The National Anti-Profiteering Authority was set up to ensure that the benefits of GST rate cut are passed on to the customers in the form of reduction in prices by various businesses. But what is this authority and what has it done so far?

In an order passed on 12 March 2020, The National Anti-Profiteering Authority has directed Patanjali Ayurveda Ltd. to pay up Rs.75.08 crores for not passing the benefit of reduced Goods & Services Tax (GST) rates to its customers. As per this order, the company is required to deposit the amount along with 18% GST into the consumer welfare funds of the Centre & States, within a period of three months.

So, what is the purpose of National Anti-Profiteering Authority (NAA) and what is their jurisdiction? Here is a detailed explainer. We also look at few prominent orders issued by the NAA.

NAA constituted to ensure GST benefits are passed onto customers

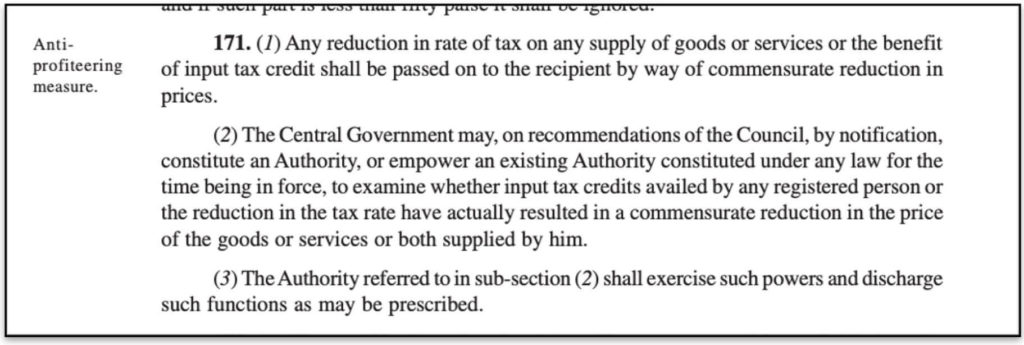

The NAA was established under Section 171 of the Central Goods and Services Tax Act, 2017. As per the provisions, any reduction of GST rates or the benefit of input tax credit needs to be passed on to the customers in the form of reduction in prices. The wilful action of not passing the benefits to the recipients is considered as profiteering.

The idea of setting up NAA, is to oversee and ensure that the registered persons transfer the benefits to the final recipients.

On 16 November, 2017, the Union Cabinet has approved the creation of the posts of Chairman & Technical members of NAA under GST. This was done in the backdrop of the reduction in the GST rates across multiple items in November, post the introduction of GST in July’2017.

From the midnight of 14 November 2017, the GST rates of around 178 items were reduced from 28% to 18%. Many other goods had the rates reduced from 18% to 12%, while few others were completely exempted. The NAA was thus constituted to ensure that the consumers benefit from this sharp fall in GST rates.

NAA is authorized to take action against the violators

The National Anti-Profiteering Authority (NAA) comprises of a five-member committee. This includes a Chairman and four technical Members.

- Chairman – is equivalent to a rank of secretary in the government

- Technical Members – Current/former commissioners of State tax or Central Tax departments

- Secretary to NAA – The Additional Director General of Safeguards under the Central Board of Indirect Taxes and Customs (CBEC)

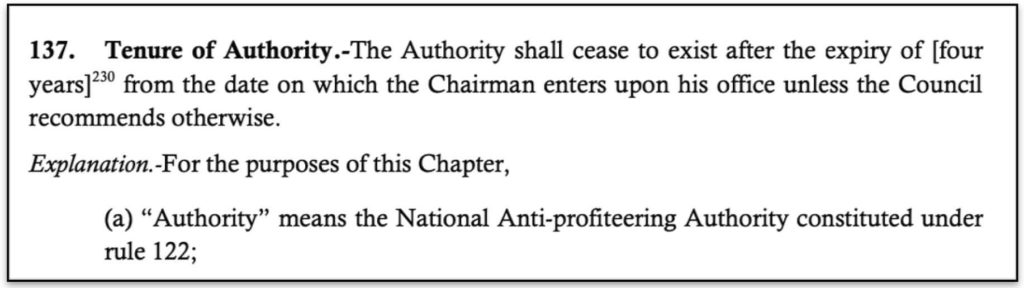

As per Rule 137, of CGST Rules, 2017 – Anti Profiteering Authority ceases to exist after a period of two years, unless recommended otherwise by GST council. However, the tenure of NAA was extended by GST council by two more years in its meeting on 21 June, 2019.

