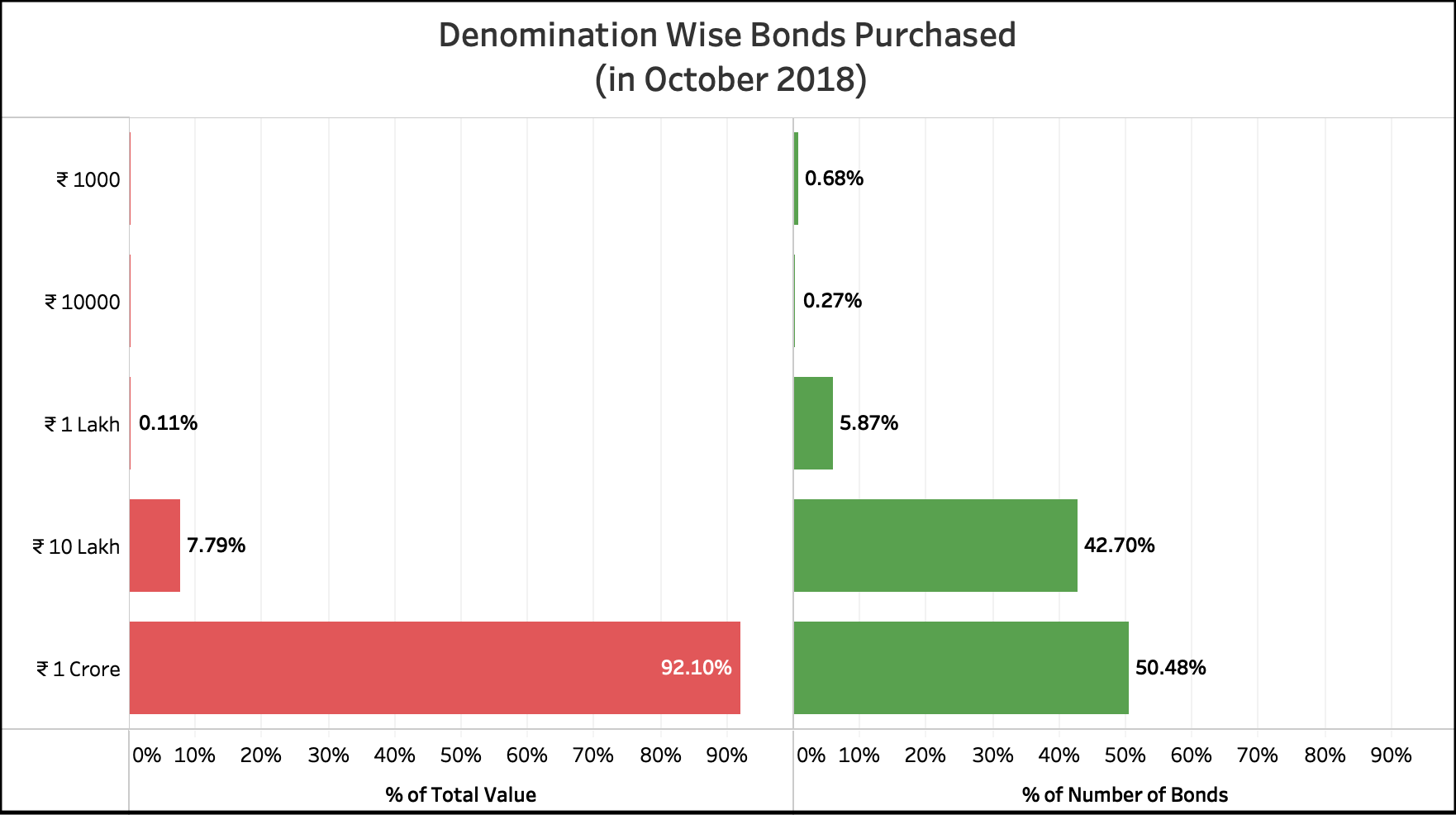

[orc]Data obtained from SBI indicates heavy purchase of electoral bonds in the fifth cycle that was open between 01st & 10th October 2018. Bonds worth more than ₹ 400 crores were purchased in 11 cities in the ten days of October cycle. Bonds in the denomination of ₹ 10 lakh & ₹ 1 crore accounted for 99.89% of the bonds purchased in terms of value.

