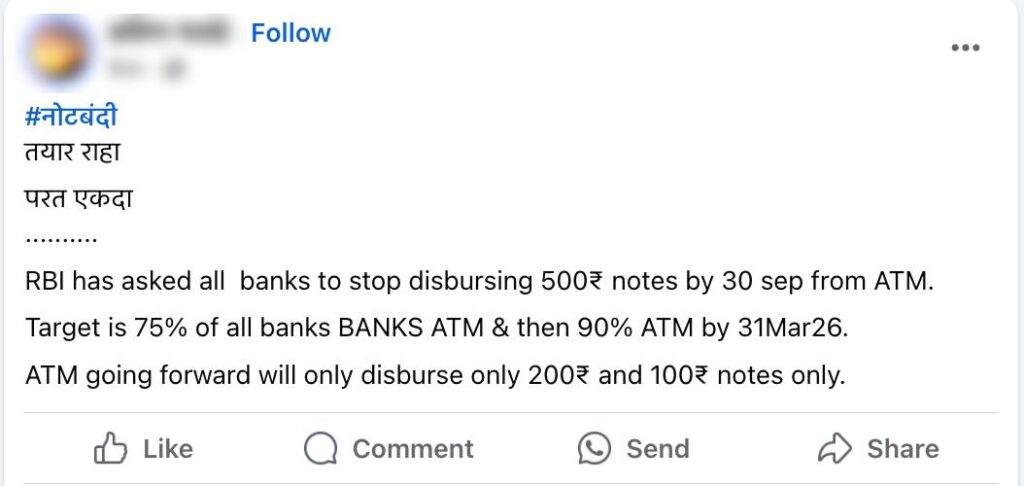

A post (here, here, here, and here) is going viral on social media platforms claiming that the Reserve Bank of India (RBI) has directed all banks to stop disbursing ₹500 notes through ATMs by 30 September 2025. The post further claims that, going forward, ATMs will dispense only ₹200 and ₹100 notes. Through this article, let us fact-check the claims made in the post.

Claim: Reserve Bank of India (RBI) has directed all banks to stop disbursing ₹500 notes through ATMs by 30 September 2025.

Fact: The RBI has not directed all banks to stop disbursing ₹500 notes through ATMs by 30 September 2025. Instead, it has instructed banks and White Label ATM Operators (WLAOs) to ensure that 75% of all ATMs dispense ₹100 or ₹200 denomination notes also by 30 September 2025, and 90% by 31 March 2026. The RBI emphasised that this move aims to improve public access to commonly used denominations, which are in high demand for daily transactions. Hence the claim made in the post is MISLEADING.

To verify the authenticity of the viral claim, we visited the official website of the RBI and reviewed its press releases, circulars, and publications. However, we did not find any information supporting the claim that the RBI has directed banks to stop dispensing ₹500 notes through ATMs.

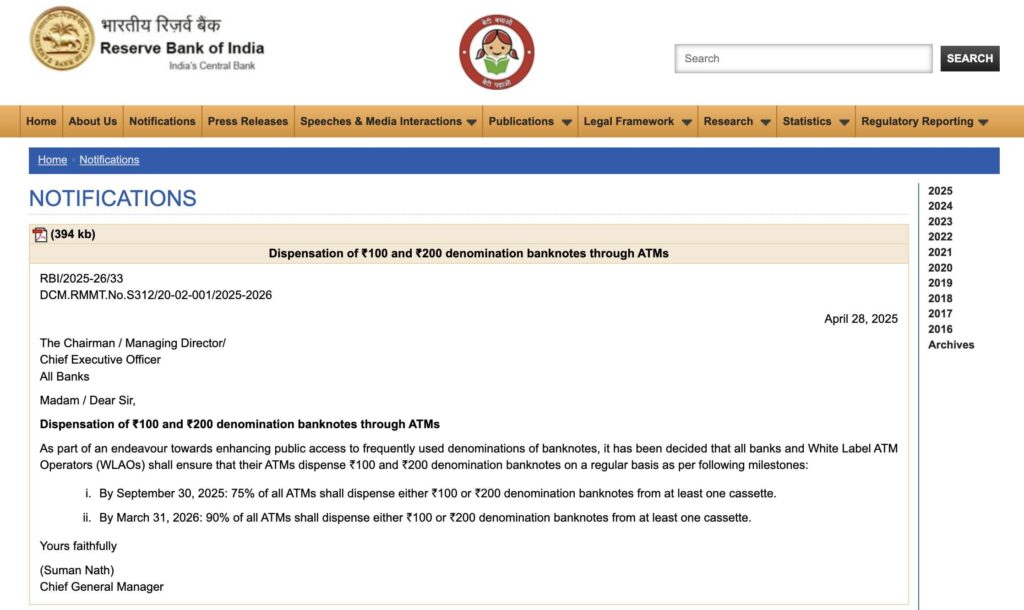

We then conducted a relevant keyword search, but this also did not yield any credible reports indicating that the RBI has directed all banks to stop disbursing ₹500 notes through ATMs. During this search, we came across multiple reports published in April 2025 (here, here, here, and here). According to these reports, the RBI issued a circular on 28 April 2025, instructing banks to ensure that ATMs dispense ₹100 or ₹200 denomination notes also in order to enhance the availability of these currency notes to the public. Banks and White Label ATM Operators (WLAOs) were asked to implement this directive in a phased manner.

Further, we searched the RBI website and, according to a notification issued by the RBI on 28 April 2025, the Reserve Bank of India has directed banks and White Label ATM Operators (WLAOs) to ensure that ATMs dispense ₹100 or ₹200 denomination notes also. The notification also outlines specific implementation milestones. By 30 September 2025, 75% of all ATMs must be configured to dispense either ₹100 or ₹200 denomination notes from at least one cassette. This figure is set to rise to 90% by 31 March 2026. The RBI emphasised that this move aims to improve public access to commonly used denominations, which are in high demand for daily transactions. There is no mention of the ₹500 note in this circular.

Based on this information, it is clear that the RBI has not directed all banks to stop disbursing ₹500 notes through ATMs by 30 September 2025. Instead, it has instructed banks and WLAOs to ensure that 75% of all ATMs dispense ₹100 or ₹200 denomination notes also by that date.

White Label ATM Operators (WLAOs) are non-bank entities authorised by the Reserve Bank of India (RBI) to set up, own, and operate ATMs in India under their own brand name, rather than that of a bank (here, here). Examples of WLAOs in India include Tata Communications Payment Solutions Ltd., which operates under the brand Indicash, and India1 Payments Ltd., which operates under the brand India1.

In ATMs, a cassette is a secure, removable container that holds currency notes of a specific denomination only (e.g., ₹100, ₹200, ₹500).

On 03 June 2025, the Government of India’s PIB Fact Check unit posted on X (formerly Twitter), stating that the claim regarding the RBI discontinuing ₹500 notes by March 2026 is false. The post confirmed that the RBI has made no such announcement, and ₹500 notes have not been discontinued and remain legal tender.

To sum it up, the RBI has not directed all banks to stop disbursing ₹500 notes through ATMs by 30 September 2025. RBI has instructed banks and WLAOs to ensure that 75% of all ATMs dispense ₹100 or ₹200 denomination notes also by 30 September 2025.

Note: This article was updated on 04 June 2025 to include the clarification issued by the Press Information Bureau (PIB) on X (formerly Twitter) regarding the viral claim.