After a major fall in GST collections in 2020-21 on account of the COVID-19 pandemic, there was a significant increase in 2021-22 by more than 20%. Almost all the states reported an increase in GST collections in 2021-22 compared to 2019-20 with the traditional frontrunner states of the West & South contributing the most.

The Goods and Service Tax (GST) is an indirect tax that has subsumed most of the earlier indirect taxes in India. Indirect Tax revenues form a key part of both the Union & State Government’s revenue of which GST has a major share.

GST is levied on the supply of goods and services and hence is intrinsically linked to the economic activity in the country. The COVID-19 pandemic-related containment measures like lockdowns, curfews, etc. have limited the scope of economic activity in the country. While there was an impetus for online commercial activity, the limitations on the overall economic activity in the country due to the pandemic cannot be denied.

In an earlier story in June 2021, we highlighted the impact of the pandemic on the Union Tax revenues including the fall in revenue through GST during the period. Apart from the first wave in 2020, the country experienced a severe wave of the COVID-19 pandemic in mid-2021.

As the country is on the path of recovery, GST revenues provide a crucial data point on the state of the economy and its direction post-pandemic. The data for the story is based on the information available on the official GST Portal. A dashboard on GST collections developed by Factly can be accessed here. It has data from the launch of GST in 2017.

Increase in Gross GST collection for 2021-22, but the collections fall short of estimates

In the financial year prior to the onset of the pandemic i.e., 2019-20, the Gross GST collection was Rs.12.11 lakh crores. Gross GST includes CGST, SGST, IGST & IGST on imports. While the early months of 2020-21 were impacted by the pandemic, there was an improvement in the later months of the year. Factly’s story on these trends can be read here. However, the overall GST collections for 2020-21 were lower than the previous year with only Rs. 11.32 lakh crores.

Since the launch of GST, revenues fell short of the Budget estimates, however, 2020-21 was the first instance when the revenue was lower than the previous year.

In terms of the Gross GST collections, there was a strong recovery in 2021-22, with total collections reaching Rs.14.76 lakh crores. This is 28% higher than the previous year and 23% more than 2019-20.

Out of the Rs. 14.76 lakh crores in 2021-22, CGST & Cess accounted for 3.68 lakh crores, SGST was Rs. 3.44 lakh crores, IGST was Rs. 3.85 lakh crores and IGST on imports at 3.79 lakh crores. While the GST collections increased even compared to the pre-pandemic year, the numbers still fell short of estimates.

Among the different components of GST, IGST on imports. In the earlier year, IGST on imports increased to Rs.3.79 lakh crores in 2021-22 compared to 2.68 lakh crores in 2020-21.

Maharashtra, Gujarat, Karnataka & Tamil Nadu continue to have the highest Gross GST collection

The varying trends of Gross GST collection witnessed during the last three years have not affected the share of collection and the position of the States. Nearly all the states had a fall in the GST collection for 2020-21 compared to 2019-20 and had a recovery in 2021-22. The GST collection of almost all the states in 2021-22 is higher than the pre-pandemic year of 2019-20.

IGST on imports is excluded from the Gross GST collection of the States.

Here is a snapshot of the Gross GST collection of the States:

- Maharashtra accounts for a major share of the country’s GST collection. The state contributes around 1/5th of the total Gross GST collection from the States & UTs. During 2020-21, the GST collection dropped by around 17% to Rs. 1.65 lakh crores, which increased to Rs. 2.17 lakh crores in 2021-22, an increase of nearly 32% contributing most to the recovery post the pandemic. The share of Maharashtra’s GST largely remained unchanged at near 20% of the country’s total with a slight fall during 2020-21.

- The two Southern States of Karnataka & Tamil Nadu are also among the states with the highest GST collection. The GST collection for Karnataka in 2021-22 was Rs. 95.9 thousand crores while in the case of Tamil Nadu it was Rs. 85.4 thousand crores. Another southern state of Telangana has the 10th highest GST collection in 2021-22. Overall, the five southern states of Karnataka, Tamil Nadu, Telangana, Andhra Pradesh & Kerala contribute to around 25% of Gross GST collections during these three years.

- Gujarat also reported a significant increase in its GST collection in 2021-22. The gross GST collection in the state was Rs. 97.1 thousand crores in 2021-22 and overtook Karnataka as the state with the second-highest GST collections.

- Among the other key states with high GST collections, Delhi reported the largest drop during 2020-21. Its GST collection fell by 17% during that year. Despite a recovery in 2021-22, the overall increase compared to 2019-20 was only around 4.7%, the only state with a single-digit growth rate among the top-20 states.

- Uttarakhand presents a contrasting picture with GST collections in 2021-22 falling short of the 2019-20 figures.

As was the case prior to the pandemic, the major contribution of GST is from two regions – the five southern states and the two western states of Maharashtra & Gujarat. The other major contributors of GST – Delhi, Haryana & West Bengal are home to large metros of New Delhi & Kolkata.

The pandemic and the later recovery have not influenced the status quo with the same traditional centres of GST collections maintaining their positions & contribution.

