As noted in our previous story, global FDI inflows reduced by 35% in 2020 reaching a record low. However, there were differences in the trends by sector & economy type. Contrary to the trend in most other sectors, FDI inflows to ICT Green-Field projects increased by 22% in 2020 due to the rise in global demand for digital infrastructure & services.

In the previous story, we had observed that as per UNCTAD’s World Investment Report -2021 (WIR), the Global Foreign Direct Investment (FDI) inflows in 2020 were the least since 2005. With the exception of a few countries, the decline in FDI flows was observed across the countries. The Developed economies were the most impacted both in terms of FDI inflows as well as outflows. In this story, we explore the trends in FDI in terms of the different projects and the various sectors receiving FDI.

Impact of the Pandemic visible across all project types

The impact of the COVID-19 pandemic on FDI inflows was evident across most of the countries irrespective of the type of economy i.e., Developed, Developing & Transitional economies. This global impact is the result of considerable impact on every type of FDI, which has further resulted in an impact across various sectors.

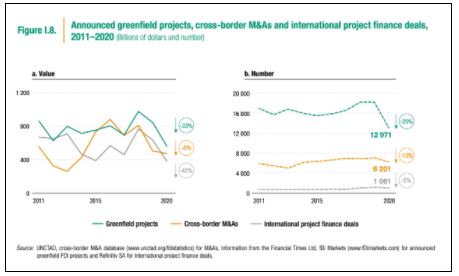

As per the World Investment Report-2020, all the three types of FDI i.e., Greenfield Projects, Cross border Mergers & Acquisitions (M&As) and International Project Finance have all seen a sharper decline.

In a Green-field FDI project investment, the parent company creates a subsidiary in a different country and establishes the operations from the ground up. These FDI inflows are also referred to as direct investments and the investing company retains a higher degree of control. These investments entail a higher degree of risk, as the volume of investment is higher, and the returns are expected only in the longer run.

Hence, the uncertainty caused by the pandemic had a considerable impact on Green-field investments, where-in the value of Green-field projects fell by 33% in 2020 compared to 2019 and the number of such investments announced fell by around 29%.

In terms of International Project Finance, the number of deals announced fell only by 5%, but the overall volume had a major decline of 40%. This type of FDI is used for investments in long-term infrastructure or industrial projects.

FDIs through Merger & Acquisitions reduced 6% by value while the number of deals saw a decline by 13%. The WIR observes that there is a sharp decline during the first half of the year, which was offset by the surge seen during the last quarter of 2020.

Green-field FDI during 2020 is the least in history

The total value of the Green Field investment projects announced in 2020 was $ 564 billion, compared to the $846 billion reported in 2019. The WIR-2021 observes that this is the least Greenfield Investment in a year in history.

This fall is visible across all types of economies.

- Developed economies are economies that have a higher Per Capita income and are highly industrialized constitute most of the countries from the European Union, along with major regional economic powers including the USA, UK, Canada, Australia, Japan, etc. The Green-field investment in these economies reduced by 16% from $ 346 billion in 2019 to $ 289 billion in 2020. Even the number of projects announced fell from around 10.3 thousand to 8.3 thousand.

- In the earlier story, we had highlighted that the decline in FDI for Developing countries was lower compared to Developed & transitional countries. However, the trend for greenfield investments stands in contrast. Most of the countries in Asia, Africa, Central & Latin America are classified as developing countries as they have comparatively lower incomes and are less industrialized. These countries generally receive higher Green-field investments. However, in 2020, the FDI inflows into greenfield projects fell by 44% from $ 454 billion in 2019 to $ 255 billion in 2020. The number of Greenfield projects announced fell to 4.2 thousand from around 7.2 thousand.

WIR-2021 states that the focus of the foreign investors for Green-field projects shifted from developing economies to the developed economies. A more stable environment could be one of the factors.

Meanwhile, FDI in Green-field projects in Transition economies also fell by 58% in terms of volume. The number of announced FDI projects in these countries fell from 697 to 371. Most of these countries are those transitioning from controlled economies to free-market economies. Hence, they mostly include Eastern-European countries & former-Soviet republics.

41% fall in the value of FDI in Green-field projects of Manufacturing Sector

The fall in FDI if Green-field projects are visible across all the three sectors. Primary Sector, which already has lower FDI inflows compared to Manufacturing & Services sectors further fell in 2020. The total volume of investment in 2020 was $ 11 billion, nearly half of $ 21 billion in 2019. The number of Green-field projects announced in 2020 was 100, compared to 151 announced in 2019.

A major portion of the investment in this sector is due to the $6.4 billion project announced by Royal-Dutch Shell, a Netherlands-UK company investing in Australia.

- The manufacturing sector witnessed a major decline in 2020. The volume of Green Project FDI in the Manufacturing sector for 2020 was $ 237 billion, 41% less than the $ 402 billion in 2019. The number of projects announced in 2020 was around 5.1 thousand compared to around 8.1 thousand in 2019.

- Comparatively, the Service sector was better off. The value FDI in Green-field projects announced in the Service sector during 2020 was $ 315 billion, compared to $ 422 billion in 2019. The total projects announced were around 7.7 thousand in 2020 compared to 9.9 thousand in 2019.

