The Central Government has recently notified draft rules of many aspects relating to the ‘Vehicle Scrapping Policy’. This article looks at the major features of the policy, the uncertainties surrounding it among other things.

Recently, the Ministry of Road Transport and Highways (MoRTH) introduced the ‘Voluntary Vehicle-Fleet Modernization Program’ or ‘Vehicle Scrapping Policy’ with the objective to create an eco-system for phasing out unfit and polluting vehicles. Through this policy, the government aims to cut down on the pollution caused by old and defective vehicles, bring down vehicular air pollution and work towards achieving India’s climate commitments, improve road and vehicular safety, and improve fuel efficiency. The draft policy which has been drafted after a comparative study of standards from various countries like Germany, the UK, USA, and Japan, has been notified in the public domain for comments and views for 30 days.

Old vehicles cause 10-12 times more pollution that the new ones

According to the estimates of MoRTH, there are over 51 lakh light motor vehicles (LMV) that are above 20 years of age, while another 34 lakh LMVs are above 15 years. Additionally, there are over 17 lakh medium and heavy motor vehicles, which are above 15 years, and running currently without valid fitness certificates. These vehicles are estimated to cause 10-12 times more pollution than the latest vehicles, according to MoRTH.

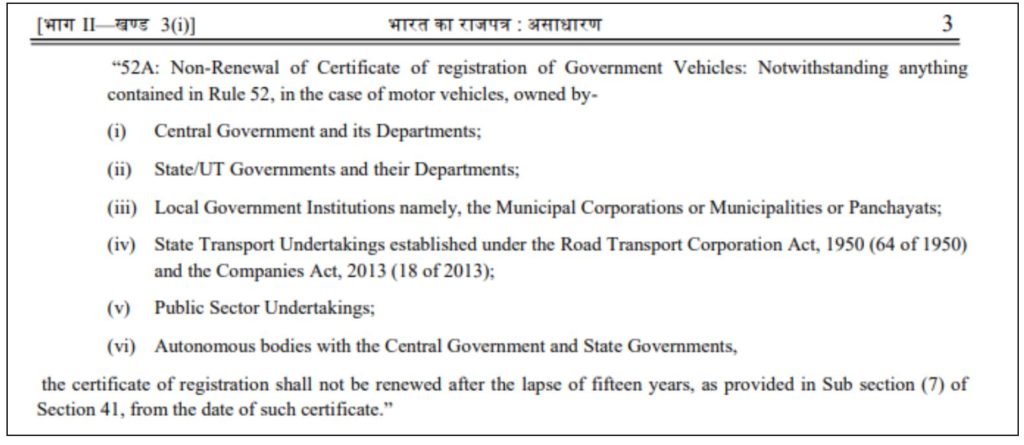

Government owned vehicles above 15 years old will be scrapped

The draft policy calls for the de-registration of commercial vehicles after 15 years if they do not get the fitness certificate. Similarly, private vehicles will be de-registered after 20 years upon failing to renew the registration certificate. In the case of government owned vehicles including PSUs, State Transport Undertakings, and autonomous bodies, all vehicles may be de-registered and scrapped after 15 years from the date of original registration. A vehicle failing the fitness test or failing to renew the registration certificate may be declared as ‘End of Life Vehicle’. The scrapping policy is not applicable to vintage cars.

Incentives and disincentives announced to promote scrapping of old vehicles

The government aims to check the number of old vehicles on roads through incentives and disincentives. It has proposed increased prices for new fitness tests, issuance of fitness certificates, and re-registrations to dissuade the usage of old vehicles. Even the cost of re-registering an old vehicle is proposed to be increased. As per a draft notification issued recently, the cost of registration & renewal of registration of all vehicles has been proposed to be hiked by up to 20 times, based on the type of vehicle, with effect from October 2021. Even the cost of conducting the fitness test of vehicles has been proposed to be increased from 2.5 to 4 times for manual and even more for automated vehicles. An additional cost for granting fitness certificates to vehicles older than 15 years has been proposed, ranging from Rs. 1000 for motorcycles to Rs.12,500 for heavy passenger/motor vehicles.

