The finance minister during the course of the budget speech for 2020-21 made claims about the FDI inflows during 2014-19 and compared that with the previous 5-year term. How true are these claims?

Union Finance Minister, Nirmala Seetharaman presented the Union Budget on 01 February 2020, and as part of her speech enlisted several achievements and policies of the government.

Factly has earlier done a deep dive of few of these claims made in the speech. In this story we look at claims made about FDI flows.

The increase in FDI

Claim: India’s foreign direct investment (FDI) increased to the level of US$ 284 billion during 2014- 19 from US$ 190 billion that came in during the years 2009-14.

Fact : The absolute numbers quoted by FM are TRUE. However they do not provide the holistic picture as the rate of growth of FDI inflows has come down. Further, Net FDI has also reduced due to increase in Investments leaving the country.

In her speech, the Finance Minister stated that FDI into India during the five-year period of 2014-19 was US$ 284 billion. Prior to that, India received US$ 190 billion during the five-year period 2009-14. The five-year period of 2014-19 is the first term of the Modi led BJP government.

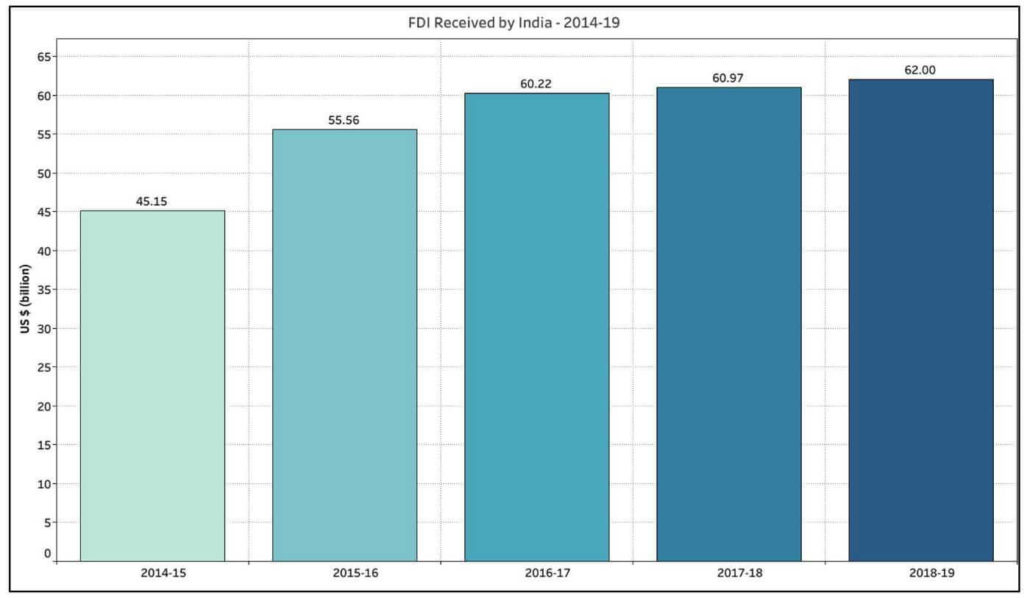

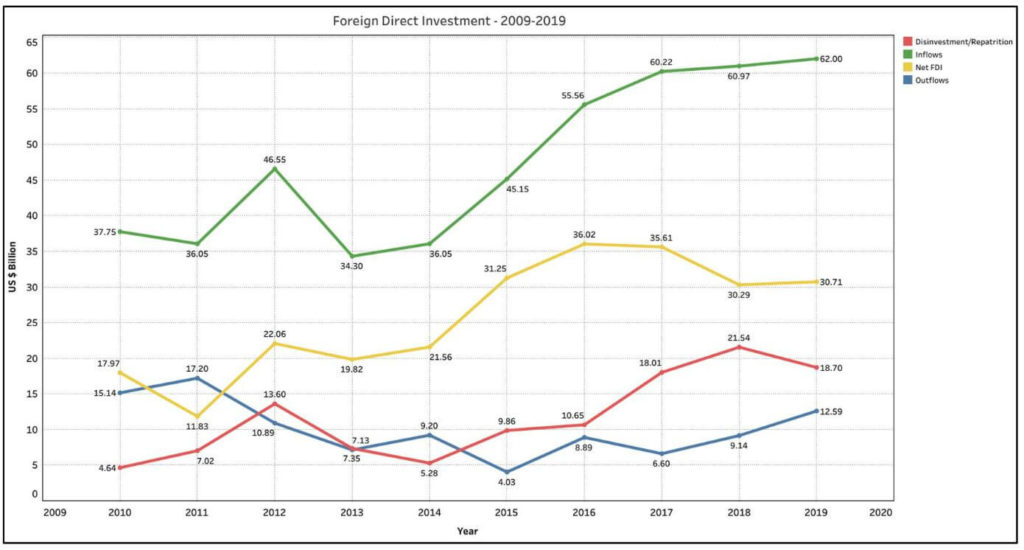

The Reserve Bank of India’s (RBI) yearly report ‘Handbook of Statistics on Indian Economy’, provides the details of FDI every year. As per the data in this report, approximately US $ 284 billion was the FDI into India during the five- year period 2014-19. There has been a yearly increase in the FDI inflow for every fiscal year during this period. The biggest increase during the period, was in 2015-16 when FDI inflows increased by nearly 10 billion dollars. The yearly increase has been lower in subsequent years.

