Data from the RBI reports & the Infrastructure and Project Monitoring Division. of the Ministry of Statistics & Program Implementation indicates that out of those central sector infrastructure projects in 16 sectors whose date of commissioning is available, about 70% are delayed. The average time overrun (delay) of these projects is 41.64 months as of August 2022.

Infrastructure is a key enabler in the economic progress and overall development of a country. The lack of good infrastructure can hinder the progress of the country. Infrastructure projects encompass various important sectors like energy, agriculture, industry, transport, communication, etc.

In a developing nation like India, investment in infrastructure aids a multi-faceted transformation, the importance of which is recognised since the first government of Independent India and continued by successive governments. Over the years, the nature of investment in Infrastructure has changed with initiatives like a public-private partnership (PPPs) encouraging investments from private players. Even then, public investment by Governments continues to be the main driver of infrastructure projects in the country. Both the Central & State governments invest in infrastructure development, with the Central Government playing a major role in funding major inter-state projects.

Despite being critical, these projects are traditionally fraught with delays due to multiple reasons. In this three-part series, we analyse the status of the Central Sector infrastructure projects in the country with a focus on time delays & cost overruns. In this first part, we look at the time delays.

Methodology

The Reserve Bank of India (RBI) has recently published its annual Handbook of Statistics on India Economy. Information from the ‘Implementation of Central Sector Projects – Status’ (Table 35) and ‘Sector-Wise Cost Overrun of Delayed Central Sector Projects’ (Table 36) is the source of data. This data is sourced from the Ministry of Statistics & Program Implementation’s (MOSPI) Infrastructure and Project Monitoring Division. (IPMD).

Infrastructure and Project Monitoring of Central Sector Projects costing more than Rs. 150 crores are one of the key mandates of IPMD. This is done through the ‘Online Computerised Monitoring System’ (OCMS), which is updated by the respective project implementing agencies. The IPMD monitors infrastructure projects across 16 sectors.

The information provided by IPMD and reported by RBI is limited to only those projects that are updated on OCMS. Hence, the reported projects do not necessarily reflect all the ongoing central sector projects costing more than Rs.150 crores. Further, the number of Public Enterprises that are reporting the status online has improved over the years, resulting in a greater number of projects in the IPMD database. Hence, it must be noted that the increased number of projects in a particular year does not necessarily mean an actual increase in the number of projects on the ground.

70% of the projects whose ‘Date of Commissioning’ is available are delayed as of end 2021-22.

As of 31 March 2022, the project status of 1,759 projects across 16 sectors was available. Among the details updated with IPMD is the status of the project and the expected time of completion. This provides an estimate of the number of infrastructure projects that are ahead or on Schedule and those that are delayed.

The availability of the ‘Date of Commissioning’ (DOC) of the project is important to ascertain the extent of the delay. A major share of the projects whose status is being updated on the IPMD, do not have an updated DOC.

As of 31 March 2022, 716 out of the 1759 projects do not have a DOC. However, this is an improvement over the previous year, when the DOC was not updated for 813 projects out of the 1656 projects reported.

Among the 1043 projects reported by end of March 2022, and that have a DOC, 726 projects are delayed. A project is considered delayed in reference to the original schedule of the project.

The number of projects delayed is higher than the previous year when it was 596. The ratio of increase in delayed projects is higher than the increase in projects reported, which could imply that there is an actual increase in the number of projects delayed. Few of these projects could be the ones whose DOC is made available.

