[orc]As per data shared by the government, more than 90000 complaints were received by the Banking Ombudsman against 47 banks in 2015-16, with public sector banks accounting for more than 70% of these complaints.

The Reserve Bank of India (RBI) has recently amended the Banking Ombudsman Scheme to include complaints relating to Misselling, Mobile/Electronic Banking. This is set to increase number of complaints to the Ombudsman. As per data shared by the government about 47 banks in the Lok Sabha, the number of complaints to the Banking Ombudsman increased by over 40% from 2013-14 to 2015-16.

More than 70% of all the Complaints against Public Sector Banks

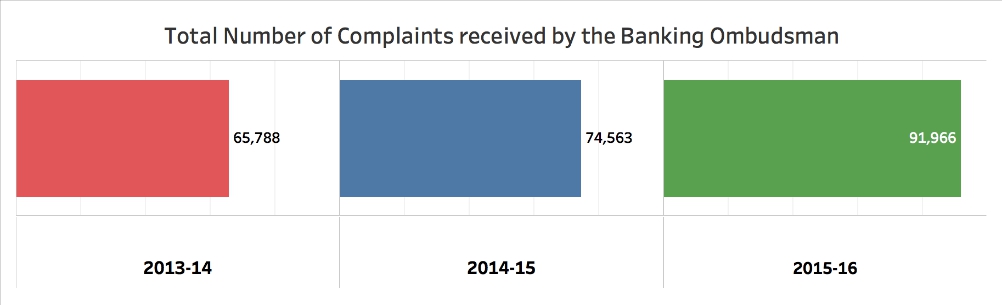

The number of complaints to the Banking Ombudsman against these 47 banks have increased continuously from 65788 complaints in 2013-14 to 91966 in 2015-16. The number of complaints increased by about 13% in 2014-15 and by about 23% in 2015-16. In these 3 years, the number of complaints increased by 40%. The number of complaints in the first four months of 2016-17 is already more than 34000. It has to be noted that the Ombudsman data for any year follows the July to June cycle unlike the cycle for a financial year.

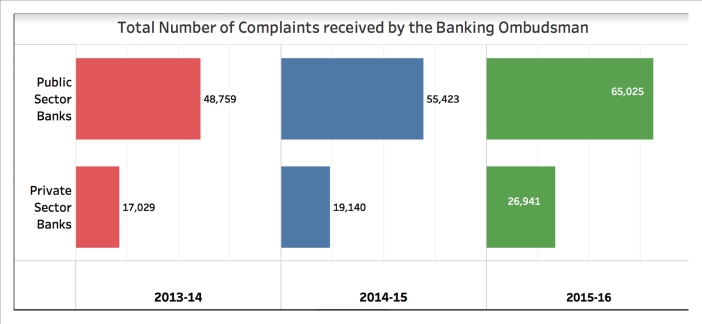

More than 70% of all the complaints received by the Banking Ombudsman in 2015-16 were against the public sector banks. Complaints were received against a total of 27 public sector banks in 2015-16. Though majority of the complaints are against the public sector banks, the number of complaints against them have increased by only 35% in the 3-year period from 2013-14 to 2015-16 compared to over 58% increase against private banks. Complaints were received against a total of 21 private banks in 2015-16. Complaints against private banks have increased by over 42% in 2015-16 compared to less than 20% increase against the public sector banks.

More than 70% of all the complaints received by the Banking Ombudsman in 2015-16 were against the public sector banks. Complaints were received against a total of 27 public sector banks in 2015-16. Though majority of the complaints are against the public sector banks, the number of complaints against them have increased by only 35% in the 3-year period from 2013-14 to 2015-16 compared to over 58% increase against private banks. Complaints were received against a total of 21 private banks in 2015-16. Complaints against private banks have increased by over 42% in 2015-16 compared to less than 20% increase against the public sector banks.

Five banks account for more than 50% of all the Complaints

Five banks account for more than 50% of all the Complaints

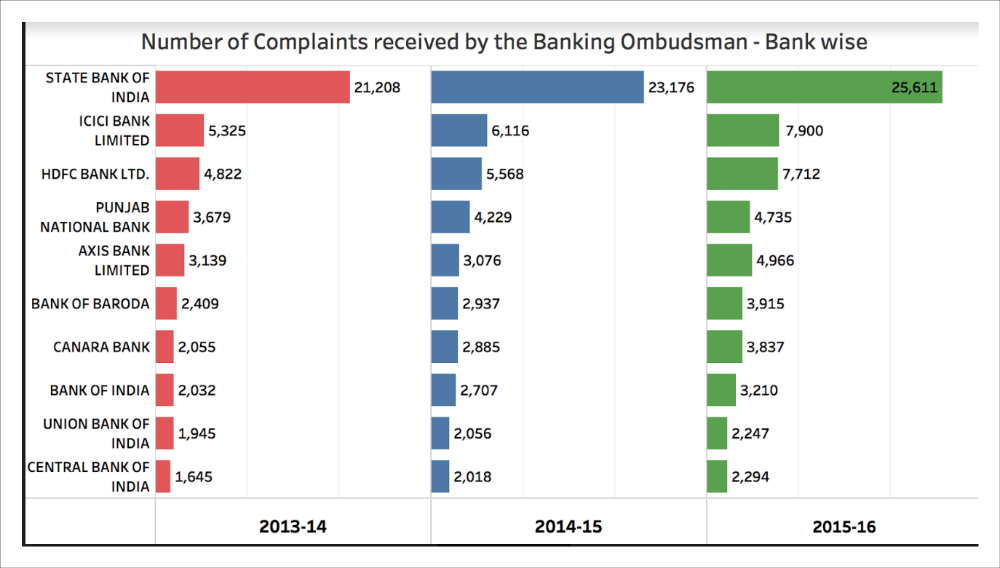

SBI, ICICI, HDFC, PNB & Axis Bank together account for more than 50% of all the complaints filed with the Banking Ombudsman. The top 10 banks in terms of complaints received are more or less the ones with the highest revenue, in that order. The top 10 banks together account for more than 70% of the complaints. There are 3 private banks in the list of top 10 banks in terms of complaints received. In 2015-16, more than 1000 complaints each were received against sixteen (16) banks and less than 100 complaints each were received against 7 banks.

Not many pending complaints, but timelines not known

Not many pending complaints, but timelines not known

The disposal rate of these complaints is above 90% in each of these years. The number of pending complaints at the end of 2015-16 was 5192 while more than 90000 complaints were disposed in that year. In 2016-17 (up to October), more than 13000 complaints were pending and only 26000 were disposed. While the disposal rate is healthy, the timelines within which these complaints were disposed is not available making it difficult to analyse if the complaints are being disposed within a short time.

Featured Image: Complaints to Banking Ombudsman

1 Comment

LG launch a new smartphone with new technology LG G7 , Check LG G7 Specification.