The RBI recently published an article State finances and the Risk Analysis. The article aims to look at the fiscal vulnerability of Indian States & emphasises on ten heavily debt-burdened states in India based on the debt-GSDP ratio in 2020-21. These ten states also account for around half of the total expenditure by all state governments in India. Here is a review.

Effective and efficient public finance management is said to be a harbinger of good governance. In the wake of the scarcity of resources and the demand-supply mismatches, having a proper public financial management system becomes paramount. A sound public finance management system aids in delivering social and economic development goals. Having a proper flow and scheme for resource generation, allocation of the resources in an optimal manner, and utilizing these resources in an efficient and effective manner form the backbone of good public finance management.

It is therefore important to timely scrutinize and evaluate the state finances and identify the inherent risks in the system. Analysing the risks and chalking out strategies to minimize and mitigate them should be of primary concern to both, states as well as the Union Government. Considering the crisis in our neighbouring country Sri Lanka, this has assumed greater importance. In this regard, we look at the article on State finances and the Risk Analysis published by the Reserve Bank of India (RBI) and note the important observation. The article aims to look at the fiscal vulnerability of Indian States. The article emphasises on ten heavily debt-burdened states in India based on the debt-GSDP ratio in 2020-21. These ten states also account for around half of the total expenditure by all state governments in India.

The major motivation for undertaking such kind of assessment is the unfolding of the crisis in Sri Lanka and the COVID-19 pandemic. Apart from these two, the enactment of different kinds of public policies in terms of cash subsidies, provision of free utility services and so on, call for effective scrutiny of states’ financial health.

Central transfers are the saviours

The selected ten states comprise half of the total expenditure by all states and union territories, and also half of the total revenue receipts (including tax devolution, central transfers like grants-in-aid, etc.) For eight out of these ten states, the central transfers account for nearly half of the states’ total revenue receipts. The rest of the revenue is dominated by States’ GST, excise duties and sales taxes.

It is also reported that the state’s own tax revenues (SOTR) for states like Madhya Pradesh, Kerala and Punjab have been declining considerably, thereby increasing the fiscal vulnerability of these states. The major drawback of such a decline in own revenues for the state is the negative effect on the expenditure and planning for the states.

State GST and sales tax are major sources of SOTR

Among the revenue generation, state GST and sales tax form a major chunk of the total tax revenues generated by these states on their own. This is followed by Stamps and Registration fees, taxes on vehicles and excise tax. Uttar Pradesh’s SGST collections are the highest among these ten states, while Punjab and Rajasthan dominate in the taxes and duties on electricity. The stamps and registration fee component are higher in states like Uttar Pradesh, Andhra Pradesh, Haryana, and West Bengal. For Andhra Pradesh, the revenue generation from state excise grew from Rs. 5,460 Crores in 2017-18 to Rs. 11,575 Crores in 2020-21. Whether this increase is due to an increase in volume or an increase in alcohol charges is not clear, given the fact that the government is looking to minimize consumption. Almost all of these ten states witnessed a decline in sales tax from 2017-18 to 2020-21, (because of the introduction of GST) which is compensated by an increase in SGST, and state excise. The cumulative state-owned total revenue (SOTR) has been declining for states like Kerala, West Bengal, and to some extent Haryana. This declining own tax revenues, coupled with volatile non-tax revenues could make the states more financially vulnerable to crises and shocks.

High on Revenue expenditure, low on Capital outlay

The expenditure trend of these states indicates the huge spending on revenue expenditure leaving minimal fiscal space for capital expenditure. The higher revenue expenditure to capital outlay ratio validates this. While there is no ideal limit of revenue expenditure, it is to be kept in mind that the impact of revenue expenditure lasts shorter than the impact of the capital expenditure. Higher revenue expenditure, with low capital outlay, could result in lower growth and higher interest for the future.

Borrowing requirements and debts

The debt-GSDP ratio of these ten states indicates the high debt burden on them, making them stressed. Among them, Bihar, Kerala, Punjab, Rajasthan, and West Bengal are highly stressed. Additionally, the interests’ payments to revenue receipts ratio is more than 10 percent for eight out of these ten states. The debt-GSDP ratio is estimated for 2026-27 using the base case scenario. It is found that many states exceed their target of 30 percent by 2026-27, with Punjab being the worst at 45 percent, followed by Rajasthan, West Bengal, and Kerala at more than 35 percent. Only two among these ten states – Bihar, and Uttar Pradesh showed a decline in their debt-GSDP ratio in 2026-27 as compared to 2021-22.

