The Insolvency and Bankruptcy Code (IBC) was supposed to improve the debt recovery process, of especially the long pending NPAs. What has been the experience of the last few years? What do various reports say about the IBC?

In Factly’s earlier story, we looked at the basics of Insolvency & Bankruptcy Code (IBC) 2016. In this article, we take a detailed look at the impact of IBC so far and attempt to throw some light on the question of how do certain NPAs qualify for reference under IBC.

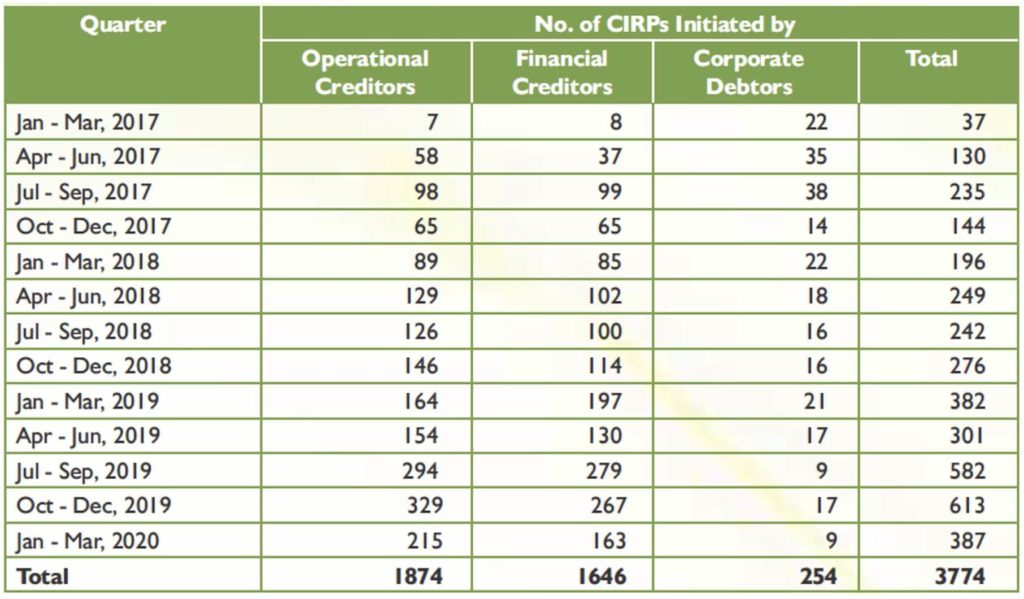

Since the inception of IBC, a total of 3774 cases (termed as Corporate Insolvency Resolution Process – CIRPs) have been commenced by the end of March 2020, as highlighted by the from IBC Quarterly Newsletters.

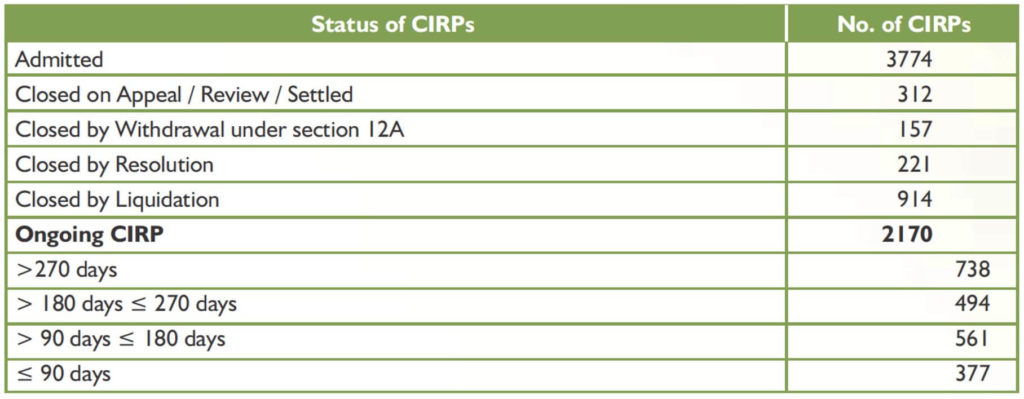

Out of these, 312 have been closed; 157 have been withdrawn; 914 have ended in orders for liquidation and 221 have ended in approval of resolution plans as of March 2020.

