As per the directions issued by IRDAI, all insurers with unclaimed amounts of policyholders for a period of more than 10 years as on 30 September, every year have to transfer such unclaimed amount to the Senior Citizens Welfare Fund (SCWF) on or before 01 March of the financial year. Here is what the data indicates.

An insurance policy provides a safety net and ensures financial security against any unforeseen events in a person’s life. The premise that any type of insurance policy, Life or Non-life, works upon is that a premium is paid to the insurer regularly with an assurance that a lump sum amount with benefits if any, are paid upon maturity or when needed as stipulated in the policy.

However, in many instances, the amount remains unclaimed for various reasons. These could include – the death of a policyholder without having a nominee in place, not having the necessary documents to make a claim, failure to complete the required premium payments, lack of communication in case of address or bank change, nominees not aware of the policy in case of death of deceased, etc.

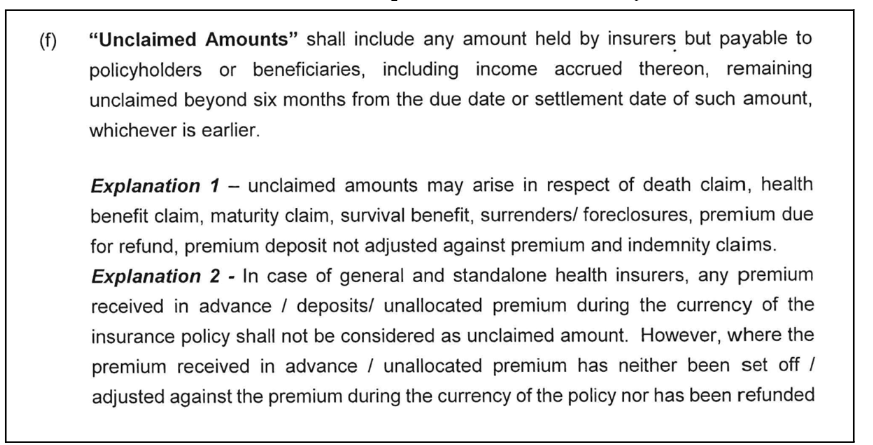

Unclaimed amount refers to the amount of money that remains unpaid to the policyholders or beneficiaries in the form of survival claims, premium funds, maturity claims, death claims, etc.

Insurance companies have processes in place to reach out to the policyholder or nominees alerting them on the unclaimed amount and advising them to make a claim. Despite the efforts from Insurance companies, a certain amount remains unclaimed. So, what happens to this unclaimed amount?

Unclaimed amount for a period more than 10 years to be transferred to Senior Citizens Welfare Fund

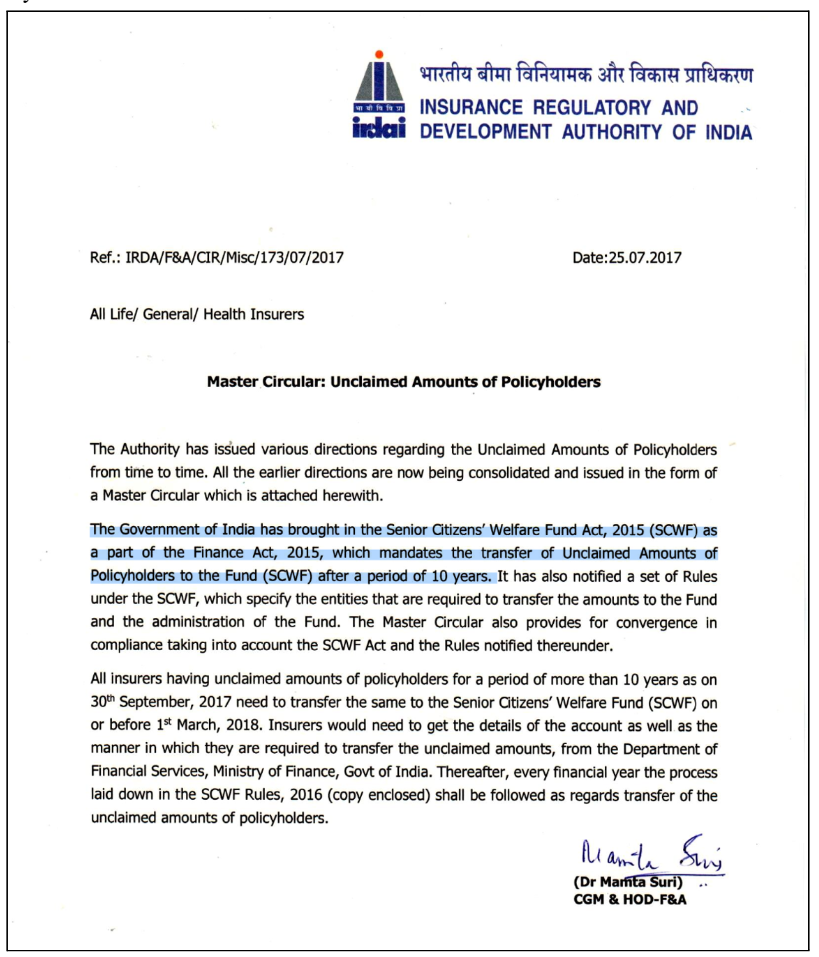

The Insurance Regulatory and Development Authority of India (IRDAI) laid down the process to be followed by the insurers in case of unclaimed policy amount. Over the years, the IRDAI has issued various directions regarding the unclaimed amounts to be paid to the policyholders. A consolidated Master circular was issued by IRDAI in July 2017.

As per the directions issued in this circular, all insurers with unclaimed amounts of policyholders for a period of more than 10 years as on 30 September, have to transfer such unclaimed amount to the Senior Citizens Welfare Fund (SCWF) on or before 01 March of the financial year.