What about 2009-14?

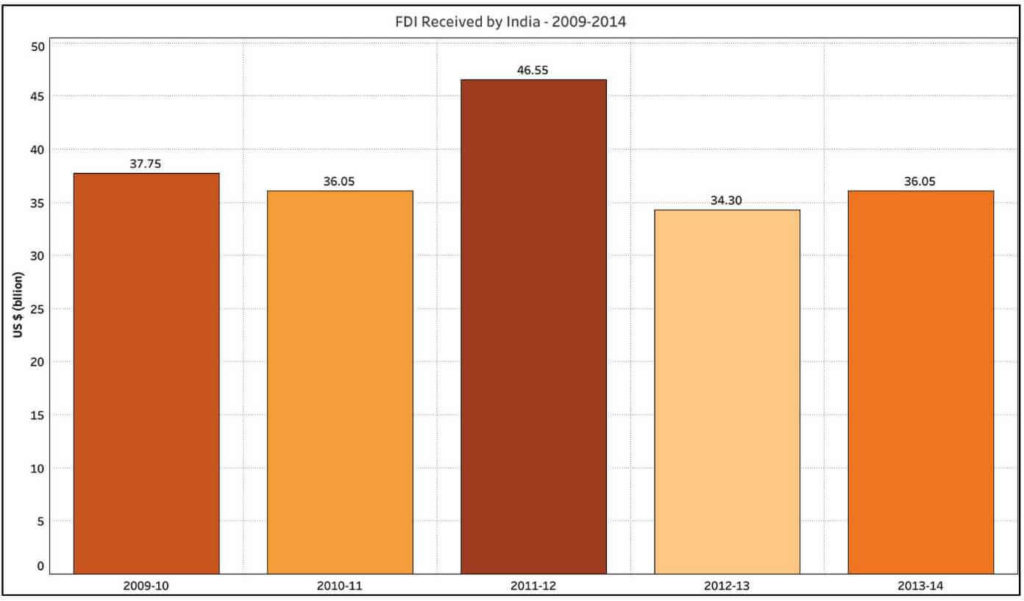

The total FDI inflows during the five-year period of 2009-14, the UPA’s 2nd term, was US $ 190 billion which matches with the number quoted by the Finance minister in the budget speech.

During these five years, 2011-12 stands out in terms of FDI inflows with US $ 46.55 billion, an increase of over US $ 10 billion compared to the previous year. However, there was a sharp decline of over US $ 12 billion in the following year 2012-13 with a slight increase in the next year.

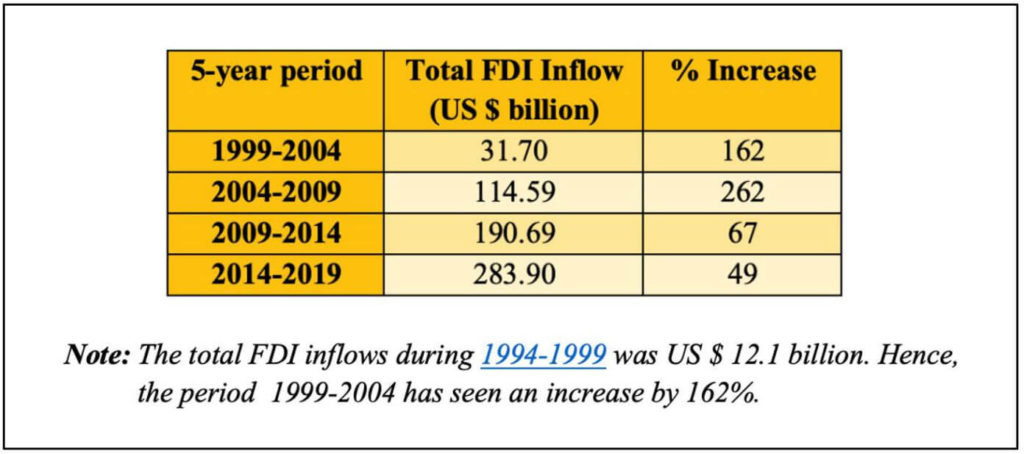

The total FDI inflows i.e. receipts into India has grown from US $ 190 billion during UPA’s second term (2009-14) to US $ 284 billion during the current government’s first term i.e. an increase by 49 %. So, this statement is true to the extent of these numbers.

Has the FDI growth rate increased?