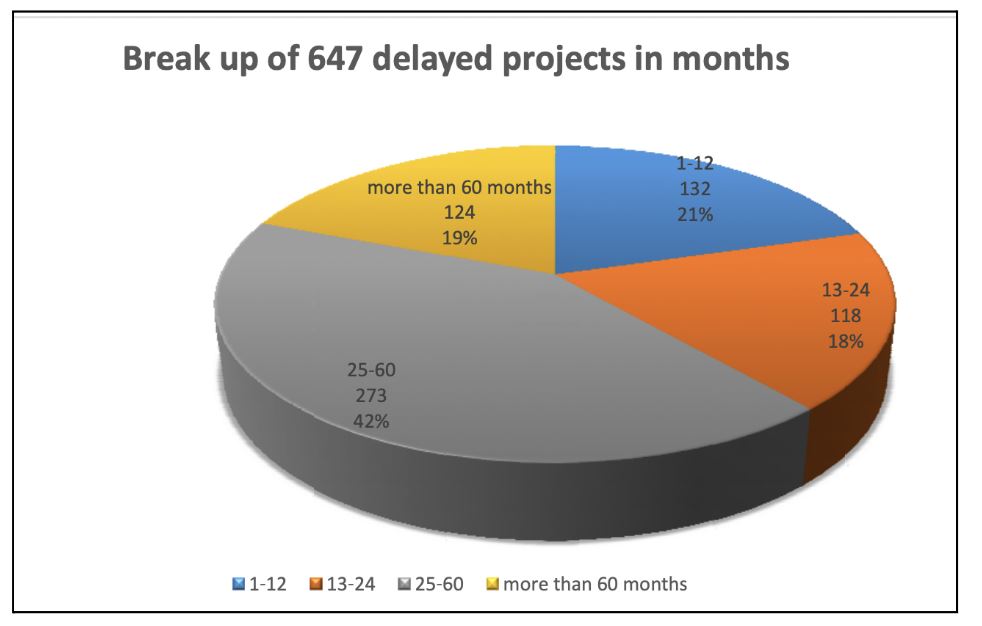

A total of 302 projects were on schedule and a further 15 projects are ahead of the estimated date of completion. The IPMD publishes a monthly flash report on Central sector projects. As per the latest flash report for August 2022, there were 1526 projects costing more than Rs.150 crores, that were reported. Among these, 12 projects are completed, 647 projects are delayed compared to their original schedule. Another 71 projects reported additional delays, as they were supposed to be completed in the previous months.

More than 90% of the Railway projects with DOC and around 65% of Surface Transport Projects delayed

IPMD monitors projects across 16 sectors. As per the updated data as of 31 March 2022, the greatest number of projects belong to Surface Transport followed by Railways. There was a total of 896 projects reported on OCMS by the end of 2021-22 for the Surface Transport sector. Of these, 505 project does not have a DOC. The surface Transport sector also contributed the highest share of projects not having a DOC. Out of the 391 projects with DOC, 253 projects are delayed and are behind schedule. 130 projects are on schedule and 8 are ahead. The number of projects without DOC is less than the number for 2020-21 when it was 648. The number of delayed projects by end of 2020-21was 155 implying, as indicated earlier, that most projects whose DOC is updated in 2021-22, could be delayed in their implementation.

Out of 285 projects belonging to Railways, 127 do not have DOC to ascertain the status of implementation and the delay. Out of the 158 projects with DOC, only 8 are on schedule and 4 are ahead. 146 projects i.e., 92% of the projects are delayed. This is the highest among the sectors with a sizeable number of infrastructure projects costing over Rs. 150 crores. Since 2020, there is an increase in the number of Railway projects. By end of March 2019, 90 out of the 187 projects with DOC were on schedule or ahead of schedule. This fell to 41 out of 190 by March 2020 and fell further in the ensuing years.

A total of 62% of its projects in the Petroleum sector with a DOC are pending. Comparatively, the Coal sector is better off with 62 out of 137 projects pending. The Coal sector only has 9 projects without a DOC.

Delays in Land Acquisition, environment clearances and COVID-19 among the reasons cited for time-delays.

The flash report for August’2022 provides information on the duration of the delayed projects. The information is available for the 647 projects updated as delayed as of 31 August 2022 on the OCMS. Out of these projects, 19% are delayed by more than 60 months.

The report states that the average time overrun for the delayed projects is 41.64 months. Railways which has 124 projects delayed, has 4 projects which are pending for over 200 months and 5 projects which are pending between 100-200 months. Many of the other sectors also have such long-delayed projects.

A review of the projects specified in the flash report shows that these delays reported are from the date of commissioning. However, there are long time gaps between the Date of Approval and the Original Date of Commissioning the project. These point to a much longer delay in the project being approved and further stages of completion.

A few of the important reasons highlighted for the delay in the flash report include – delay in land acquisition, delay in getting environmental clarences, process delays (delay in tendering, getting project finances, contractual issues, change in scope), technical approvals, coordination with state governments, etc. The COVID-19 pandemic is also cited as one of the reasons for the time delays.

In the second part of the story, we would look at the Cost overrun of the projects.

Featured Image: Central Sector projects