The Electoral Bonds were first announced in the 2017-18 budget and the scheme was subsequently notified in January 2018. Factly had earlier written about the bonds, their impact on transparency etc.

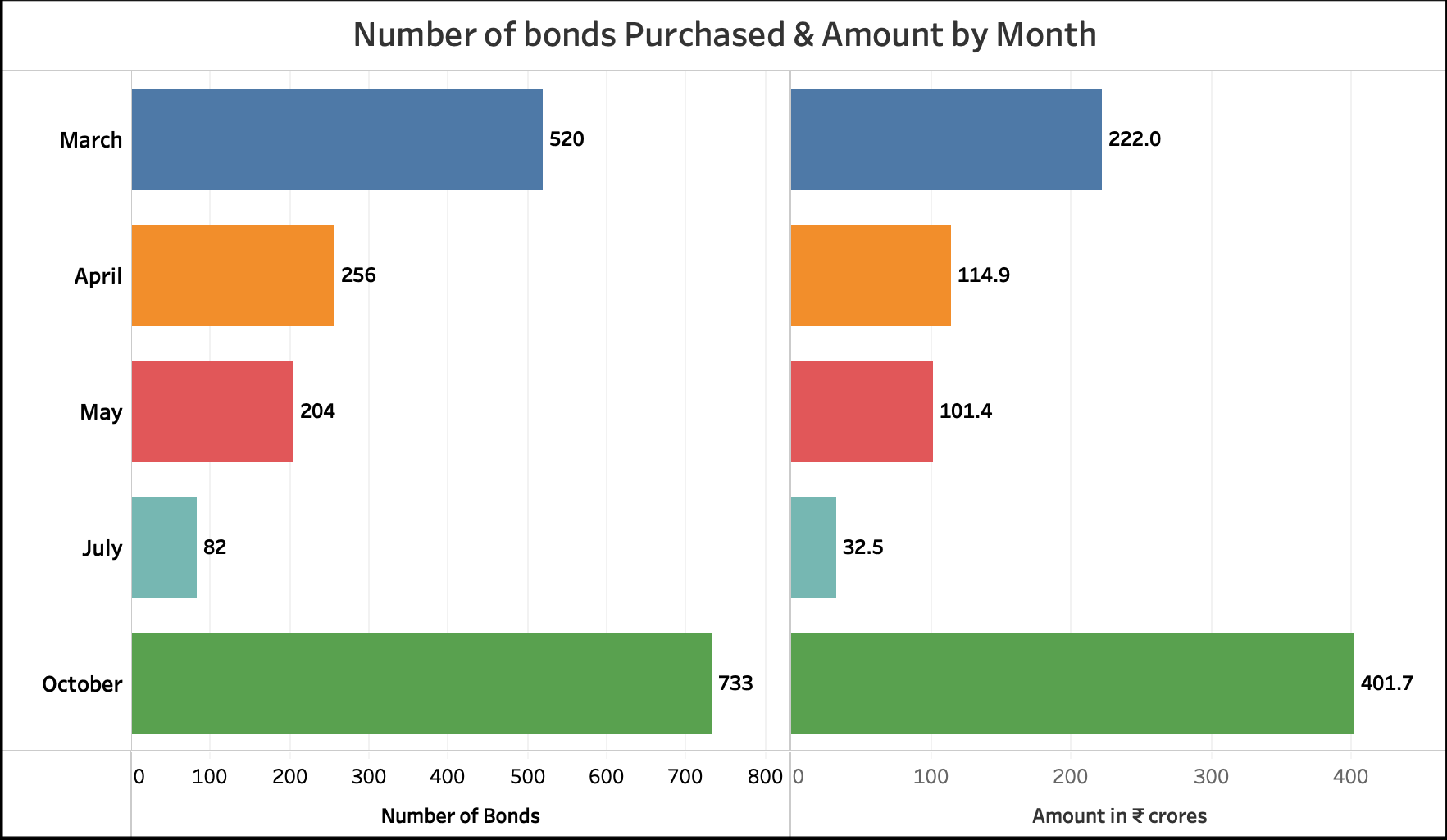

Factly had also analysed the data obtained from the State Bank of India (SBI), the authorized bank to issue electoral bonds, about bonds purchased in the first four sale cycles in March, April, May & July 2018, to conclude that there was hardly any demand for electoral bonds of lower denomination. The latest data provided by SBI for the October cycle suggests heavy purchase of electoral bonds in this cycle that was open between 01st & 10th October 2018. Bonds worth more than ₹ 400 crores were purchased in 11 cities in the ten days of October cycle. As with other cycles, bonds in the denomination of ₹ 10 lakh & ₹ 1 crore accounted for 99.89% of the bonds purchased in terms of value even in the October cycle.

Not a single bond was purchased in 18 branches in October 2018

October 2018 was the first month when the electoral bond scheme was made available in 29 SBI branches across India covering almost all the states & UTs. Among the 29 branches, bonds were purchased only in eleven (11) branches. Not a single bond was purchased in the rest of the eighteen (18) branches. This was the first month when the number of bonds purchased and the amount increased substantially compared to the other cycles. This could be due to general elections to five (5) state assemblies in November & December. The sixth cycle of sale of bonds is already complete in the first 10 days of November.

A total of 733 bonds worth ₹ 401.7 crores were purchased in October. This is the highest ever purchase of the bonds since the inception of the scheme. The previous highest was 520 bonds purchased in the inaugural cycle of March 2018. In fact, 46% of all the bonds purchased in terms of amount till date were purchased in October alone.

