[orc]After hue & cry about hefty charges for non-maintenance of Monthly Average Balance (MAB), SBI has revised penalty amount for non-maintenance of MAB along side revising MAB criteria.

After hue & cry about hefty charges on non-maintenance of Monthly Average Balance (MAB), the largest bank in the country, State Bank of India has revised penalty amount. These will be applicable from 01st October, 2017.

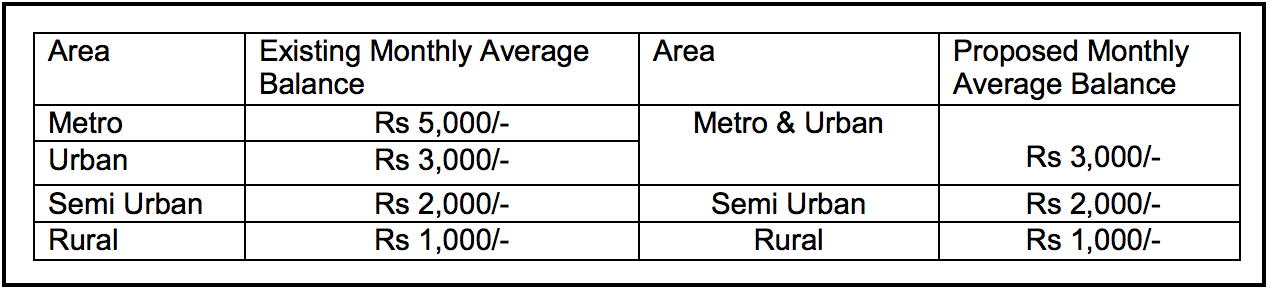

Revised criteria for Monthly Average Balance (MAB) in Savings Bank Accounts

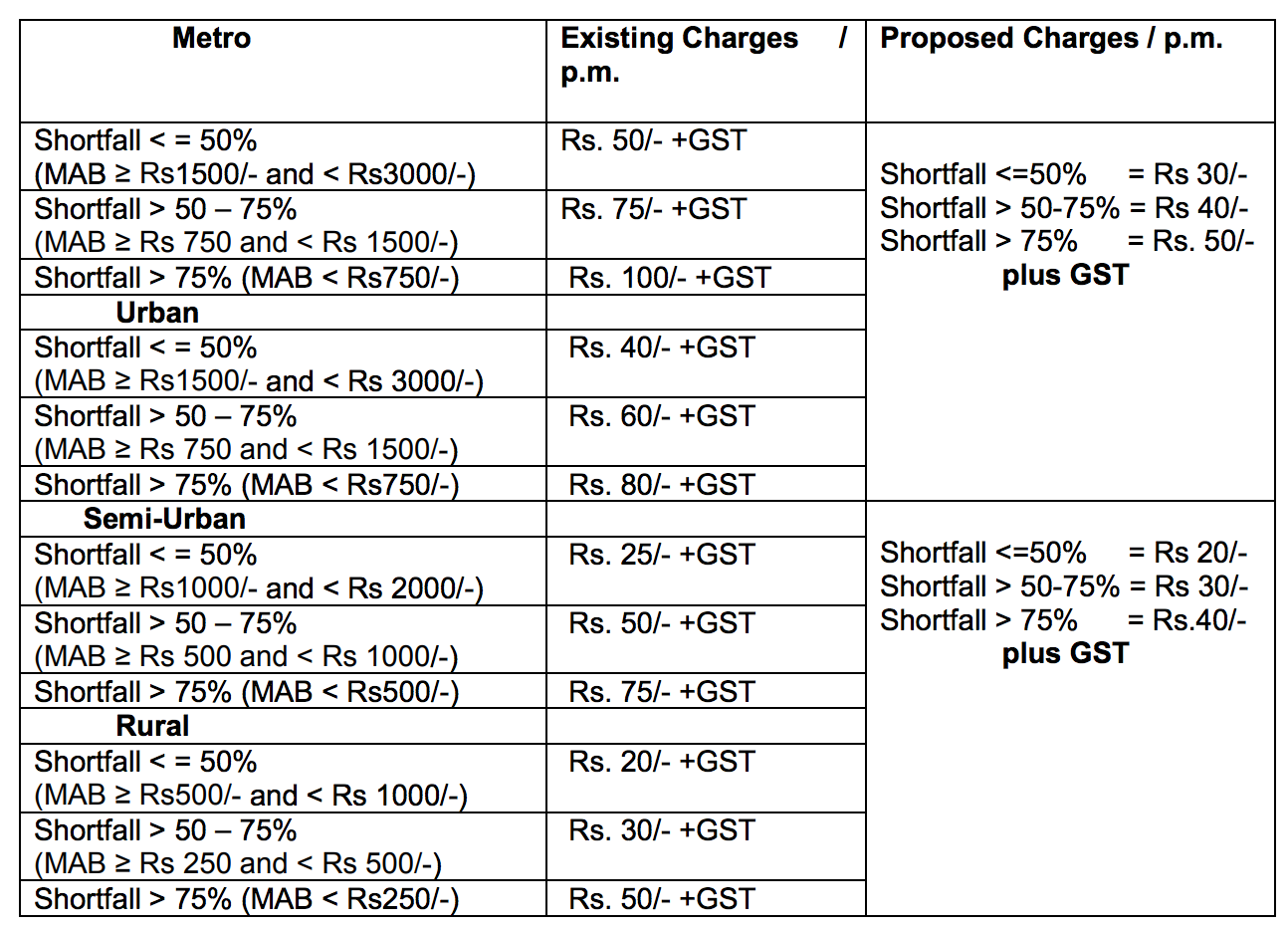

Penalty for Non-maintenance of Monthly Average Balance (MAB) in Savings Accounts

Penalty for Non-maintenance of Monthly Average Balance (MAB) in Savings Accounts

SBI has exempted the following categories of savings accounts from the MAB requirement

- Financial Inclusion Accounts

- Basic Savings Bank Deposit Accounts

- Small Accounts

- Phela Kadam and Pheli Udaan accounts

- Accounts held by minors up to the age group of 18 (Primary Account Holder)

- Accounts held by pensioners, all categories, including recipients of social welfare benefits

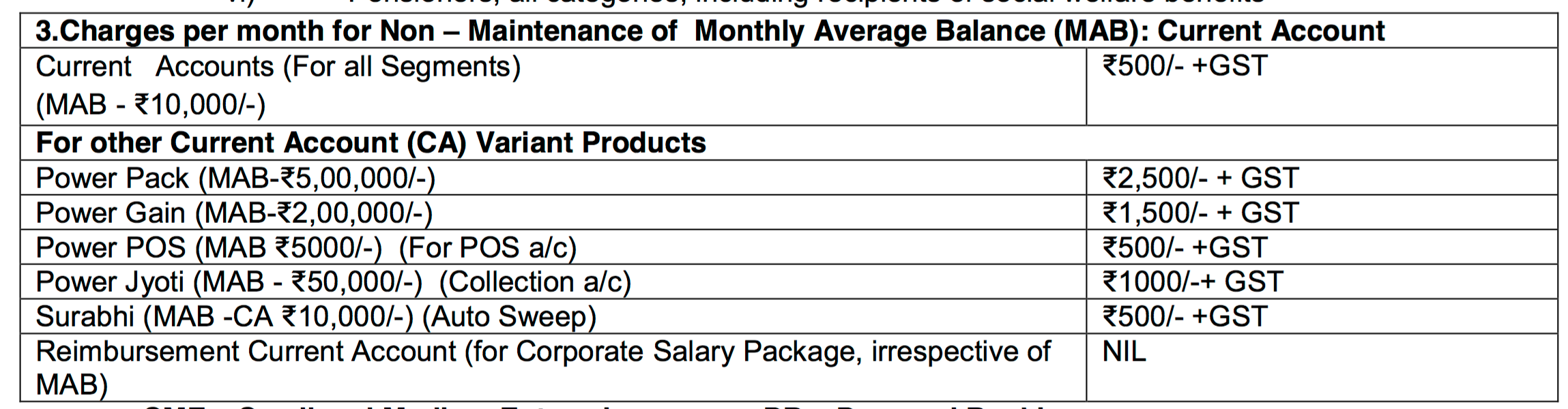

Penalty for Non-maintenance of Monthly Average Balance (MAB) in Current Accounts

Explanation of Terms

- QAB – Quarterly Average Balance

