Loans obtained from foreign lenders, such as foreign commercial banks, foreign governments, and international financial institutions, are often referred to as external debt. We look at the trends in India’s external debt, based on status report 2020-21, published by the Department of Economic Affairs.

External debt is defined as “the outstanding sum of those actual current, and not contingent, liabilities that require payment(s) of principal and/or interest by the debtor at some point(s) in the future and that are owed to non-residents by residents of an economy (External Debt Statistics – Guide for Compilers and Users, International Monetary Fund (IMF), 2003). Loans obtained from foreign lenders, such as foreign commercial banks, foreign governments, and international financial institutions, are often referred to as external debt. Countries usually borrow money from foreign lenders to budget their own spending, build infrastructure, finance the recovery from natural disasters and pandemics, and sometimes even to pay off their prior external debt.

The most significant drawback of external debt is that it frequently triggers a debt cycle, which is a cycle of ongoing borrowing, mounting debt, and eventual default. When payments for external debts raise above sustainable levels, it becomes difficult for the governments to incur expenditures for the development of the country. Adding to this, the frequent devaluations of the currency and the ever-changing market conditions make external debts even dangerous. This burden of external debt is not uniform across countries. Developing nations are at a greater risk than developed nations.

Frequent review of the status of external debt is of utmost importance, as it enables the governments to adopt course corrective actions. In today’s story, we look at the trends in India’s external debt, based on the status report 2020-21, published by the Department of Economic Affairs, Ministry of Finance.

India’s External Debt on a rise

India’s external debt by the end of March 2010, stood at 260.9 billion USD. It rose by 21% to 317.9 billion USD by end of March 2011, which again rose substantially every year to reach 474.7 billion USD by end of March 2015. Thereafter, the percentage change in external debt year-on-year stabilized to below 3% till the end of March 2021. In all these years, the external debt corresponding to the previous year declined only once (External debt in 2016-17 stood at 471 billion USD, while in 2015-16, it stood at 484.8 billion USD). The provisional figures for 2021-22 project a steep rise in external debt, increasing by 8% over the previous year.

Vulnerability of external debt

Maintaining external debt at a sustainable level indicates the financial prudence of a nation. Several indicators reflect the vulnerability of external debt. Most important among them are:

External debt to GDP ratio: The external debt to GDP ratio (derived by scaling the total outstanding debt stock (in rupees) at the end of the financial year by the GDP (in rupees at current market prices)) has increased from 18.5 in 2009-10 to 23.9 in 2013-14, thereafter which it declined consistently. From 2016-17 to 2021-22, this value had been stabilized at around 20%.

Foreign currency reserves as a ratio to external debt: The foreign currency reserves, which often act as a buffer to the vulnerabilities of the external sector, as a percentage of external debt, declined from 106.9% in 2009-10 to 68.2% in 2013-14. It again rose consistently from 72% in 2014-15 to 101.2% in 2020-21, except for a fall in 2018-19 to 76%. The provisional value for 2021-22 stood at 97.8%.

Short-term debt as a ratio to total external debt: In this, the external debt is looked at from a maturity standpoint. The maturity structure is an important parameter to analyse the potential debt vulnerability. Short-term debt is often regarded as volatile capital flows. Piling up huge short-term debts exposes the economy to external volatilities and shocks. Short-term debts include

- short-term trade credit up to 180 days and above 180 days & up to 1 year,

- foreign Institutional Investor investments in Government T-Bills & corporate securities,

- investments by foreign central banks and international institutions in T-Bills &

- external debt liabilities of the central banks and commercial banks.

The ratio of short-term debt to total external debt always stood below 25% in India. From 2014-15, it stabilized below 20%.

Debt Service Ratio (DSR): The ratio of total debt service payments (i.e., principal repayment plus interest payment) to the current receipts minus official transfers of the Balance of Payments (BoP) is known as the debt service ratio. It is an indicator to measure the servicing burden of external debt on the BoP. The higher the debt service ratio, the greater the economic threat to the nation.

The trend of DSR in India has not been consistent. It increased and decreased over the years. Such variations in DSR could be due to changes in the quantum of exports, higher debts, greater interest rates, currency devaluation, etc.

