The National Statistics Office (NSO) conducted its first-ever survey on private sector CAPEX intentions between November 2024 and January 2025. The survey found that 29% of enterprises did not provide information on their planned CAPEX for 2025-26. Among those who did respond, 43.2% said they did not intend to make any capital investments that year, essentially projecting zero CAPEX.

It’s not a term that sparks much emotion. It sounds dry, technical & even boring. It’s not the headline-grabbing kind of spending. It doesn’t offer instant political rewards. But Capital Expenditure (CAPEX) is where real transformation begins. It’s what builds the skeleton of a growing nation, the things that make everything else possible.

Unlike day-to-day spending, which keeps the engine running, CAPEX builds the engine itself. And yet, for all its importance, CAPEX often escapes public attention. We see the end results but rarely think about the planning and resources behind them. This is why comprehensive data on capital expenditure matters.

The National Statistics Office (NSO) conducted its first-ever survey on private sector CAPEX intentions between November 2024 and January 2025. In this story, we look at the key aspects, such as survey coverage, sampling methodology, data collection process and findings of the survey.

Genesis of the survey

In 2022-23, the Parliamentary Standing Committee on Finance recommended that the Ministry of Statistics and Programme Implementation (MoSPI) develop a clear and structured approach to collect capital expenditure (CAPEX) data from the private sector. The aim was to better understand how private enterprises are investing in long-term assets that contribute to economic growth.

In response, MoSPI, in consultation with the Department of Economic Affairs (DEA), Ministry of Finance, designed survey instruments to capture details on past investments, expected CAPEX over the next two years, and the distribution of investments by asset type.

Acting on this recommendation, the National Statistical Office (NSO) conducted the first-ever Forward-Looking Survey on Private Sector CAPEX Investment Intentions between November 2024 and January 2025. This marked MoSPI’s initial effort to engage with the corporate sector through a self-administered, web-based platform, supported by chatbot assistance to guide participants through the process.

The survey covers capital expenditure trends over the last three financial years (2021-22, 2022-23, and 2023-24), as well as expected investments for 2024-25 and 2025-26.

Survey Methodology

The survey focused on large private companies with significant industry presence, selected from the Ministry of Corporate Affairs (MCA) database based on their turnover in any of the last three financial years. The thresholds were ₹400 crores for manufacturing, ₹300 crores for trade, and ₹100 crores for other sectors. A total of 16,025 eligible companies were identified.

These were grouped into 17 business categories. Categories with 100 or fewer firms included all units. For larger categories, companies were split into two groups:

- Census Sector: Firms with the highest asset values, covering 90% (or 80% for Construction and Trade) of total assets.

- Sample Sector: A 10% random selection from the rest.

Altogether, the survey covered 5,380 enterprises, with 4,145 firms in the Census Sector and 1,235 in the Sample Sector. The survey was conducted under the Collection of Statistics Act, 2008. Companies were informed in advance and assured of data confidentiality.

Before we look at the findings, a quick note of caution: only 58.3% of companies responded. Some didn’t share future plans. The survey mostly excludes SPVs and covers only large firms. As this is the first edition, the results are indicative and reflect trends among larger firms, and subsequent rounds may bring a clearer, more complete picture.

Average CAPEX estimated to be approximately 5 lakh Crore in 2025-26

The survey examined capital investment trends among large private sector firms over a five-year period covering actual spending from 2021-22 to 2023-24, and projected investments for 2024-25 and 2025-26. In 2021-22, the average CAPEX stood at ₹3.94 lakh crore. This rose sharply to ₹5.72 lakh crore in 2022-23, reflecting strong investment sentiment. However, 2023-24 saw a decline, with average CAPEX falling to ₹4.2 lakh crore.

The outlook for 2024-25 is notably positive, with firms expecting to spend a record ₹6.6 lakh crore. This upward momentum, however, is likely to moderate in 2025-26, with estimated CAPEX dropping to ₹4.9 lakh crore. Overall, capital investment is projected to grow by 23.9% over the five-year reference period.

The average Gross fixed asset (GFA) per enterprise in the private corporate sector was estimated to be ₹3,151.9 crore in 2021-22. Average GFA per enterprise grew by 4.0% to reach ₹3,279.4 crore in 2022-23 and thereafter by 27.6% to reach ₹4,183.3 crore in 2023-24, suggesting a growth in long-term productive assets. These trends suggest a fluctuating but forward-looking investment climate.

