The Income Tax Act provides tax incentives to promote exports, regional development, infrastructure growth, employment generation, rural development, scientific research, cooperative sectors, personal savings, and charitable donations. Data indicates deductions under Section 80C and rebates under Section 87A together account for nearly 75% of the total revenue foregone for individual taxpayers.

The Union Budget 2025-26 introduced revised direct tax slabs under the new income tax regime. As per the proposal, individuals with an annual income of up to ₹12 lakh (₹1 lakh per month) will not be required to pay any income tax, except on special rate income such as capital gains. Additionally, salaried individuals earning up to ₹12.75 lakh per year will have zero tax liability due to the standard deduction of ₹75,000. The revised tax structure, along with other direct tax measures is expected to result in a revenue loss of approximately ₹1 lakh crore for the government. These changes aim to benefit taxpayers across income brackets, significantly reducing the tax burden on the middle class while boosting household consumption, savings, and investment.

Given the Government’s emphasis on promoting the new tax regime, we examine data on revenue foregone due to various incentives, exemptions, and deductions across different categories of taxpayers, most of which are available in the old regime for individual taxpayers. This includes the corporate sector, the non-corporate sector such as firms, Associations of Persons (AoPs), and Bodies of Individuals (BoIs), as well as individual taxpayers and Hindu Undivided Families (HUFs).

Note: The impact of each tax incentive is calculated individually, assuming no changes to other tax provisions. However, since different tax concessions can overlap and influence one another, the total revenue foregone may not always be a straightforward sum of individual estimates.

Find all the data about Revenue Foregone due to incentives, exemptions and deductions in respect of all the categories of taxpayers on Dataful.

The Need for Tax Incentives, Deductions, and Exemptions

The primary purpose of tax laws and their implementation is to generate revenue for government spending. The total revenue collected depends on two key factors: the overall tax base and the effective tax rates. Various provisions such as special tax rates, exemptions, deductions, rebates, deferrals, and credits influence these factors and are collectively known as “tax incentives” or “tax preferences.” These incentives impact government revenue and reflect important policy decisions. These tax incentives can be seen as indirect subsidies for specific taxpayers and are often referred to as ‘tax expenditures.’

The Income Tax Act provides tax incentives to promote exports, regional development, infrastructure growth, employment generation, rural development, scientific research, cooperative sectors, personal savings, and charitable donations. Additionally, accelerated depreciation is offered as an incentive for capital investment. These benefits are available to both corporate and non-corporate taxpayers.

Additionally, it is important to note that tax expenditure figures do not imply that this revenue was entirely waived by the government. Instead, these incentives are designed to support specific sectors and activities. Without such measures, certain economic or social initiatives might not take place or could occur on a much smaller scale.

Total Revenue impact is more than ₹30 Lakh Crore between 2004-05 and 2023-24.

The revenue impact of tax incentives is estimated across different taxpayer categories, including the Corporate Sector, Non-Corporate Sector and Individuals and HUFs. While the tax incentives for corporates and non-corporates are broadly similar, individuals receive additional benefits tailored specifically to them.

The revenue impact of tax concessions claimed by different entities is determined using the weighted average statutory tax rate. For corporate taxpayers in 2022-23, this rate stands at 34.69%, while for non-corporate entities such as AoPs, BoIs and firms, it is 34.09%. In the case of individuals and Hindu Undivided Families (HUFs), the tax impact under various sections of Chapter VI-A of the Income Tax Act is calculated based on claims for tax benefits reported in the filed Income Tax Returns.

Between 2004-05 and 2023-24, total revenue foregone due to tax incentives across all taxpayer categories amounted to ₹30.8 lakh crores. Individuals and HUFs accounted for ₹15 lakh crores, closely followed by the corporate sector at ₹14.69 lakh Crore, making up 96% of the total revenue impact.

