A video comparing the profit of banks in India during Manmohan Singh’s and PM Narendra Modi’s regime is being widely shared on social media claiming that the profit of banks was -11.2 % during 2013-14 and has reached a profit of 1 lakh plus crore rupees during 2020-21. Let’s verify the claim made in the post.

Claim: Profit of banks in India is -11.2% during 2013-14, whereas the profit reached above 1 Lakh crore rupees during 2020-21.

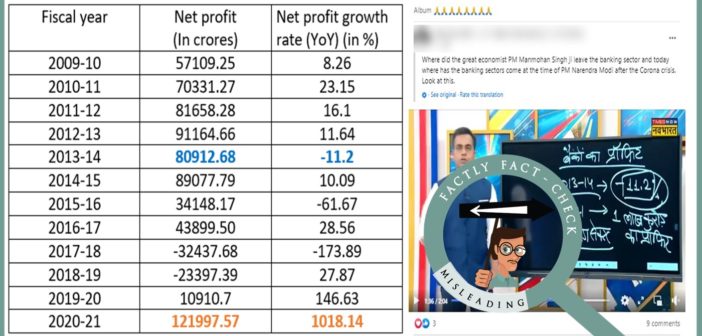

Fact: As per the RBI data, net profit of all the scheduled commercial banks (SCBs) during 2013-14 was ₹80,912.68 crores with the annual net profit growth rate of ‘-11.2%’. Similarly, for 2020-21, net profit is ₹1,21,997.57 with growth rate of ‘1018.14 %’. However, the video inappropriately compares the total net profit during 2020-21 with annual net profit growth rate during 2013-14. Hence the claim made in the video is MISLEADING.

According to the data on ‘appropriation of profit of scheduled commercial banks’ available on RBI’s Database on Indian Economy, the following table shows the net profits of the all scheduled Commercial banks (SCBs) in India over the years:

| Fiscal year | Net profit (In Rs. crores) | Net profit growth rate (YoY) (in %) |

| 2009-10 | 57109.25 | 8.26 |

| 2010-11 | 70331.27 | 23.15 |

| 2011-12 | 81658.28 | 16.1 |

| 2012-13 | 91164.66 | 11.64 |

| 2013-14 | 80912.68 | -11.2 |

| 2014-15 | 89077.79 | 10.09 |

| 2015-16 | 34148.17 | -61.67 |

| 2016-17 | 43899.50 | 28.56 |

| 2017-18 | -32437.68 | -173.89 |

| 2018-19 | -23397.39 | 27.87 |

| 2019-20 | 10910.7 | 146.63 |

| 2020-21 | 121997.57 | 1018.14 |

From the above table, it is evident that the video compares the annual net profit growth rate of ‘-11.2%’ during 2013-14 with the total net profits of ₹1.21 lakh crores during 2020-21. This comparison is inappropriate. It should be noted that net profit of all the SCBs during 2013-24 was ₹80,912.68 crores. The negative net profit in some of the recent years is due to provisioning for Non-Performing Assets (NPA), slow growth among others.

To sum it up, video compares net profit growth rate with total net profits of banks in India, thus making the comparison inappropriate.