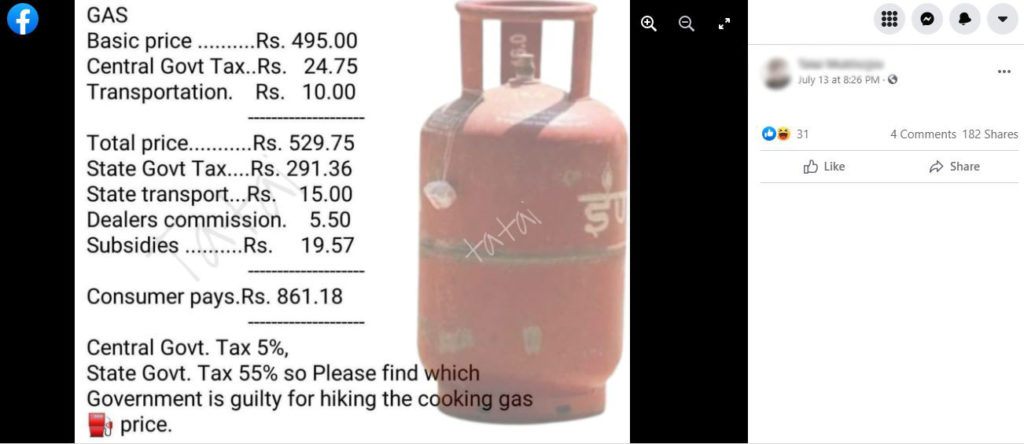

A post with some figures related to the domestic LPG cylinder price is being shared widely on social media with a claim that the Central government’s tax on an LPG cylinder is just 5% whereas the respective State governments levy a tax of 55%. Let’s fact-check the claim made in the post.

Claim: On the domestic LPG cylinders, the State Government levy a tax of 55% whereas the Central Government’s tax is just 5%

Fact: The domestic LPG cylinders fall under the 5% GST (CGST – 2.5% + SGST – 2.5%) slab. The Central and the State governments do not levy separate taxes of their own on the LPG cylinders. There is no basis for the claim that the State government impose a tax of 55% on the LPG cylinders. The numbers given in the post regarding the dealer’s commission are also not correct. The dealer/distributor’s commission is Rs. 61.84 on a 14.2 kg LPG gas cylinder. Hence the claim made in the post is FALSE.

Many details are given in the post regarding the components of the domestic LPG cylinder price. Let us try to check the veracity of them individually.

Do State governments impose a 55% tax on LPG?

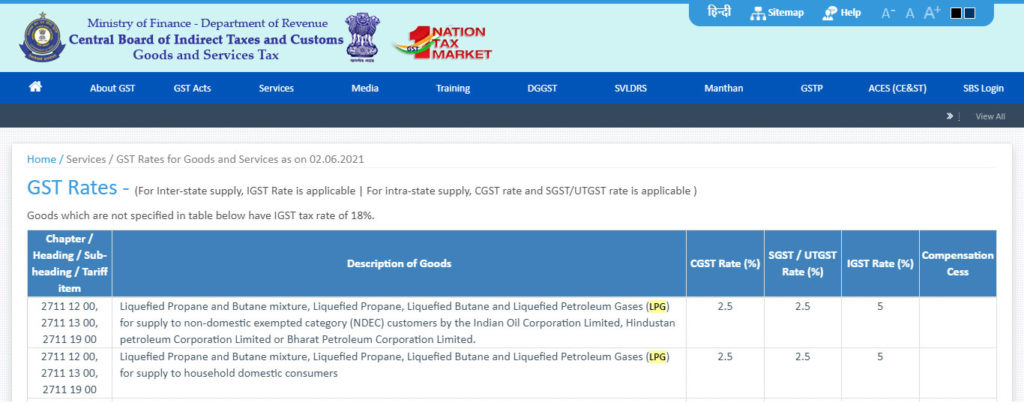

The GST (Goods and Services Tax) is levied on the domestic LPG cylinder. The Central and the State governments do not levy separate taxes of their own on the LPG cylinders. On the official website of ‘Central Board of Indirect Taxes and Customs (CBIC)’, it can be found that the domestic LPG cylinders fall under the 5% GST (CGST – 2.5% + SGST – 2.5%) slab. The same information can be also found in the ‘Ready Reckoner’ (November 2020) document released by the ‘Petroleum Planning & Analysis Cell (PPAC)’, of the Government of India.

