India is one of the largest Gold markets and also a leading importer of the yellow metal. Data indicates that after a slump in demand during 2019 on account of COVID-19, the demand for gold is back to the pre-pandemic highs. Historical data also indicates that the average yearly price of Gold has increased by more than 6 times since 2005.

Gold occupies a distinct place in the hearts of people, particularly Indians. This yellow metal is regarded as a symbol of wealth and is also perceived as a ‘safe haven’ in terms of investment owing to its liquidity and the ability to hedge during periods of economic stress. Despite the transition to fiat currency, gold still remains a popular choice for the central banks of different nations to safeguard against any macroeconomic emergencies.

Gold does not generate any passive income, unlike other assets. Any income that is generated by gold is only because of price fluctuations. Basic economic theory suggests that any price fluctuations are due to the supply and demand of the good. However, the pricing of gold depends on lot of factors, both domestic as well as international. As a result, gold prices change almost every single day. In fact, gold is seen as a barometer for gauging market behaviour. We look at the trends relating to gold and its pricing in this story.

Determinants of domestic gold prices in India

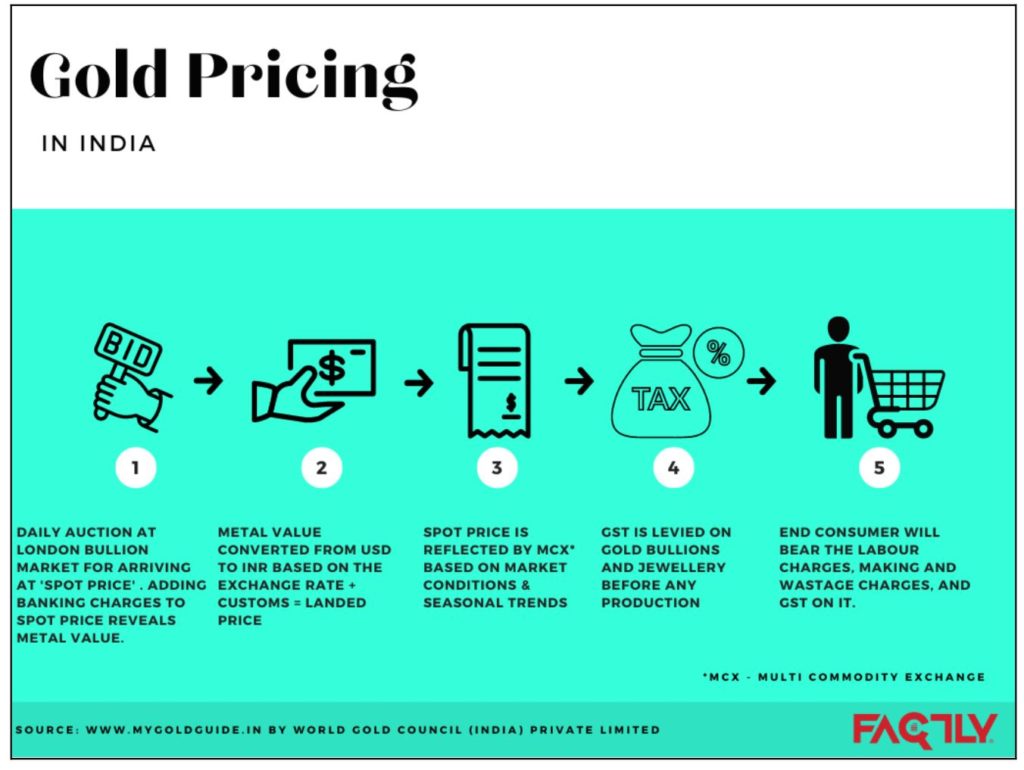

Daily auctions of precious metals like gold, silver, palladium, and platinum take place in London and the London Bullion Market determines the ‘spot price’ of per ounce of 995K gold. It is a fluctuating market price for an asset bought or sold on commodity exchanges contracted for immediate payment and delivery. A nominal transaction charge is added by importing banks, which when added to the spot price determines the metal value. This metal value in US dollars is converted to Indian Rupees based on the exchange rate. Adding the customs tariff for this metal value gives the ‘landed price’. Once this landed price is arrived at, depending on the government policies, seasonal trends, and market conditions, the Multi Commodity Exchange of India Limited (MCX) and National Commodity and Derivatives Exchange Limited reflect the spot price in the Indian context.