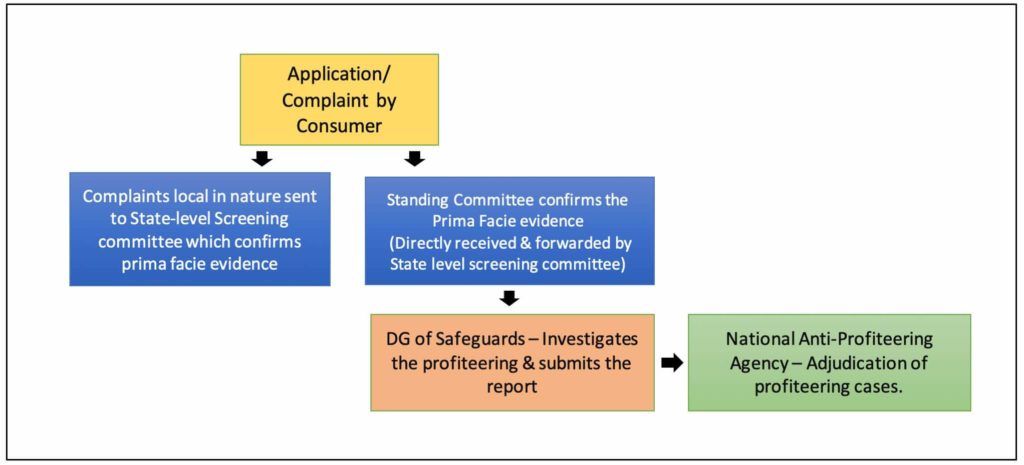

The complaints by consumers can be registered online via NAA’s portal. The redressal process of complaints is based on jurisdiction. Those that are local in nature are first sent to a State-level committee for screening, while the ones at national level are sent directly to the Standing committee. An instance of profiteering that relates to an item of mass consumption which has ramifications across the country are also sent directly to the Standing committee.

Based on the merit of the complaint, the respective committees will refer the case for further investigation to ‘Directorate General of Safeguards’, who conduct the investigation and submit the report with NAA. In case NAA finds that the company has not passed on the GST benefits, it would be directed to within a stipulated timeline to either:

- Pass the benefits to the consumers

- If the beneficiary cannot be identified, transfer the amount to ‘consumer welfare fund’

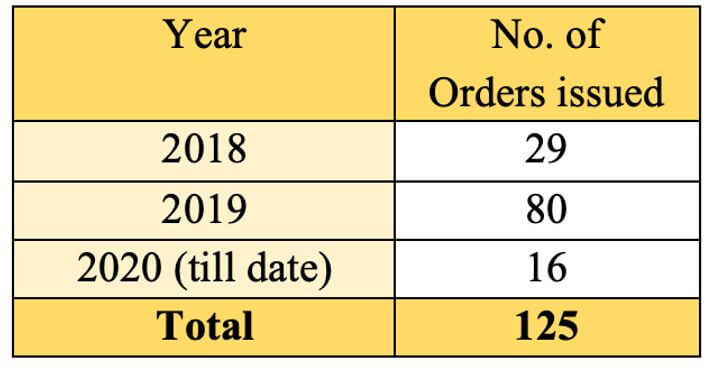

So far, a total of 125 orders issued by NAA

As per the list of orders provided on NAA Portal, there are a total of 125 orders from the time it was constituted. In the current year i.e. 2020, 16 orders were issued including the recent one regarding Patanjali Ayurveda ltd. In 2018, 29 orders were issued while in 2019, a total of 80 orders were issued.

Responding to a question in Lok Sabha on 02 July 2019, the Minister of Finance, has stated that as on 20 June 2019, a total of 67 orders were passed by NAA. This figure tallies with the list of orders provided on NAA portal, as on that date.

Further, the Minister also stated that out of these 67 cases as on 20June 2019, 26 cases were confirmed as instances of profiteering by businesses, with the profiteering amounting to Rs. 600.51 crores. As on date, further 58 orders were issued, after the response in Lok Sabha.

As per a response given by Minister of Finance on 22December 2017, a total of 70 complaints were received by NAA.

Whereas in 2018, 360 complaints were received by NAA, as per the information provided in Lok Sabha on 08 January 2019. There is no information available on the number of complaints received in 2019 and 2020.

Some of the prominent orders issued by NAA:

NAA fines Hindustan Unilever for 223 crores for profiteering

In one of its first high profile orders, NAA found India’s largest FMCG company, Hindustan Uniliver (HUL) guilty of profiteering from the revision in GST rates and not transferring the benefits to the consumers.

As per the order issued on 24 December 2018, HUL is alleged to have profiteered to an extent of Rs. 383 crores after the rate cut in November 2017. The case was initially filed by an anonymous applicant via email and later other complaints were received by NAA. As per the applicant, the GST rate was reduced from 28% to 18% on a large number of products related to HUL’s product line. It was also alleged that HUL has increased the base price to counterbalance the fall in GST rates. During the investigation, HUL has contended the valuation of amount of profiteering as well as the actions it took in respect to pass on the benefits to the consumers across its wide range of products.

Since HUL has proactively deposited Rs.160 crores to Central Consumer Welfare fund, it has been asked to deposit a further Rs. 223 crores in 50:50 ratio to central and state consumer welfare funds. The official copy of this order is not available on NAA portal. Since then, HUL has filed a case against the order in Delhi High Court but the high court has refused to stay the order.