The average gross borrowing requirement as a percentage of GSDP for four states is higher than five percent, with Punjab being at the top at 9.60 percent, followed by Andhra Pradesh at 6.1 percent, West Bengal at 6.0 percent, Haryana at 5.3 percent, and Kerala at 5.1 percent.

Growing Freebies by the states

Lately, there is a growing tendency towards the adoption of free or subsidized schemes ostensibly to gain the mandate of the people. However, states must be careful while announcing the freebies or any cross-subsidies. Only states that have the fiscal space to allocate expenditure for these schemes without any impact on the overall financial health of the states would be able to bear the effects in the long term.

Even if there is no clear definition for what they exactly are, freebies must be distinguished from public/merit goods, which are expenses that result in economic advantages, such as the public distribution system, employment guarantee programs, and state assistance for health and education. Freebies have the potential to undermine the credit culture, disincentivizes work culture and private investments through market distortions. While not all freebies are bad, a fine balance must be achieved in terms of financial costs involved and the overarching goals.

The share of subsidies in total revenue expenditure has increased from 7.8 percent to 8.2 percent during 2019-20 and 2021-22 for 19 states. Huge asymmetry between the states can be observed in the share of subsidies, with states like Punjab, Rajasthan, and Chhattisgarh spending more than 10 percent of their total revenue expenditure. States like Kerala, Odisha, Jharkhand, Uttar Pradesh, and Telangana have seen a huge increase in expenditure on subsidies in the last three years.

DISCOMs Bailouts

As seen in the earlier section, cross-subsidies and freebies significantly impact the financial health of the state. Among the cross-subsidies, power sector subsidies account for much of the financial burden on the state governments. Electricity for farm sectors is heavily subsidized in many states, and state governments provide subsidies by depressing the costs. To help electricity distribution firms (DISCOMs) make profitable projects, state governments also inject funds into them through stock and loans. Additionally, recurring bailouts, when governments assume the DISCOMs’ losses or debt burdens, have a significant impact on state budgets (3 DISCOM bailouts in the previous 20 years).

The performance of the DISCOMs has remained poor despite several financial restructuring initiatives, with their losses exceeding the pre-UDAY level of 0.4% of GDP in 2018–19. Their long-term debt also began to rise starting in 2017–18, reaching the pre–UDAY level by 2018–19, and continuing to rise in 2019–20. Additionally, since March 2018, the amount of money that DISCOMs owe power companies (GENCOs) has increased which may require fresh liquidity injections to ensure an uninterrupted power supply.

In 2019–20, the combined losses of the five states with the highest levels of debt—Bihar, Kerala, Punjab, Rajasthan, and West Bengal—accounted for 24.7 percent of all DISCOM losses, while their combined long-term debt was 22.9 percent of all DISCOM debt. Despite substantial variations across states, the cost of the bailout will be 2.3% of the GSDP for the 18 largest states. The states most in danger from a potential bailout are Tamil Nadu, Madhya Pradesh, Rajasthan, and Punjab, while Gujarat, Assam, Haryana, and Odisha are comparatively at lower risk.

Observations of the 15th Finance Commission on these states

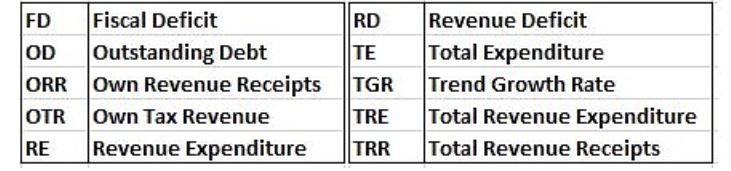

Finance Commission studies each State’s economy. The studies concentrated on the states’ tax-gathering capacities, actions made to increase them, a study of their own non-tax revenues, examinations of their spending habits, and analyses of their deficits, financing methods, and debt. These studies focused on the States’ performance on several metrics, including their efforts to consolidate their budgets, their potential to mobilize additional resources, their performance as public sector enterprises, and their performance in the power sector, among other topics covered in the Terms of Reference (ToR). Some of the abbreviations used in the observations are:

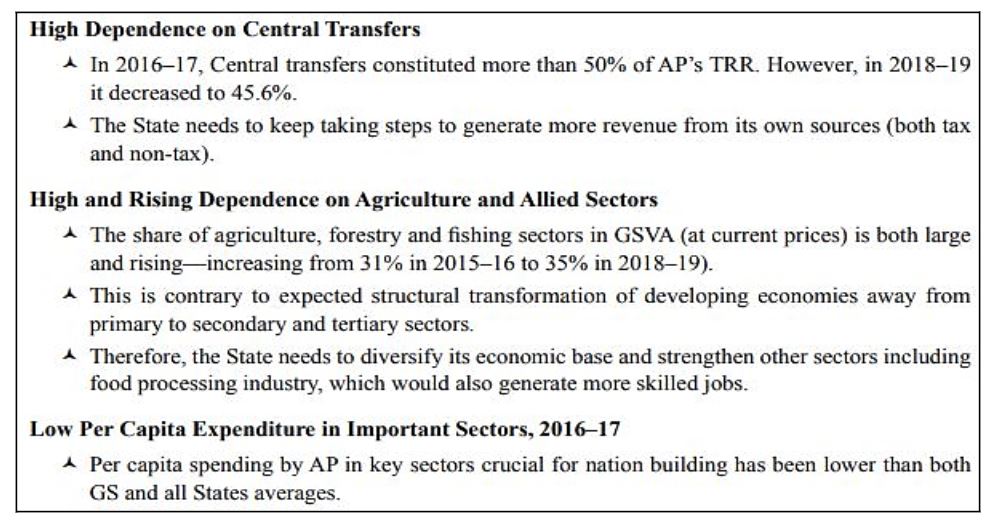

Andhra Pradesh

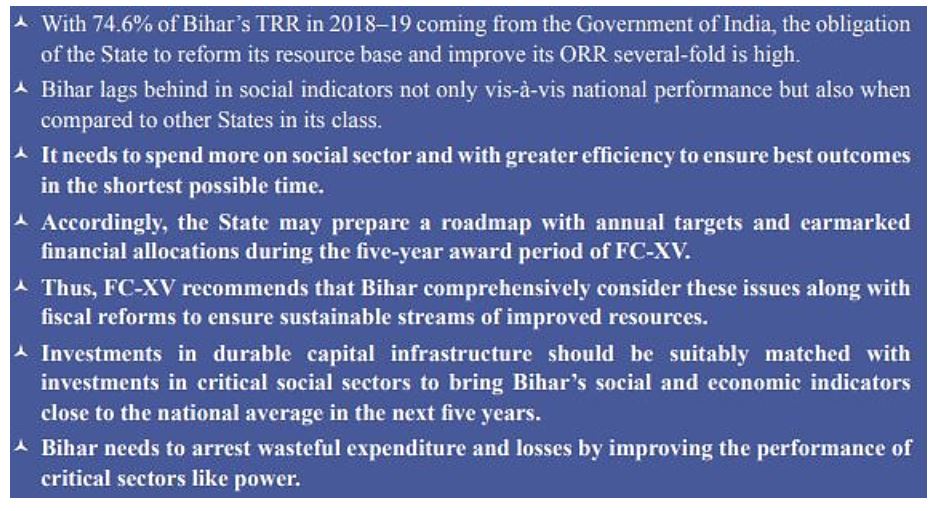

Bihar

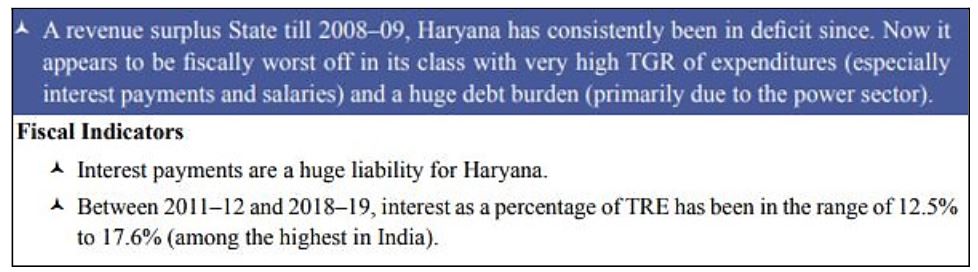

Haryana

Jharkhand

Kerala

Madhya Pradesh

Punjab

Rajasthan

Uttar Pradesh

West Bengal

The alarming fiscal indicators provide for an immediate course correction. It is imperative for these states to take measures in that regard.

Featured Image: State finances and the Risk Analysis