Among the various industries, the ‘Coke & refined petroleum’ sector saw a major decline, wherein the value of investments fell from $ 94 billion in 2019 to $ 30 billion in 2020. The preference of the investors in the energy sector has shifted to Renewable sources of energy. However, even this sector was impacted by the pandemic with a 5% decline in investment during 2020. Still, investments in renewable energy sectors were better off compared to most other sectors

‘Construction and Automotive Industry’ also saw a major decline in investments during 2020. In both these industries, the value of FDI fell by 47%. The investments in Transportation & Storage industry fell by around 39%.

The pandemic had a positive impact on the ‘Information & Communication Technology’ (ICT) sector. The rise in global demand for digital infrastructure & services led to an increased preference for FDI projects in the ICT industry. The value of the projects in the ICT industry increased by 22% to $ 81 billion during 2020 compared to $ 66 billion in 2019. US-based Amazon’s announcement of investing $2.8 billion in India is one of the major Green-field projects announced in the ICT industry.

FDI in International Project Finance, Global M&A saw a lower decline during 2020

International Project Finance

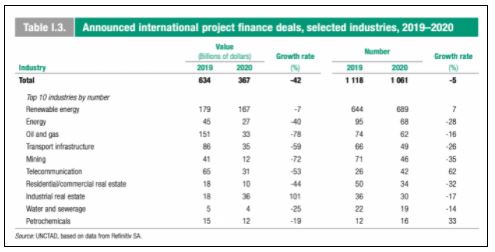

Compared to Green-field projects, the FDI as ‘International Project Finance’ witnessed a lower impact during the pandemic year. However, the total project value fell by around 42% to only $ 367 billion in 2020. This is the least in a year since 2003.

- A large impact is seen in Developing economies, where the value of such projects fell by 53%, from $ 365 billion in 2019 to $ 170 billion in 2020.

- Oil & Gas industry witnessed a major decline in the FDI in form of International Project Finance with only $ 33 billion worth of FDI in 2020, compared to $ 151 billion in 2019. Asia had a major impact in this industry with only $ 17 billion worth of projects announced in 2020 as against $ 68 billion the previous year.

It must be noted that while there has been a drastic fall in the value of the projects announced, the decline in the number of projects is only nominal, a reduction of 5%. This could point to hesitancy among the investors to commit high-value investments in 2020.

- Investment in Energy infrastructure also fell by 40% in value, while the number of projects announced was 68 in 2020 compared to 95 in 2019. This is the least in the last 8 years.

- Similar to Green-field investments, the international project Finance FDI flows were better off in the Tele-communication industry. There was an increase in the number of Projects to 42 compared to 26 in 2019. However, this is not reflected in the value of the projects as it fell by 53%.

Cross-Border M&As

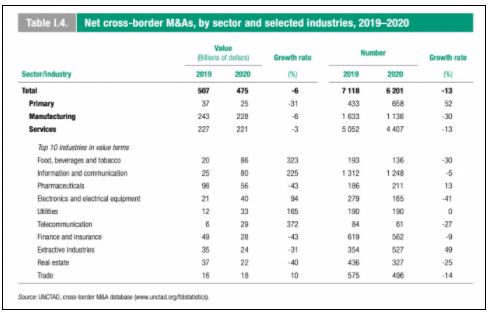

Global Merger & Acquisitions among the Multi-national entities are also one of the major sources of FDI flows between the countries. Cross-Border M&A had the least impact in terms of volume during 2020, with a fall of only 6%. However, there are major variations within the sectors.

- The FDI through M&A increased four-fold for Food, Beverage & tobacco industry in 2020. However, a major portion of the $ 88 billion FDI in this industry is due to a single deal i.e., a corporate reconfiguration due to the merger of Unilever (UK) with Unilever (Netherlands) worth $ 81 billion.

- While there was a decline in the value for the pharmaceutical industry, it stabilized at $ 56 billion. A major factor is the deals between Pharma companies like the one Pfizer (USA) had with BioNTech (Germany) to develop the COVID-19 vaccine. The upheaval caused by the pandemic had an impact on M&As in the pharma industry with the number of projects increasing to 211 in 2020 compared to 186 in 2019.

- The positive impact of the pandemic on the ICT industry continues to be seen even in the FDI flows relating to M&A. The value of FDI through M&A in the ICT industry in 2020 was $ 80 billion, a more than a three-fold increase compared to 2019.

FDI investments on Sustainable recovery

As per the predictions provided in WIR-2021, Global FDI is expected to increase by around 10-15% in 2021. While the recovery would still be lower than the decline experienced in 2020, it would at least signal a change in the right direction. As per the projections, the recovery could continue further in 2022 and reach the levels of 2019 with total FDI touching $ 1.5 trillion.

The uncertainty around the pandemic which continues even in 2021 is cited as the main reason for a moderate projection in 2021. The emergence of a second wave in most of the countries after the opening up of the economy and the prospect of further waves of COVID-19 infection creates further challenges in encouraging investments.

The recovery across the countries is expected to be un-even. Developed countries with their inherent stability and resources are expected to be leading the recovery in FDI. The report states that Asia’s resilience in attracting FDI during 2020 would continue and it would be an attractive destination for FDI even in 2021. The focus for future FDI flows would be in sustainable projects including infrastructure, green economy & digital economy sectors.

Featured Image: Global FDI flows