RBI has undertaken a periodic review of the regulatory procedures and instructions to make them more rationalized, streamlined and ease the burden of compliance. Recently, the report of the second such periodic review in the form of Regulations Review Authority 2.0 was released. Here is a review.

Regulatory governance forms an important part of the functioning of the Reserve Bank of India (RBI). The regulatory and enforcement mechanism of the RBI is mandated by various statutes. Accordingly, the regulated entities (REs) have a statutory obligation to ensure regulatory compliance, failure of which could potentially invite penal actions from the RBI. At the same time, the instructions and the mandate specified by the RBI should be clear, concise, and proportionate, for its effective adherence.

As technology evolves, the financial system undergoes transformations in its style of functioning. As a result, more and more regulatory advice and instructions are needed to ensure that these transformations do not result in adverse Outcomes. Because of this, there could be a possibility of having a multiplicity of instructions, and duplicates, thereby making compliance a burden. To avoid such issues, RBI has undertaken a periodic review of the regulatory procedures and instructions to make them more rationalized, and streamlined and ease the burden of compliance.

Today’s story looks at the report of the second such periodic review in the form of Regulations Review Authority 2.0 (RRA 2.0). Previously, Factly published a similar story on the RBI regulations and the performance of RBI in ensuring the compliance of regulatory instructions, which can be accessed here.

Need for RRA

As mentioned earlier, the scope and functions of the RBI under regulatory governance have evolved over the past few decades. To cope with the latest technological advancements in the financial systems, the RBI periodically comes up with master directions and instructions for the regulated entities. These instructions could well be revised in the future or made redundant completely, depending on future developments. As a result, a need emerges to rationalize these instructions and make them more streamlined, so that effective compliance is ensured.

Accordingly, the RBI had constituted RRA 1.0 in March 1999 as the first step in the process of regulatory review. The purpose of such review was to enable an opportunity for the common public to seek either removal or addition or modification of the existing circulars and instructions if they become either redundant or an alternative cost-effective and hassle-free solution is available. Initially set up for a period of one year, its term was extended by another year in 2000 to enable more participation.

Major recommendations of RRA 1.0

During the initial one year after the set-up of the RRA 1.0, it received more than 350 suggestions from 200 applications. One of the most important achievements that this RRA has enabled is to make RBI aware of the needs and requirements of its customers. Another significant accomplishment is initiating the work related to subject-specific master circulars by condensing a sizable number of circulars published over the years on a certain subject into a single circular. Additionally, individual banks were provided with the flexibility to levy service charges based on their service provisioning costs.

In addition to this, some of the recommendations which were accepted by the RBI are:

- Removed the demand for a succession certificate from the legal heirs, regardless of the value of the amount in the dead customer’s account.

- Evolved a procedure to use the RBI website to quickly disseminate information on foreign institutional investors (FII) investments in Indian enterprises.

- Enabled the permission to mutual funds to issue units to Foreign institutional investors.

- Eliminated the practice of testing freshly printed MICR instruments with samples in MICR check processing centres before using them.

Furthermore, a working group was set up to work on the modalities for the dissemination of information in electronic format, whose report can be accessed here. Overall, the RRA 1.0 enabled several processes to be streamlined and made more effective. Regulatory prescriptions were made simpler, reporting requirements for regulated businesses were decreased, and Master Circulars, which condense regulatory guidance on a subject-specific topic, were made possible.

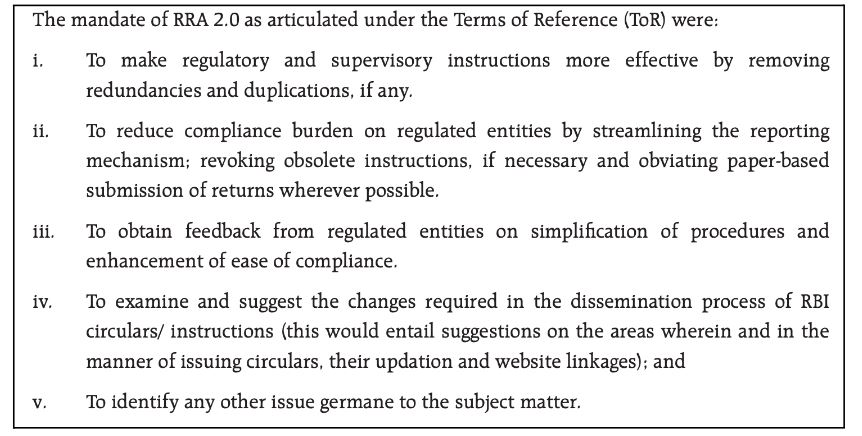

Regulations Review Authority 2.0

Considering the technological evolution in the financial sector landscape, RBI felt the necessity of another periodic review of the regulatory governance. Accordingly, RRA 2.0 was set up in April, 2021 its report was released in June 2022. While the RRA 1.0 focus was on streamlining and simplifying regulatory prescriptions, the focus of RRA 2.0 is to internally examine regulatory procedures and solicit input from the Regulated Entities (REs) and other stakeholders, to make it easier for the REs to comply with the law without altering the current regulatory landscape. The Terms of Reference (ToR) of the committee were as below:

