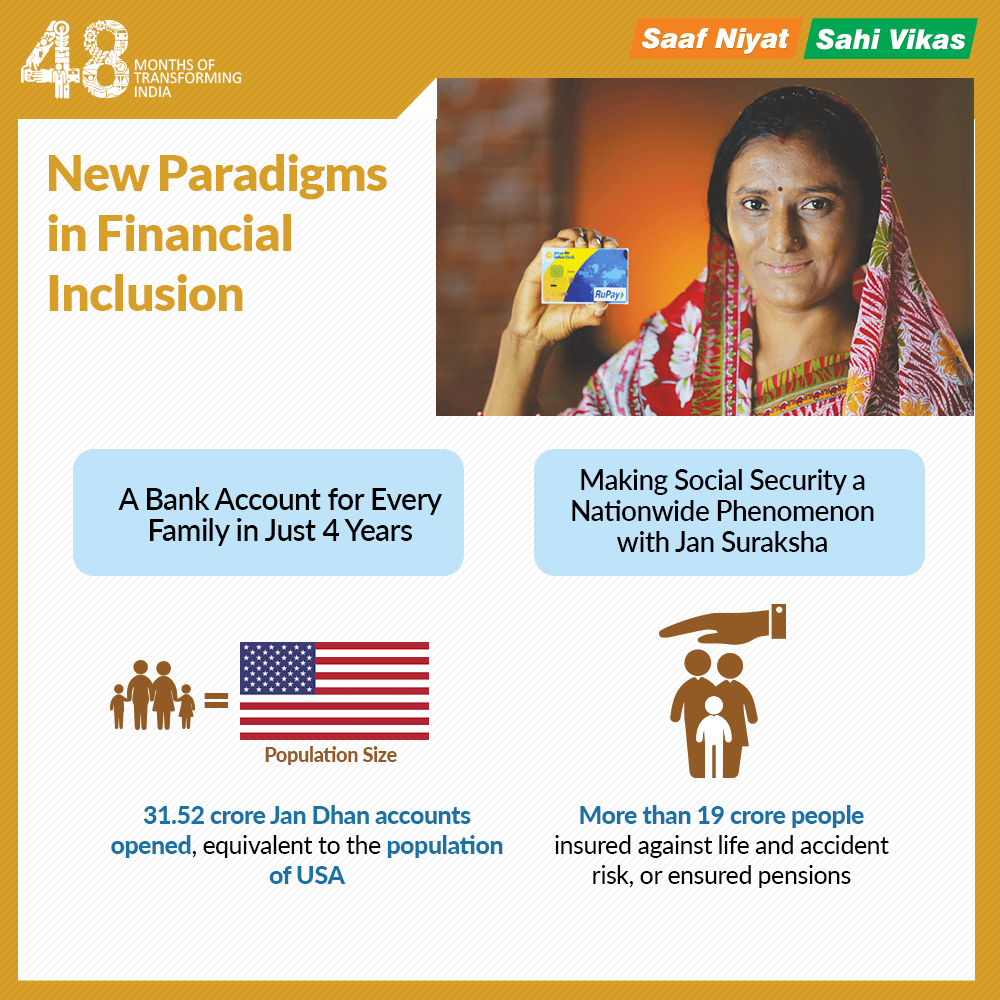

The first claim is that a bank account has been opened for every family in just four years. It also claims that 31.52 crore Jan Dhan accounts have been opened, equivalent to the population of USA.

In an answer provided in the Lok Sabha, the current finance minister mentioned about the PMJDY and how it is different from the earlier financial inclusion schemes. He said, ‘The Pradhan Mantri Jan-Dhan Yojana (PMJDY) envisages universal access to banking facilities with at least one basic banking account for every household, financial literacy, access to credit, insurance and pension. The beneficiaries would get a RuPay Debit Card having inbuilt accident insurance covers of Rs 1 Iakh. In addition, there is a life insurance cover of Rs. 30000 to those people who open their bank accounts for the first time between 15/08/2014 and 26/01/2015 and meet other eligibility conditions of the Yojana. PMJDY is different from the earlier financial inclusion programme (Swabhimaan) as it seeks to provide universal access to banking services across the country and focuses on coverage of all households (both rural and urban) while the earlier Financial Inclusion Programme was limited to provide access point to villages with population greater than 2000. Further, PMJDY focuses on interoperability of accounts which was not there earlier; has simplified KYC guidelines and involves the Districts and States for monitoring and follow-up.’

In the year 2005, the Reserve Bank of India (RBI) has directed banks to make a basic, ‘no-frills’ account available to all the citizens. In the year 2012, the RBI issued detailed guidelines to banks about the Basic savings bank deposit account, which was also a financial inclusion scheme. Information about the number of such accounts is not available in the public domain.