- MAB – Monthly Average Balance

- CA – Current Account

Here is a brief snapshot of the other charges as on date.

| Description | Earlier Charges | Current Charges |

| Multi City Cheque Books for Savings Account | If QAB < Rs 25,000 50 cheque leaves free per year, thereafter Rs 3 + ST (per leaf) If QAB >= Rs 25,000 50 cheque leaves free per year, thereafter Rs 2 + ST (per leaf) | If QAB < Rs 1,00,000 25 cheque leaves free per year, thereafter,

If QAB >= Rs 1,00,000 Senior Citizens |

| Multi City Cheque Books for Current Account | First 100 leaves free, thereafter Rs 2 + ST (per leaf) | First 50 leaves free, thereafter Rs 3 + GST (per leaf) |

| Account Closure Charges | Within 14 days – Nil From 14 days-upto 6 months – Rs 255 (individual) Rs 1019(non – individual) After 6 months but before 12 months – Rs 153 (individual) Rs 509 (non- individual) | Within 14 days – Nil After 14 days Rs 500 + GST (individual) Rs 1000 + GST (non-individual)

|

| Balance Certificate | Rs 102 | Rs 150 + GST |

| No dues Certificate | Rs 102 | Rs 100 + GST (individual) Rs 200 + GST (non-individual) |

| Photo Attestation charges | Rs 102 | Rs 150 + GST |

| Postal charges | Ordinary – Rs 15 Regd/Speed post/courier Rs 36 | Ordinary – Actual Expenditure (Min Rs 20 + GST) Regd/Speed post/courier – Actual Expenditure (Min Rs 50 + GST) |

