Data indicates that by the end of 2021-22, nearly 5.02 lakh cases remained unresolved at the first appeal level (CIT(A)), with ₹14.18 lakh crore locked in disputes—an 87.3% pendency rate. This marks a significant backlog in tax litigation. A major factor contributing to this backlog is the slow pace of case disposal. From 2007-08 to 2021-22, the proportion of disposed cases crossed 30% in only two years.

In the first part of this two-part series on Taxes raised but not realized, we looked at the quantum of taxes that are yet to be realized, the age and type of tax-wise categorization, and the disputed status of that amount. In this second and final part, we look at the pendency of cases across different levels of judicial administration and explore key statistics on litigation management.

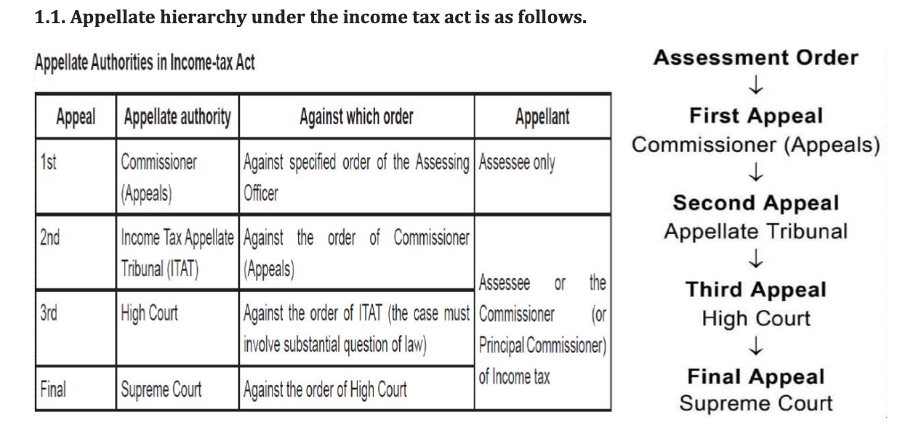

A brief structure of Direct Tax litigation cycle

In the first part, we looked at the general litigation cycle of direct tax disputes in India. Tax disputes begin with notices from authorities and can escalate legally. Taxpayers can appeal, starting with the Commissioner of Income Tax (Appeals) [CIT(A)] for direct taxes and move up to the Income Tax Appellate Tribunal (ITAT), High Courts, and even the Supreme Court.

5 lakh appeal cases pending in CIT (Appeals) at the end of 2021-22

By the end of 2021-22, nearly 5.02 lakh cases remained unresolved at the first appeal level (CIT(A)), with ₹14.18 lakh crore locked in disputes—an 87.3% pendency rate. This marks a significant backlog in tax litigation. In 2020-21, the situation was even more concerning, with 4.6 lakh pending appeals, but the amount tied up in disputes soared to a record ₹24.6 lakh crore, the highest ever, and the pendency rate stood at 94.6%.

A major factor contributing to this backlog is the slow pace of case disposal. From 2007-08 to 2021-22, the proportion of disposed cases crossed 30% in only two years, highlighting systemic inefficiencies in the tax dispute resolution process. The persistently low disposal rates have led to a growing pile-up of unresolved cases, increasing the financial burden on both taxpayers and the government while delaying revenue realization.

Disputed amount in Appeals at various fora stands at ₹14 Lakh Crore by 2023-24

Taxpayers can challenge adverse orders in judicial forums, through ITAT, High Courts, and the Supreme Court. By the end of 2023-24, pending cases stood at 20,296 in ITATs, 38,099 in High Courts, and 5,916 in the Supreme Court, with disputed amounts totalling ₹8.56 lakh crore, ₹5.64 lakh crore, and ₹23,000 crore, respectively.

