The quantum of imports of certain goods from China has decreased in the last two years. However, the overall imports of these goods haven’t come down indicating that certain other countries have compensated for the fall of imports from China.

In an earlier story, we analysed India’s trade with China. The data indicates that even though China lost its position as India’s leading trade partner combined with the marginal decrease in the value of total imports from China, it continues to hold a dominant share in total value of imports.

A deeper analysis of the data reveals variances in the import trend of different goods. While there is a drastic fall in the case of a few goods, substantial increase is observed in the case of a few other goods. In this story, we dig deeper into the import trends of some important goods over the years, which could inform us on the current and emerging state of the India-China trade.

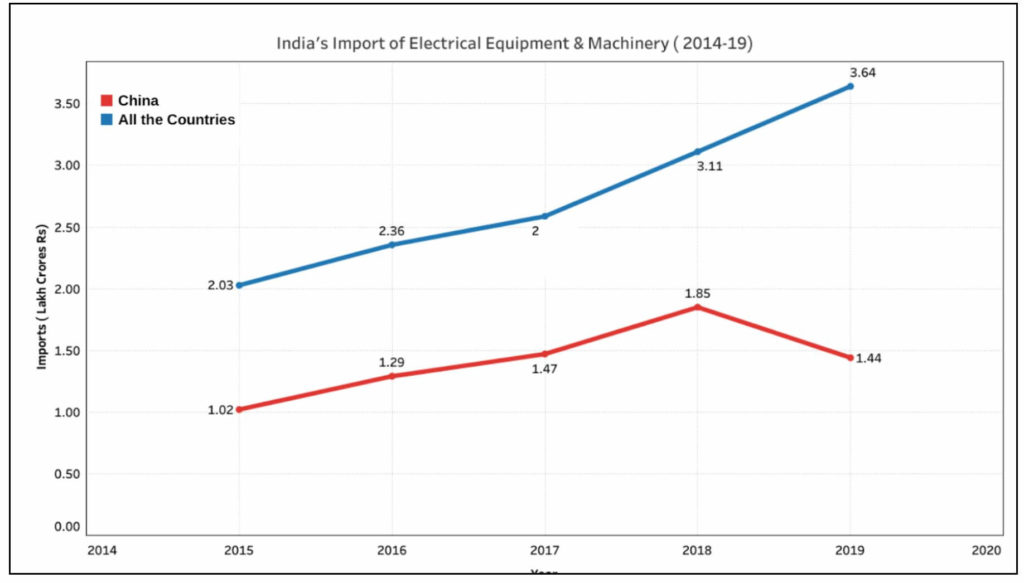

Increase in overall imports of Electrical Machinery & Equipment despite fall in import from China

‘Electrical Machinery & Equipment’ is the major category under which India imports the maximum value of goods from China. It accounts for 11.02% and 10.8% of the total imports in 2017-18 & 2018-19. However, in 2018-19, the value of imports from China in this category fell from ₹1.85 lakh crores to ₹1.44 lakh crores i.e. a decrease ₹ 0.42 lakh crores. This is contrary to the trend observed in previous years. Among the major goods categories imported from China, this is the only category where the value of imports from China has decreased.

Analysis of data from 2014-15 to 2018-19 indicates that the imports from China in this category consistently accounted for more than 50% of the total imports. Furthermore, China’s share increased from around 50% in 2014-15 to 59% in 2017-18. Surprisingly, China’s share fell to 40% in 2018-19 because of the decrease in the value of imports from China. Despite such a fall of imports from China, the overall imports under this category did not decrease. In fact, the total imports under ‘Electrical Machinery & Equipment’ increased in 2018-19 to ₹ 3.64 lakh crores compared to ₹ 3.11 lakh crores in 2017-18.

Increase in imports from Hong Kong compensates for the fall of imports from China.

