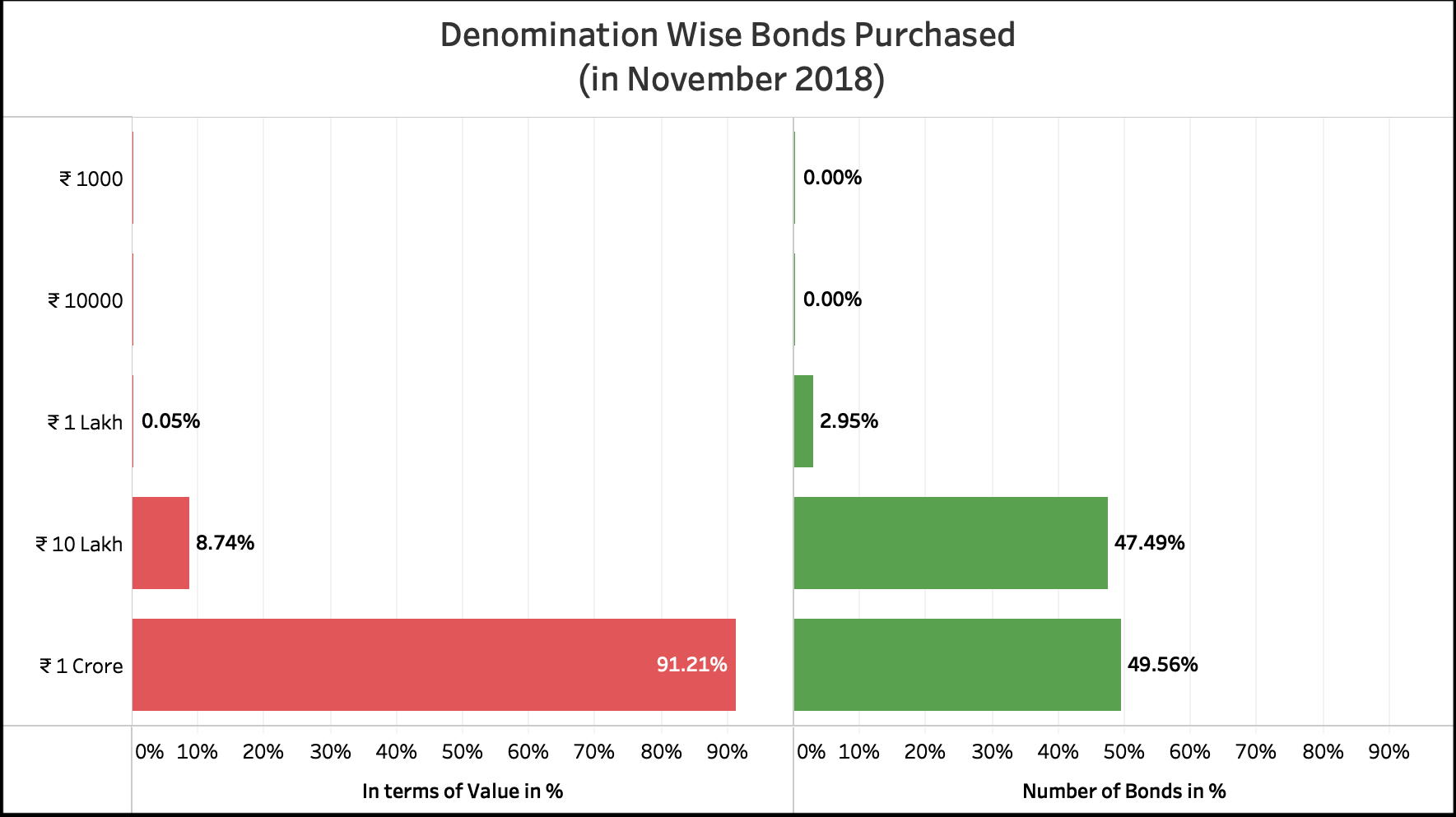

[orc]Like in the October cycle, November 2018 also witnessed heavy purchase of electoral bonds. As per data shared by SBI, bonds worth more than ₹ 180 crores were purchased in 8 cities in the ten days of November cycle. As is the case with past cycles, bonds in the denomination of ₹ 10 lakh & ₹ 1 crore accounted for 99.95% of the bonds purchased in terms of value.

