[orc]The BJP government published an infographic on the 48-months portal that makes claims about the number of houses built in the last four years and the interest subsidy on housing loans. This article is a fact check of the claims.

The BJP government published an infographic on the 48-months portal that makes claims about the number of houses built in the last four years and the interest subsidy on housing loans. This article is a fact check of the claims.

How many houses have been constructed?

The first claim is that 1 crore houses have been built in the last four years of this government.

In response to a question in the Rajya Sabha, the government stated that, ‘To pursue the objective of Housing for All by 2022, the Government approved re- structuring of the erstwhile rural housing scheme Indira Awaas Yojana (IAY) into Pradhan Mantri Awaas Yojana -Gramin (PMAY-G). Under PMAY-G, the beneficiaries are to be selected from Socio Economic and Caste Census (SECC) 2011 list and as verified by the Gram Sabha will get enhanced unit assistance with additional assistance for toilet construction, unskilled wage labour under MGNREGS. Use of locally available construction material, increased availability of rural masons through rural mason training programme for better quality of construction, availability of house design choices etc. are other feature of PMAY-G. Under PMAY-G, it is proposed to construct one crore houses in three years from 2016-17 to 2018-19.’

In response to another question in the Rajya Sabha, the government stated a total of 94.91 lakh houses were built in the rural areas between 2015 and 2018 and 42.93 lakh houses were sanctioned to be built in urban areas during the same period. This makes the total of more than one crore houses. Hence the claim is true.

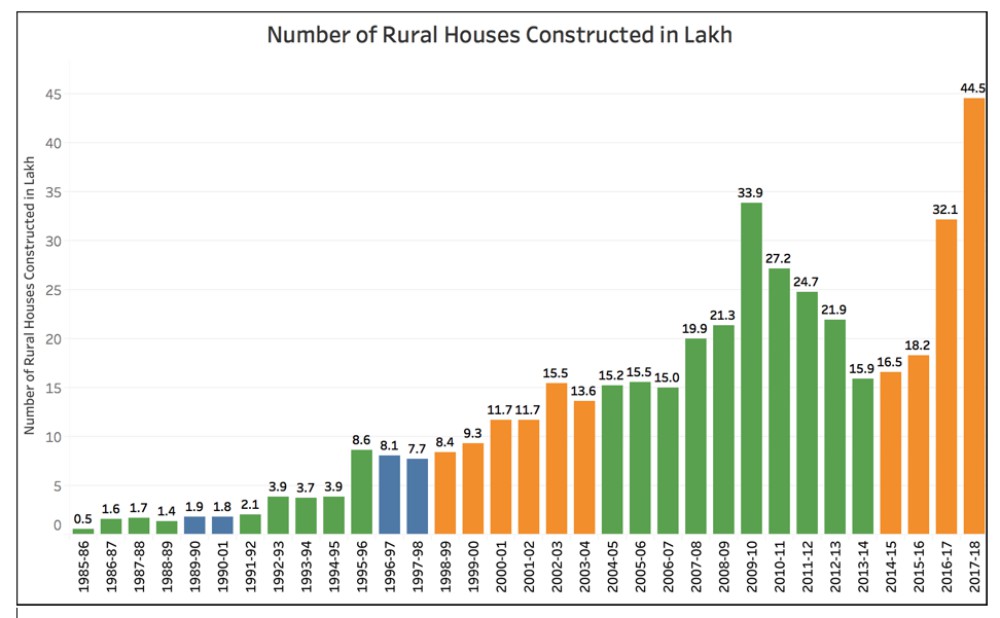

However, it has to be noted that even during the previous government, substantial number of houses were built in the rural areas. Information provided by the government in the Rajya Sabha in 2016, in the Lok Sabha in 2018, CAG report of the year 2014, annual reports of the Ministry of Rural development indicate that substantial number of houses were also built during the previous government.

As per these figures, the UPA government constructed a total of 89.65 lakh houses as part of the IAY in their last four years between 2010-11 & 2013-14. The current government on the other hand constructed a total of 111.44 lakh houses in their first four years between 2014-15 & 2017-18.