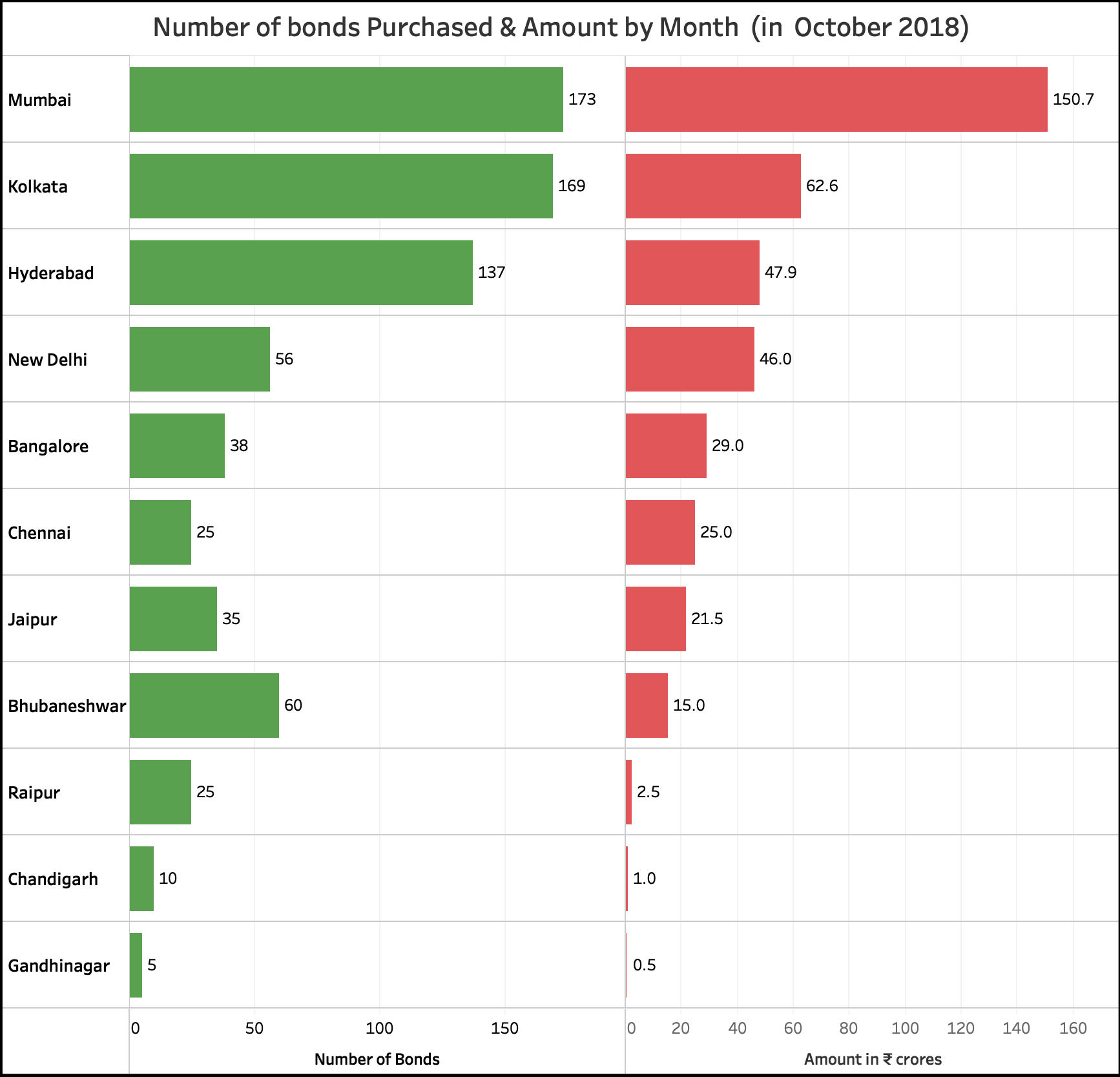

In terms of value, Mumbai, Kolkata, Hyderabad & Delhi account for more than 75% of the bonds

In terms of value, Mumbai, Kolkata, Hyderabad & Delhi account for more than 75% of the bonds

A total of 733 bonds worth ₹ 401.7 crores were purchased in the October cycle, taking the total value of bonds purchased in the four cycles to ₹ 872.53 crores. In the October cycle, most number of bonds were purchased in Mumbai (173) followed by Kolkata (169) and Hyderabad (137). These are the only three branches where more than 100 bonds each were purchased. In addition to these three branches, more than 50 bonds were purchased in Bhubaneshwar & New Delhi. While assembly general elections are due in five states, only the Hyderabad branch in Telangana saw heavy purchase of the bonds followed by Jaipur in Rajasthan & Raipur in Chhattisgarh. Not a single bond was purchased in Bhopal branch of Madhya Pradesh and the Aizwal branch of Mizoram though elections are due in these two states as well.