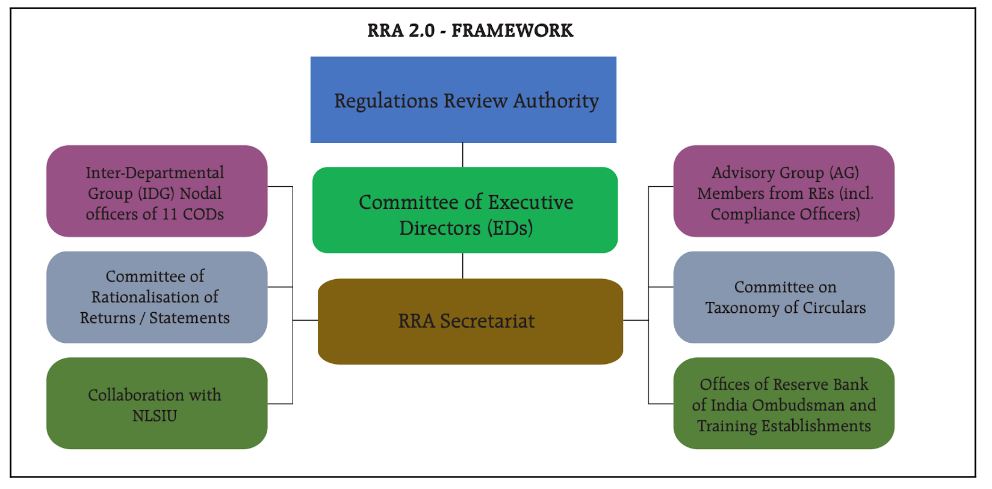

The RRA 2.0 had extensive consultations with stakeholders and had attempted a comprehensive exercise with the RRA. To enable this, the RRA constituted dedicated working groups on specific tasks. Each group had a different mandate, and they were entrusted with the responsibility to provide individual recommendations task-wise. Below is the framework of RRA 2.0.

The advisory group (AG) was entrusted with the task of engaging with all stakeholders, including the regulated entities. It held consultations with industry bodies and self-regulatory organisations. The Inter-Departmental Group (IDG) was mandated to internally review all the circulars, and instructions and identify redundancies, contradictions, and duplicates. Additionally, the RRA 2.0 also referred to the Reserve Bank of India Ombudsman (RBIO) and training establishments (TEs) for information on regulatory instructions. The committee on review of returns was asked to rationalize and streamline the reporting mechanism. The committee on circulars was instructed to guide the manner in which circulars should be issued to make them more effective and suggest changes in the information dissemination through circulars and instructions.

Recommendations of RRA 2.0

The report makes comprehensive recommendations covering a wide range of issues in the regulatory governance spectrum. Some of the broad recommendations are as below.

- Ease of compliance and reduction of regulatory burden: It is recommended that any kind of regulatory instruction should contain a brief note on its importance, and the underlying rationale behind such direction. This should be augmented with additional FAQs, illustrations, and guidelines, wherever essential. Additionally, the creation of a separate web page on the RBI website, ‘Regulatory Reporting’ is recommended for data source consolidation.

- Streamlining the reporting mechanism: Recommended elimination of more than 65 regulatory returns, and a necessity for periodic review at least once for every three years had been suggested. Moreover, it is advised to switch from the present prescription of reporting data every two weeks to a system of reporting data on the 15th and final working day of every month instead.

- Issuance of regulatory instructions: Recommended standardization of circulars, and uniform and consistent template for different types of regulatory instruments, supplemented with a standard appendix of certain terms and descriptions. Timebound review of master circulars must be undertaken to transform them into master directions, and prior public consultation for important regulatory changes without compromising on preserving financial stability is advised.

- Dissemination and ease of accessibility of regulatory instructions: It is recommended that the RBI website is updated on a real-time basis and make the interface the website to be more interactive and convenient.

In addition to these broad recommendations, each advisory group had its own specific suggestions, a few important of them are mentioned below.

Recommendations on Review of Returns

- Elimination of paper-based returns in a time-bound manner in the future.

- Returns Governance Group (RGG) should ascertain the non-duplication of new returns or modifications to existing returns. RGG approval is mandatory for the conversion of any ad-hoc return into a permanent feature.

- To increase data integrity, REs may be given access to all the Reserve Bank’s data validation standards.

Recommendations on review of circulars

- Master Directions/Master Circulars may contain four sections: Part A with necessary directions, Part B with advisory information, Part C with FAQs, and Part D with explanations of relevant examples.

- The regulatory departments may look at creating a regulatory handbook or handbooks with regulations applicable to a group of REs or on a specific topic. The REs could use this as a quick reference manual. A capsule material for complex regulations can be prepared.

- Usage of ambiguous words like ‘generally’, ‘typically’, ‘ordinarily’ must be minimized.

Recommendations on the dissemination of instructions

- RBI website must be made more robust by enabling a flexible search functionality, using different filters like keywords, date, and subject.

- The landing page for an instruction on the website must include the necessary interlinkages with the related content. When an instruction is repealed, updated, or modified, it must be assured that all pertinent content is also updated at the same time.

Way forward

The aim of any RRA is to make the regulations simple, clear, and more streamlined. It should result in ensuring more compliance by reducing the burden on the reporting entities. Throughout the exercise, the RRA felt some additional improvements are needed to make regulatory governance more effective and consultative. The RRA asserts that there is a further need to enable skill development for regulatory drafting and provide continuous training and orientation to the officers. Additionally, the RRA desires that a structured mechanism is put in place to take periodic reviews of the supervisory and regulatory instruments to keep pace with the advancements in the financial sector landscape. Finally, the RRA is hopeful that individual departments take ownership and be proactive in weeding out the redundant instructions and if possible, engage personnel to oversee this process. The outcomes of this RRA must be sustained and this process is institutionalized for the future as well with more regular reviews.