During her budget speech for 2020-21, the finance minister made multiple claims related to reduced corporate tax rate & export of medical equipment. Here is a series that fact checks these claims.

The Budget Speech, delivered by Finance Minister Nirmala Sitharaman, while presenting the Union Budget for the year 2020-21 presents a summary of major achievements and future plans of the government. Here’s a fact-check of the claims relating to the corporate tax rate & export of medical equipment. Part-1 of this fact-check series can be read here.

India’s Corporate Tax Rate

Claim (Point 113): Historic decision of reducing the corporate tax rate for new companies in the manufacturing sector to an unprecedented level of 15%. Similarly, for the existing companies, the rate has also been brought down to just 22%. As a result, India’s corporate tax rates are now amongst the lowest in the world.

Fact: It is TRUE that the new corporate tax rate is among the lowest in Asia. However, India does not find a place in the top-20 countries with the lowest corporate tax rates.

The claim of India’s tax rate now being amongst the lowest is the world has drawn significant attention. While some sources have concluded it to be amongst the world’s lowest tax rate, others have concluded that it is amongst Asia’s lowest tax rate.

A variety of organisations like KPMG, Deloitte, E&Y, and others, provide an overview of corporate taxes around the world. Let’s look at Tax Foundation’s recent publication titled ‘Corporate tax rates around the world, 2019’, which draws from various sources including KPMG, Deloitte, and OECD, amongst others. The report provides a database of corporate tax rate trends around the world from 1980-2019. The foundation has published a similar ranking exercise in the previous years.

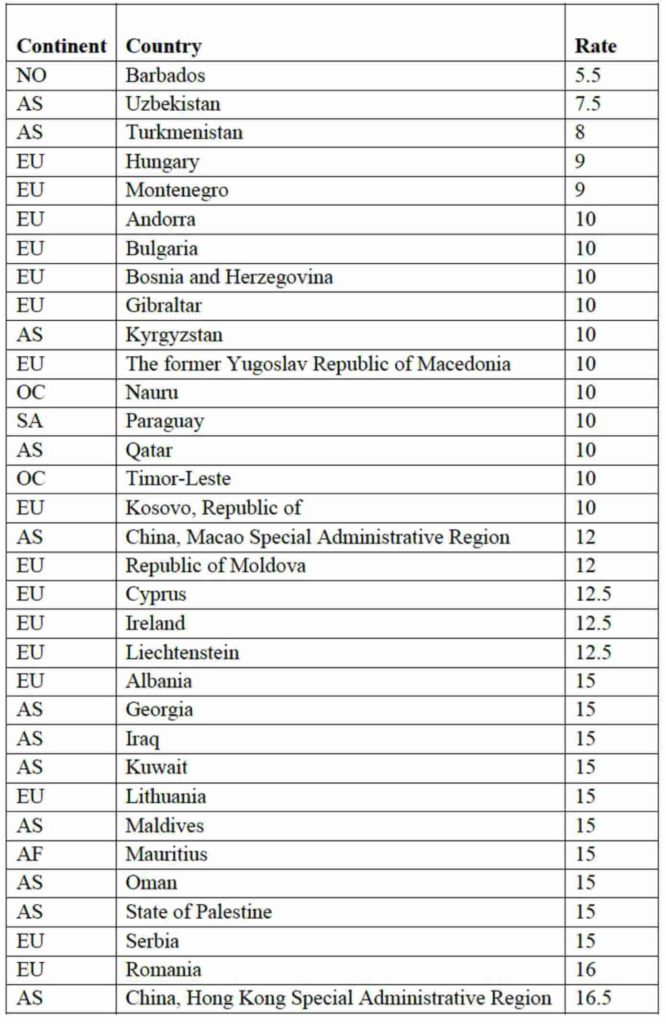

According to the report, Europe has the lowest regional average statuary corporate tax rate at 20.27%, while Asia’s average stands second at 21.32%. In the list of 20 countries with the lowest statuary corporate tax rate around the world, there are 12 European countries and 5 Asian countries amongst others. The highest statuary tax rate in this top-20 list stands at 12.5%. India’s new corporate tax rate at 15% would not place India in the list of top 20 countries with lowest statuary corporate tax rates.

Let’s check the database to understand where can India be placed given the recent change in its corporate tax rate. Based on the trends for 2019, here is a list of countries with corporate tax rates up to 15 % arranged in ascending order of their statuary corporate tax rates (excluding jurisdictions with zero percent tax rate).

- If India’s new tax regime is to be incorporated in the table, it would make its place after Liechtenstein (last entry in the top 20 countries with lowest statuary corporate tax rates).

- If we take the case of Asian countries in the top 20 list, India new tax regime would certainly place it amongst one of Asia’s lowest corporate tax rates.

- The government in response to a question in the Lok Sabha mentioned that the India’s new corporate tax rate is lower than most ASEAN countries.

Impact of Make in India on Medical Equipment Exports

Claim (Point 140): Policy of Make in India has started giving dividends. India is now making world class goods and exporting such products. We have made considerable progress in medical equipment too. Till few years back we were dependent on imports for medical equipment. Now, not only we are manufacturing medical equipment but also exporting them in large quantities.

