[orc]The latest annual report of the RBI paints a very grim picture as far as bank fraud cases are concerned. The amount involved in fraud cases detected in a particular year has increased by over 35 times between 2009-10 and 2018-19.

RBI has recently released its annual report for the year 2018-19. Among other things, one of the highlights from the annual report is the increase in the number of cases detected relating to banking fraud.

RBI annual report observes that for the year 2018-19, the number of bank fraud cases detected has increased by 15% and the amount involved in bank fraud cases has increased by 73.8%. Is this a continuing trend over the years or a one-off increase for the year 2018-19?

How does RBI count the bank fraud data?

It has to be noted that the numbers in the RBI report are cases where the amount involved in fraud is ₹ 1 lakh or more. It also has to be noted that the number of fraud cases in the RBI report are those that are detected & reported in that particular year and not necessarily the ones committed in that year. This is also mentioned in an answer provided in the Lok Sabha by the government where it said that ‘fraud data is by the year of reporting and not the year of occurrence of the fraud or sanction of loan, Letter of Undertaking etc., which may be of an earlier period’. One of the other answers also goes onto mention that ‘it is not possible from this data to arrive at year-wise increase in banking frauds’.

The Amount involved in fraud cases has increased over the last decade

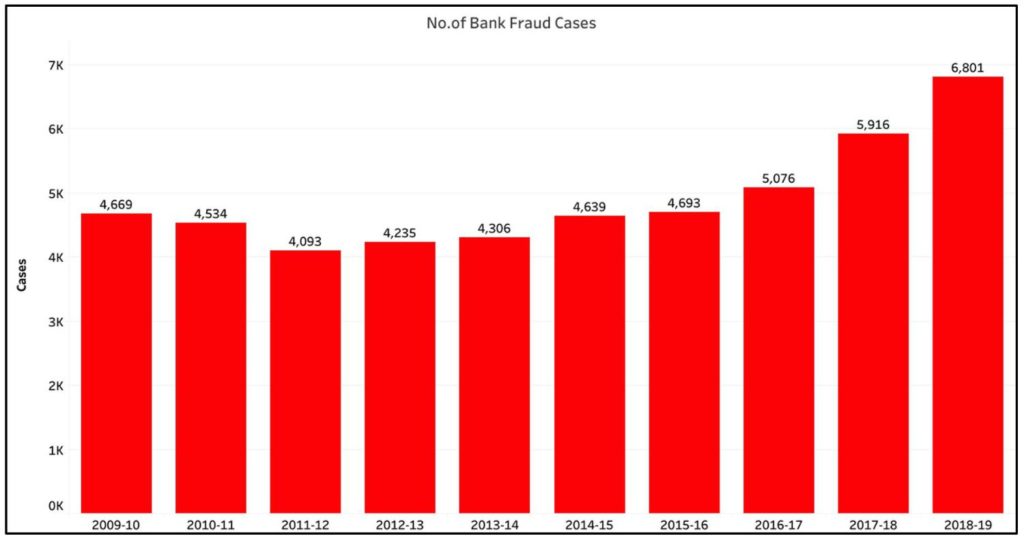

As per RBI data, the number of cases identified as bank fraud has increased over the years. For the year 2009-10, the total number of cases recorded was 4,669 and in the year 2018-19 this number is 6801.

The number of cases reported has consistently increased over the years, barring 2010-11 & 2011-12 where the number of cases were 4534 and 4093, less than the 4669 cases recorded in 2009-10. Post 2011-12, the number of cases has seen a gradual increase every year.

The highest increase in the year on year cases compared to previous year was observed over the last two years. In 2017-18 there was in increase by 840 cases and in 2018-19 there was an increase of 885 cases compared to the previous year.