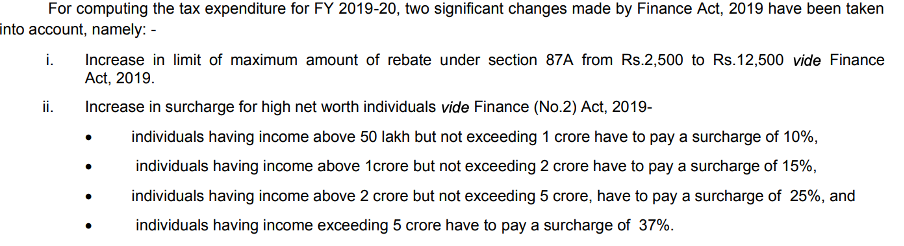

Revenue foregone for Individuals and HUFs has been rising steadily since 2012-13 and is projected to surpass ₹2 lakh crore for the first time in 2023-24. Notably, it increased from ₹95,377 crore in 2018-19 to ₹1,30,244 crore in 2019-20, possibly due to the following changes introduced in the Finance Act 2019.

For this analysis, the period is divided into four segments:

- T1 (2004-05 to 2008-09)

- T2 (2009-10 to 2013-14)

- T3 (2014-15 to 2018-19)

- T4 (2019-20 to 2023-24)

The average revenue foregone for corporate taxpayers rose from ₹53,321 Crore in T1 to ₹90,666 Crore in T4, while for individuals and HUFs, it surged from ₹24,174 Crore to ₹1,73,982 Crore during the same period. Notably, revenue foregone for individuals and HUFs grew by 120% between T2 and T3 and by 140% between T3 and T4. In contrast, for corporate taxpayers, the growth was 35% between T2 and T3 but slowed to just 5% between T3 and T4.

80C and 87A account for three-fourths of the revenue foregone for Individuals/HUFs

An analysis of section-wise revenue foregone reveals that for individuals, Section 80C (covering life insurance premiums, provident fund contributions, and certain equity investments) and Section 87A (tax rebate) together account for nearly 75% of the total revenue foregone. In 2022-23, 80C contributed 52%, while 87A accounted for 21%. The share of 80C has declined from an average of 80% (2006-07 to 2015-16) to 62% (2016-17 to 2023-24). Meanwhile, the impact of 87A has risen significantly since 2019-20, averaging 21%, up from 7% in previous years, following amendments in the Finance Act 2019.

For corporate taxpayers, Sections 32 (Accelerated Depreciation), 10AA (SEZ export profit deductions), and 80-IA (Infrastructure development deductions) together accounted for three-fourths of the total revenue foregone in 2022-23. Similarly, for non-corporate entities such as firms, AoPs, and BoIs, Sections 32, 10AA, and 80P (co-operative society income deductions) made up 75% of the total revenue foregone in this category.

Tax Revenue could have been 15% higher from non-corporate sector without these Incentives

To gauge the impact of major tax incentives, we analyse a hypothetical scenario where no such incentives exist. In this case, the total tax revenue for each taxpayer category would be the sum of actual tax collections and the revenue foregone due to incentives. While this scenario is not practically feasible, it helps illustrate the scale of tax incentives.

By comparing this ideal scenario with the current reality, we find that for corporate taxpayers, the actual tax revenue averaged 81% of the ideal scenario between 2006-07 and 2014-15, increasing slightly to 88% between 2015-16 and 2023-24. For non-corporate taxpayers (including individuals, HUFs, AoPs, BoIs, and firms), the figures were 80% and 84%, respectively. This means that due to tax incentives, approximately 15% of potential tax revenue is not realized for the non-corporate sector, while the shortfall is 12% for corporates.

A silver lining, however, is that despite the presence of tax incentives, the gap between actual tax revenue collection and the ideal scenario is gradually narrowing for corporate taxpayers. For non-corporate taxpayers, however, the gap had slightly widened and is now back to 2011-12 levels, which explains the increasing push towards the adoption of the new tax regime.