A collage of newspaper clippings is being shared on social media claiming that the Government of India is planning to end the insurance guarantee for the depositors saving their money in banks. Let’s verify the claims made in the post.

Claim: Central Government is planning to end the insurance guarantee for the money deposited in banks.

Fact: The news clippings shared in the post were published in 2017 regarding, ‘The Financial Regulation and Deposit Insurance Bill, 2017’ introduced by Government of India. While assuring that FRDI Bill does not adversely modify the earlier protections given to the depositors, the Ministry of Finance issued a press release clarifying that the FRDI Bill will provide additional protections to the depositors in a more transparent manner. Following the widespread criticism of its controversial provisions, GoI has withdrawn FRDI Bill in 2018. In February 2020, the Deposit Insurance and Credit Guarantee Corporation (DICGC) raised the depositors’ insurance cover limit to 5 lakhs, which earlier used to be one lakh rupees. Hence, the claim made in the post is MISLEADING.

On reverse image search of the screenshots of the news clippings shared in the post, we found that these news clippings are being shared on social media at least since 2017. They can be seen here and here. On observing the clearer version of these news clippings, it is found that both these news clippings talk about the risks of depositors from the ‘The Financial Regulation and Deposit Insurance Bill, 2017’.

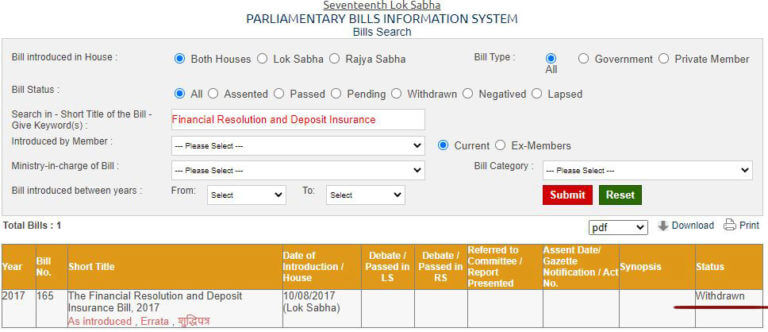

The Government of India introduced ‘The Financial Regulation and Deposit Insurance Bill, 2017‘ in Lok Sabha on 10 August 2017. The Joint Committee of Parliament was asked to consult stakeholders on the provisions of the FRDI bill and was asked to submit their report on the last day of the budget session, 2018.

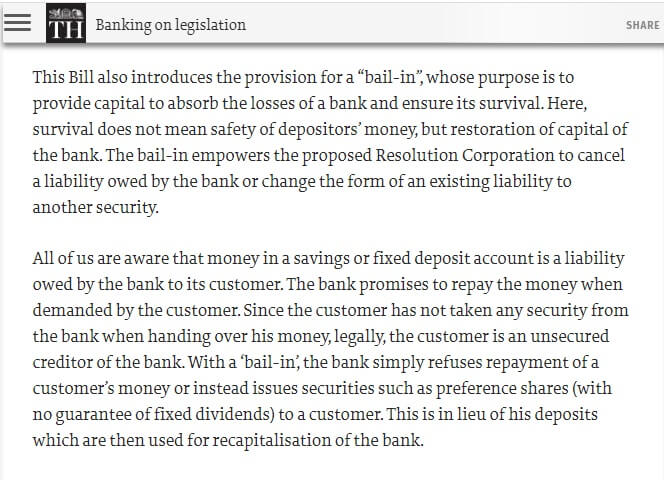

Following the introduction of the bill, several news websites published articles reporting that bail-in-provision introduced in the FRDI bill empowers the proposed ‘Resolution Corporation’ to cancel the liability owed by the bank or change the form of an existing liability to another security. They can be seen here and here. An article published by ‘The Hindu’ in November 2017 states, “All of us are aware that money in a savings or fixed deposit account is a liability owed by the bank to its customer. The bank promises to repay the money when demanded by the customer. Since the customer has not taken any security from the bank when handing over his money, legally, the customer is an unsecured creditor of the bank. With a ‘bail-in’, the bank simply refuses repayment of a customer’s money or instead issues securities such as preference shares (with no guarantee of fixed dividends) to a customer. This is in lieu of his deposits which are then used for recapitalisation of the bank”. All these articles reported that there will be no guarantee for the fixed deposit money because of the bail-in provision of the FRDI bill.