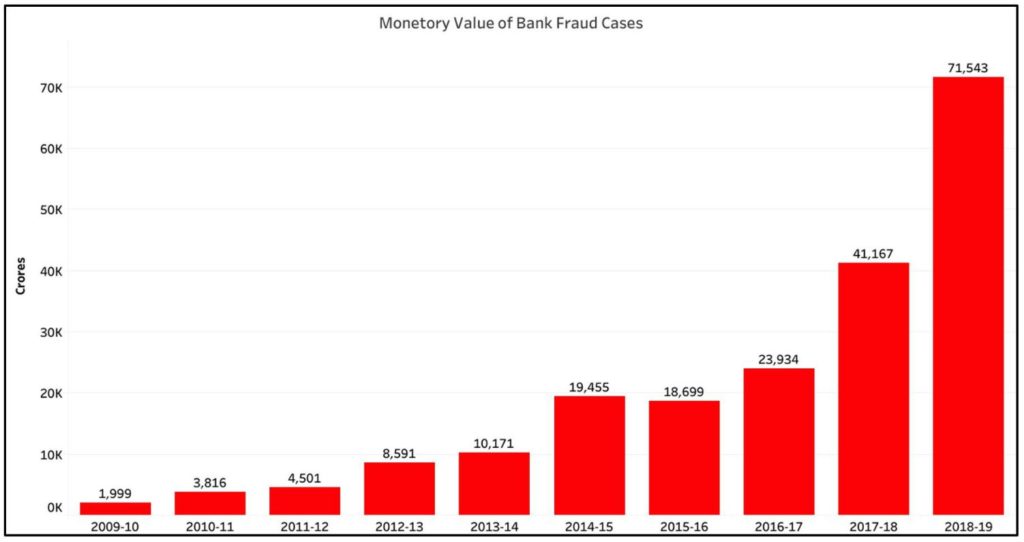

Apart from the increase in the number of fraud cases, the exponential increase in the total value of the fraud cases is matter of concern. In 2009-10, the total value of the frauds reported was ₹ 1,999 crores. The value of the bank frauds reported for 2018-19 went up to ₹ 71,543 crores i.e. an increase by approximately 35 times. While there has been a year on year increase in the value of the bank frauds, the years of 2012-13, 2014-15, 2017-18 and 2018-19 have witnessed a substantial increase in the amounts involved in those frauds.

2015-16, is the only year where the amount involved in fraud (₹ 18,699 crores) was less than the previous year, 2014-15 when the amount involved in fraud was ₹ 19,455 crores.

Different numbers mentioned in the Rajya Sabha

Responding to a question asked in the Rajya Sabha on 23 July 2019, the Finance minister furnished the details of the banks frauds of select Scheduled Commercial Banks and Financial Institutions. The details provided as per the answer is Rajya Sabha are given below. It has to be noted that these numbers are very different from the data quoted in the RBI report because the Rajya Sabha answer covers frauds committed in a particular year and not the ones reported in that year.

