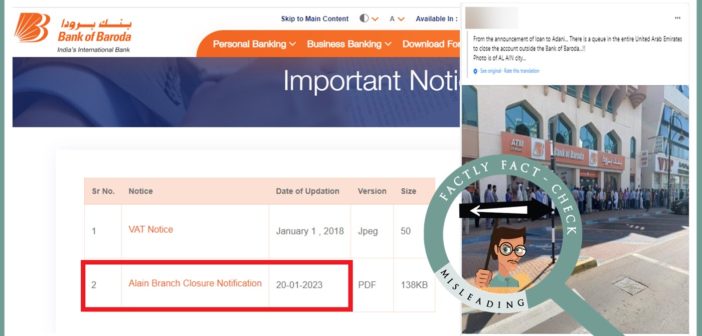

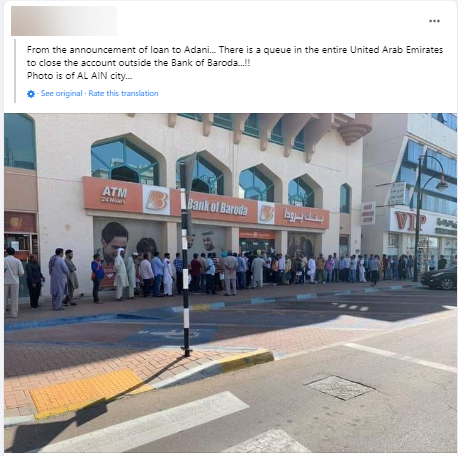

Following the Bank of Baroda’s willingness to lend to the Adani group despite the controversy surrounding the Hindenburg Report, a photo showing a long line of customers queuing up at a Bank of Baroda branch in the UAE has been widely shared on social media claiming that they were closing their accounts in response to the Bank’s decision to lend to Adani.

Claim: A photo of customers queuing up at a Bank of Baroda branch in the UAE to close their accounts in response to the bank’s decision to lend to the Adani group despite the Hindenburg report controversy.