Classification of External debt

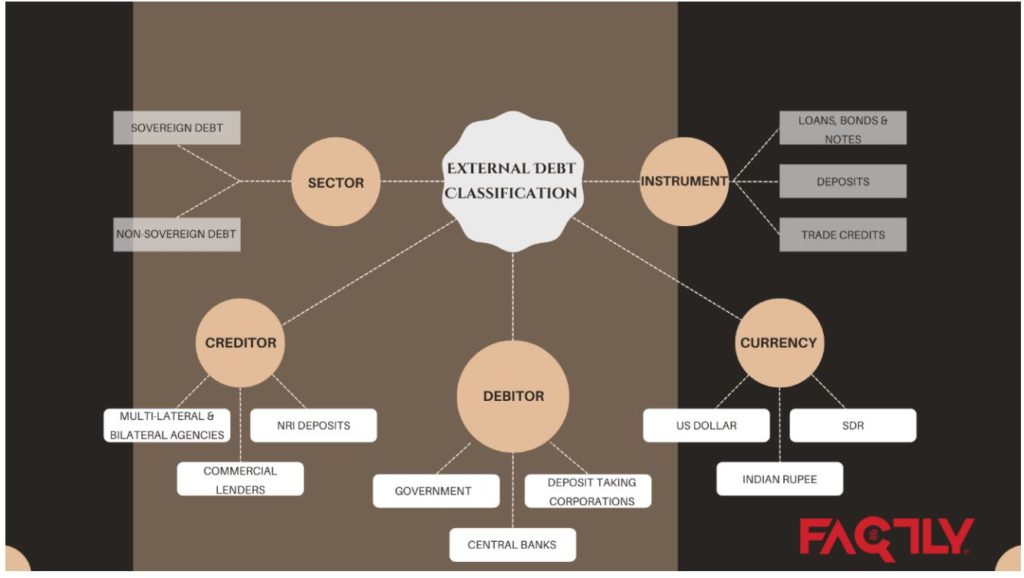

External debts are classified into five broad themes, which are further divided into several categories. These five themes are – the type of sector, creditor & debtor type, the instrument used, and the type of currency.

Sovereign vs Non-Sovereign Debt

Sovereign external debt (SED) includes defence debt, investments by FPIs, foreign central banks, and other international organisations in treasury bills and government securities, as well as SDR allocations by the IMF. SED was 83.7 billion USD in 2013-14 which grew to 130.8 billion USD in 2021-22, marking a 56% growth. Similarly, non-SED grew from 362.6 billion USD in 2013-14 to 490 billion USD in 2021-22, thereby registering a growth of 35%.

Creditor-wise external debt trend

The old format and the new IMF format are two different ways that statistics about India’s external debt are released. The data is categorised under the following general categories of creditors in the old format: multilateral debt, bilateral debt, IMF-SDR, trade credit, commercial borrowings (CBs), non-resident deposits, rupee debt, and short-term debt. Major creditors among these are Commercial Lenders, NRI Depositors, and short-term trade creditors, accounting for more than three-fourths of the total external debt.

Loans from multilateral institutions are usually long-term and majorly on concessional terms, hence minimizing the risk from external borrowings of the Government. The share of multi-lateral debt as a percentage of total external debt has been declining from 2014-15 to 2020-21. It was 73.6% in 2014-15, which fell to 66.5% in 2019-20. It slightly increased to 67.6% in 2020-21. This is a worrisome trend as the loans acquired from bilateral agencies could invite more short-term risks.

Currency-wise external debt trend

The currency composition of external debt is another important parameter to gauge the potential vulnerability of the external debt. The data for currency-wise external debt trend from 2011-12 till date indicate a dominance of the US Dollar, comprising of over half of the total external debt. It is followed by Indian Rupee, SDR, and Japanese Yen. US Dollar averaged at 58% percent from 2011-12 to 2015-16, which decreased to 52% from 2016-17 to 2021-22. Similarly, Indian Rupee averaged at 24.4% percent from 2011-12 to 2015-16, which increased to 33.7% from 2016-17 to 2021-22. The share of SDR declined from 6.8% to 5.3% during the same period. One of the reasons for such a growth in the Indian Rupee composition could be the rise in FPI investments.

Featured Image: India’s External Debt