In terms of value, Mumbai was again ahead where bonds worth ₹ 150.7 crores were purchased followed by Kolkata where bonds worth ₹ 62.6 crores were purchased. In Hyderabad where the sale of bonds took place for the first time in October, bonds worth ₹ 47.9 crores were purchased. In terms of value, Mumbai, Kolkata, Hyderabad & Delhi accounted for more than 75% of the bonds purchased in October.

99.89% of bonds purchased (in terms of value) were in denomination of ₹ 10 lakh & ₹ 1 crore

Data for October 2018 indicates that the bonds of lower denomination were hardly in demand like in the other cycles, an indication that citizens may not be purchasing these bonds. Of the lower denominations, only 5 bonds of ₹ 1000 and two bonds of ₹ 10000 were purchased in the October cycle. Out of the 733 bonds purchased in October, 43 were of ₹ 1 lakh denomination, 313 were of ₹ 10 lakh denomination and the remaining 370 were of ₹ 1 crore denomination. Together, bonds in the denomination of ₹ 10 lakh & ₹ 1 crore accounted for 99.89% of the bonds purchased in terms of value. It is highly likely that the Rs 10 lakh & Rs 1 crore denomination are purchased by corporates than individuals. There is no concrete information on the type of purchasers since SBI has refused to share such information.