What has been the impact of the IBC?

Here is what the data from Reserve Bank of India (RBI), World Bank, and Economic Survey of Government of India say about the impact of IBC in terms of other parameters.

RBI Reports

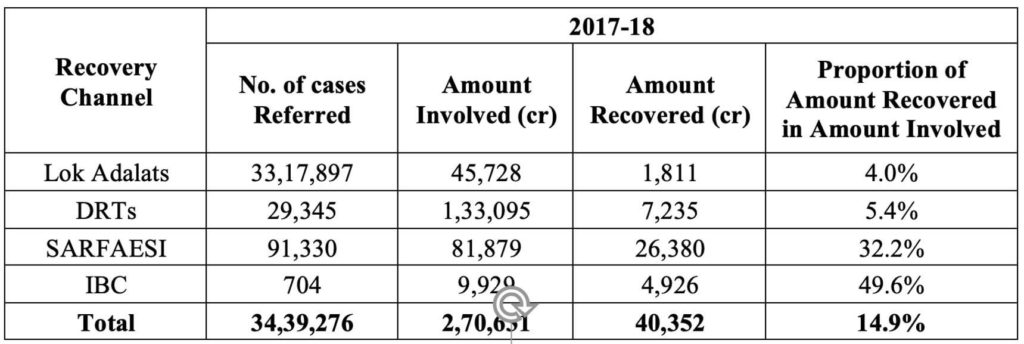

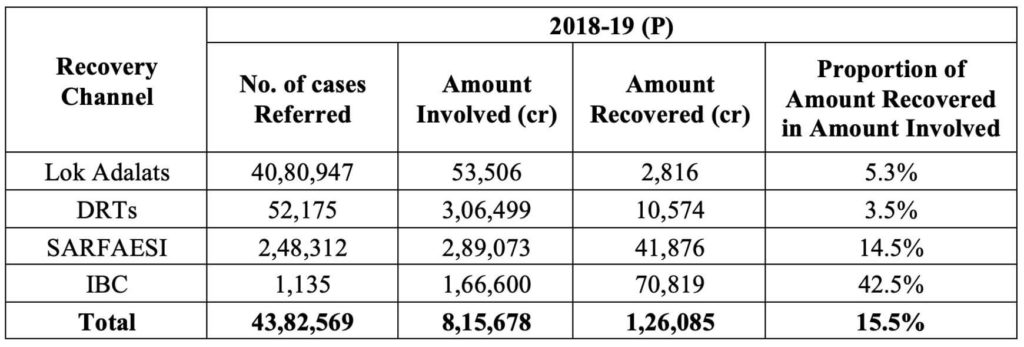

The resolution under IBC in terms of proportion has been substantially higher as compared to other processes. As per the data provided in the report on Trend and Progress of Banking in India 2018-19, the amount recovered as a percentage of amount involved in 2017-18 and 2018-19 has been much higher for IBC at 49.6% in 2017-18 and 42.5% in 2018-19 as compared to Lok Adalats, DRTs etc.

Economic Survey, 2019-20

The Economic Survey of the Government of India for 2019-20 noted the progress made under the IBC since its enactment, in terms of its use by stakeholders and the development of an ecosystem of service providers. The realizations under the IBC for Financial Creditors and time taken for the same were noted as being better than those under other available avenues for resolving distressed assets in the country, drawing from aforementioned RBI reports.

Ease of Doing Business Report, 2020

The Ease of Doing Business Report assesses 190 economies in terms of 10 parameters that span the lifecycle of a business as to how conducive the environment is for doing business in an economy. According to the Ease of Doing Business Report 2020, India’s overall ranking improved by 14 places to 63rd position among 190 countries as against last year’s 77th position. With this India earned a place among the world’s top ten improvers in ease of doing business, for the third consecutive year.