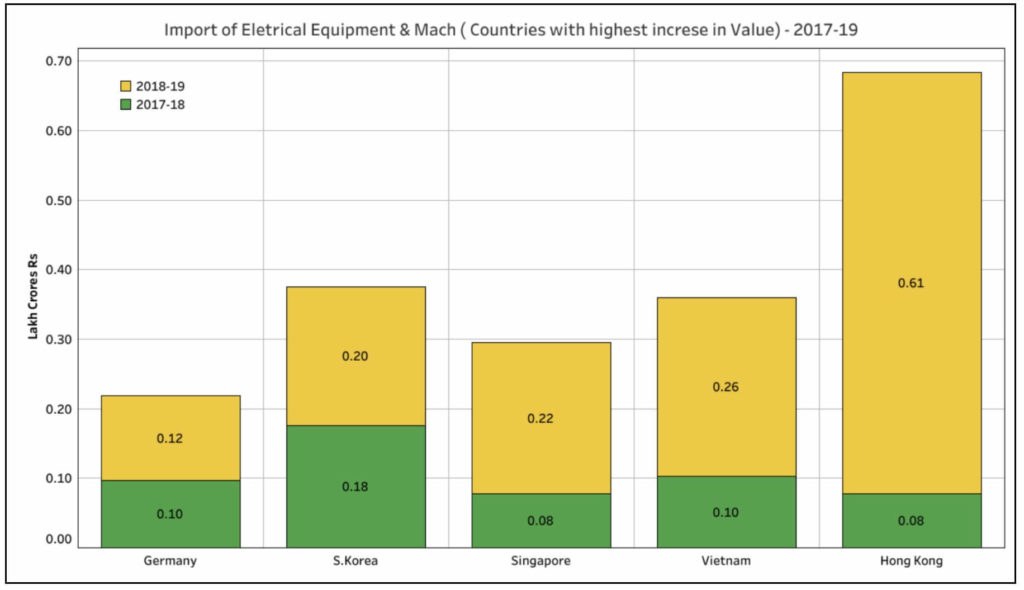

The increase in the overall imports of ‘Electrical Equipment and Machinery’ despite the fall in imports from China is due to the substantial increase in the imports under this category from Hong Kong, Vietnam and Singapore. The increase in the value of imports from these countries, not only compensate the fall in import numbers from China but also increase the total value of the imports under this category.

Hong Kong individually more than compensates for the proportional fall in import from China, with an increase of ₹ 0.53 lakh crores in 2018-19 compared to 2017-18. As highlighted in the earlier part of the story, Chinese imports for this category fell by ₹ 0.42 lakh crores in 2018-19. The value of imports from Hong Kong increased to ₹ 0.61 lakh crores compared to ₹ 0.07 lakh crores in 2017-18. The imports from Hong Kong continue to be at this level even in 2019-20. As per the data available until Feb’ 2020, the value of imports from Hongkong is ₹ 0.57 lakh crores. The value of imports from Vietnam and Singapore have also recorded a significant increase.

Fall in imports of certain goods from China in 2018-19 not fully substituted by imports from other countries

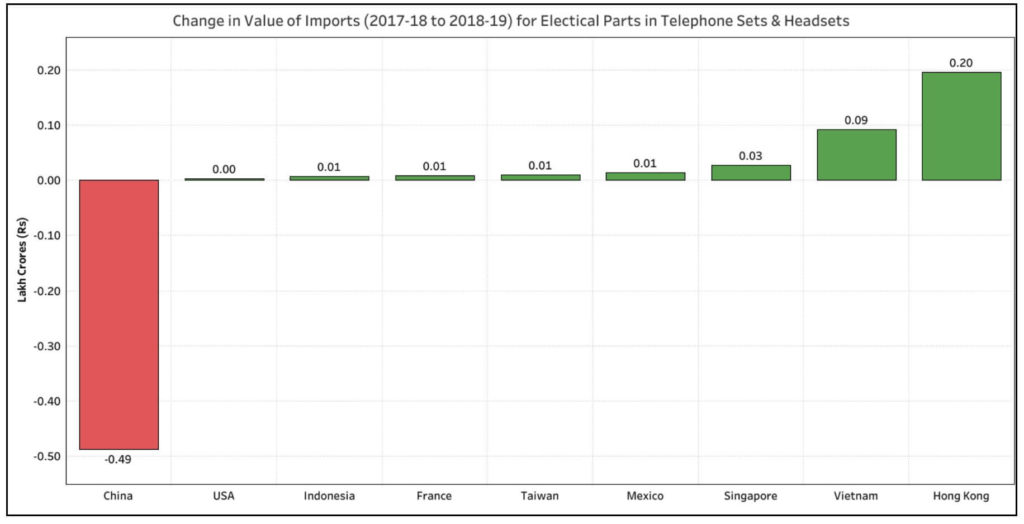

Under the broader head of ‘Electrical Equipment & Machinery’, the sub-categories of ‘Electrical parts for Telephone Sets & Headsets etc.’ & ‘Diodes, Transistors, Semiconductors etc.’ have the highest fall in the imports from China. However, unlike the broader category, the fall in the imports from China is not fully substituted by other countries under these sub-categories.