The Electoral Bonds were first announced in the 2017-18 budget and the scheme was subsequently notified in January 2018. Factly had earlier written about the bonds, their impact on transparency etc.

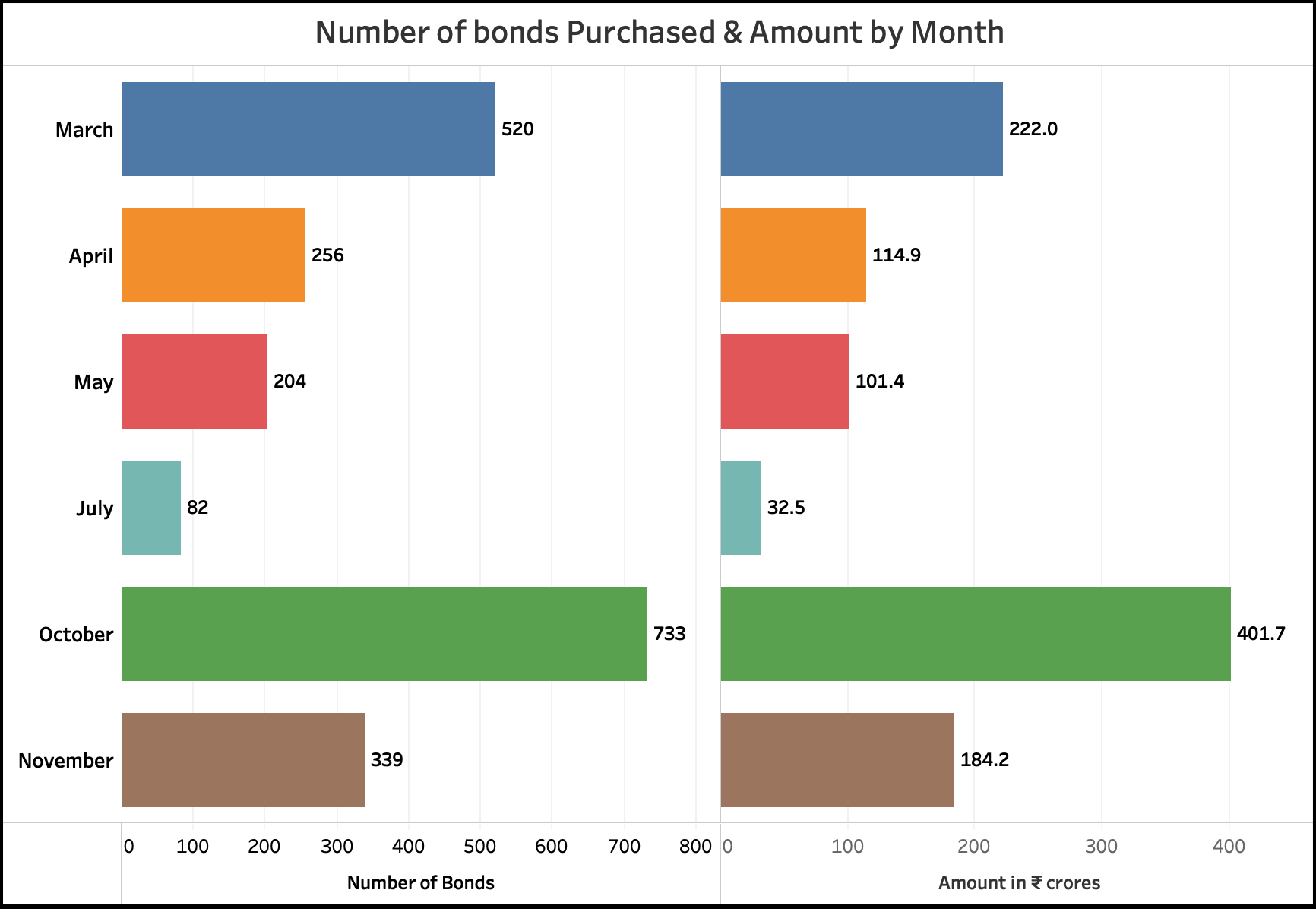

Factly had also analysed the data obtained from the State Bank of India (SBI), the authorized bank to issue electoral bonds, about bonds purchased in the first first five cycles (till October 2018) to conclude that there was hardly any demand for electoral bonds of lower denomination. The latest data provided by SBI for the November cycle suggests heavy purchase of electoral bonds. Bonds worth more than ₹ 180 crores were purchased in eight (8) cities in the ten days of November cycle. As with other cycles, bonds in the denomination of ₹ 10 lakh & ₹ 1 crore accounted for 99.95% of the bonds purchased in terms of value, even in the November cycle.

Not a single bond was purchased in 21 cities in November 2018

In November 2018, the electoral bond scheme was made available in 29 SBI branches across India covering almost all the states & UTs. Among the 29 branches, bonds were purchased only in eight (8) branches. Not a single bond was purchased in the remaining twenty one (21) branches. This was the second month in succession where bonds worth more than ₹ 150 crores were purchased. The increased purchase could be due to general elections to five (5) state assemblies that were held in November & December.

A total of 339 bonds worth ₹ 184.2 crores were purchased in November. More than half the bonds (168) purchased in November were in the denomination of ₹ 1 crore.