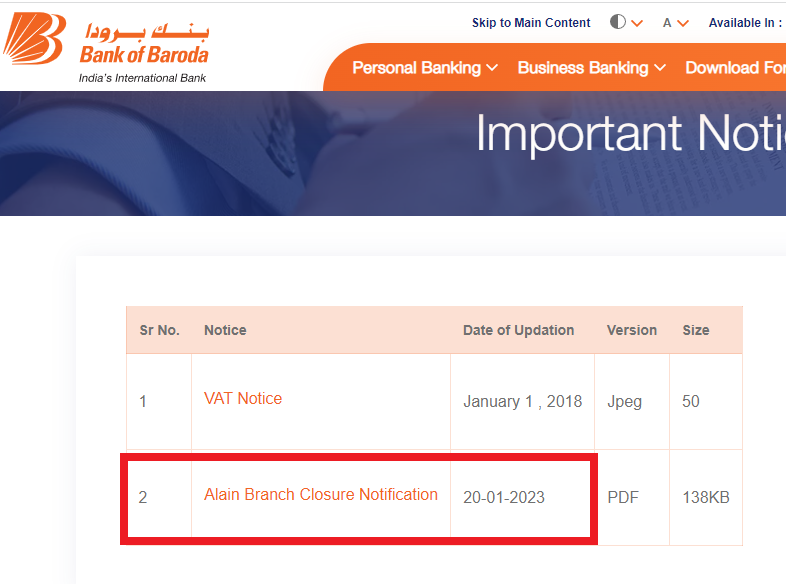

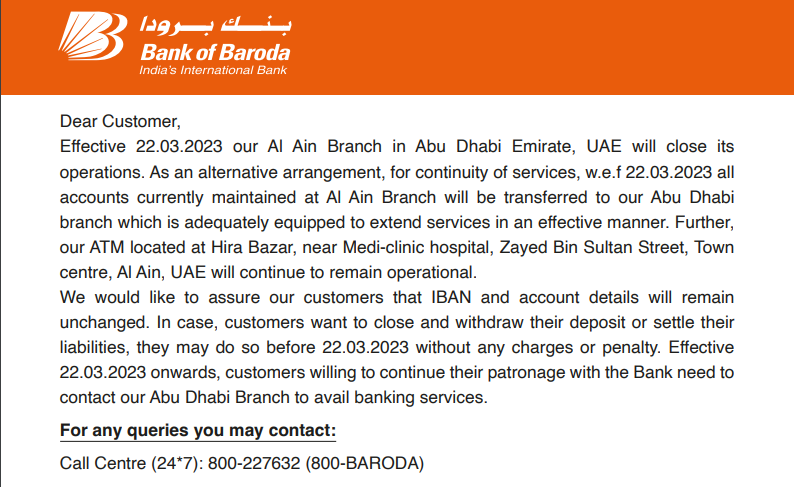

Fact: On 20 January 2023, Bank of Baroda announced that it would be closing its Al Ain branch in the UAE for commercial reasons. According to a statement from the bank’s representative, the decision to close the branch was made a year prior and was subsequently approved by the central bank of the UAE. The accounts held at the Al Ain branch will be transferred to the Abu Dhabi branch, and customers who wish to close their accounts may do so without penalty before 22 March 2023. The bank also advised customers to disregard any false or misleading information that may be circulating on social media regarding the closure. It is worth noting that the Hindenburg report on Adani was released on 24 January 2023, which is after the Bank of Baroda’s decision to close its Al Ain branch. Hence the claim made in the post is MISLEADING.

Initially, we conducted an inquiry into Bank of Baroda’s social media accounts to ascertain further details regarding this matter. Our investigation revealed that the bank had released a statement regarding this issue via Twitter on 26 February 2023.

According to the statement, a year ago, Bank of Baroda made a commercial decision to close its Al Ain branch in UAE, which was approved by the Central Bank of UAE. The closure will take effect from 22 March 2023, and all accounts will be transferred to the Bank’s Abu Dhabi branch. Customers can close their accounts before the closure date without any charges or penalties. Furthermore, the statement clarifies that the Customers are visiting the Al Ain branch to provide their consent or further instructions and urges users not to believe any misleading and false information that is being shared on social media platforms.

After searching the Bank’s website, we discovered that the bank had released a notification regarding the branch closure on 20 January 2023. It’s worth noting that the Hindenburg report was published on 24 January 2023, while Bank of Baroda’s MD & CEO, Sanjiv Chadha, spoke about the bank’s readiness to provide loans to Adani only in February 2023.

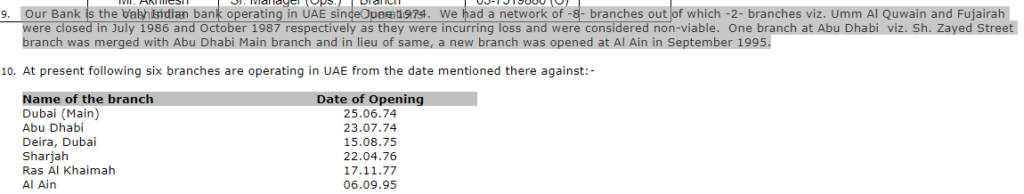

Bank of Baroda’s decision to close its Al Ain branch in UAE is not unprecedented, as the bank has previously closed two branches in UAE due to financial losses in 1986 and 1987. This information is available on the bank’s website. In addition, other Indian public sector banks have also shut down their branches in India and overseas for various reasons in the past.

To sum it up, there is no truth to the rumour that Bank of Baroda customers in the UAE are closing their accounts in protest of the bank’s decision to lend to Adani. This is because the bank had already made a decision to close its UAE branch before the release of the Hindenburg report, making any alleged connection between the two events unfounded.