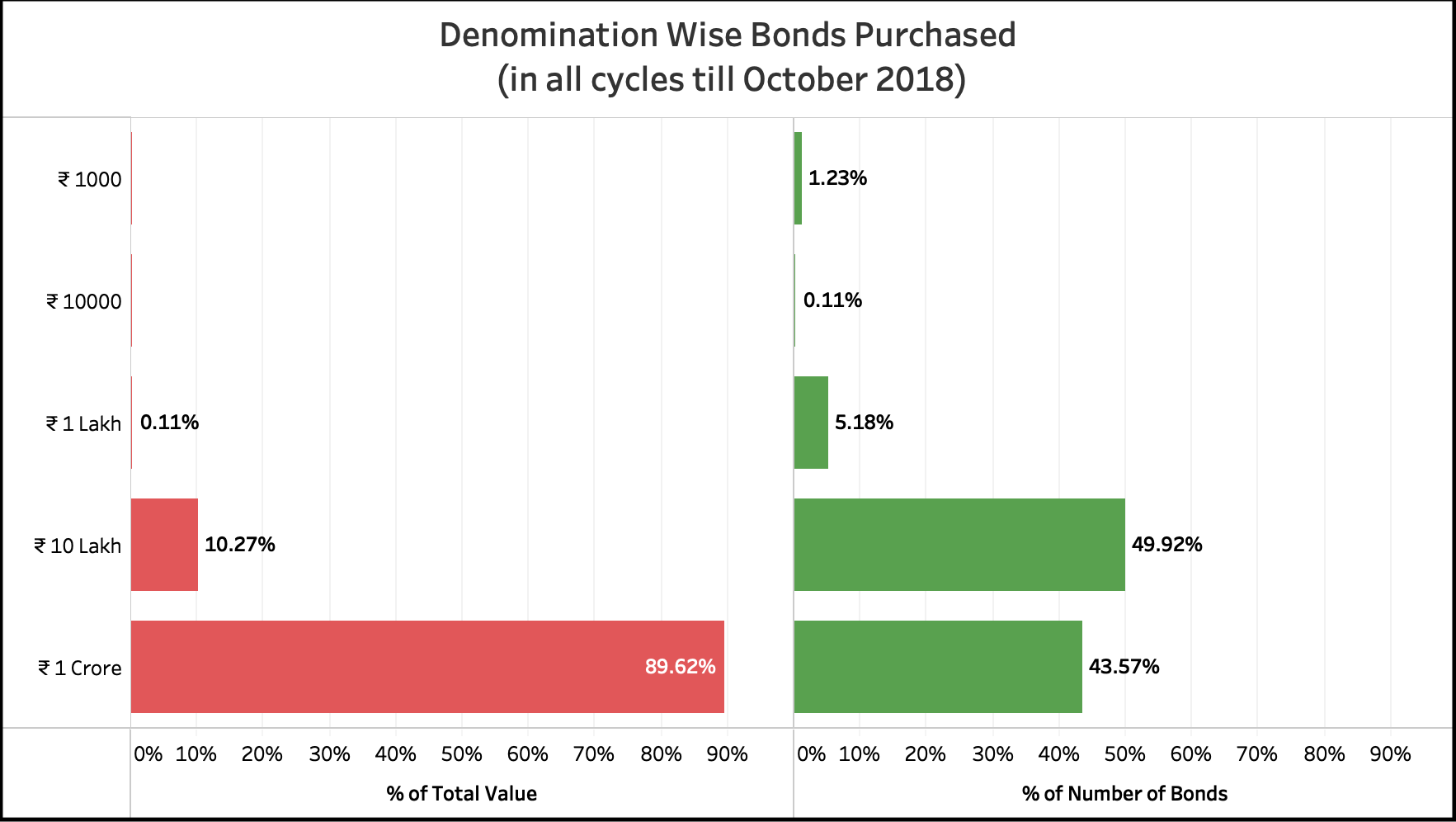

Data from all the cycles till October indicates no demand for lower denomination

Data from all the cycles till October indicates no demand for lower denomination

Data of electoral bonds purchased in all the cycles till October clearly indicates that there is no demand for bonds of lower denomination. In terms of value, bonds of ₹ 1 crore denomination accounted for ₹ 782 crore or 89.6% followed by bonds of ₹ 10 lakh denomination that accounted for ₹ 89.6 crore or 10.3%. Together, they have accounted for close to 99.9% of total value of bonds purchased till date. Even in terms of the number of bonds purchased, 1678 out of the 1795 or 93.5% electoral bonds purchased till date are in the denomination of ₹ 10 lakh and ₹ 1 crore.