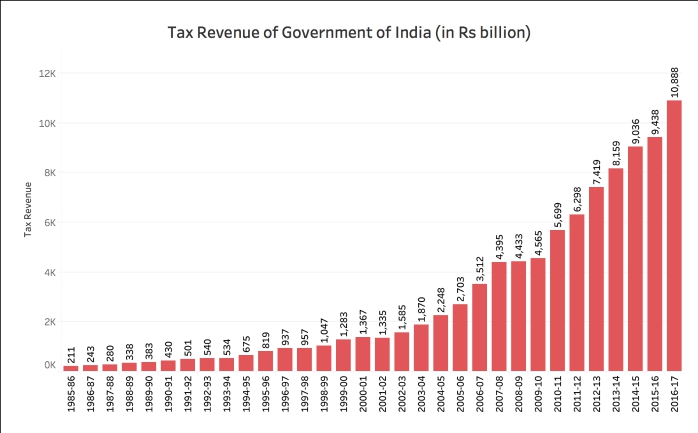

[orc]Government of India’s tax revenue increased by more than 50 times between 1985-86 and 2016-17. From Rs 211.4 billion in tax revenue in 1985-86, the tax collection touched Rs 10888 billion in 2016-17.

The Reserve Bank of India (RBI) recently released the hand book of statistics on Indian Economy for 2016-17. As per the statistics, the Central Government’s tax revenue increased by over 50 times in a span of 30 years between 1985-86 and 2016-17. From Rs 211.4 billion in 1985-86, the tax revenue increased to Rs 10887.9 billion in 2016-17. During the same period, the non-tax revenue also increased by more than 48 times.

Tax Revenue touched One lakh crore in 1998-99

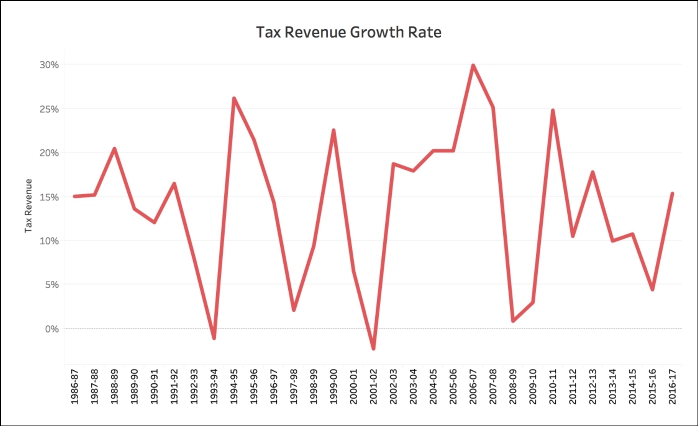

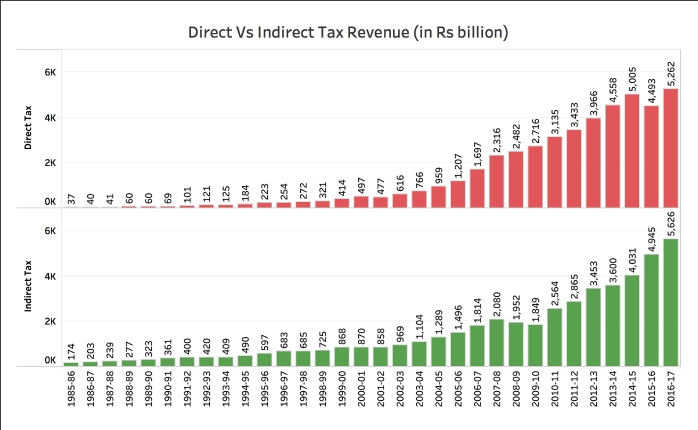

Total tax revenue of the Government of India includes both direct & indirect taxes. Direct taxes include personal income tax and corporation tax while indirect taxes comprise of Excise & Customs duties. During the 30-year period from 1985-86 to 2016-17, the tax revenue decreased compared to the previous year (negative growth) on two difference occasions, in 1993-94 and 2001-02. Greatest increase in the tax revenue was seen in 2006-07 when the tax revenue increased by close to 30%. The tax revenue increased by more than 20% only in nine (9) of the thirty years. In thirteen (12) of these years, it grew between 10% and 20%. The growth was less than 5% on four occasions.

The tax revenue crossed Rs 50000 crore in 1991-92 and one lakh crore in 1998-99. The tax revenue crossed 5 lakh crore in 2010-11 and 10 lakh crore in 2016-17.

Indirect Tax revenue was more than 4 times the Direct Tax revenue in 1985-86

In 1985-86, the indirect tax revenue was Rs 174 billion, more than 4 times that of the direct tax revenue of a mere Rs 37 billion. The share of indirect taxes in the total tax revenue was 83% compared to the 17% share of direct taxes in 1985-86. In a span of 30 years, the share of both has more or less become equal. In 2016-17, share of direct taxes was 48% in the total tax revenue compared to the 52% share of indirect taxes. The share of direct taxes in the total tax revenue crossed 30% for the first time in 1998-99 and crossed 40% for the first time in 2003-04. In fact, in the 8 years between 2007-08 and 2014-15, the share of direct taxes in the total tax revenue was more than the share of indirect taxes. In 2009-10, the share of direct taxes was close to 60%, the highest ever till date. Starting again in 2015-16, the share of indirect taxes has overtaken the share of direct taxes.

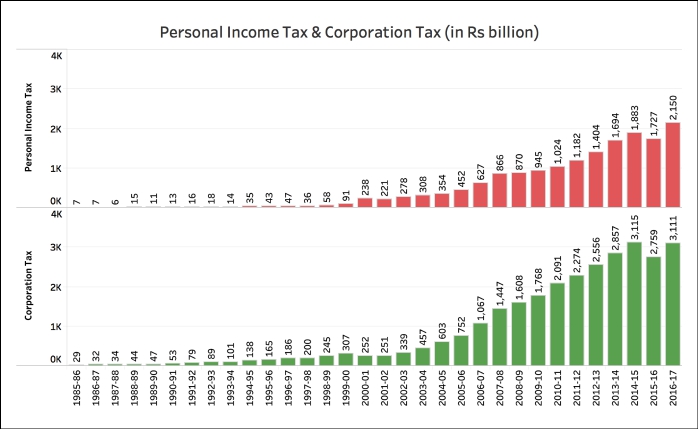

Personal Income Tax collection crossed 1 lakh crore in 2010-11

In 1985-86, corporation tax accounted for more than 3/4th of the total direct tax revenue. It remained more or less the same till 1999-00. Starting 2000-01, the share of income tax in total direct tax collection has significantly increased. Since 2000-01, the share of income tax in the total direct tax collection has been more than 35% except in 2010-11. Personal Income tax collection crossed one lakh crore for the first time in 2010-11 while corporation tax crossed one lakh crore in 2006-07.

Featured Image: Central Government’s Tax Revenue

1 Comment

visit this website for new government schemes.