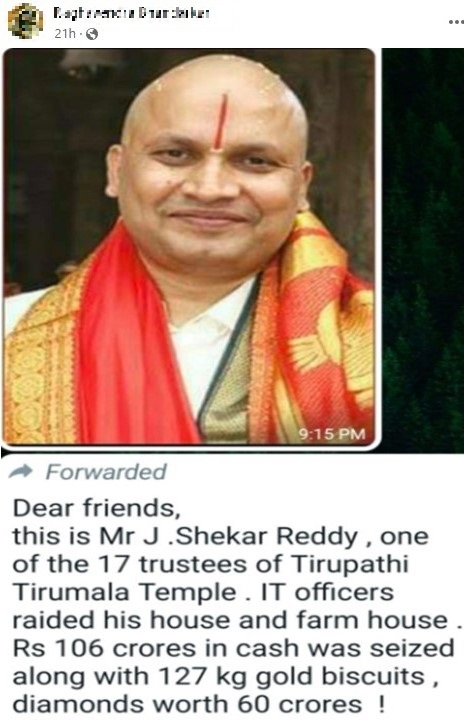

A post is being widely shared on social media claiming that IT officers had recently raided the house of one Mr. J Sekar Reddy, who is one of the 17 trustees of the Tirumala Temple. The post even claims that ₹106 crores cash, 127 kg gold biscuits, and diamonds worth 60 crores were seized by the IT officers. Let us fact-check the claim made in the post.

Claim: TTD Board member Sekar Reddy was raided by IT officers recently.

Fact: ₹100 crore cash and 120 kg gold were seized when the residences and offices owned by TTD Board member J Sekar Reddy were raided by the Income-tax officials in 2016. However, the case filed by the CBI against Sekar Reddy were dismissed by a special court in September 2020 on grounds of lack of evidence after CBI filed a closure report. The Andhra Pradesh government removed Sekar Reddy as a member of TTD when IT raids happened, and huge cash was seized. Sekar Reddy was back on the TTD Board when the cases were closed. Hence, the claim made in the post is MISLEADING.

When we searched on google about IT raids on Sekar Reddy, a 2016 article was found. The article published on 09 December 2016 states that ₹100 crore cash and 120 kg gold was seized by the Income-Tax officials from the residences and offices owned by TTD Board member J Sekar Reddy. After that, the CBI and the ED swooped in.

However, in September 2020, a special court for CBI cases in Chennai dismissed the case against Sekar Reddy and five others on grounds of lack of evidence. “In view of a stalemate in the investigation due to lack of evidence, CBI had submitted to the court that they have lack of evidence to prove the suspect to have committed the crime as is being alleged, following which the special court dismissed the case booked against TTD special invitee J Sekar Reddy and his associates.”

According to the Hindu article, in this sensational cash seizure case of 2016 CBI’s Anti-Corruption Bureau registered three FIRs. While the Madras High Court quashed two FIRs, the third has been closed by lack of evidence. “S. Jawahar, XIth additional special judge for CBI cases, allowed the CBI’s plea, seeking closure of the case due to lack of sufficient evidence.”

However, under the Prevention of Money Laundering Act (PMLA), an Enforcement Case Information Report (ECIR) was registered in December 2016. The allegation was that Sekar Reddy diverted the amount during the demonetisation period and converted old notes to new currency notes. The lawyers from Sekar Reddy’s side petitioned the Madras High Court to quash the proceedings in the ED case (filed in Principal Sessions Court, Special Court for PMLA cases, Chennai). They argued that ‘the trial of the offences under the PMLA can never proceed when the FIR with regard to the schedule offence (the case CBI filed) was closed for want of evidence’. The High Court, from a reading of the provisions in the PMLA, stated, “the offence of money laundering is independent of the schedule offences.” And dismissed, in 2021, the petitions filed by Sekar Reddy’s lawyers.

Sekar Reddy appealed to the Supreme Court of India after the judgement in Madras High Court. Having heard the petition on 26 November 2021, the Supreme Court stayed the proceedings in the case until the next hearing.

The Andhra Pradesh government removed Sekar Reddy as a member of TTD when IT raids happened, and huge cash was seized. Sekar Reddy was back on the TTD Board when the CBI case was closed. However, he was not included in the new TTD board which was constituted in August 2021.

To sum it up, Income-tax officers raided TTD Board member Sekar Reddy’s house in 2016 but the case CBI filed against him was dismissed in 2020 due to lack of evidence.