As per the data provided in the RBI’s annual report, the share of high-value currency notes (Rs. 2000 and Rs. 500) in circulation was 87. 9% by the end of 2022-23 compared to 87.1% by the end of 2021-22. With the withdrawal of the Rs. 2000 denomination note, it remains to be seen if this reduces significantly by the end of 2023-24.

Currency is a critical piece of any economy, with its pivotal role as the accepted medium of exchange for the payment of goods and services. Over the centuries of societal evolution, the form of currency has changed. Currency in circulation, i.e., the physical form of currency, is among the most liquid of the asset classes and therefore forms an important part of the monetary system.

In the current times, an effort to move from the physical form of currency to a digital format is being made across countries. India is experiencing this transition at an increased pace post-demonetization in 2016, wherein a less cash-based economy was cited as one of its objectives.

However, data indicates that there has been an increasing trend of Currency in Circulation, albeit at a slower rate. Our story on the trends as of 2021-22 can be read here. The recent announcement by the Reserve Bank of India (RBI) on the withdrawal of the Rs. 2000 currency notes has once again brought to the fore the discussion around ‘Currency in Circulation’ (CIC) in the system. RBI has also recently released its Annual Report for 2022-23, which provides the latest data on various aspects related to currency.

In this story, we analyse the trends in various aspects relating to currency management in the country. Datasets relating to currency management available on Dataful are considered for the analysis. These datasets are sourced from the RBI reports.

Notes in circulation continue to increase in 2022-23, but the growth rate slowed down

Traditionally, ‘Currency in Circulation’ includes banknotes and coins in circulation. With the launch of the digital rupee (e₹) on a pilot basis during 2022-23, even this is included in the definition of Currency in Circulation.

Currency notes form the bulk of the total currency in terms of both volume and value. Coins are of lower denominations, with the highest being Rs. 20. Hence, the trends in currency notes in circulation affect the CIC not so much the coins. By the end of 2022-23, the total value of currency notes in circulation increased to Rs. 33.48 lakh crores. As was the trend last year, while the total value increased, the growth rate has slowed down.

In 2021-22, the growth rate fell to 9.87% compared to 16.7 % in the earlier year. During 2022-23, the growth rate further slowed down to 7.8 % in terms of the value of total currency notes in circulation.

In terms of volume, it increased to Rs. 13.62 thousand crores. Even in the case of the volume of currency notes in circulation, the growth rate slowed down but marginally. In 2021-22, it was 4.9% which fell to 4.37 % in 2022-23.

The value of coins in circulation increased to Rs. 30.2 thousand crores by the end of 2022-23 compared to Rs. 27.9 thousand crores by the end of 2021-22. The volume of the newly introduced e₹ was Rs. 10.69 crores for e₹ Wholesale (e₹-W) and Rs. 5.7 crores for e₹ Retail (e₹-R).

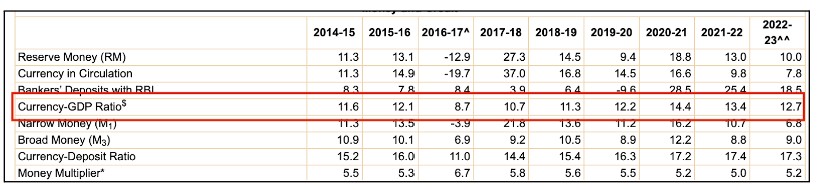

Reducing the ‘Currency to GDP ratio’ was one of the intended objectives of Demonetization. In continuation with the trend of last year, the Currency to GDP ratio fell in 2022-23. In 2021-22 it was 13.4%, which fell to 12.7% in 2022-23. While the decline continues, it is still higher than the pre-demonetization year of 2015-16 when it was 12.1%.

Slight fall in ‘Notes in Circulation’ post the withdrawal of Rs. 2000 note

The value of currency notes in circulation continued to increase during the initial weeks of 2023-24. As per the data available in RBI’s ‘Weekly Statistical Supplement’, the value of notes in circulation as on 07 April 2023 is Rs. 33.87 lakh crores, higher than the value at the end of 2022-23.

This continued to increase every week. As on 12 May 2023, the total value of notes in circulation was Rs. 34.58 lakh crores. The announcement by RBI regarding the withdrawal of Rs. 2000 currency notes was made on 19 May 2023. The value of notes in circulation fell to Rs. 34.48 lakh crores as on 19 May 2023. It fell further to Rs. 34.12 lakh crores as on 26 May 2023. As per the latest weekly supplement released by RBI, the value of notes in circulation fell further to Rs. 33.84 lakh crores.

Rs. 500 currency notes account for 77% of the value of total currency notes in circulation

Rs. 2000 and the new Rs. 500 currency notes are the two high-value currency notes issued after demonetization. In our previous story, we highlighted a decline in the volume & value of Rs. 2000 currency notes. This trend continued in 2022-23 as well. The value of Rs. 2000 currency notes in circulation was Rs. 3.62 lakh crores by the end of 2022-23, compared to Rs. 4.28 cores by the end of 2021-22.

Regarding the withdrawal of Rs. 2000 banknotes, RBI stated that these notes were introduced in 2016 to meet the immediate currency requirements after the demonetization exercise. With an adequate supply of other denominations available, the printing of Rs.2000 notes was stopped in 2018-19 and now is being withdrawn.

