The Income-tax Act, 2025 (here, here) is a new legislation enacted to replace the decades-old Income-tax Act, 1961, to simplify India’s direct tax framework. The law will come into force on 01 April 2026.

In this context, a post circulating on social media claims that the Income Tax Department will have the authority to access individuals’ social media accounts and emails to curb tax evasion starting 01 April 2026. The post suggests that income tax officers will be allowed to monitor online activity as part of enforcement measures. Let’s verify the claim made in the post in this article.

Claim: The Income Tax Department will have the authority to access individuals’ emails and social media accounts to curb tax evasion starting 01 April 2026.

Fact: Under the Income Tax Act, 1961, Section 132 provides search and seizure powers. However, the new Section 247 in the Income Tax Act, 2025 does not introduce any new powers. It continues the existing search and seizure rules, including digital data such as emails, electronic files, and records stored in the cloud, within the lawful scope of a search. Section 247 does not grant tax authorities any permission to spy on individuals or read personal messages. The PIB Fact Check clarified that the viral post is misleading, stating that the provisions of Section 247 in the Income Tax Act, 2025, are strictly limited to search and survey actions. Apart from conducting official searches based on evidence of tax evasion, the tax department has no authority to access individuals’ private digital spaces. Hence, the claim made in the post is MISLEADING.

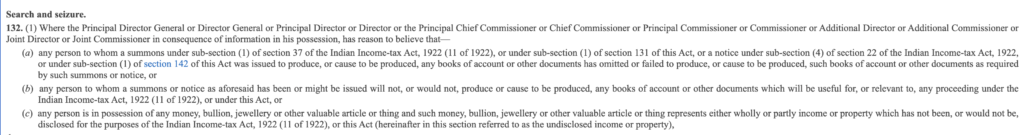

To verify the claim, we did a Google search using relevant keywords and found that the Income Tax Department has had search and seizure powers under Section 132 of the Income Tax Act, 1961, since 1961. Under this section, if there are reasonable grounds to believe that a person has concealed income or engaged in tax evasion, tax authorities can carry out search and seizure actions without prior court warrants.

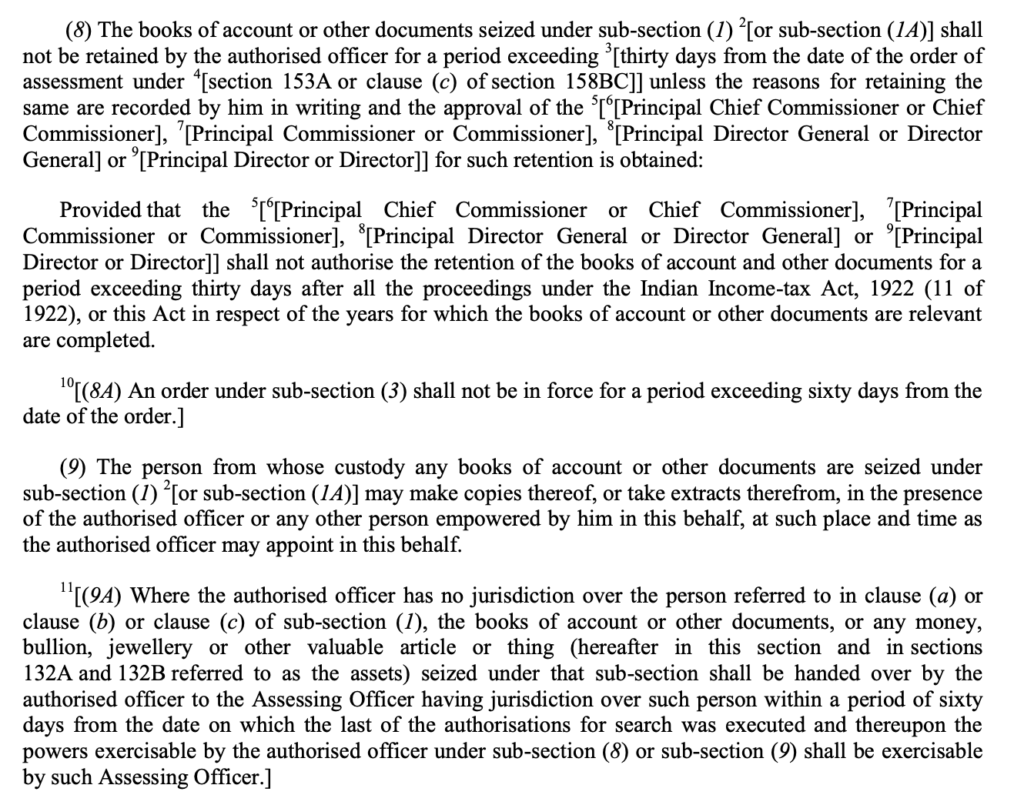

Under this law, authorities can initiate searches only after approval from a senior-level officer. Search and seizure actions are not conducted arbitrarily. Though the “reasons to believe” that empower a tax officer to carry out such actions are generally not disclosed to the taxpayer, the legality of these actions can be challenged in court by the taxpayer and reviewed judicially. Taxpayers have the right to obtain copies of the seized documents, and after examining the records, authorities must return them within the timeframe specified by law.