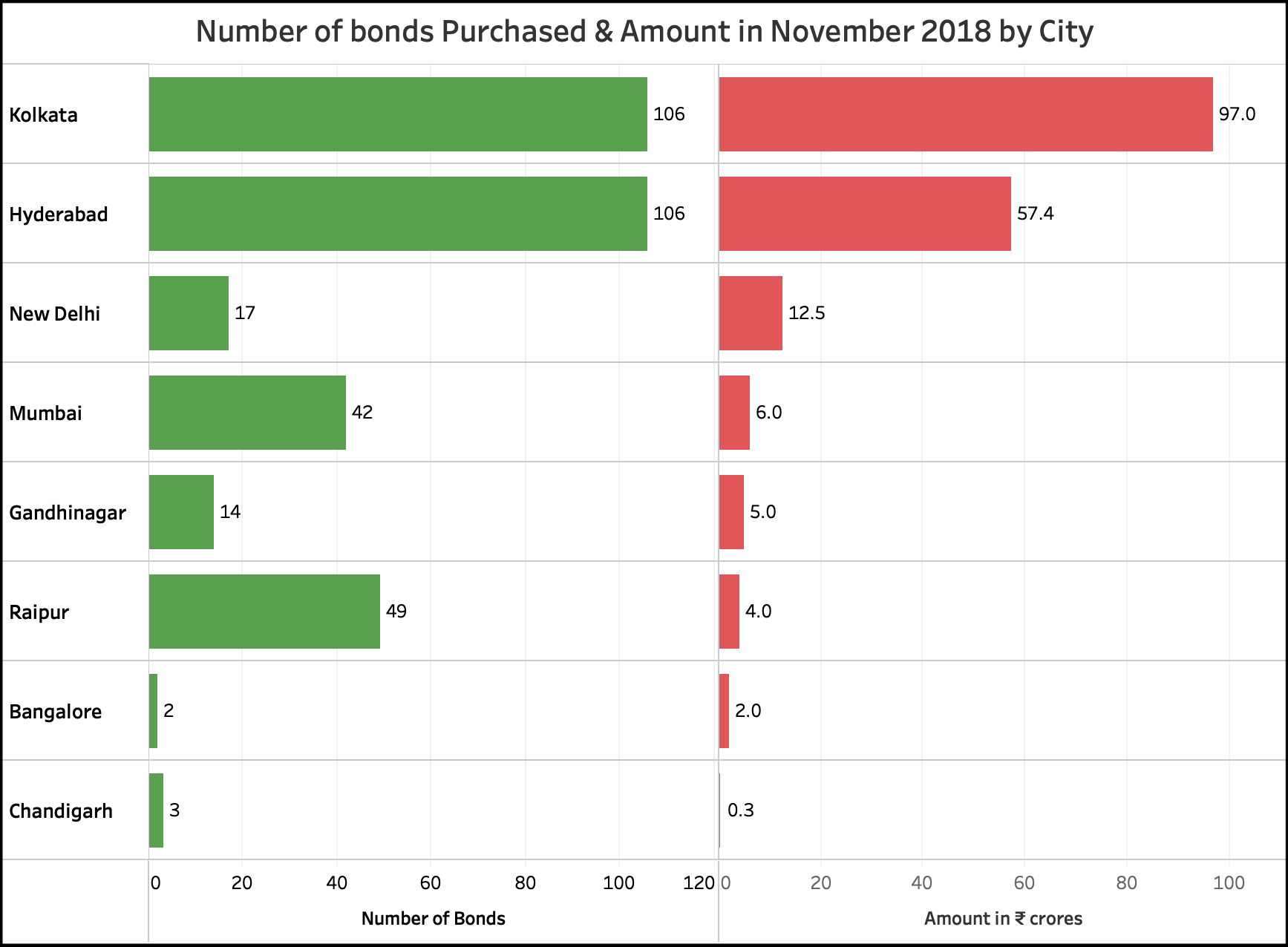

More than 80% of the bonds were purchased in Hyderabad & Kolkata

More than 80% of the bonds were purchased in Hyderabad & Kolkata

A total of 339 bonds worth ₹ 184.2 crores were purchased in the November cycle, taking the total value of bonds purchased in the four cycles to ₹ 1056.73 crores. In the November cycle, 106 bonds each were purchased in Hyderabad & Kolkata. in Raipur, 49 bonds were purchased followed by 42 in Mumbai. While assembly general elections were due in five states, only the Hyderabad branch in Telangana saw heavy purchase of the bonds. Surprisingly, the highest number of bonds & the highest amount were purchased from Kolkata where no elections were due. Even though elections were due in Madhya Pradesh, Rajasthan & Mizoram, not a single bond was purchased in Bhopal, Jaipur & Aizwal in November.

In terms of value, Kolkata was on the top where bonds worth ₹ 97 crores were purchased followed by Hyderabad where bonds worth ₹ 57.4 crores were purchased. Hyderabad & Kolkata accounted for more than 80% worth of the bonds purchased in November.

99.95% of bonds purchased (in terms of value) were in denomination of ₹ 10 lakh & ₹ 1 crore

Data for November 2018 indicates that not a single electoral bond of ₹ 1000 and ₹ 10000 denomination was purchased, an indication that citizens may not be purchasing these bonds. Out of the 339 bonds purchased in November, 10 were of ₹ 1 lakh denomination, 161 were of ₹ 10 lakh denomination and the remaining 168 were of ₹ 1 crore denomination. Together, bonds in the denomination of ₹ 10 lakh & ₹ 1 crore accounted for 99.95% of the bonds purchased in terms of value. It is highly likely that the Rs 10 lakh & Rs 1 crore denomination are purchased by corporates and not individuals. There is no concrete information on the type of purchasers since SBI has time & again refused to share such information.

