NPAs and wilful defaulters is an on-going debate in the country. The Insolvency and Bankruptcy Code (IBC) was supposed to improve the debt recovery process, of especially the insolvent & bankrupt businesses. What is this code and what has been the experience with the code?

In the wake of COVID-19, various relief measures for the corporate sector were announced including giving relief to companies defaulting on loans due to the COVID-19 stress. The Finance Minister has also announced that no fresh insolvency will be initiated for one year under the Insolvency and Bankruptcy Code (IBC). Furthermore, minimum threshold to initiative insolvency proceeding has been raised to Rs 1 crore from Rs 1 lakh to benefit MSMEs. Also, coronavirus-related debt will be excluded from definition of default.

In the light of these announcements, let’s take a look at the Insolvency and Bankruptcy Code. The Insolvency and Bankruptcy Code (IBC) 2016 is a comprehensive corporate insolvency framework. The insolvency resolution process in India has in the past involved the simultaneous operation of several statutory instruments. The IBC in that sense is a game changer in the resolution of Non-Performing Assets (NPAs) because it provides a framework for time-bound insolvency resolution with the objective of promoting entrepreneurship and availability of credit while balancing the interests of all stakeholders.

What is Insolvency & Bankruptcy?

Insolvency is the inability to pay debts when they are due. There are solutions for resolving insolvency, including borrowing money or increasing income so that you can pay off debt. One could negotiate a debt payment or settlement plan with creditors. Bankruptcy is usually a final alternative when other attempts to clear debt fail. While insolvency is a state of economic distress, bankruptcy is a court order that decides how an insolvent debtor will deal with unpaid obligations. That usually involves selling assets to pay the creditors and erasing debts that can’t be paid.

An individual or company can be insolvent without being bankrupt — especially if the insolvency is temporary and correctable — but not the opposite.

In case of loan defaulters, the creditors (including a bank) can decide to start the process of debt resolution under the IBC framework. For instance, in August 2017, Reserve Bank of India (RBI) has sent commercial banks a second list of at least 26 defaulters with which it wants creditors to start the process of debt resolution before initiating bankruptcy proceedings

Framework of IBC

The Code applies to companies and individuals and provides for a time-bound process to resolve insolvency. When a default in repayment occurs, creditors gain control over debtor’s assets and must take decisions to resolve insolvency within a 180-day period. In cases where bank is the creditor, the banks now have the discretion in taking the defaulting companies to National Company Law Tribunal (NCLT) under Insolvency and Bankruptcy Code (IBC).

What is the procedure under the Code?

Initiation: When a default occurs, the resolution process may be initiated by the debtor or creditor. The insolvency professional administers the process. The professional provides financial information of the debtor from the information utilities to the creditor and manage the debtor’s assets. This process lasts for 180 days and any legal action against the debtor is prohibited during this period.

Decision to resolve insolvency: A committee consisting of the financial creditors who lent money to the debtor will be formed by the insolvency professional. The creditors committee will take a decision regarding the future of the outstanding debt owed to them. They may choose to revive the debt owed to them by changing the repayment schedule or sell (liquidate) the assets of the debtor to repay the debts owed to them. If a decision is not taken in 180 days, the debtor’s assets go into liquidation.

Liquidation: If the debtor goes into liquidation, an insolvency professional administers the liquidation process. Proceeds from the sale of the debtor’s assets are distributed in the following order of precedence:

- Insolvency resolution costs, including the remuneration to the insolvency professional

- Secured creditors, whose loans are backed by collateral, dues to workers, other employees

- Unsecured creditors

- Dues to government

- Priority shareholders

- Equity shareholders.