| Collection of Outstation Cheques | Up to Rs 5,000 (Rs 28) From Rs 5,000 – 10,000 (Rs 56) From Rs10,000 – Rs 1 Lakh (Rs 112) From Rs 1 Lakh – 5 Lakh (Rs 225) From Rs 5 Lakh – 10 Lakh (Rs 253) Above Rs 10 Lakh (Rs 281- Max) | Up to Rs 10,000 (Rs 50 + GST) From Rs10,000 – Rs 1 Lakh (Rs 100 + GST) Above Rs 1 Lakh (Rs 200 + GST) |

| NEFT Charges (through Net Banking) | Up to Rs 10,000 (Rs 2) From Rs10,000 – Rs 1 Lakh (Rs 4) From Rs 1 Lakh – 2 Lakh (Rs 12) Above Rs 2 Lakh (Rs 20) | Up to Rs 10,000 (Re 1 + GST) From Rs10,000 – Rs 1 Lakh (Rs 2 + GST) From Rs 1 Lakh – 2 Lakh (Rs 3 +GST) Above Rs 2 Lakh (Rs 5 + GST) |

| RTGS Charges (through Net Banking) | From Rs 2 Lakh – 5 Lakh (Rs 25) Above Rs 5 Lakh (Rs 45) | From Rs 2 Lakh – 5 Lakh (Rs 5 + GST) Above Rs 5 Lakh (Rs 10 + GST) |

| IMPS/UPI Charges | Up to Rs 1,000 – Nil From Rs 1,000 – 10,000 (Rs 2) From Rs10,000 – Rs 1 Lakh (Rs 4) From Rs 1 Lakh – 2 Lakh (Rs 12) | Up to Rs 1,000 – Nil From Rs 1,000 – 1,00,000 (Rs 5 + GST) From Rs 1 Lakh – 2 Lakh (Rs 15 + GST) |

| Number of Cash Transactions in a Month (Savings Account) | 3 transactions free Beyond 3 Transactions in a month (Rs 50 per Transaction) | 3 transactions free Beyond 3 Transactions in a month (Rs 50 per Transaction + GST) |

| Issue of Demand Draft/ Bankers’ Cheque | Up to Rs 5,000 (Rs 10) From Rs 5,000 – 10,000 (Rs 41) From Rs10,000 – Rs 1 Lakh (Rs 51 minimum or Rs 3 per thousand) From Rs 1 Lakh – 5 Lakh (Rs 306 minimum or Rs 3 per thousand) | Up to Rs 5,000 (Rs 25) From Rs 5,000 – 10,000 (Rs 50) From Rs10,000 – Rs 1 Lakh (Rs 60 minimum or Rs 5 per thousand) Above Rs 1 Lakh (Rs 600 minimum or Rs 4 per thousand) Maximum Rs 2000 |

| Locker (Small) | Metro/Urban – Rs 1100 Semi-Urban/Rural – Rs 800 | Metro/Urban – Rs 1500 + GST Semi-Urban/Rural – Rs 1000 + GST |

| Locker (Medium) | Metro/Urban – Rs 2800 Semi-Urban/Rural – Rs 1800 | Metro/Urban – Rs 3000 + GST Semi-Urban/Rural – Rs 2000 + GST |

| Locker (Large) | Metro/Urban – Rs 6000 Semi-Urban/Rural – Rs 5000 | Metro/Urban – Rs 6000 + GSTSemi-Urban/Rural – Rs 5000 + GST |

| Locker (Extra Large) | Metro/Urban – Rs 8000 Semi-Urban/Rural – Rs 7000 | Metro/Urban – Rs 9000 + GST Semi-Urban/Rural – Rs 7000 + GST |

| Locker Visit Charges | 12 Visits Free thereafter Rs 100 per visit | 12 Visits Free thereafter Rs 100 per visit + GST |

| Debit Card Issuance Charges | Classic – Nil Global – Nil Gold –Nil Platinum – Rs 306 | Classic – Nil Global – Nil Gold – Rs 100 + GST Platinum – Rs 300 + GST |

| Debit Card Annual Maintenance Charges | Classic – Rs 100 Global – Rs 150 Platinum – Rs 200 | Classic – Rs 125 + GST Global – Rs 175 + GST Platinum – Rs 250 + GST Pride/Premium – Rs 350 + GST |

| Debit Card Replacement Charges | Classic – Rs 204 Global – Rs 204 Gold – Rs 200 Platinum – Rs 200 | Rs 300 + GST

|

Featured Image: SBI revised charges

3 Comments

Pingback: SBI Will Charge You For Low Balance In Account; Know About The Other ChangesEducation Hindustan | Online Educational Website | Education Hindustan | Online Educational Website

Pingback: SBI Will Charge You For Low Balance In Account; Know About The Other Changes – TopTea

It’s not fare how can middle class family maintain their sbi account, we are Closing our sbi account