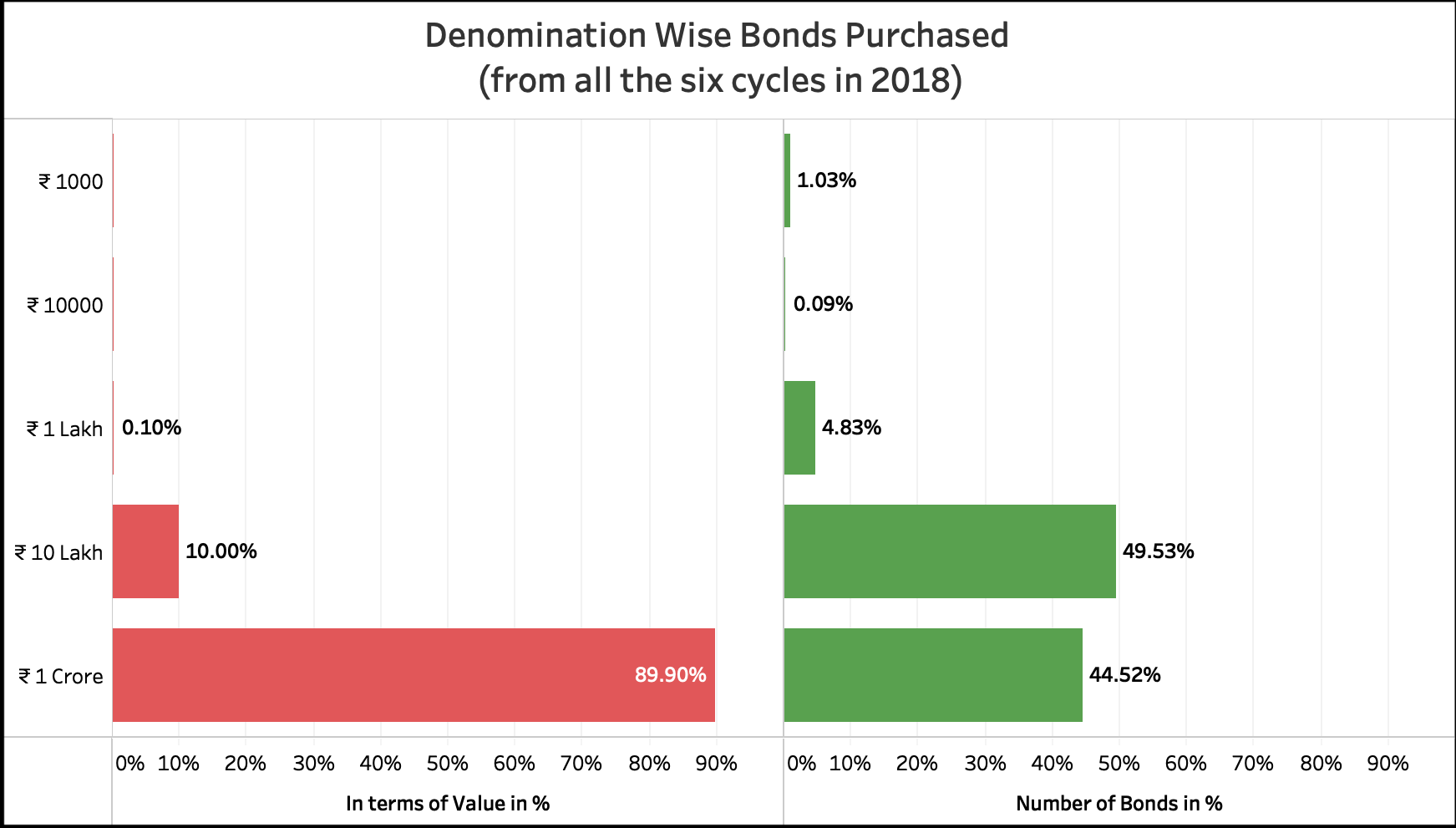

Data from the six cycles of 2018 indicates no demand for lower denomination

Data from the six cycles of 2018 indicates no demand for lower denomination

Data of electoral bonds purchased in the six cycles of the year 2018 clearly indicates that there is no demand for bonds of lower denomination. In terms of value, bonds of ₹ 1 crore denomination accounted for ₹ 950 crores or 89.9% followed by bonds of ₹ 10 lakh denomination that accounted for ₹ 105.7 crore or 10%. Together, they accounted for over 99.9% of total value of bonds purchased till date. Even in terms of the number of bonds purchased, 2007 out of the 2134 or 94.1% of the bonds purchased till date are in the denomination of ₹ 10 lakh and ₹ 1 crore.