Cumulatively, ₹14 lakh crore was locked in tax disputes across these forums—a 100% increase from ₹7 lakh crore in 2022-23. This marks the highest-ever disputed amount recorded at the close of any year since 2007-08, underscoring the urgent need for faster resolution of tax appeals.

Income Tax Department is the biggest litigant in these cases

The Economic Survey 2017-18 puts the Tax Department as the biggest litigant, accounting for nearly 85% of all appeals in direct tax cases. What’s particularly striking is the low success rate of the Tax Department, with a win probability in less than 30% of its cases across all three levels of appeal—Appellate Tribunals, High Courts, and the Supreme Court—for both direct and indirect taxes. In fact, it loses nearly 65% of its cases. Over time, the Department’s success rate has steadily declined, while taxpayers have seen increasing success in their appeals.

Parliamentary Panel calls to study Global Best Practices as existing measures fall short

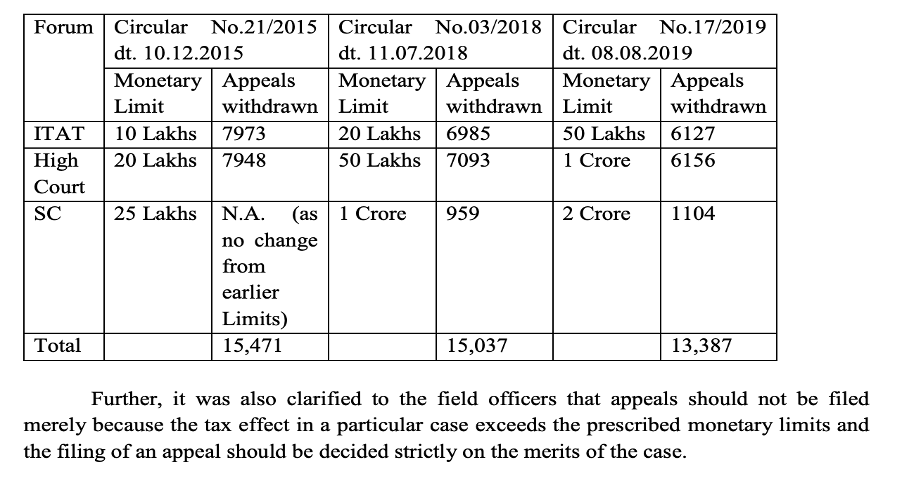

To reduce litigation, several measures have been introduced. These include raising the threshold for filing appeals to focus on high-value cases and avoiding further appeals in cases where the government has already lost at two appellate stages. The current monetary limits for filing appeals before ITAT, High Court and Supreme Court have been raised to Rs. 60 lakhs, Rs. 2 crore and Rs. 5 crore respectively, from 17 September 2024 vide circular No.9/2024. A snapshot of the cases withdrawn after raising the limits is given below.

Further, Appeals are now to be filed selectively after rigorous scrutiny to avoid routine litigation. Senior officers oversee the process, requiring approval at multiple levels— Principal Commissioner of Income Tax (Pr. CIT) for ITAT appeals, a Chief Commissioner of Income Tax (CCIT) collegium for High Court cases, and the Directorate of Legal and Research for Supreme Court matters. Only ‘Substantial Questions of Law’ are pursued in higher courts, with government law officers consulted for Special Leave Petitions (SLPs). These are enumerated in CBDT’s Instruction No. 2/2022 (dated 15 December 2022). Additionally, Section 158AB, introduced in the Finance Act, 2022, prevents repetitive appeals by deferring cases where identical legal questions are already pending before the jurisdictional High Court or Supreme Court.

The Standing Committee on Finance noted that these measures have not yielded desired results. The Committee emphasizes the need to strengthen tax dispute resolution mechanisms and take additional measures to ease the burden on taxpayers. It notes that CBDT has not assessed global best practices in mitigating tax disputes. To formulate effective alternatives, the Committee recommends a comprehensive study of international models, evaluating their impact, effectiveness, and suitability for implementation in India.