Jubilant Food Works found guilty of not passing GST cut benefit of Rs. 41.42 crores

In an order issued on 31 January 2019, NAA has observed that Jubilant Food Works which is the operator of Domino’s Pizza chain in India, is guilty of not passing the GST-cut benefit to the tune of Rs. 41.42 crores on the sale of certain Pizza products. This is in response to an email complaint filed by a customer that the prices for two of its products i.e. ‘Domino’s Stuffed Garlic Bread’ and ‘Medium Veg. Pizza’ were not reduced, despite the reduction of GST to 5% from 18%. The GST on restaurants was reduced to 5% in 2018.

NAA has stated that Jubilant Food Works did not pass on the benefits of the rate-cut and quantified the amount to Rs. 41.42 crores.

NAA has ordered the below actions:

- Reduce the prices of the products commensurate with the GST rates.

- Refund to the applicant an amount of Rs 5.65 along with interest @18 per cent from the date of charging the above amount from him till its refund.

- Deposit the balance amount of Rs. 41.42 crores in the ratio of 50:50 in the Central and the State Consumer Welfare Funds along with interest @18 per cent till the same is deposited, within a period of 3 months

NAA has also issued a show cause notice to Jubilant Food Works to explain why penalty should not be imposed on the company.

Abbott Healthcare found profiteering to the tune of Rs. 96.59 lakhs

On 05 March 2019, NAA issued an order to Abbott Healthcare stating that is it guilty of not passing the benefits of GST tax rate cuts to an amount totalling Rs. 96.59 lakhs. This is about their product ‘Melaglow Rich (Nianamide) Depigmentation & Glow Restoration Cream’.

As part of the investigation, it was found that the tax rate on the product was 30.06% in pre-GST regime, which was reduced to 28% in the initial GST rollout, and further reduced to 18% on 15 November 2017. During this period, the base price increased from Rs. 202.06 to Rs. 230.90, thereby resulting in an increase in selling price and hence not passing of the benefit of tax reduction to the customers.

An amount of Rs. 96.59 lakhs for the period 01 July 2017 to 31 July 2018 is estimated to be the profit amount. This Mumbai based company was directed by NAA to deposit the amount to the Consumer Welfare Fund of the Centre & states along with 18% interest. Abbott Healthcare has challenged this order in the court and obtained a stay from Delhi High Court.

McDonalds franchisee Hardcastle Restaurants found guilty of profiteering Rs. 7.49 crores

Hardcastle Restaurants is a franchisee of fast food chain McDonald’s and NAA has found it to be guilty of not passing the GST rate cut benefits of Rs.7.49 crores to the customers, as per its order on 16November 2018.

A complaint was filed accusing the restaurant of keeping the prices same in-spite of a reduction in GST rate from 18% to 5% w.e.f. from 15November 2017. As part of the investigation, Directorate General of Anti-Profiteering (DGAP) has found out that the restaurant has not transferred the benefit of the rates cut and also did not pass on the benefits from Input Tax Credit availed by them. This comes up to a total of Rs. 7.49 crores. This includes the extra GST which the customers were forced to pay due to the increase in the basic prices.

Hence the NAA has asked Hardcastle Restaurants to:

- Reduce the prices commensurate with GST reduction.

- Deposit Rs.7.49 crores in Consumer welfare fund along with 18% interest within a period of three months.

This order was challenged in the court and the Bombay High Court set aside the ruling of NAA. The contention of the company was around the fact that the NAA order was pronounced by four members of authority, while only 3 were hearing the case.

Patanjali Ayurveda fined Rs. 75.08 crores by NAA

In its latest order, the NAA fined Patanjali Ayurveda Ltd Rs.75.08 crores. The NAA stated that the benefits from the rate change from 28% to 18% as well as that of 18% to 12% in November 2017 have not been passed on to the consumers. Patanjali has also increased the price of their washing powder, after GST reduction.

During the investigation, Patanjali has contested that they have borne the increase in cost due to reduction of GST and have not increased their product prices accordingly. However, NAA did not accept this argument stating that it was the business call of Patanjali not to increase the price of the product and that cannot be used as an excuse for denying consumers the benefit of reduced GST. It has instructed Patanjali Ayurveda to deposit the fine amount of Rs. 75.08 crores along with 18% GST to Central and State consumer welfare funds.

Pendency of cases a key reason for extension, with litigations also a matter of concern

NAA was initially set up for a period of two years. The initial presumption was that this period would be enough to check the implementation of passing on the benefits of GST tax reductions. It was also initially thought that this would be limited to few large companies. However, complaints were received from nearly all the sectors which has resulted in a large number of pending complaints. Hence NAA tenure was extended by two more years.

The lack of a framework for compliance has resulted in many of the businesses not passing on the rate cut benefit to the customers, resulting in increase in the number of cases.

Most of the orders being issued by NAA are being challenged in different courts, and some of them are currently pending in courts. The lack of an appellate mechanism within the executive, to file an on the orders of NAA, leaves the businesses the only option of approaching courts.

The following steps could help in reducing the number of pending cases as well as mitigate the scope of non-compliance.

- Provision for an appellate mechanism

- Defining framework of compliance

- Specific mechanism of calculating profiteering which could reduce the subjectivity during investigation