Every year on 15 August, the country remembers the great sacrifices of the freedom fighters. As a token of respect for their contribution, the central government had launched a pension scheme ‘Swatantrata Sainik Samman Yojana (SSSY)’ in 1980. Here is all about the scheme.

After decades of struggle, India was declared independent from the British on 15 August 1947. The struggle for freedom was long and was a result of sacrifices of many freedom fighters. Every year on 15 August, the Independence Day is religiously celebrated across the country, which however has been scaled down this year because of the pandemic. As the country remembers and pays tribute to the great sacrifices of freedom fighters on the occasion of 74th Independence Day, this story looks at the schemes and facilities provided by the Indian Government to the freedom fighters and their families.

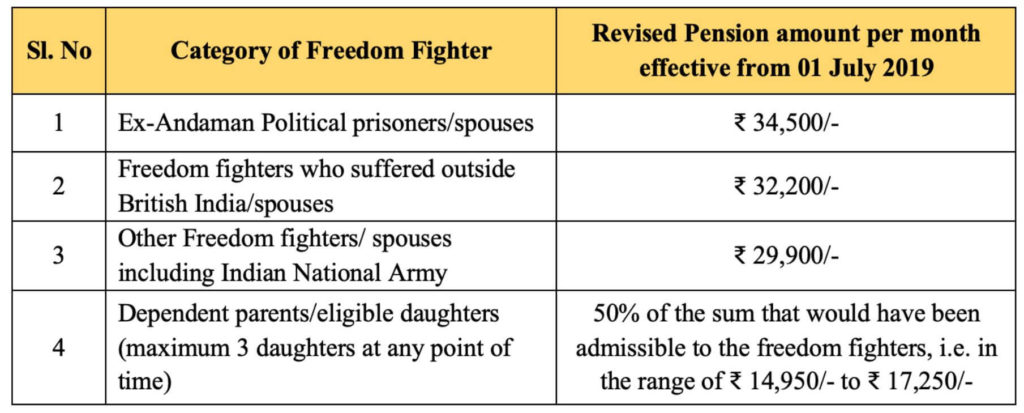

Source: knowindia.gov.in

Swatantrata Sainik Samman Pension Scheme was launched in 1972

A central scheme was introduced in 1972 during the silver jubilee year of independence which grants pension to freedom fighters and their eligible dependents if the freedom fighter had already expired. Later in 1980, it was liberalized and renamed as Swatantrata Sainik Samman Pension Scheme, and made effective from August the same year. In 2017, when the 12th Five Year Plan ended, the NDA government approved the continuation of the scheme after renaming it as Swatantrata Sainik Samman Yojana (SSSY) up to 2020. The monthly pension is considered a token of respect for the contribution of freedom fighters in the national freedom struggle. Various State wise pension schemes also exist for freedom fighter pensions.

Forty movements/mutinies have been recognized for award of pension

A list of forty movements/mutinies have been recognized for award of pension under the scheme- Kuka Namdhari Movement of 1871, Jallianwala Bagh Massacre of 1919, Quit India movement of 1942, to name a few. The latest to be added to this list are Hyderabad Liberation Movement and Goa Liberation Movement. The following persons are eligible for the Samman Pension Scheme-

- Eligible dependents of martyrs

- A person who had suffered at least 6 months imprisonment for participating in the freedom struggle (at least 3 months in case of women, and freedom fighters belonging to SC/ST)

- A person who had to stay underground for more than six months for participating in the freedom struggle

- A person who had interned in his home or extended from his district for at least 6 months

- A person whose property was attached/confiscated/sold for participating in the freedom struggle

- A person who became permanently incapacitated on account of participation in the freedom struggle during firing or lathi charge

- A person who lost his government job for participation in the freedom struggle

- A person who was awarded the punishment of ten or more strokes of caning/flogging/whipping on account of participation in the freedom struggle

- Spouses (widows/ widowers), unmarried and unemployed daughters (up-to maximum three) and mother or father of deceased freedom fighters (as also of martyrs) in that order are eligible. At one point of time, only one of the above-mentioned categories of dependents is eligible for family pension.