| Year | No. of Cases of fraud committed | Amount involved in ₹ crores |

|---|---|---|

| 2009-10 | 4003 | 13672.46 |

| 2010-11 | 3530 | 14748.5 |

| 2011-12 | 3910 | 20210.86 |

| 2012-13 | 4504 | 24819.4 |

| 2013-14 | 4359 | 21542.03 |

| 2014-15 | 4269 | 23694.65 |

| 2015-16 | 4207 | 16779.42 |

| 2016-17 | 3927 | 25883.98 |

| 2017-18 | 4228 | 9866.23 |

| 2018-19 | 2836 | 6734.65 |

Public Sector Banks account for majority share of Banking fraud cases

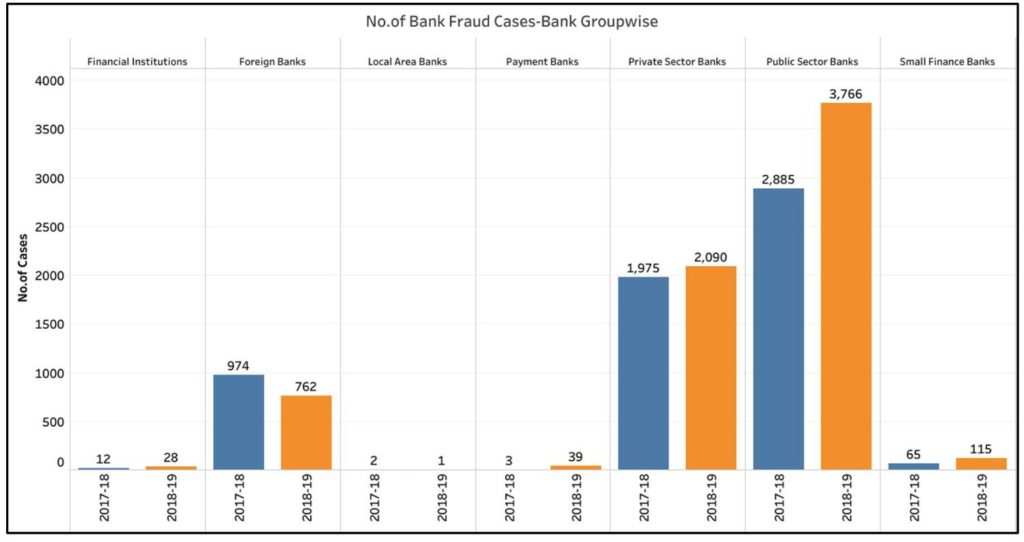

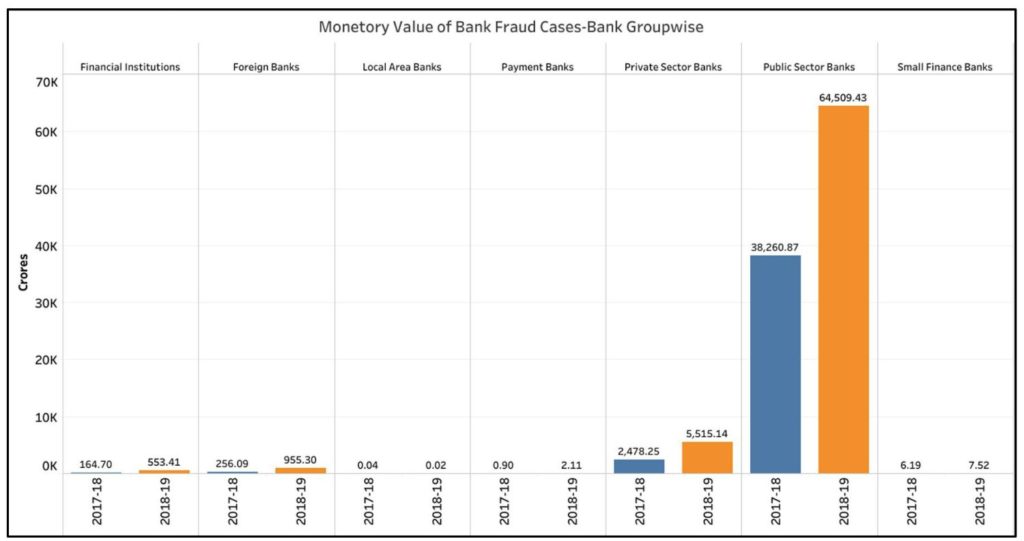

As per the RBI annual report (2018-19), 54.4% of the bank fraud cases in 2018-19 were reported in public Sector Banks (PSBs), a total of 3,766 cases. The number of cases in PSBs for the year 2017-18 was 2885. As for the amount involved in these cases, PSBs account for a whopping 90.2% of the total amount involved in bank fraud cases for the year 2018-19. This amounts to a total of ₹ 64,509 crores, an increase in 68.6% over the amount involved in fraud cases in 2017-18 which was ₹ 38,261 crores.

The number of fraud cases in PSBs as reported by RBI varies from the data provided in an answer in Lok Sabha on 01 July 2019, where it is specified as 1545. This difference is again on account of the way of reporting these cases. The Lok Sabha data is based on based on date of occurrence of the fraud and not the date on which the fraud was reported.

