[orc]Subsidies are often debated in the context of welfare schemes for the poor and disadvantaged. The Economic Survey for 2015-16 has now come up with the amount of subsidy going to the well-off sections of society on account of tax rate/subsidies on various commodities. The survey estimates the total amount of subsidy going to the well-off to be about Rs 1 lakh crore.

The direct and indirect subsidies to the poor and disadvantaged are often debated in the budget season. There are also demands to cut down subsidies and focus on targeting. But there are also policies that benefit the well-off sections of society. The Economic Survey for 2015-16 has a dedicated chapter on the policies that benefit the well-off. The policies include tax benefits for small savings schemes and the tax/subsidy policies on cooking gas, railways, power, aviation turbine fuel, gold and kerosene. The Economic Survey estimates that all these policies together account for Rs 1 lakh crore in subsidies to the well-off. The survey also finds that the tax incentives benefit those at the top of the income distribution more than the middle class. The chapter is included in the survey to show that the Government’s generosity is not restricted to its poorest citizens, but many cases, the beneficiaries are disproportionately the well-off sections of society.

The Not So Small Savings Schemes

The Economic Survey mentions that Public Provident Fund (PPF) and tax-free bonds issued by designated public sector companies like IRCL, IIFCL, PFC, HUDCO, NHB, REC, NTPC, NHPC, IREDA, NHAI and others are contributing to the subsidies extended to the well-off. The survey argues that savings schemes ideally should follow the EET (Exempt, Exempt, Taxation) model of taxation, which means that the contribution and the interest on these savings should be exempt while principal should be taxed when it is withdrawn. Contrary to this, the PPF in particular follows an EEE model where all the three components are exempt.

Government data also indicates that the highest claim under Section 80C of the IT act is made by those in the 30% and 20% income tax bracket. The survey also says that raising the limit of this exemption to 1.5 lakh also disproportionately benefitted those in the higher tax bracket. In 2013-14, the average income in the 30 percent tax bracket was Rs 24.7 lakh and these earners were roughly 25 lakh in number (1.1 percent of all taxpayers) and are in the top 0.5 percent of overall Indian income distribution. Similarly, the 54 lakh income earners in the 20 percent tax bracket represented the top 1.6 percent of the Indian income distribution.

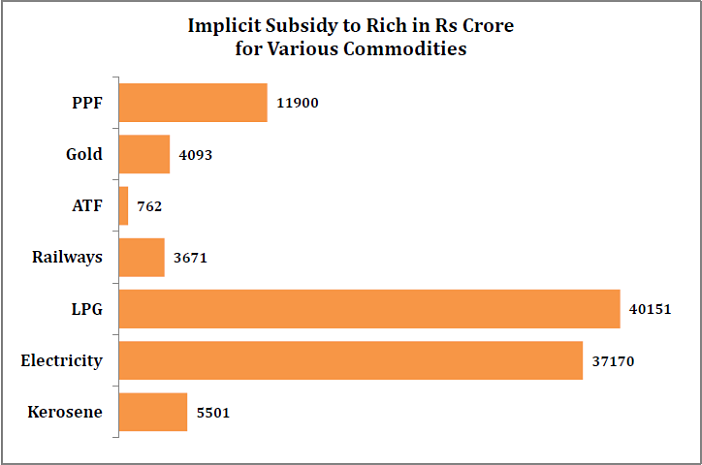

The survey estimates the implicit subsidy of PPF at Rs 11,900 crore while the subsidy under Tax-free bonds is about Rs 111 crore.

Other Subsidies

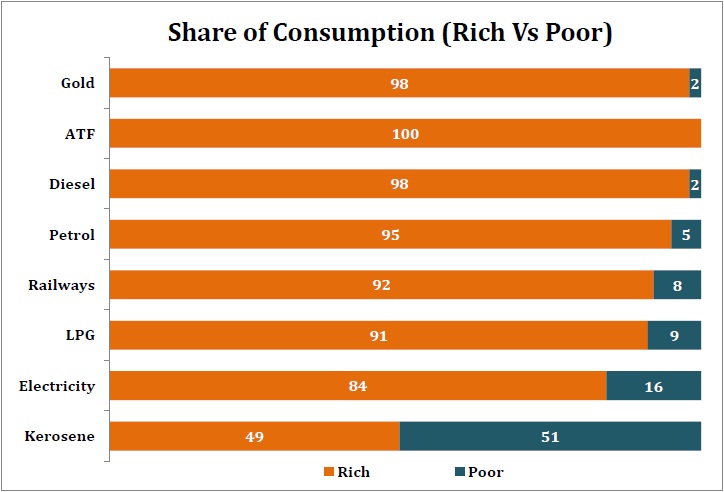

The survey makes a mention of other subsidies such as Gold that has one of the lowest rates of tax (an average of 1%) while most other normal commodities are taxed at 26% (including Central & State taxes). This difference of 25% in tax mostly benefits the well-off and 98% of this subsidy is accrued to them.

For other goods, the survey estimates that the well-off enjoy a subsidy rate of 34% in Railways, 36% on LPG and 32% in Electricity. The difference of more than 30% in the tax rate of Aviation Turbine Fuel (ATF) and Petrol/Diesel also significantly contributes to the subsidy for the well-off. The survey also mentions that half of the Kerosene subsidy goes to the well-off.

The Rich’s share of consumption of these commodities is also disproportionately high. The survey categories the Poor as the bottom 30% of the population and rich as the top 70% divided based on the expenditure distribution of the National Sample Survey Data. 98% of Gold, 100% ATF, 98% Diesel, 95% Petrol, 92% of Railways, 91% of LPG, 84% of Electricity & 49% of Kerosene is consumed by the rich.

Total Subsidy for the Well-Off

The survey goes onto say that the effective subsidy to the well-off is not just the actual subsidy or tax on that commodity, but the difference between what the tax burden on that commodity should be on the rich and the actual subsidy/ tax rate. Based on normative tax rate for various commodities, the survey estimates the total subsidy to the well-off to be more than Rs 1 lakh crore.

The survey argues that the Rs 1 lakh crore of subsidy going to the better-off merely on account of 6 commodities plus the small savings schemes represent a substantial leakage from the government’s kitty and an opportunity foregone to help the truly deserving.

2 Comments

The word “IMPLICT” plays a major role here. If we increase taxes to make these on par with other goods,we can get 1 lakh crore . India cannot afford to not decrease taxes on items such as Kerosene, Electricity , LPG. Already Kerosene is not given to tax payers in lot of states. LPG now is given only to people who are less than 10 lakh taxable income. Electricity price is still less than lot of countries worldwide.

Implicit subsidies on GOLD , ATF can be removed. However, it will face severe backlash from both upper and middle class people.

It is very funny to see this in Economic Survey 2016. Where did they get this data of rich and poor? It is mostly assumptions. For Example, ATF is used in aircrafts, and since they are used by the non-poor, it is 100 percent. What about other commodities?

It is also inconsistent and contradictory. While these figures should be appealing, one should go through the recommendations on how these ‘subsidies’ are being shifted from rich to the poor. In the past, World Bank-led reforms many subsidies were removed by citing the same, even while not addressing corruption and inefficiencies in delivery mechanisms.

This Economic Survey 2016 is completely different from the previous ones. It is trying to bring in a new kind of economic policy thinking which is not germane to India, and Indian conditions. You would see the result soon on 29th February, 2016, in the budget, or in the next one year.