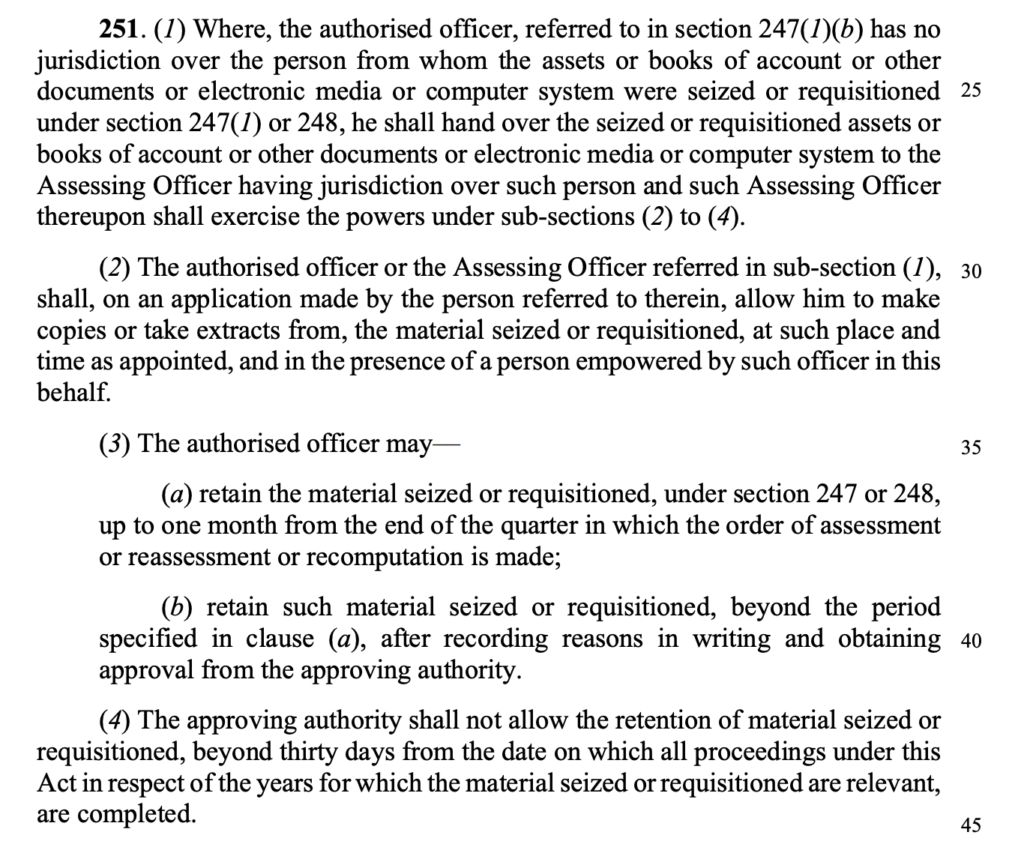

The new Section 247 in the Income Tax Act, 2025, does not introduce any new powers. It simply extends the existing search and seizure rules to include digital data such as emails, electronic files, and records stored in the cloud within the lawful scope of a search.

Section 247 does not grant tax authorities any permission to spy on individuals or read personal messages. As in the earlier Section 132, records can be examined only during a lawful search or survey. Such actions can be taken only when there is clear evidence of tax evasion and prior approval from senior authorities. Individuals’ right to privacy remains fully protected, and the right to challenge any misuse of powers in court continues unchanged.

Additionally, an X post by PIB Fact Check on 22 December 2025 debunked the viral claim, stating that it is misleading. The post clarified that the provisions of Section 247 of the Income Tax Act, 2025, are strictly limited to search and survey activities. It clearly stated that the tax department does not have the authority to access individuals’ private digital spaces except when conducting official searches based on evidence of tax evasion. The Income Tax India Facebook page on the same day also clarified the same.

To sum up, authorities cannot access taxpayers’ social media or email data without a legally authorised search operation.