Impact of IBC

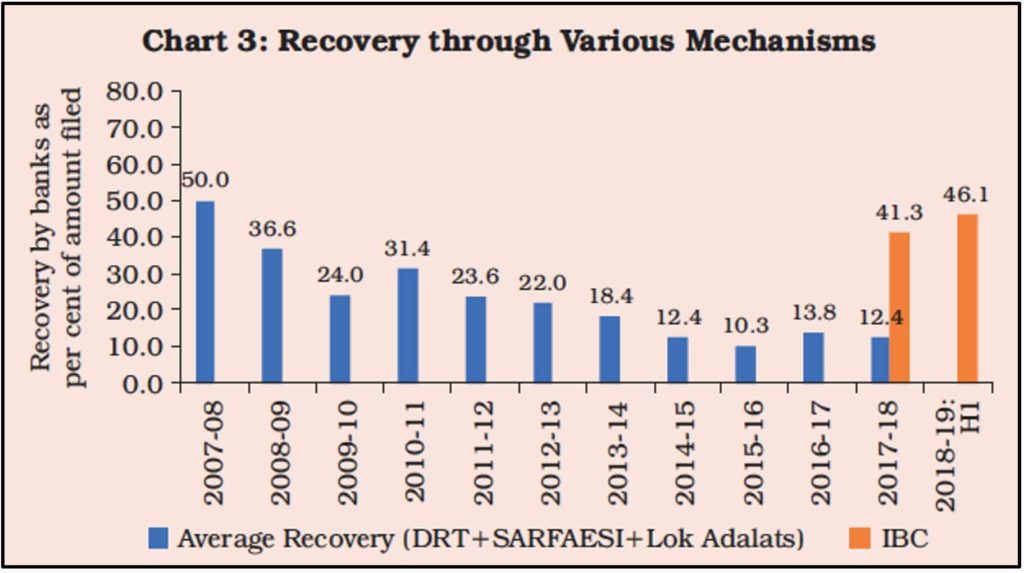

Since its inception in 2014, IBC has resolved 221 cases and achieved 44% recovery. According to RBI reports, around half of the claims under the IBC were settled in 2018-19 and the statistics for the past decade show that the experience with IBC has been encouraging. The average recovery through mechanisms that existed before IBC viz., the Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest (SARFAESI) Act, Debt Recovery Tribunals (DRTs) and Lok Adalats has been declining over the years. The average recovery through IBC is greater than these mechanisms and is also improving gradually, pointing to the need and efficiency of such a channel.

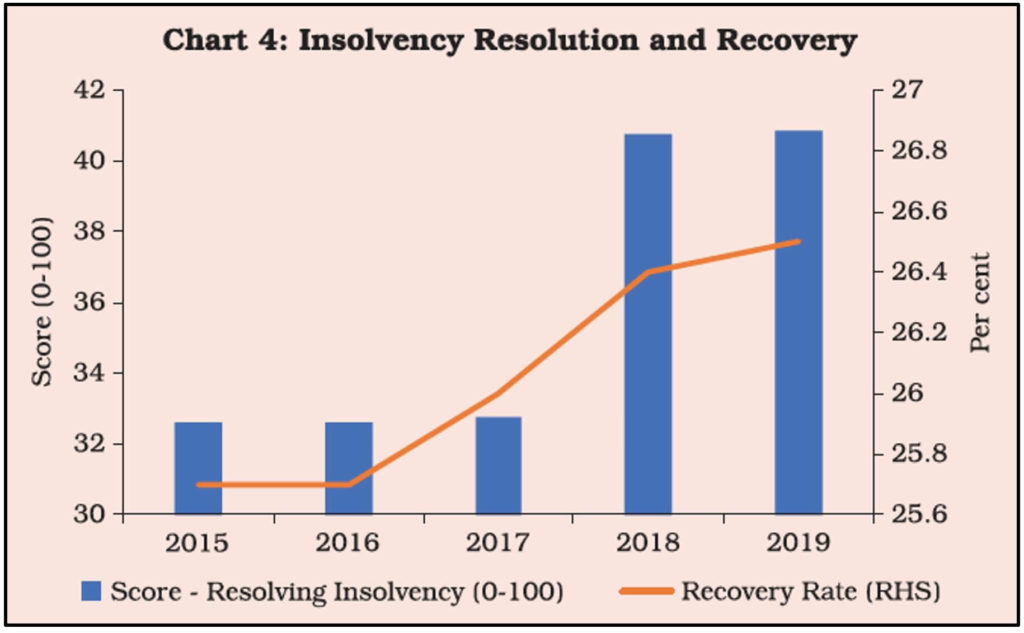

Reflecting this, India’s insolvency resolution score and recovery rate improved substantially in the World Bank’s Ease of Doing Business Index 2019, after the introduction of IBC, 2016.

Featured Image: Insolvency and Bankruptcy Code