The increase in the volume and value of Rs. 500 currency notes over the years substantiate RBI’s claim of the availability of other currency notes. By the end of 2022-23, the total value of Rs. 500 currency notes was Rs. 25.8 lakh crores. This is more than 77% of the total currency notes in circulation, compared to around 73% by the end of 2021-22. The share of high-value notes in circulation (Rs. 2000 and Rs. 500) increased slightly by the end of 2022-23 to 87.9% compared to 87.1% by the end of 2021-22. With the withdrawal of the Rs. 2000 note, the share of these notes might reduce by the end of 2023-24.

There is a slight increase in the value of Rs. 200 currency notes by the end of 2022-23. In terms of volume, the share of Rs .500 currency notes increased from 35% by the end of 2021-22 to 38% by the end of 2022-23.

Increased in the number of Rs. 500 Counterfeit Notes detected in the system

Curbing fake currency in the system was one of the stated goals of demonetization. The high-value currency notes of Rs. 500 & Rs. 1000 notes were demonetised as there were multiple instances of widespread circulation of fake currency notes involving these denominations.

In the initial few years following demonetisation, there was a decline in the number of counterfeit notes detected in the system. However, in 2021-22, there is an increase in the total number of counterfeit notes with 2.31 lakh currency notes. In 2022-23, this number was 2.25 lakhs.

Rs.500 currency notes form the major share of these counterfeit notes. In 2022-23, 91.1 thousand counterfeit notes of Rs. 500 were detected. This is around 40% of the total notes detected. Not only does this denomination form the major portion of the total counterfeit notes, but there is also an increasing trend. After a decline post-demonetisation, the number of Rs. 500 denomination counterfeit notes have increased year-on-year since 2019-20.

Unlike 2021-22, where there was an increase in the number of Rs. 2000 counterfeit notes detected in the system; the number fell in 2022-23 to 9.8 thousand counterfeit notes compared to Rs.13.6 thousand in 2021-22.

With a slight increase in 2022-23, the increasing trend of counterfeit notes of Rs. 200 continued. Rs. 200 currency notes are the other new currency note issued after demonetisation. Comparatively, there is a steep decline in the number of Rs.100 counterfeit notes that are being detected.

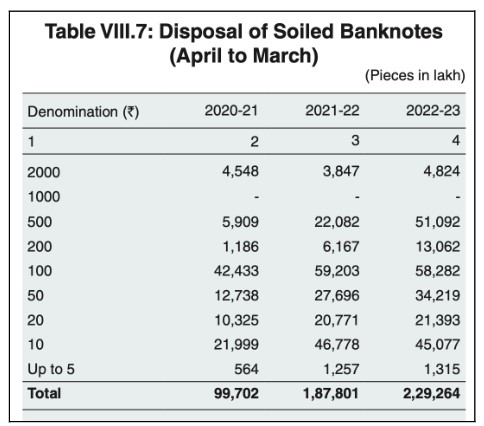

RBI allows for the exchange of soiled bank notes. All the banks are authorised to accept soiled banknotes in exchange for full value. As per RBI’s Annual report, there is an increase in the number of such soiled notes disposed in the last two years i.e., 2021-22 & 2022-23. In 2020-21, the number of such currency notes fell to 99.7 thousand compared to 1.46 lakhs in 2019-20. During 2022-23, the number of soiled banknotes disposed in the case of Rs. 500 denomination more than doubled.

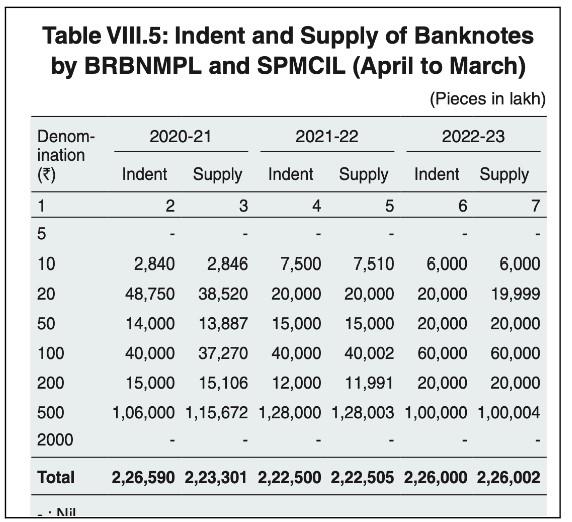

Fall in Indent & Supply of Rs. 500 notes during 2022-23, with a marginal overall increase

Ensuring the supply of currency notes in the market is critical for the proper functioning of the economy. Accordingly, RBI estimates the demand for currency and ensures the supply of the same.

As per RBI’s annual report for 2022-23, there is a slight increase in the indent and supply of currency notes in 2022-23. This is despite a fall in the indent & supply of Rs. 500 currency notes. In 2021-22, the indent for Rs.500 notes was 1.28 lakhs, which fell to 1 lakh in 2022-23. Unlike in 2020-21, the supply was more than the indent only by a few notes in the last two years.

Despite a fall in indent & supply of Rs. 500 notes, the overall increase was due to the increase in the indent for other currency notes i.e., Rs. 50, 100 & Rs. 200 notes.

A detailed data set of indent & supply of Bank notes & coins can be found here on Dataful.

The total expenditure incurred on security printing during 2022-23 was Rs. 4.68 thousand crores. This a slightly lower than Rs. 4.98 thousand crores incurred on printing in 2021-22. During 2020-21, RBI switched to the financial year ending March, from its regular July-June accounting cycle. Hence, the value reported in 2020-21 was only for a 9-month period.

In 2019-20, which is for a 12-month period, the cost of printing was Rs.4.37 thousand crores. While RBI stopped printing Rs. 2000 notes in 2018-19, the cost involved in printing new Rs. 2000 notes was one of the aspects discussed during the withdrawal of the Rs.2000 currency note.