As far as PMJDY is concerned, as per an answer provided by the government in March 2018 in the Lok Sabha, 31.34 crore accounts were opened. As per another answer provided in August 2018, the government mentioned that 32.17 crore accounts have been opened under PMJDY. The government also stated that out of the total accounts, 59% are in rural/semi-urban centers and 53% have been opened by women beneficiaries. As on 29th October 2018, the PMJDY website shows that there are 32.99 crore beneficiaries of the scheme.

According to the Census of India’s population enumeration data collected in 2011, there are 24.7 crore households in India. Hence, the number of bank accounts opened under PMJDY is more than the total number of households (32.99 crore). However, it cannot be verified if every family has a bank account (despite assuming a household as a proxy for a family). The Census Bureau of the United States shows that there were 32.88 crore people in the country as on 28th October 2018.

Claim: A bank account has been created for every family in just four years.

Fact: 32.99 crore accounts have been opened under PMJDY but it is not possible to verify if each & every family has a bank account. Hence, the claim remains UNVERIFIED.

Claim: 31.52 crore Jan Dhan accounts have been opened, equivalent to the population of USA.

Fact: A total of 32.99 crore accounts have been opened under PMJDY till date. The latest population of the USA is 32.88 crores. Hence, the claim is TRUE.

Is social security ensured to all citizens?

The next claim is that social security has been made a nationwide phenomenon with Jan Suraksha. It also claims that more than 19 crore people have been insured against life and accident risk or ensured pension.

As per an answer provided by the government in Lok Sabha, “Three social security schemes were launched in May 2015 pertaining to the Insurance and Pension Sectors namely Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY) and the Atal Pension Yojana (APY) in a move towards creating a universal social security system, targeted especially for the poor and the underprivileged. The schemes provide essential and affordable social protection to all citizens in a convenient manner linked to auto-debit facility from bank accounts. These schemes address the issue of low coverage of life or accident insurance and old age income security in the country.”

PMJJBY was launched in May 2015 and it offers life cover of Rs. 2 lakh to all subscribing bank account holders in the age group of 18 to 50 years, covering death due to any reason, for a premium of Rs.330 per annum per subscriber. The scheme is administered through LIC and other Life Insurance companies willing to offer the product on similar terms. PMJJBY covers death by any cause including suicide and murder. According to the latest progress report on the Jan Suraksha website, a gross enrollment of 5.3 crore has been reported by banks.

Also launched in May 2015, the PMSBY offers a renewable one-year accidental death cum disability cover of Rs. 2 lakh to all subscribing bank account holders in the age group of 18 to 70 years for a premium of Rs.12 per annum per subscriber. The scheme is administered through Public Sector General Insurance Companies (PSGICs) and other General Insurance companies willing to offer the product on similar terms. According to the latest progress report of the scheme, 13.5 crore is the gross enrollment reported by banks.

The Atal Pension Yojana (APY), is focused on all citizens in the unorganized sector, who join the National Pension System (NPS) administered by the Pension Fund Regulatory and Development Authority (PFRDA). Under the APY, the subscribers would receive the fixed minimum pension of Rs. 1000 per month, Rs. 2000 per month, Rs. 3000 per month, Rs. 4000 per month, Rs. 5000 per month, at the age of 60 years, depending on their contributions, which itself would be based on the age of joining the APY. According to an answer provided by the government in the Lok Sabha, nearly 1.08 crore enrolled for APY till July 2018.

Similar to the APY , the NPS or National Pension Scheme was in existence. It was a contribution scheme launched by the Indian government. The NPS was launched in January 2004. The NPS was made open to every Indian citizen between the age of 18 and 60. Further, the UPA government had announced Swavalamban Scheme in the Union Budget 2010-11 to address the longevity risk of poorer sections of the country. Under the Swavalamban, the Government of India shall contribute a sum of Rs. 1,000 to each subscriber account of the New Pension System (NPS) during 2010-11 and the next three years provided the subscriber contributes any amount between Rs. 1,000 to Rs. 12,000 per annum. With the introduction of the APY, the enrolment under Swavalamban has been closed and the eligible subscribers under Swavalamban Scheme are being automatically migrated to the Atal Pension Yojana unless they opt out.

Claim: Social security has been made a nationwide phenomenon with Jan Suraksha

Fact: This is a very subjective claim. However, there have existed similar schemes before 2014 as well. Hence, the claim is MISLEADING.

Claim: More than 19 crore people have been insured against life and accident risk or ensured pension.

Fact: 5.3 crore people under PMJJBY, 13.5 crore under PMSBY and 1.08 crore people under APY have been covered. Hence, the claim is TRUE.

This story is part of a larger series on the 4-years of the Modi government. This series has been made possible with the flash grant of the International Fact Checking Network (IFCN). Read the rest of the stories in this series here.