NITI Aayog along with TIFAC recently released a report, ‘Forecasting Penetration of Electric Two-Wheelers in India’. The report estimates future electric two-wheeler penetration in India under various constraints & conditions. A tool was jointly developed by TIFAC and NITI Aayog, to analyse the future penetration of electric two-wheelers in the country across eight separate scenarios. Here is a review.

Countries around the world are encouraging a shift to electric vehicles through incentives and policies. In the last two decades, there have been considerable technological advancements in the case of electric vehicles which have helped improve their utility, reduce costs, and lower GHG emissions from the transport sector, thereby increasing the demand for electric mobility. Likewise, India is also pushing for a shift towards electric mobility to control carbon emissions and reduce the huge imports of petroleum. A national target of achieving 30% electric vehicle sales penetration by 2030 has been set by India. To achieve this, various measures such as boosting localization of EV component manufacturing, subsidies, incentives, are some central level interventions. Several states have also come up with their own policies covering subsidies and tax exemptions, among other incentives, for buyers of electric vehicles.

NITI Aayog and TIFAC released a report to forecast electric two-wheeler penetration in India

Two-wheelers dominate the Indian road transport sector, including the electric vehicles segment. According to the Vahan dashboard, a total of 5.05 lakh electric 2-wheelers have been registered in the country so far. Furthermore, the technology for electric two-wheelers has now reached a critical stage of development, and several manufacturers have launched marketable models. Considering this, Technology Information Forecasting and Assessment Council (TIFAC) and NITI Aayog came up with a bottom-up estimate of the annual growth of the use of electric two-wheelers which provides crucial information about the necessary infrastructure, manufacturing capacity, policy initiatives, and technological development objectives. The report, Forecasting Penetration of Electric Two-Wheelers In India was released recently.

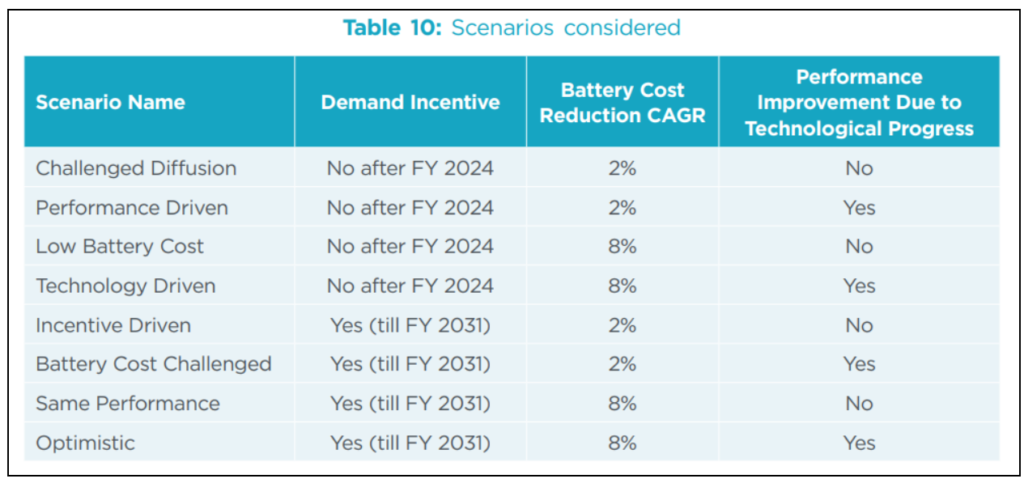

A tool was jointly developed by TIFAC and NITI Aayog, to analyse the future penetration of electric two-wheelers in the country across eight separate scenarios. The scenarios have been constructed based on three major factors influencing the market penetration of electric two-wheelers- demand incentives, battery cost, and vehicle performance in terms of range and power. Each factor has been analysed further at two different levels. Additionally, four constraint levels were developed depending on vehicle production capacity and charging infrastructure. Full constraint means both production capacity and charging infrastructure are constraints.

Shift to electric mobility in the 2-wheeler segment can be faster than anticipated

According to the report, the shift to electric mobility, particularly in the two-wheeler segment, may happen faster than anticipated. The analysis observed that 100% market penetration could be obtained in a scenario with full constraints with the base level of production capacity and charging infrastructure. However, it called for an increase in production capacity, or else, the sales of electric two-wheelers would be constrained by supply, thereby leading to a decline in their relative market share. Furthermore, a combination of technological improvement and incentives are required to achieve 100% penetration in the full constraint scenarios. A maximum penetration, which is 71.5% in the technology-driven scenario, can be achieved with the demand incentives removed after the financial year 2024. Even if incentives are maintained through the financial year 2031, only a penetration level of 21.9% can be achieved in the absence of technological advancement and a decline in battery costs.

The demand for different scenarios has been discussed below.