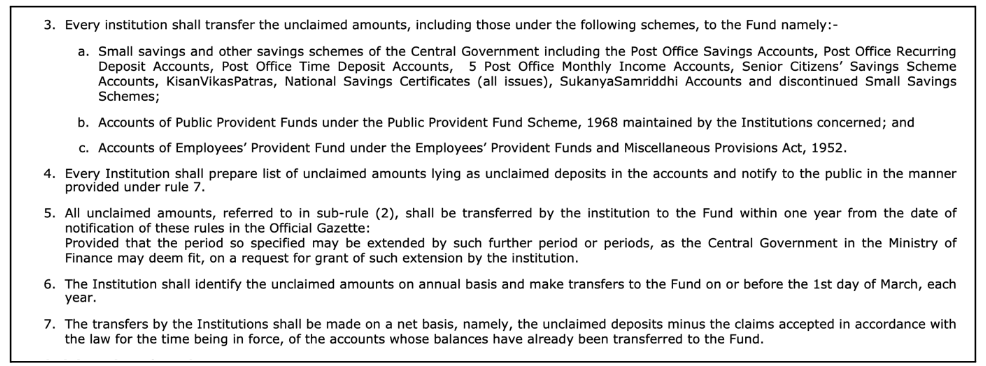

The IRDAI also laid down the directions for the accounting procedures to be followed in transferring the unclaimed amount to the designated account of the Government of India. The Government of India set up the Senior Citizens Welfare Fund (SCWF) through the provisions of the Finance Act, 2015, for promoting the welfare of Senior citizens. Various institutions are enlisted to transfer unclaimed amounts, to be utilized for various schemes. Insurance companies are also listed among these institutions whose unclaimed insurance policy amounts are required to be transferred to SCWF. The process to be followed by Insurance companies is in accordance with SCWF rules.

As already indicated above, in the case of Insurance Companies, all the unclaimed amounts for more than 10 years are required to be transferred to SCWF. The insurance companies are required to categorize the unclaimed policy amount based on tenure and transfer all the amount that is unclaimed for more than 10 years. The latest Master circular in this regard was released by the Government in November 2020. The emphasis of the latest circular is on monitoring, reporting, and certification of unclaimed amounts.

But how much amount is transferred by Insurance companies to SCWF? Factly filed an RTI application seeking this information from the IRDAI. The dataset based on the response to this RTI can be found on Dataful.

More than 2.85 thousand crores of Unclaimed Insurance amount transferred to SCWF as of March 2023

As per the RTI response, a total of Rs. 81.63 crores were transferred to SCWF by Insurance companies as on 01 March 2018. This is the first time that the unclaimed amounts were transferred to SCWF after the implementation of the new regulation. Out of this, an amount of Rs. 48.95 crores are from Life Insurers while another Rs. 32.68 crores from Non-Life Insurers.

During 2019-20, the total value of insurance amount transferred increased nearly four-fold to Rs. 398.95 crores. This increase is due to the increase in the amount transferred by Life Insurers.

However, in the ensuing year, the amount transferred by Life Insurers fell to around Rs. 188 crores. This is reflected in the overall amount transferred by the Insurance companies to SCWF.

In the following years, there is a steady increase, mainly contributed by the increase in the amount transferred by Life Insurers. During 2022-23, the amount transferred in the year increased by 80% compared to 2021-22. It ought to be noted that the values for the respective fiscal years are as on 01 March of the respective fiscal year, as per the guidelines which require the transfer to happen by the first of March of every year.

LIC accounts for 83 % of the total amount transferred to SCWF by Life Insurers

Out of the total unclaimed amount transferred to SCWF by Insurance companies, the highest proportion is by Life Insurers. Out of the total Rs. 2.85 thousand crores of unclaimed insurance amount transferred to SCWF; Life Insurers transferred Rs. 2.54 thousand crores i.e., 89% of the total. A major share of this is contributed by the largest life insurer i.e., the Life Insurance Corporation of India (LIC).

Between 2017-18 and 2022-23, the total amount transferred by LIC to SCWF was Rs. 2.1 thousand crores. This makes up around 83% of the total amount transferred by Life Insurers. This also accounts for around 74% i.e., nearly 3/4th of the total unclaimed amounts transferred by insurance companies to SCWF.

Among the other Life insurers, ICICI Prudential Life transferred the second greatest unclaimed amount of Rs. 108.7 crores between 2017-18 and 2022-23. A majority of this i.e., Rs. 73.4 crores are during the past two years i.e., 2021-23. Another noticeable trend is that there is an increase in the number of Insurers who have transferred unclaimed amounts to SCWF. In 2017-18 there were 12 Insurers, which increased to 22 in 2022-23.

ICICI Lombard and New India Insurance make up more than 57% of amount transferred by non-life insurers

Compared to Life Insurers, the share of various non-life insurers of the total amount transferred to SCWF is more evenly distributed. However, two non-life insurers account for a major share of the amount transferred to SCWF.

Between 2017-18 and 2022-23, ICICI Lombard General transferred Rs. 97.5 crores out of the total Rs. 315.5 crores transferred by non-life insurers to SCWF i.e., 31% of the total. Except for 2022-23, ICICI Lombard was the highest contributor year on year. The total contribution of New India Insurance is Rs. 84.09 crores during this period. A major share of which was in 2022-23 with Rs. 38.3 crores transferred during the year.

While transferring unclaimed insurance amount to SCWF has a purpose-full utilization, it is also required that the Insurers adopt more proactive strategies to ensure that the unclaimed amount reaches the right beneficiaries instead of the remaining unclaimed for more than 10 years.