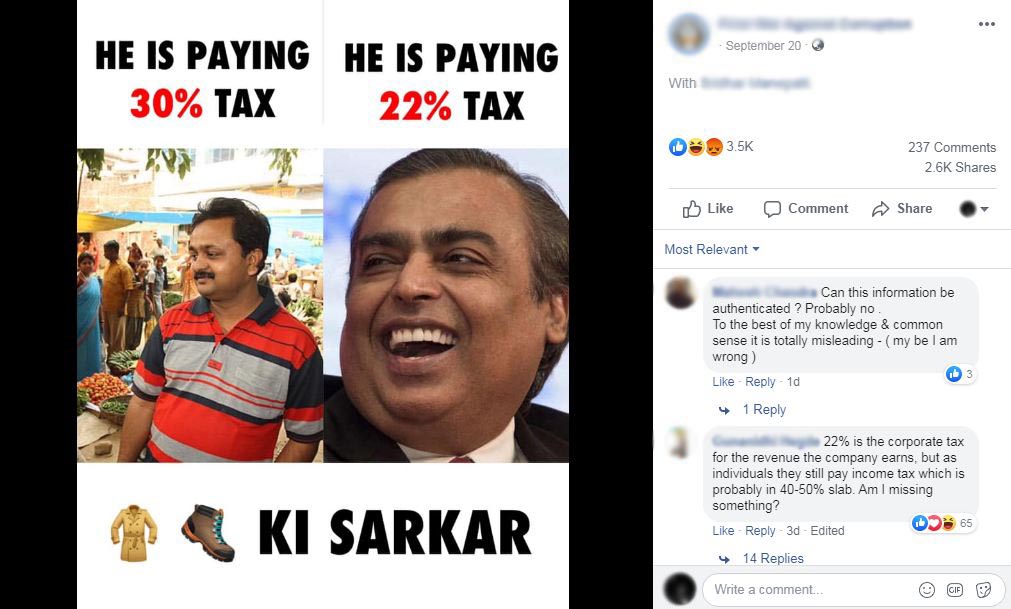

A post is being shared widely on social media with a claim that a common man pays 30 per cent tax whereas Mukesh Ambani pays only 22 per cent tax. This comparison was posted in the context of the recently announced Corporate Tax rate reduction in India. Let’s try to analyze the claim made in the post.

Claim: While a common man is paying 30% tax, Mukesh Ambani is paying only 22% tax.

Fact: The Corporate Tax was reduced to 22%, not Income Tax. So Reliance Industries Limited would now have to pay a corporate tax of 22% on its profits. Mukesh Ambani as an individual would still be paying income tax as per his income bracket. Hence the claim made in the post is Misleading.

The new Corporate Tax rates announced recently by the Finance Minister can be found in an infographic tweeted by a Union Minister.

Government under Prime Minister @narendramodi ji has taken several measures to stimulate #economy and boost local manufacturing. Domestic companies including those incorporated after 1/10/2019 now have to pay lower #CorporateTax.@PMOIndia@FinMinIndia @nsitharaman pic.twitter.com/rr0bwfOtoS

— Sadananda Gowda (@DVSadanandGowda) September 21, 2019

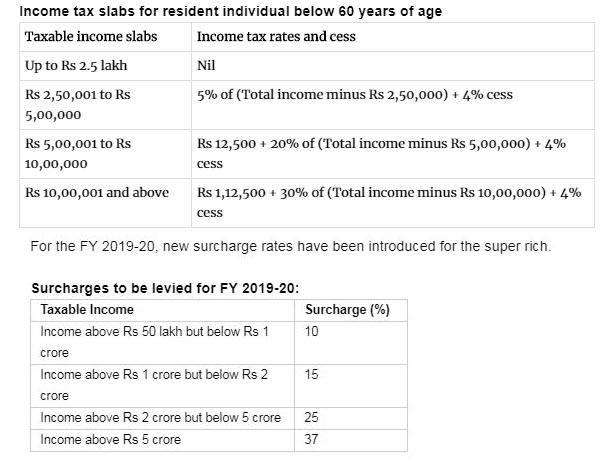

It can be seen that the new Corporate Tax rate (without exemption) for Domestic Companies is 22%. The new Effective Tax Rate including surcharge and cess would be 25.17%. These new tax rates would apply to the Corporate tax paid by the companies in which Mukesh Ambani is a major shareholder but not to his personal income. The Income Tax rates and slabs were not changed in the recent measures to boost the economy. According to the existing income tax slabs and rates, Mukesh Ambani would be paying more than 30% tax, depending on his income. The amount of taxes, cess and surcharges to be paid by an individual, based on his income, can be found in the ‘Economic Times’ article.

To sum it up, Corporate tax was reduced to 22%, not Income Tax. Mukesh Ambani would still pay more than 30% as Income tax if his income is more than Rs. 10 lakh.

Did you watch our new Episode of the DECODE series?