Other than pension, host of other facilities are extended to these beneficiaries

In addition to the pension, the freedom fighters & their eligible dependents are also provided with some other facilities by the Government of India namely,

- Free railway pass in Duronto, Rajdhani, and Shatabdi for freedom fighters, their widow/widower, along with a companion, for life.

- Medical facilities under Central Government Health Services and free medical treatment in hospitals run by PSUs

- Telephone connection, if feasible, without installation fees and on payment of half the rental

- 4% reservation under ‘combined category’ including physically handicapped personnel, outstanding sportspersons, and freedom fighters in normal selection procedure by Public Sector Oil Marketing Companies.

- General pool residential accommodation (within overall 5% discretionary quota) to freedom fighters in Delhi. Widow of a freedom fighter is also permitted to retain the accommodation for 6 months after the spouse’s death

- Freedom Fighters’ Home at New Delhi that provides transit accommodation (stay and meal) for freedom fighters and their eligible dependents.

The Pension amount is reviewed periodically

The amount of pension is reviewed periodically. Currently, the amount of pension payable is given in the table below.

In addition to the pension amount, facility of free travel by air for Ex- Andaman freedom fighters or their widows to Andaman and Nicobar Islands, once a year, along with companion is extended.

Periodically, the rate of pension is reviewed. When the scheme was launched in 1972, the pension amount was ₹ 200 per month. The pension amount is not taxable.

Over 1.71 lakh beneficiaries have benefitted from the scheme so far

As on 31 March 2019, over 1.71 lakh freedom fighters and their eligible dependents have been sanctioned pension under this scheme. In the 15-year period from 2004-05 to 2018-19, around 2300 new beneficiaries have been approved pension under the scheme. The total number of beneficiaries since the introduction of the scheme went up from 1,69,331 in 2004-05 to 1,71,631 in 2018-19.

However, this does not mean that all 1.71 lakh beneficiaries are currently drawing pension. Many of them may have expired or their dependents are no longer eligible under the prescribed criteria. As of 31 March 2017, only about 37,356 persons were drawing pension under the scheme including freedom fighters and their dependents. This number reduced to 30,798 by November 2018. The current number could be much lesser.

On the other hand, as of January 2018, a total of 12,657 freedom fighters were availing the pension and as on 12 July 2019, the number of freedom fighters currently drawing pension has gone down to 9,689.

Government of India spent close to ₹ 11000 crores on the pension scheme in the last 16 years

The total expenditure of the Central Government under the SSSY scheme between 2004-05 and 2016-17 is ₹ 8670 crores. It was estimated that the expenditure would be ₹ 750 crores in 2017-18, ₹ 825 crores in 2018-19, and ₹ 907 crores in 2019-20. Together, the expenditure would come to around ₹ 11,000 crores in in the 16 years between 2004-05 and 2019-20.

Apart from the pension scheme, the government had also incurred expenditure on free railway passes of ₹ 261 crores in the period between 2004-05 and 2016-17. Further, the government also spent ₹ 2.1 crore on the freedom fighter home in Delhi during the same period. There was zero actual expenditure on free railway passes in 2015-16 and 2016-17.

Bihar and Jharkhand have the greatest number of beneficiaries

State-wise data of the number of beneficiaries (as of March 2019) indicates that the erstwhile Bihar which includes the present-day Jharkhand also had the highest number of beneficiaries with close to 25,000 followed by West Bengal with over 22,500 beneficiaries. Together with these states, the present-day Uttar Pradesh and Uttarakhand, Maharashtra, Andhra Pradesh & Telangana account for more than 57% of the beneficiaries reported until March 2019. There are over 22,468 beneficiaries under Indian National Army.

The pension is liable to cancellation if false information is provided

To avail the scheme, the applicant must submit proof of claim of suffering along with an application form and other required documents to the Chief Secretary of the concerned state government or UT administration and Deputy Secretary of Government of India, Ministry of Home Affairs (MHA). The application is then verified. To rule out the possibility of fake claims by family members, an affidavit along with joint photograph of spouse as well as unmarried daughters should be furnished before issuing the formal pension.

The sanctioned pension will be cancelled or modified without prior notice if it was sanctioned on false ground/ information. It will also be cancelled if the recipient is found indulging in anti-social activities over a long period for which he/she has been convicted more than once.