The next highest number of fraud cases in 2018-19 was reported by private sector banks followed by foreign banks. There were 2,090 cases of fraud in private sector banks where the total amount involved was ₹ 5,515 crores. Comparatively in 2017-18, the total cases reported by private sector banks was 1,975 and the total amount involved was tune of ₹ 2,478 crores. In other words, the amount involved in fraud cases in private banks increased by 122.5% in 2018-19 compared to 2017-18.

Although the number of fraud cases involving foreign banks has come down in 2018-19 to 762 from 974 in 2017-18, the amount involved in these cases has nearly tripled. In 2017-18, the total amount was ₹ 256 crores while it increased to ₹ 955 crores in 2018-19. During the same period, the amount of bank fraud in financial institutions increased multifold with the amount for 2018-19 being ₹ 553 crores (28 cases) compared to ₹ 165 crores in 2017-18 (12 cases).

Exponential increase in the total amount of fraud involving advances

For the year 2018-19, a total of 3606 cases of fraud were detected involving ‘advances’ extended compared to 2525 cases in 2017-18. The amount of fraud under ‘advances’ for 2018-19 is ₹ 64,548 crores compared to ₹ 22,558 crores in 2017-18.

Comparatively, the amount of fraud in other areas of banking has reduced in 2018-19 compared to 2017-18. The number of cases relating ‘Off-Balance Sheet’ banking fraud in 2018-19 was 33 compared to 20 cases in 2017-18. However, the value of the fraud was lower in 2018-19 with ₹ 5,538 crores compared to ₹ 16,288 crores in the previous year of 2017-18.

Similarly, the value of frauds under ‘foreign exchange transactions’ for 2018-19 is ₹ 695 crores compared to ₹ 1,426 crores in 2017-18. Although the value is lower for ‘Card & Internet related’ frauds, the number of cases recorded in this area are next only to the cases related to ‘advances’ extended. The number of ‘card & internet related’ fraud cases in 2017-18 was 2059 which came down to 1866 cases in 2018-19.

Huge amount of delay in detecting fraud cases

In its annual report for 2018-19, RBI observed that the time lag between the occurrence of fraud and the detection by the banks is almost 22 months. The report further observes that the lag time increases to 55 months in cases where the value of the bank fraud is more than ₹100 Crores. The total amount of such high value frauds reported in 2018-19 is ₹ 52,200 crores.

As per Central Vigilance Commission’s report in 2018, a total of 689 complaints were received in banking sector of which 591 cases were disposed and 98 cases are pending. Of the pending cases, 32 cases are pending since more than 6 months. CVC has also compiled an analysis in 2018 on top 100 frauds, which provides the details of the various frauds including modus operandi, anomalies, loopholes etc.

What is the government doing to reduce the bank frauds?

In a response to a question in Rajya Sabha, the Finance Minister highlighted the steps taken by the government to reduce bank frauds. As per the response, the following is reportedly being done by the government.

- A framework is put in place which allows for timely detection, reporting and investigation of large value bank frauds in Public Sector Banks. The framework includes examining NPAs exceeding ₹ 50 crores for possible fraud, reporting to RBI, seeking report from Central Economic Intelligence Bureau in regard to the borrower related to NPA.

- Enacting Fugitive Economic Offenders Act, 2018 to deter economic offenders from being outside jurisdiction of Indian courts.

- Certified copy of passport of promoters/directors/authorized signatories of companies availing more than ₹ 50 crore to be obtained by Public Sector Banks.

- RBI instructions to strictly adhere to the rotational transfer of officials and employees of PSBs.

- National Financial Reporting Authority is established as an independent regulator to enforce auditing standards.

- Bank accounts relating to 3.38 lakh inoperative companies were frozen.

While the government has listed down a number of steps to prevent these frauds, the increasing amounts of fraud reported every year is a cause for concern. It remains to be seen if the steps taken by the government result in any reduction in the number of bank fraud cases in the coming years.

1 Comment

Pingback: Amount involved in Bank Fraud cases increased 35 times in 10 years - Fact Checking Tools | Factbase.us