Claim: 1 crore houses have been built.

Fact: 94.91 lakh houses were built in the rural areas between 2015 and 2018 and 42.93 lakh houses were sanctioned to be built in urban areas during the same period. Hence, the claim is TRUE. However, it has to be noted that substantial number of houses were also built during the previous government.

What about interest subvention on Housing Loans?

The second claim is that loans up to Rs. 9 lakh and Rs. 12 lakh get interest subvention of 4% and 3% respectively. Interest subvention is a subsidy provided on the interest rate. It simply implies that the borrower need not pay the total interest amount on the money borrowed since part of the interest amount is borne by the government.

Interest subvention on housing loans is not a new initiative. The UPA-2 government announced & implemented a scheme of 1% interest subvention on Housing Loan up to Rs. 10 lakh with cost of the housing unit not exceeding Rs. 20 Lakh in 2009-10. This scheme was implemented through Scheduled Commercial banks (SCBs) and Housing Finance Companies (HFCs).

The scheme was extended for 2011-12 with an increase in housing loan limit up to Rs. 15 Lakh (from earlier limit of 10 Lakh) and the unit cost of house up to Rs. 25 Lakh (from earlier limit of 20 lakh). The scheme was further extended for 2012-13.

To improve the affordability of housing loans to Economically Weaker Section (EWS)/Lower Income Group (LIG) segments in urban areas, Ministry of Housing and Urban Poverty Alleviation (MHUPA), implemented Interest Subsidy Scheme for Housing the Urban Poor (ISHUP) in December 2008 to provide home loan to EWS/LIG persons for construction of house. The Scheme provided a subsidy of 5% for a loan amount up to Rs. 1 lakh for the entire tenure of loan on an upfront basis. The scheme had closed in September 2013. This scheme was renamed in 2013 as Rajiv Rinn Yojana (RRY) and under RRY, the amount of loan has been revised up to Rs. 5 lakh for EWS and Rs. 8 lakh for LIG beneficiaries. However, the interest subsidy was made available for a maximum of Rs. 5 lakh for both categories of beneficiaries.

As per the website of the Ministry of Housing and Urban Affairs, the current government is implementing a demand side intervention known as the Credit Linked Subsidy Scheme (CLSS) under the Pradhan Mantri Awas Yojana (PMAY). Under the CLSS, the interest subsidy will be credited upfront to the loan account of beneficiaries resulting in reduced effective housing loan and EMIs. The Net Present Value (NPV) of the interest subsidy will be calculated at a discount rate of 9 %.

Under the CLSS, there are two different provisions for the EWS/LIG group and the MIG (Middle Income Group). Beneficiaries of the EWS/LIG would be eligible for an interest subsidy at the rate of 6.5% for a tenure of 20 years or during tenure of loan whichever is lower.

The newly launched CLSS for MIG covers two income segments in the MIG, that is Rs.6,00,001 to Rs.12,00,000 (MIG-I) and Rs.12,00,001 to Rs.18,00,000 (MIG-II) per annum. In the MIG-I, an interest subsidy of 4% is provided for loan amounts up to Rs. 9 lakh while in MIG-II, an interest subsidy of 3% is provided for loan amount of Rs. 12 lakh. Housing loans above Rs. 9 lakh and Rs. 12 lakh will be at non-subsidized rates.

Claim: Loans up to Rs. 9 lakh and Rs. 12 lakh get interest subvention of 4% and 3%.

Fact: Under the newly launched Credit Linked Subsidy Scheme (CLSS) for the Middle Income Group (MIG), in the MIG-I (income segment Rs.6,00,001 to Rs.12,00,000), an interest subsidy of 4% is provided for loan amounts up to Rs. 9 lakh while in MIG-II (income segment Rs.12,00,001 to Rs.18,00,000), an interest subsidy of 3% is provided for loan amount of Rs.12 lakh. Hence, the claim is TRUE. However, interest subvention as an initiative is now new and has been implemented during the UPA as well.

This story is part of a larger series on the 4-years of the Modi government. This series has been made possible with the flash grant of the International Fact Checking Network (IFCN). Read the rest of the stories in this series here