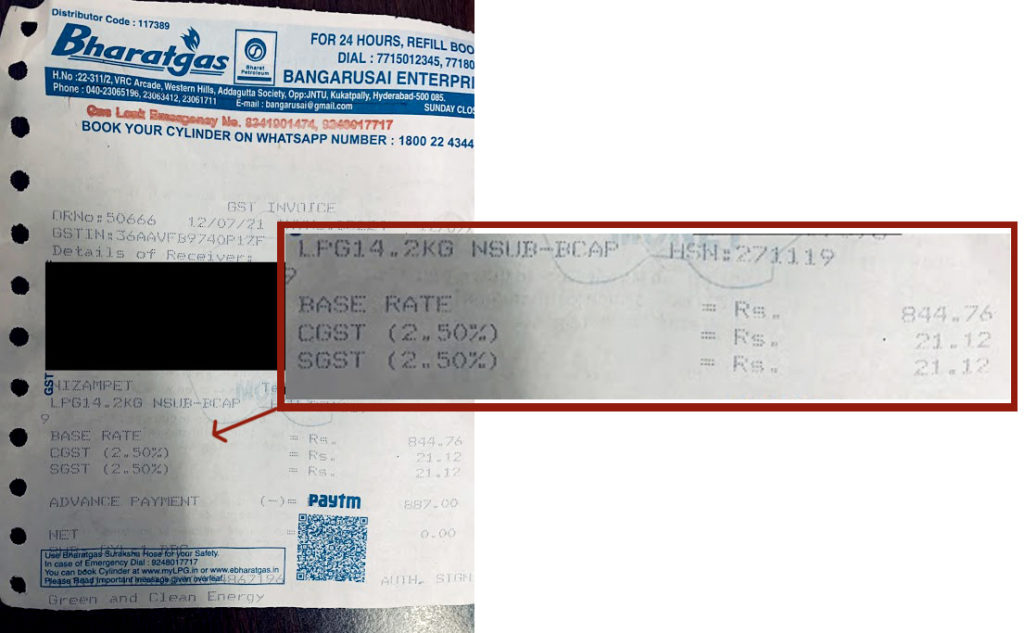

For example, the 14.2 kg domestic LPG cylinder bill in the below photo can be seen. It can be observed in the bill that there is a CGST of 2.5% and an SGST of 2.5% (i.e., a total of 5% GST). So, there is no basis for the claim that the State government impose a tax of 55% on the LPG cylinders.

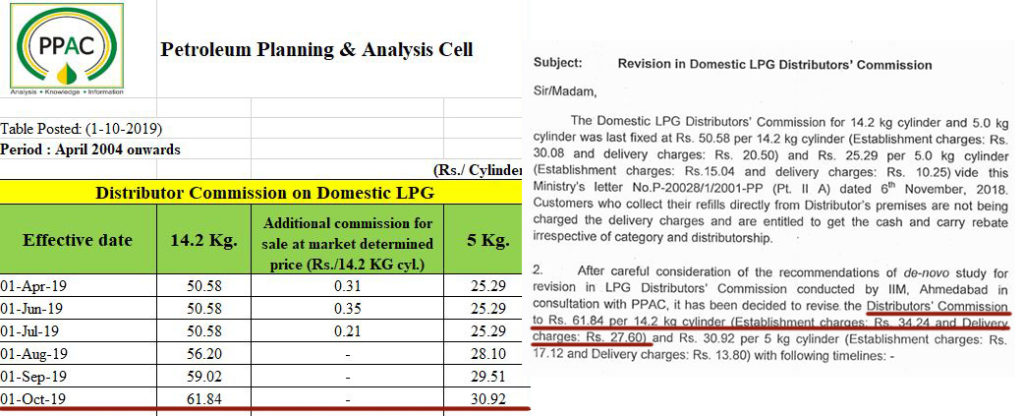

How much is the dealer’s commission?