Fact: The claim is TRUE to the extent that India is now exporting medical equipment in large quantities (given the growth during 2018-19). However, the claim is partly MISLEADING as India’s dependence on imports of medical equipment has also increased instead of coming down in the backdrop of Make in India scheme.

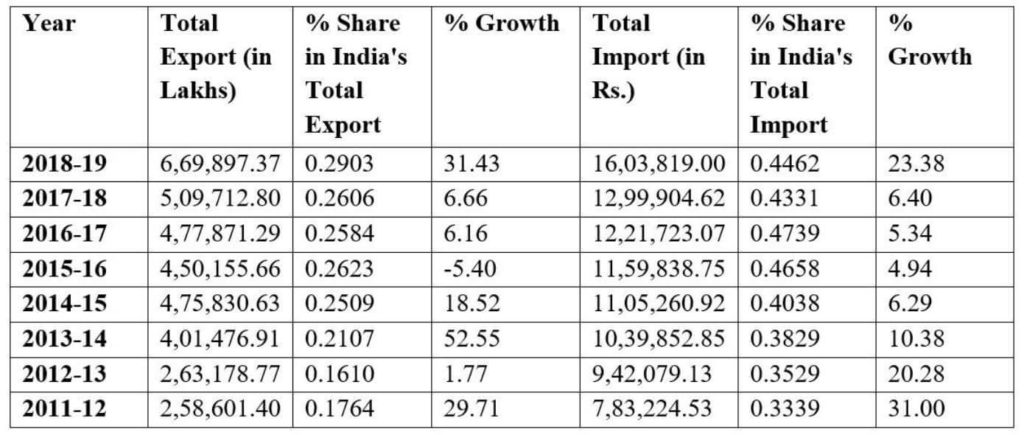

In order to gain a comprehensive understanding of the export-import scenario of medical equipment in India, let’s look at the database maintained by Ministry of Commerce and Industry. The claim is that, with the advent of Make in India policy, the country has become less dependent on imports for medical equipment and the export of medical equipment has increased significantly.

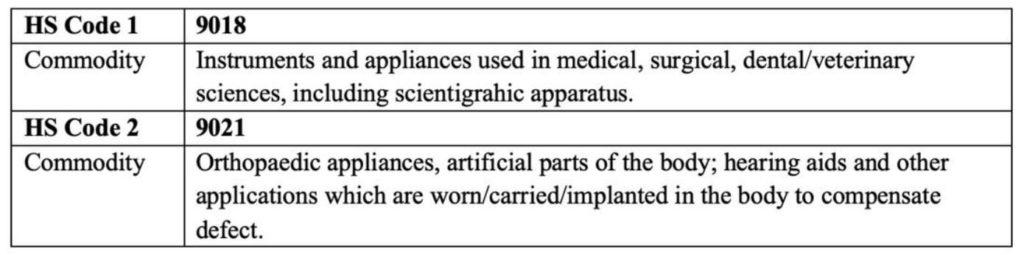

In order to gain a comprehensive view, data from two HS (Harmonised System) codes related to medical equipment have been collated. Data for imports & exports of medical equipment related to these two HS codes is considered for analysis.

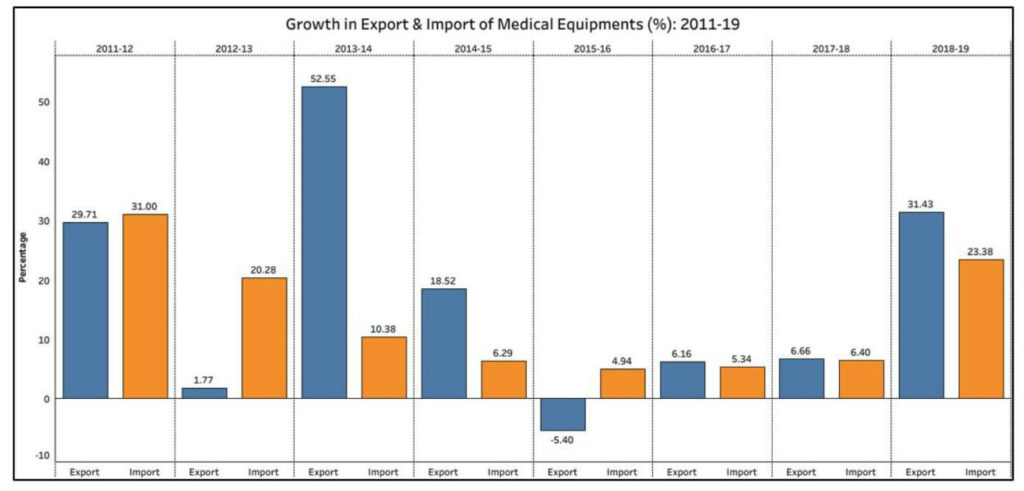

The patterns of export and import of medical equipment from 2010 to 2019 reveals that there has been a jump in the share of India’s export of medical equipment as well as import of medical equipment during 2018-19. In the previous years as well, the export and imports have shown significant growth. While the claim is true to the extent that India is now exporting medical equipment in large quantities, the growth in both the export and import of medical equipment during 2018-19 onwards render the claim misleading. India’s dependence on imports of medical equipment has also increased instead of coming down in the backdrop of Make in India.

Featured Image: Finance Minister Budget Speech Claims