- In a ‘Challenged Diffusion Scenario’, where the incentive is withdrawn from the financial year 2024, batter cost reduction is 2%, and there is no technological progress, there can only be a maximum market penetration of 5.82% by the financial year 2024. This may further decline to 3.1% in the financial year 2031. The sales are expected to be around 9.85 lakh units and 7.80 lakh units in financial years 2024 and 2031, respectively in full constraints condition.

- Under the ‘Performance-Driven Scenario’, the demand incentive is withdrawn after the financial year 2024, the battery cost reduction annually is at 2% and the only positive influence is improvement in the range and power of the electric two-wheelers by 5% annually during the financial years 2024 to 2027. It is projected that the sales would be 12.7 Lakh units in the financial year 2024, which will go up to 17.87 Lakh units by the financial year 2031 under full constraints. The market penetration level is expected to reach 7.5% in the financial year 2024. Then, a decline is anticipated following the withdrawal of subsidies. Yet, the penetration is expected to grow again and reach 7.12% by the financial year 2031, higher than in the previous scenario.

- The penetration levels are projected to be higher in the ‘Low Battery Cost Scenario’ where the battery cost is assumed to reduce annually at a rate of 8%. Nonetheless, a slump is projected after the financial year 2024 and the penetration levels do not increase by enhancing the production level or charging infrastructure. The sales volume of electric two-wheelers reaches a maximum of 15.33 lakh units in the financial year 2024 and subsequently at 27.62 lakh units in the financial year 2031 under full constraints.

- In the ‘technology-driven scenario’, where incentives are withdrawn post financial year 2024 and the battery cost is reduced by 8% annually, the performance of electric two-wheelers is expected to improve by 5% between financial years 2024-2026 and by 10% in the financial year 2027 because of technological progress, the sales volume is projected to reach 21.02 Lakh by the financial year 2024 and 179.7 lakhs by the financial year 2031 under full constraints.

- ‘Incentive Driven Scenario’ is when the demand incentive is assumed to continue till the financial year 2031. The maximum level of penetration of electric two-wheelers that can be achieved is about 22% in this case with full constraints. The sales are projected to be around 54.9 lakhs in the financial year 2031.

- Under the ‘Battery Cost Challenged Scenario’, ‘the cost of the battery is the only major obstacle to the larger penetration of electric mobility. It is assumed to reduce at an annual rate of 2% only. Here, the projected market penetration of electric two-wheelers in the base level of production is expected to reach a maximum value in the financial year 2029 when the number of electric two-wheelers sold equals the number of electric two-wheelers produced. After this, since sales cannot increase further, the share of electric two-wheelers in the market will drop, unless production is increased.

- As per the ‘Same Performance Scenario’, the demand incentive is expected to continue while battery cost reduces by 8% annually. In this situation, it is estimated that the penetration would reach 98.1% in the financial year 2029, when the number of electric two-wheelers sold equals the installed production capacity in the base production level following which their overall share in the market will drop to 87.6% in the financial year 2031. However, if the supply of vehicles is increased, the penetration can reach 100%.

- Under the ‘Optimistic scenario’ wherein all the conditions favour the adoption of electric vehicles like the continuation of demand incentive and an annual reduction in battery cost by 8%, the penetration of electric two-wheelers can reach 100% in the financial year 2028 even in full constraints. Increased production would then be required to maintain 100% penetration. The projected sales of two-wheelers can go up to 220 to 251 lakhs or 2.2 to 2.5 crores under different levels of constraints.

Domestic manufacturing of components should be enhanced alongside policy intervention

The report suggests that the performance of vehicles and improved battery technology can help increase penetration even compensating for the impact of financial incentive withdrawal. Though demand incentives are necessary to increase the penetration level of electric two-wheelers, the larger issue of manufacturing costs remains, which is mainly influenced by the battery cost. The cost can be reduced significantly if the domestic manufacturing of components picks up alongside relevant policy interventions. Sustained high prices of petrol, and a ‘positive mindset’ about electric vehicles also influence the shift to electric vehicles. However, the recent incidents in which electric scooters caught fire have the potential to sow seeds of doubt. As per recent reports, the government set up a panel to suggest certification, testing SOPs for batteries

Additionally, a higher ratio of charging points to electric vehicles is necessary for the initial stages to bring about confidence in people. Even in Europe, charging points is a concern. According to WEF, 10 countries in Europe including Greece, Poland, Romania and Latvia, do not have one charger for every 100km of key road and a total of 18 EU members have under five charging points per 100km of road.

The International Energy Agency also suggests that governments should not abruptly change the incentive structures in place. Instead, the incentives and subsidies must transition to more targeted and financially sustainable tools. Further, it suggested that governments clearly lay down policy frameworks and foster international collaboration to tackle the strains on the material supply chain when the battery industry expands.

Featured Image: Penetration of Electric Two-Wheelers in India