Taxes such as GST are levied on gold bullion and jewellery before any production. Adding to this, the final consumers bear the wastage charges, making charges, and production costs. GST is also applicable on the making charges and wastage charges. The cumulative of all these factors is the domestically determined gold price. Prices could vary above the determined price depending on the sellers’ charges and discounts.

Demand and Supply of Gold in India

It is a common understanding that the dynamics of demand and supply influence the pricing of any good. However, as stated earlier, the pricing of gold is influenced by a wide variety of factors such as inflation, currency exchange value, market conditions, and people’s preferences. The chart below depicts the demand and supply of gold in India as per the data of the World Gold Council. It can be seen that except for the year 2016, the supply of gold exceeded the demand for gold. In the pandemic year of 2020, the demand and supply of gold hit the lowest in the last decade. However, with the easing of COVID-19-related restrictions and the comeback of the Indian wedding season, the demand and supply in 2021 reached almost the 2015 levels

Trend in Gold Prices – both domestic and international

As mentioned earlier, gold prices depend on a lot of factors such as inflation rates, central bank purchases, currency exchange rates, and state taxes. Analysis of the yearly average price of gold from 1985-86 indicates that till 2005-06, there is a gradual increase in the average prices. From 2007-08, there has been an exponential increase in the average price till 2012-13, growing by almost 130% during that period, thereafter which it briefly declined till 2017-18. From 2018-19 to 2020-21, there was an increase in yearly average gold prices by 56%. It is also observed that the yearly average price of gold in Mumbai exceeded that of London from 2012-13.

International and domestic gold prices seem to be closely interlinked, both showing similar variations over a period of time. The fluctuation of domestic gold prices follows that of global gold prices. It is said that due to the liberalisation of the gold market, movements in domestic gold prices should roughly match the international gold prices after adjusting for the exchange rate, which is the case if one looks at the relevant data.

The increase from 2018-19 to date could be attributed to multiple factors such as the introduction of the GST system, which caused an increase in gold prices. There are also other factors such as the easing of COVID-19 restrictions and the resumption of normal economic activity including events such as weddings.

Influence of Exchange Rate on Gold Prices

India is one of the largest importers of Gold. The foreign market affects daily fluctuations in gold prices. Data shows that whenever the value of the Indian rupee depreciates, gold prices generally tend to increase. However, this is not an exact correlation as other factors might also impact the pricing of gold.

For instance, during 2006-07 to 2007-08 and 2007-08 to 2009-10, the value of the rupee appreciated from 45.2 to 40.3 and depreciated from 40.3 to 46 respectively. However, the gold prices during the same corresponding period rose from Rs. 9240 to Rs. 9995 to Rs. 12890. Further, between 2011-2012 and 2012-13, the value of the rupee depreciated from 47.9 to 54.4, while the price of gold jumped from Rs.25,722 to Rs. 30,163. However, from 2012-13 to 2013-14, the value of the rupee depreciated from 54.4 to 60.5, while the price of gold decreased from Rs.30,163 to Rs. 29,190.

Similarly, between 2014-15 to 2015-16, the value of the rupee depreciated from 61.1 to 65.5, while the price of gold declined from Rs.27,414 to Rs. 26,534. However, from 2019-20 to 2020-21, the value of the rupee depreciated from 70.9 to 74.2, while the price of gold increased from Rs.37,017 to Rs. 48,723. This also could be because of low demand and supply in the market, enabling the price volatility of gold.

In most cases, it is observed that changes in exchange rates have caused an increase in gold rates, irrespective of the degree and direction of change. While an exact correlation between average exchange rates and gold prices could not be established, it can be said that they are interlinked, with other factors such as inflation, and market conditions also causing volatility in gold prices.

Featured Image: Gold Prices Increase