Under the sub-category ‘Electrical parts for Telephone Sets & Headsets etc.’, the imports from China fell from ₹0.99 lakh crores to ₹ 0.5 lakh crores i.e. by ₹ 0.49 lakh crores. Meanwhile, the imports from Hong Kong increased from ₹ 0.05 lakh crores to ₹ 0.24 lakh crores. It is followed by Vietnam and Singapore whose exports to India under this sub-category also increased.

Similarly, for the sub-category ‘Diodes, Transistors, Semiconductors etc.’, the imports from China fell by around ₹ 0.10 lakh crores in 2018-19. But the highest increase in imports by a country is for Singapore which is only ₹ 0.02 lakh crores followed by Hongkong with ₹ 0.01 lakh crores.

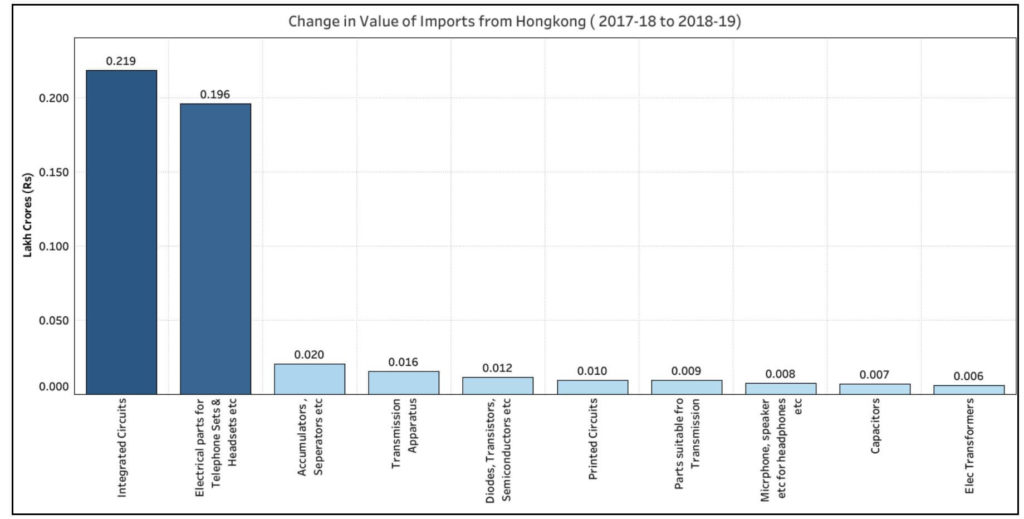

Substantial increase in imports from Hongkong in 2018-19

As observed in the earlier part of the story, at the category level of ‘Electrical equipment & machinery’, Hong Kong more than compensated for the fall in imports from China in 2018-19.

In 2018-19, Hong Kong recorded a remarkable increase in imports by ₹0.53 lakh crores under this category. The major increase in the imports from Hong Kong was under the sub-category ‘Integrated Circuits (ICs)’ which increased by ₹ 0.22 lakh crores. Under the same sub-category, the imports from China increased by ₹ 0.15 lakh crores.

Ambiguity around the source of substitutes for the products whose imports from China have reduced

The imports from China in 2018-19 fell to the levels of 2014-15 with the data available until Feb’2020 also indicating a proportional trend in 2019-20. It is yet early to confirm if this trend would continue going forward.

The data for 2017-19 shows that fall in imports from China is majorly around ‘Electrical equipment & Machinery’ category. This fall is compensated majorly by the imports from Hong Kong and to an extent from Vietnam as noted earlier.

However, if one goes beyond the surface, it appears that China may be routing goods through countries like Hong Kong. For instance, data as per OEC indicates that ‘Integrated Circuits (ICs)’ form 3.51% of China’s exports in 2018 of which 42% is to Hong Kong. And this is the sub-category under which the imports from Hong Kong increased. There are news reports, which indicate that China might be routing its exports through Hong Kong. A Factsheet by Govt of Hong Kong’s Trade and Industry Department, states that Hongkong plays a key role as an entrepôt between Mainland China and Hongkong.

We cannot conclusively prove the quantum of Chinese imports routed through Hong Kong. However, this trend may only increase in the days to come as opposition to Chinese goods grows.

Featured Image: By Jon Sullivan/Public domain