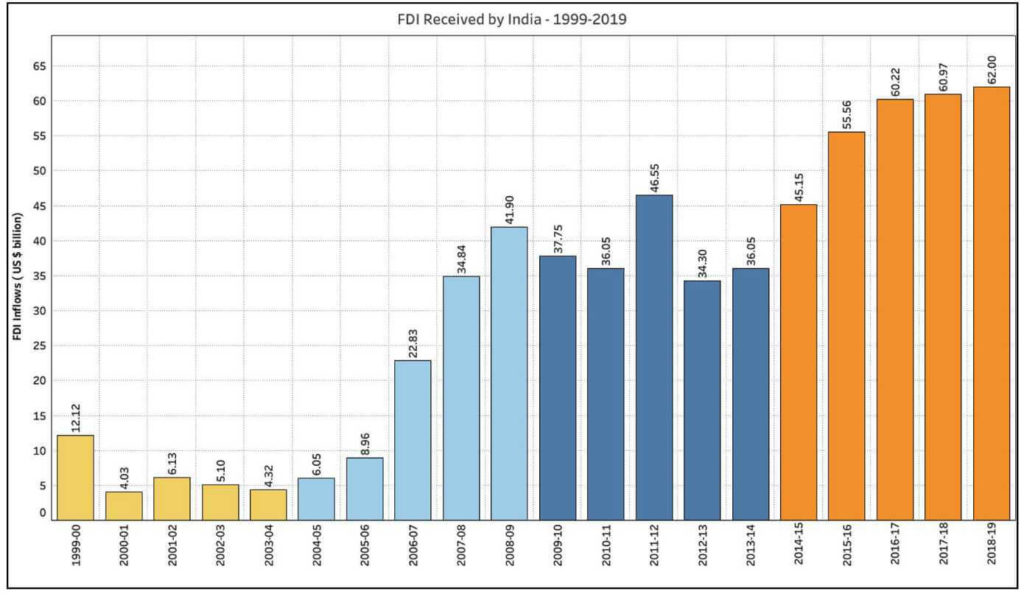

However, what one also needs to look at is the rate of growth and if the 49% growth achieved during the Modi government’s first term is substantially higher than the rate of growth achieved by previous governments.

During UPA’s 1st term i.e. from 2004-09, the total FDI inflows into India were approximately US $ 114 billion. This means that there was an increase in FDI inflows by 67% during UPA- II when the inflows were US$ 190 billion between 2009-14.

During the period 2004-2009, there has be an exponential increase in the FDI inflows in the year 2006-07. During this year, FDI worth US $22.8 billion flowed into India compared to the two years before that where it was only around US $ 6 billion and US $ 9 billion respectively. The exponential increase continued in the final two years of UPA-I’s tenure.

During the period 1999-2004, where NDA government was at the Centre under the leadership of Vajpayee, the FDI inflows were around US $ 31.6 billion, of which US $ 12 billion were during the first year i.e. 1999-2000, with the FDI inflows tapering off during the reminder of the tenure. When compared to this period, the FDI inflows during UPA–I (2004-09) increased by 262%.

Even though in terms of absolute numbers, FDI inflows for the period 2014-19 is higher than that of the earlier five-year period of 2009-14, the rate of growth of FDI inflows is less than the two earlier terms.

While this is the case in terms of FDI growth, it also has to be noted that amount of FDI inflows also depend largely on the FDI policy and opening up of more sectors.

Net FDI indicates a negative trend

The FDI inflows are only one side of the overall FDI picture. FDI inflows are the FDI that are made in India by foreign investors. Apart from this, there is also scope for investments leaving the country i.e. FDI Outflow. Apart from this there is also Disinvestment/repatriation of the funds that were invested earlier in India. Hence, the Net FDI provides a more holistic picture of the state of FDI than just the FDI inflow numbers.

In the recent years, the net FDI has shown a negative growth especially with an increase in the FDI outflows as well as disinvestment/repatriation amount.

FDI Outflows during the period of 2009-14 was US $ 59 billion, while the outflows during the period 2014-19 is lesser i.e. US $ 41.25 billion. However, it needs to be noted that a major part of the FDI outflows during 2009-14 were during the first two years. On the other hand, FDI outflows have being increasing year on year during the period 2014-19. In 2014-15, FDI outflows were US $ 4 billion and increased incrementally every year to reach US $ 13 billion in 2018-19. Reasons for FDI outflows could be varied like better investment opportunities in other countries.

Meanwhile, the amount being disinvested/repatriated has more than doubled during the five-year period 2014-19. During 2009-14, The total amount that left India due to disinvestment/repatriation was around US $ 38 billion, which increased to US $ 79 billion for the period 2014-19. Apart from a slight dip in 2018-19, there has been a consistent incremental increase over the five years in the case of disinvestment/repatriation.

This increase in FDI Outflows and Disinvestment/repatriation has affected the net FDI as seen in the chart below.

Hence, even though the higher FDI inflow as quoted by the finance minister for the five-year period 2014-19 is true, the rate of growth is lower when compared to the earlier period. Furthermore, when the whole FDI scenario including outflows and disinvestment is taken into context, the FDI situation does not indicate a positive increasing trend.