Cost of re-registration, fitness certificate issuance and test hiked manifold

For instance, the cost of re-registering a light motor vehicle (non-transport) currently is Rs. 200. In order to conduct the fitness test for renewal of the fitness certificate, the owner will have to pay Rs. 200 and for issuance of the fitness certificate, they will have to pay Rs. 100, and the expenses will come to a total of Rs. 500 approximately. If the proposed draft rules are implemented, the re-registration cost will be Rs. 5,000. To conduct the fitness test, it will cost between Rs.800 to Rs.1000. If the vehicle is older than 15 years & is a transport vehicle, the owner will have to pay Rs. 7,500 for issuance of fitness certificate. The total expense for the owner can go up to Rs. 13,500 if the draft rules are implemented without considering the additional charges which are applicable for delay in renewing these certificates after the expiry date.

Incentives like Road-tax rebate, waiver in registration fees to be offered

The incentives to be offered to vehicle owners for scrapping their old vehicles and procure new vehicles are the following.

- Scrap value for the old vehicle (approximately 4% to 6% of ex-showroom price of a new vehicle) will be provided by the registered scrapping centre. The scrapping centres shall also provide scrapping certificates to the vehicle owners.

- State governments may be advised to provide road-tax rebates of up to 25% for personal vehicles and up to 15% for commercial vehicles.

- Vehicle manufacturers may also provide a discount of 5% on submitting the scrapping certificate while purchasing a new vehicle. The registration fees may also be waived.

The policy implementation is to be done in a phased manner starting with the implementation of new rules from October 2021, scrapping of government vehicles from April 2022, and mandatory fitness tests from April 2023.

Draft rules for setting up of RVSF has also been notified

The Ministry has also notified draft rules for setting up Registered Vehicle Scrapping Facility (RVSF) and prescribes procedures for its authorization and functioning. Any legal entity is eligible to set up such a facility with a license that is valid for an initial period of 10 years and renewable for another 10 years. The processing fee for applications is Rs. 1 Lakh along with a bank guarantee of Rs. 10 Lakhs. These centres will be linked to NCRB and Police Database for verification of stolen vehicles and those involved in criminal activities. The Ministry also has plans to promote setting up of Automated Fitness Centres on a PPP model by the state government, private sector, automobile companies, etc.

The government is expecting to attract additional investments of around Rs. 10,000 Crore and 35,000 job opportunities through the implementation of the policy. Furthermore, the government expects that the policy will help formalize the informal vehicle scrapping industry and boost the availability of low-cost raw materials for the automotive, steel, and electronics industries, in addition to the environmental benefits. The policy will also help in reducing India’s dependency on imports and control the cost of materials, as per the government’s enumeration of the benefits of the policy.

Many uncertainties around the draft policy

According to a CSE report of September 2020, India will have over 2.18 crore vehicles nearing the end of their lives by 2025. The number of vehicles that need to be scrapped, the volume of non-biodegradable waste that will be generated, will be huge. The policy also encourages the purchase of new vehicles by providing incentives for the same when old vehicles are scrapped. However, the benefits for those not purchasing a new vehicle are low especially considering that COVID-19 has affected the economy and people’s ability to purchase new vehicles in the next few years. Also, with respect to the incentives mentioned, there is uncertainty involved since the onus to provide tax rebates is on the state governments. State governments will already be incurring a heavy price to replace their fleet of vehicles that are older than 15 years. Hence, expecting them to provide further benefits may not be practical. Furthermore, while people are being encouraged to buy new cars, energy consumption is high for producing cars which can offset the emission gains of the new technology, especially in a country like India where thermal energy (coal and other fossil fuels) is the primary source of electricity. Hence unless a detailed cost-benefit analysis is performed, the policies’ benefits may not considerably outweigh the costs involved.

CSE proposed measures for vehicle scrapping in its report in 2020

The CSE report calls for mandating ‘Extended Producer Responsibility (EPR)’ which holds manufacturers responsible for the safe disposal of the waste from their products and produce safe products for lifetime use. It also called for taking insights from European regulations on end-of-life which are more stringent as compared to Indian rules.

Germany has largest vehicle scrappage scheme

Among the major economies, Germany has the largest vehicle scrappage scheme which is being implemented starting in 2009. The scrappage premium of 2,500 Euros was given and cars older than 9 years are eligible for scrapping. Following this, the Germain retail industry faced considerable loss at beginning of 2009. The low demand resulted in discounts as high as 40% by car manufacturers. More people bought small, compact, and fuel-efficient vehicles under the scheme. However, new car registrations rose in the first half of 2009.

Featured Image: Vehicle Scrapping Policy