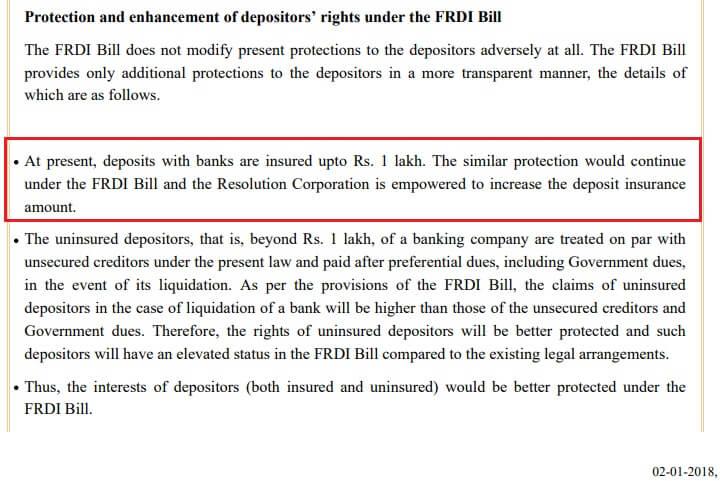

On 07 December 2017, the Ministry of Finance issued a press release stating that provisions of the Financial Resolution and Deposit Insurance Bill, 2017 were meant to protect the interests of depositors. A statement from the press release reads, “The provisions contained in the FRDI Bill, as introduced in the Parliament, do not modify present protections to the depositors adversely at all. They provide rather additional protections to the depositors in a more transparent manner”. In another press statement released by the Ministry of Finance in January 2018, the government emphasised that they will provide one lakh deposit insurance coverage as provided in the past.

Following the widespread criticism of its controversial provisions, GOI has withdrawn FRDI Bill in August 2018. On checking the status of the Bill on the Lok Sabha website, it was found that the Bill has been withdrawn. In February 2020, many news agencies reported an alleged statement made by the Finance Minister which read “We are working on the FRDI Bill, but not sure when it can get through the House”. But, in July 2020, it has been clarified by the ‘Ministry of Finance’ that ‘the Government has not taken any decision to reintroduce the FRDI Bill’. The tweets regarding this clarification can be found here and here.

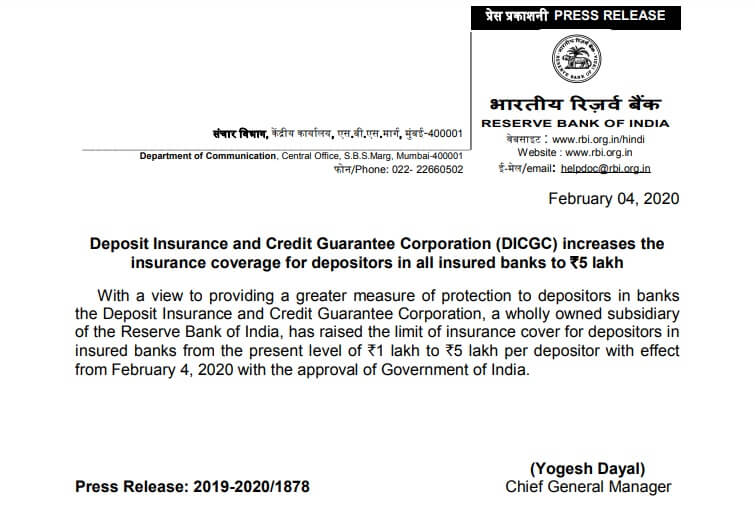

In February 2020, the Deposit Insurance and Credit Guarantee Corporation (DICGC) raised the limit of insurance cover for depositors in insured banks from one lakh to five lakh rupees. A statement issued by the RBI on 04 February 2020 reads, “ With a view to providing a greater measure of protection to depositors in banks the Deposit Insurance and Credit Guarantee Corporation, a wholly owned subsidiary of the Reserve Bank of India, has raised the limit of insurance cover for depositors in insured banks from the present level of `1 lakh to `5 lakh per depositor with effect from February 4, 2020 with the approval of Government of India”.

To sum it up, old news clippings related to FRDI Bill withdrawal are shared claiming that the government is planning to end the deposit insurance guarantee.