A graphic claiming that “the government of India just announced that crypto trading is legal and that taxes will be reduced from 30% to 10%”, is going viral on social media (here, here, and here). Through this article, let’s fact-check the claim made in the post.

Claim: Recently, the government of India declared that crypto trading is legal and that taxes will be reduced from 30% to 10%.

Fact: The government of India has not explicitly banned cryptocurrencies but has not provided clear guidelines on their legality. Since as far back as 2013, the Reserve Bank of India has issued circulars and cautioned users, holders, and traders of virtual currencies (cryptocurrencies). In 2018, the Reserve Bank of India (RBI) issued a circular prohibiting regulated firms from offering services to individuals or companies involved in cryptocurrency trading. However, the Supreme Court of India overturned this circular in March 2020. In 2021, the government prepared a bill that would have banned private cryptocurrencies, though it has not been introduced yet. In 2023, as the president of the G20, India called for a global framework to regulate cryptocurrencies. In the year 2022, in its 2022-23 Budget, the government introduced a flat 30% tax on income from digital virtual assets or cryptocurrency. Hence the claim made in the post is MISLEADING.

We have found that this graphic with the same claim has been going viral on social media since at least 2023 (here, here).

What is Cryptocurrency?

Cryptocurrency, sometimes called crypto-currency or crypto, refers to any form of currency that exists digitally or virtually and uses cryptography to secure transactions. Cryptocurrencies do not have a central issuing or regulating authority; instead, they use a decentralized system to record transactions and issue new units. They are supported by a decentralized peer-to-peer network called the blockchain and secured by cryptography. To understand cryptocurrency, one needs to first understand three key terms: blockchain, decentralization, and cryptography. More information regarding cryptocurrency can be found here.

Is cryptocurrency legal or illegal in India?

According to reports, the government of India has not explicitly banned crypto mining but has not provided clear guidelines on its legality as of date. To understand the legal status of crypto mining in India, we need to consider various factors and developments regarding cryptocurrency or crypto trading.

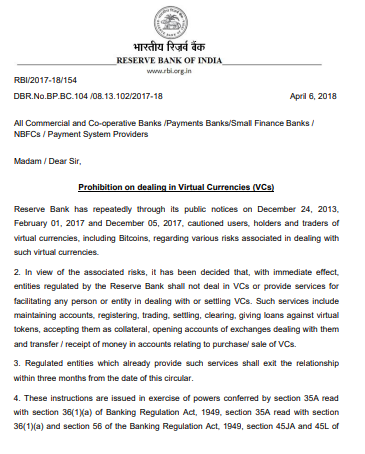

Since as far back as 2013, the Reserve Bank of India has issued circulars and cautioned users, holders, and traders of virtual currencies (VCs), including Bitcoins, about the potential financial, operational, legal, customer protection, and security-related risks they face (here, here, here).

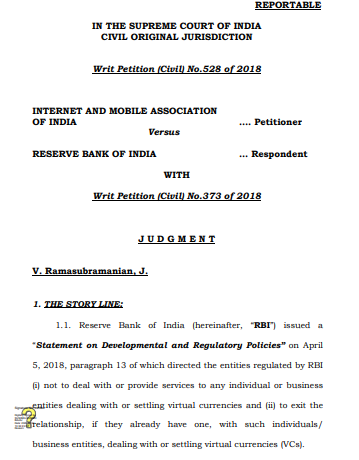

In 2018, the Reserve Bank of India (RBI) published a circular forbidding regulated firms from offering services to individuals or companies engaged in cryptocurrency trading.

However, the Supreme Court of India struck down this circular in March 2020. Since then, the legal status of crypto mining in India has been somewhat ambiguous due to the absence of comprehensive legislation, although no legislation has declared it illegal.

According to reports, the Securities and Exchange Board of India (SEBI) has suggested that multiple regulators should supervise cryptocurrency trading. This recommendation indicates a significant openness towards permitting the use of private virtual assets (cryptocurrencies) in the country. However, it also highlights a contrasting viewpoint with the Reserve Bank of India (RBI), which believes that private digital currencies pose a macroeconomic risk, as indicated in separate documents. Thus, there is a divergence of opinions between SEBI and RBI regarding the regulation and risks associated with cryptocurrencies in India.

In February 2022, the government of India introduced a crypto tax in the Budget for 2022-23, announcing a flat 30% tax on income from digital virtual assets or cryptocurrency. In her Budget Speech 2022, Finance Minister Nirmala Sitharaman also mentioned that no set-off would be allowed in case of losses, and gifts of virtual digital assets would be taxed in the hands of the recipient.

In 2023, as the president of the G20, India called for a global framework to regulate cryptocurrencies. In 2021, the government of India prepared a bill (The Cryptocurrency and Regulation of Official Digital Currency Bill, 2021) intended to be introduced in the Lok Sabha during budget session and winter session (here, here). The bill seeks to establish a framework for the creation of digital currency issued by the Reserve Bank of India (RBI) and would have banned private cryptocurrencies. However, the bill has not been introduced yet.

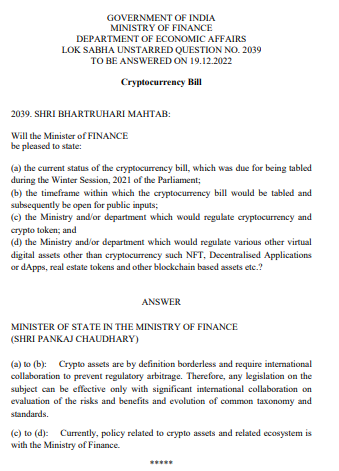

In 2022, Bhartruhari Mahtab, an MP from Odisha, questioned the Ministry of Finance about the Cryptocurrency Bill. The questions reads: What is the current status of the Cryptocurrency Bill? When will it be tabled and open for public input? Which ministry or department will regulate virtual assets such as cryptocurrencies, non-fungible tokens (NFTs), decentralized applications, real estate tokens, and other assets?

Minister of State for Finance, Shri Pankaj Chaudhary, representing the Ministry of Finance, responded, “Crypto assets are inherently borderless and necessitate international collaboration to prevent regulatory arbitrage. Therefore, any legislation on this subject can only be effective with significant international cooperation to assess risks, benefits, and the development of common taxonomy and standards.” He later clarified that the policy framework and regulation of crypto assets fall under the jurisdiction of the Ministry of Finance.

To sum up, the government of India has not explicitly banned cryptocurrencies but has not provided clear guidelines on their legality and has not announced any reduction in taxes.