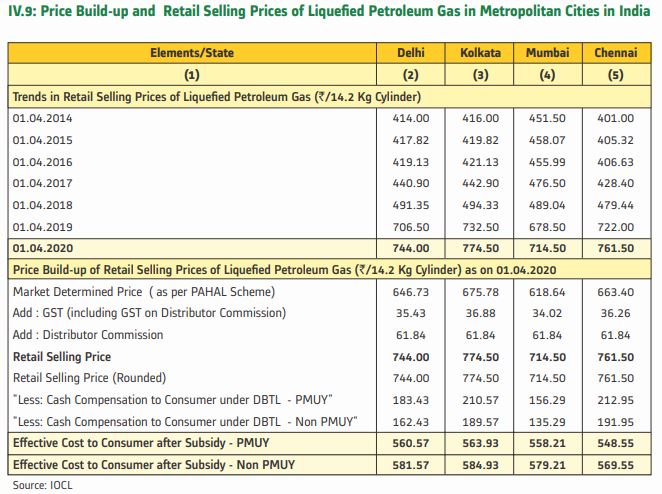

The dealer’s commission is given as Rs. 5.50 in the post. However, on the PPAC website, it can be seen that the dealer/distributor’s commission is Rs. 61.84 on a 14.2 kg LPG gas cylinder. An order was issued by the government in July 2019 for increasing the dealer’s commission to Rs. 61.84 and it can be read here. It was found that the Rs. 61.84 includes Rs. 34.24 as ‘Establishment charges’ and Rs. 27.60 as ‘Delivery charges’. So, the numbers given in the post regarding the dealer’s commission are also not correct.

Different components of the domestic LPG cylinder price:

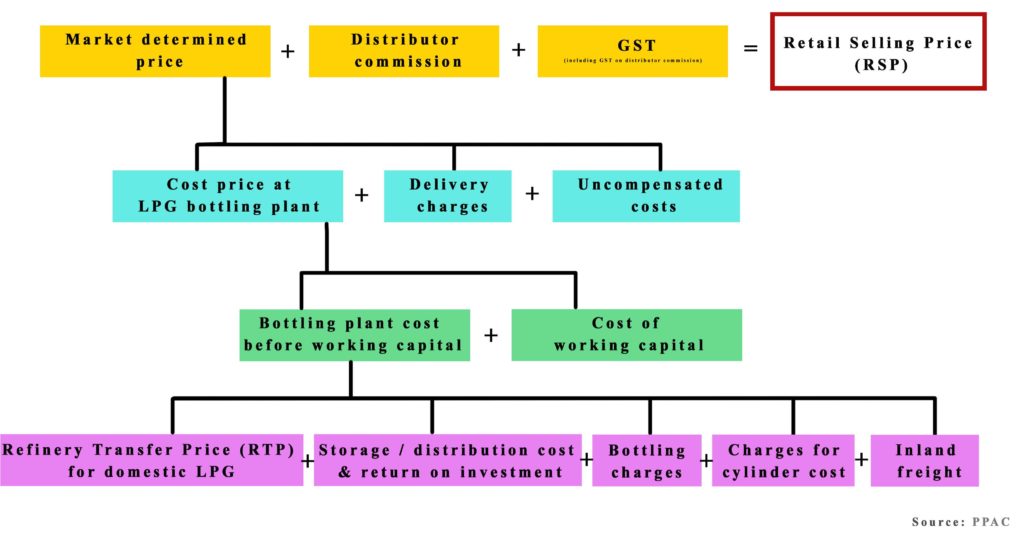

In the ‘Indian Petroleum & Natural Gas Statistics 2019-20’ report released by the Ministry of Petroleum and Natural Gas, the details regarding the prices of domestic LPG cylinders in four major cities of India, as of 1 April 2020, were found. The details of the cylinder price in Delhi, as of 1 June 2021, can be found here. The retail price of a cylinder includes ‘Market Determined Price’, ‘Distributor Commission’, and ‘GST’. We have already explained the GST and the distributor commission. Below are the components of the ‘Market Determined Price’.

What are the components of ‘Market Determined Price’?

The details regarding the different components of ‘Market Determined Price’ can be found in the PPAC’s ‘Ready Reckoner’ (June 2018) document. Some of these components’ prices vary according to the States. However, the difference is not due to taxes but due to other factors like location, uncompensated costs under PAHAL, etc.

To sum it up, a GST of 5% is levied on the domestic LPG cylinders; no State imposes 55% tax.