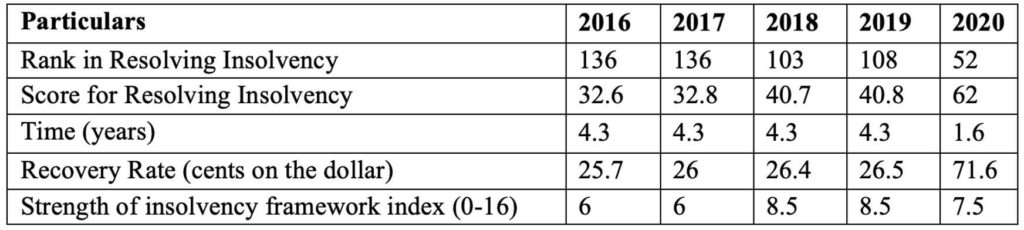

In the ‘resolving insolvency’ parameter, India’s ranking improved 56 places to 52 this year from 108 last year. As per this report, owing to the establishment of a modern insolvency regime with the enactment of the IBC, India made resolving insolvency easier by promoting reorganisation proceedings in practice. The Code has put in place effective tools for creditors to successfully negotiate and effectuated greater chances for creditors to realise their dues. As a result, the overall recovery rate for creditors jumped from 26.5 to 71.6 cents on the dollar and the time taken for resolving insolvency also came down significantly from 4.3 years to 1.6 years.

Here’s a snapshot of India’s journey in the ‘resolving insolvency’ parameters, according to Ease of Doing Business Reports over the past few years.

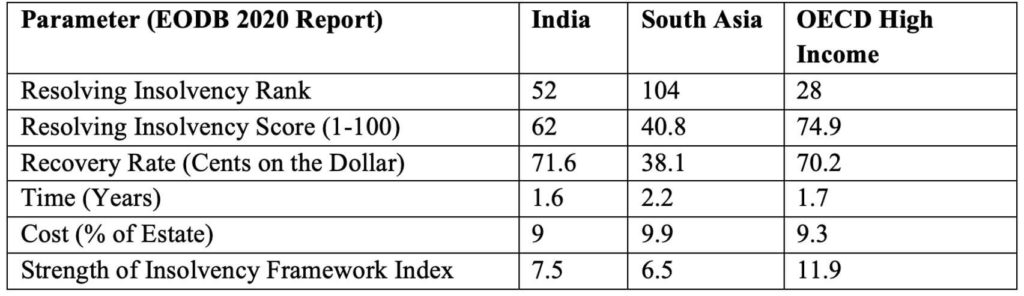

India is now, by far, the best performer in South Asia on the resolving insolvency component and does better than the average for OECD high-income economies in terms of recovery rate, time taken and cost of a corporate insolvency resolution process, the Ease of Doing Business 2020 Report noted.

What are the criteria for NPAs to qualify for referral under IBC?

Soon after the constitution of IBC in 2016, the Banking Regulation (Amendment) Ordinance, 2017 was promulgated in May 2017. The Ordinance had inserted two new Sections viz. Section 35AA and Section 35AB in the Banking Regulation Act, 1949, in line with the objective to clear the nation with bad loans. Section 35AA grants powers to Central Government to order RBI to issue directions to banks to make use of insolvency resolution process as iterated in the IBC 2016 and Section 35AB bestows some powers on the Reserve Bank.

By virtue of the above powers, RBI constituted an Internal Advisory Committee (‘IAC’), which accordingly held its first meeting in June 2017. The IAC reached a consensus to specifically focus on large stressed assets while taking into consideration the accounts which are classified partly or wholly as non-performing from amongst the top 500 exposures in the banking system.

The IAC has decided a criterion for referring stresses assets’ account for resolution under IBC. Accordingly, all accounts with 60% or more classified as NPAs as on 31 March 2016 having fund-based and non-fund based outstanding amount greater than Rs. 5000 crores shall be referred to IBC. For the remaining NPAs, which do not qualify under above criterion, the committee has proposed a timeline of 6 months, within which the banks should finalise, a resolution plan, failing which it shall be compulsory for them to file for insolvency under IBC.

Featured Image: Insolvency & Bankruptcy Code