Near 50 % increase in Odisha’s GST collection compared to 2019-20

As noted earlier, the GST collection of nearly all the states fell during 2020-21 and recovered in 2021-22. A comparison of the GST collection between the pre-pandemic year of 2019-20 and 2021-22 provides insights into the extent of recovery as the effects of the pandemic are slowly waning.

- Gujarat reported the highest percentage increase in GST collections among the top-5 states. This is evident from Gujarat reaching the 2nd place overtaking Karnataka as the state with the 2nd most GST collections.

- Meanwhile, both Karnataka & Tamil Nadu reported an increase of around 15% in GST collections compared to 2019-20. Andhra Pradesh report the most increase in terms of percentage among the Southern states with a 20% increase in GST collection in 2021-22 compared to 2019-20.

- Delhi, as stated earlier, had the least growth in its GST collection among the top states. Overall, the GST collections of Delhi in 2021-22 were only 4.7% more than that of 2019-20.

The most significant improvement in GST collection is made by Odisha. In fact, it is one of the two large states whose GST collection did not fall even in 2020-21 while the other is Chhattisgarh. After a slight improvement in 2020-21, the GST collection of Odisha in 2021-22 increased by 49% compared to 2019-20. In 2019-20, Gross GST collections of the state were Rs. 29.6 thousand crores which increased to Rs. 44.3 thousand crores in 2021-22. Jharkhand & Punjab are the other states which reported more than a 20% increase in GST collections in 2021-22 compared to 2019-20.

GST refunds could bring down the Net GST collections

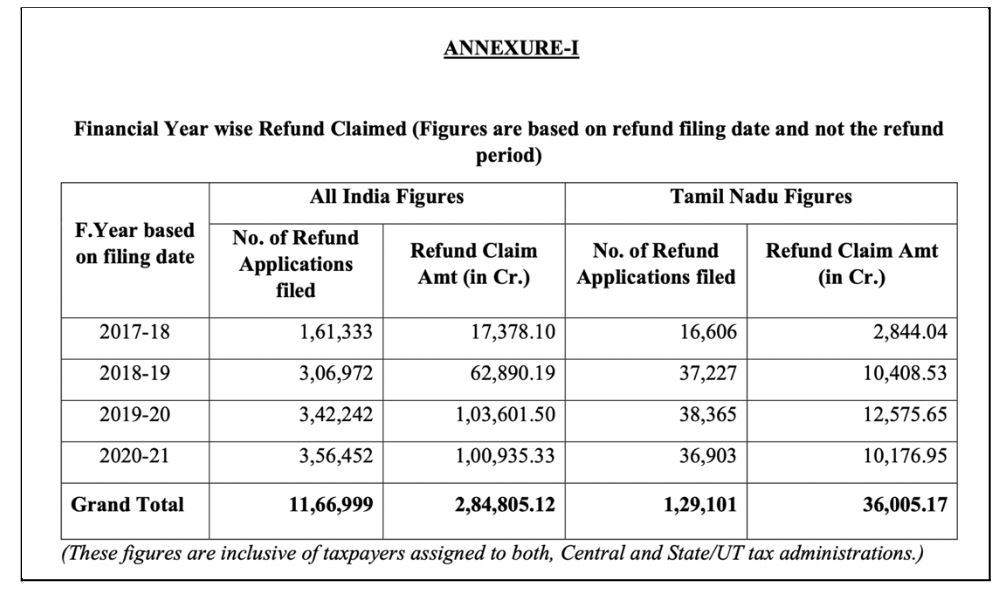

GST refund allows the taxpayers to seek a refund of the excess amount paid by them compared to their GST liability. This implies that a part of the gross GST collections by the government would be lost in the form of refunds. Available data regarding refunds indicates that there is an increase in both the number of applications for GST refunds as well as the amount of refunds.

As per a response provided in Lok Sabha on 08 March 2021, as of February 2021, there were around 3.56 lakh refund applications during the year amounting to around Rs. 1 lakh crores.

In the year before, there were 3.42 applications filed on the GST portal amounting to a claim amount of Rs. 1.03 lakh crores.

It is the prerogative of the GST department to review these refund requests and process the valid requests. Hence there are chances that a portion of the refund claim amount is rejected. However, the trends in the claim amount does indicate that a considerable portion of the GST collected is returned in the form of refunds.

The wise information available is not for the year of the collection but the year of the filing of the refund request. As per available data, the total refund claim amount between 2017-18 and 2020-21 constitutes around 7% of the Gross GST collected during that period.

Continuing the trend, GST collections fall short of government estimates

Various factors could influence the trend in the GST collection. The number of Tax filings or those eligible to file GST does not show much variance compared to last year. A case can also be made that the increase in the quantum of GST collections in part could be due to the increase in GST rates. It ought to be noted that various products attract different GST rates, and the government has over the period, made changes to GST rates.

A large number of GST rate changes were made by the 45th GST council meeting in September 2021. While relief was provided to a few healthcare-related goods in view of the COVID-19 pandemic, there were other goods for which the GST rates were increased.

In addition, an increase in the volume of trade & economic activity also could have significantly contributed to the increase in GST collections. However, this increase in the GST collections does not match with the government estimates presented during the budget. While there is a month-on-month increase in GST collections being reported, this may not be adequate to match the estimates.

Featured Image: GST collections