Half of the total projected CAPEX in 2024-25 is for ‘income generation’

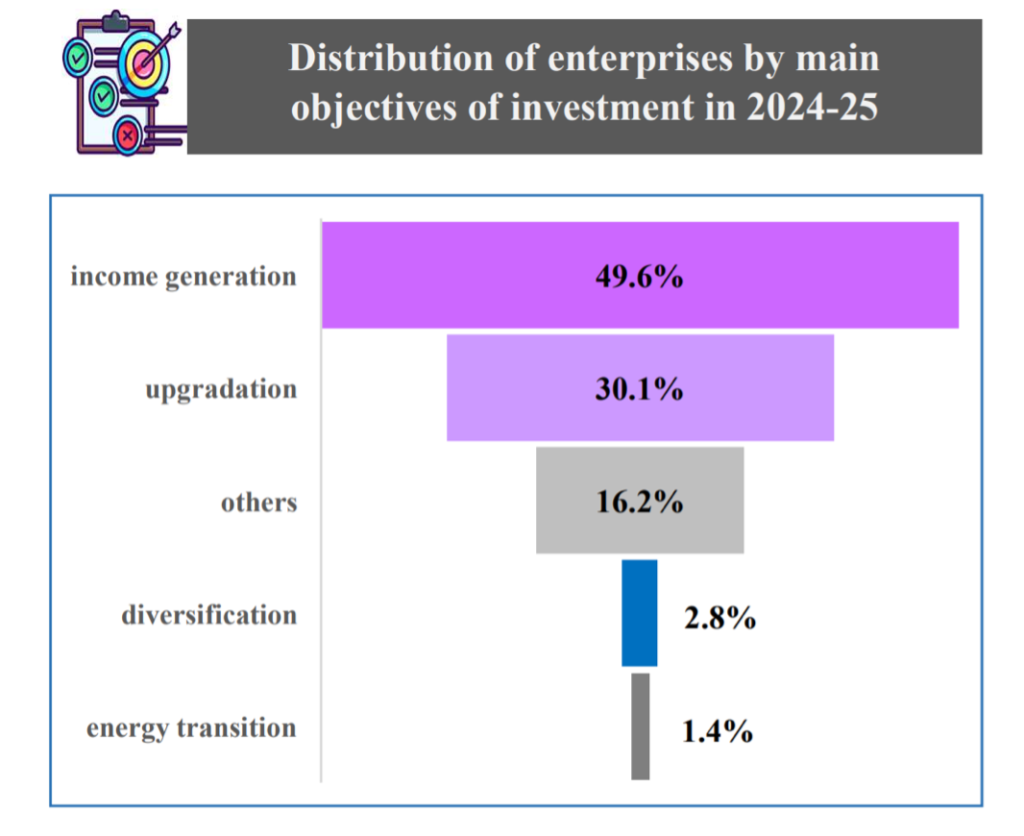

Enterprises have the flexibility to decide how they want to use their capital investments, and the survey offers insights into their priorities for 2024-25. Nearly half of the firms reported that their main goal for CAPEX was income generation. Around 30% aimed at upgrading existing assets, while 16% cited other reasons. A smaller share of enterprises said they were investing in diversification (3%) or transitioning to cleaner energy (1.4%).

From a sectoral perspective, Manufacturing is expected to dominate capital investment in 2024-25, accounting for more than 40% of projected CAPEX. This is followed by Information and Communication activities at 15.6% and Transportation and Storage at 14%. When it comes to the type of assets being funded, Machinery and Equipment top the list, making up 53.1% of proposed CAPEX. This is followed by ‘capital works in progress’ at 22%, investments in buildings and structures at 9.7% and intangible assets like intellectual property at 5.8%.

The survey also shows how investment per enterprise has shifted over time. On average, capital expenditure rose from ₹109.3 crore in 2021-22 to ₹148.8 crore in 2022-23. It then dipped slightly to ₹107.6 crore in 2023-24. For 2024-25, however, firms estimate a notable rise, with provisional CAPEX per enterprise expected to reach ₹172.2 crore.

More than 40% of enterprises have not reported CAPEX for 2025-26

The survey found that 29% of enterprises did not provide information on their planned CAPEX for 2025-26. Among those who did respond, 43.2% said they did not intend to make any capital investments that year, essentially projecting zero CAPEX. The rest of the non-respondents were expected to invest, but did not share the figures yet.

Among the firms that did report, the outlook was varied. About 20.2% planned to keep their CAPEX unchanged from 2024-25, while 32.5% expected to increase it, suggesting plans for growth or expansion. In contrast, 4.1% indicated they would reduce spending.

When viewed by economic activity, two-thirds of the enterprises in sectors like ‘Mining’, ‘Construction’, and ‘utilities (electricity, gas, steam, and air conditioning)’ reported Zero CAPEX for 2025–26. Meanwhile, sectors like ‘Education’ and ‘Human Health and Social Work’ had the fewest number of enterprises reporting zero CAPEX. Interestingly, the highest share of enterprises planning to reduce CAPEX also came from the ‘Human Health and Social work’, followed by ‘Administrative and Support Services’.