[orc]A total of 18 insurance companies are empanelled to implement the PMFBY. Of these, 5 are public sector companies and the rest are private companies. How do the public & private companies compare with respect to premium, claim settlement ?

In the previous story on Pradhan Mantri Fasal Bima Yojana (PMFBY), we looked at in detail, the number of farmers enrolling under the scheme and their variation with seasons. The numbers related to claims were also looked into. In this story, we look at the insurance companies, claim settlements made by them and if there is any difference between claim settlements by private and public sector insurance companies.

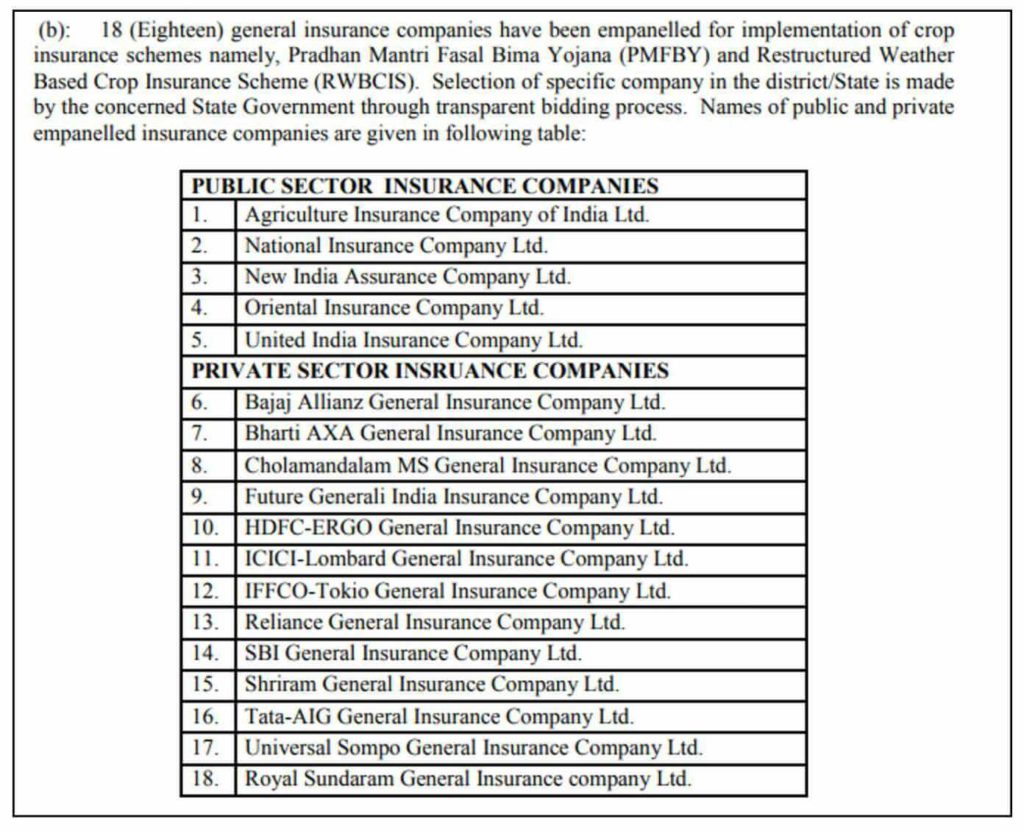

Five public general insurance companies and eight private general insurance companies have been empanelled under PMFBY

A total of 18 general insurance companies have been empanelled for implementing the scheme in the states which have opted to be a part of PMFBY. Of the 18 companies, 5 are public sector insurance companies while the remaining 13 are private companies. As per the scheme guidelines, it is the responsibility of the state government to find insurance companies in their state for implementation of the scheme. The state governments invite tenders from both public and private companies to implement PMFBY. The selection of companies is done based on the lowest bidder.

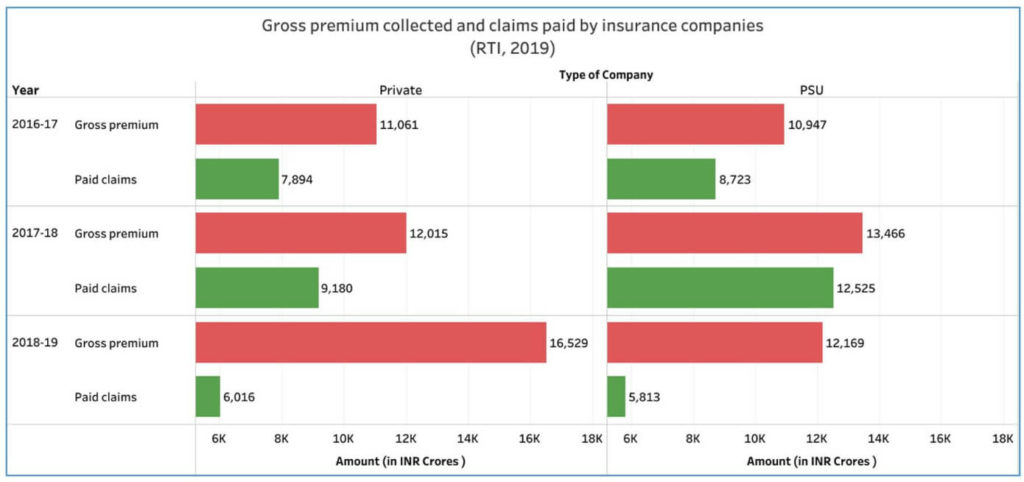

Public companies paid claims worth 93% of gross premium while private companies paid only 76% in 2017-18

In 2016-17, a total of Rs. 22,010 crores gross premium was paid to the insurance companies. Premium collected by private and public sector insurance companies was more or less similar in 2016-17 with private companies collecting a premium of Rs. 114 crores more than public sector ones. In the same year, the total claims paid amounted to 75.5% of gross premium. While private companies paid claims worth 71.4% of the premium, the public sector companies paid 80% of the gross premium. In the subsequent year, 2017-18, it was observed that Rs. 25,481 crores were the total gross premium collected. Private companies accounted for 47% of the gross premium and the remaining 53% was with the public companies.

In 2017-18, the private companies paid claims amounting to 76% of gross premium collected whereas the public companies paid claims worth 93% of the gross premium resulting in a total of 85% claims compared to the premium amount. Data for 2018-19 shows that 57.6% of the total gross premium collected was with the private companies as compared to 42.4% with their public counterparts. The claims paid in 2018-19 amounted to 41.2% of premium in total. Private companies in 2018-19 paid claims which is 36.4% of gross premium paid while the public companies have paid claims equal to 47.8% of the gross premium. Since the data for 2018-19 is still provisions, these numbers are on the lower side.

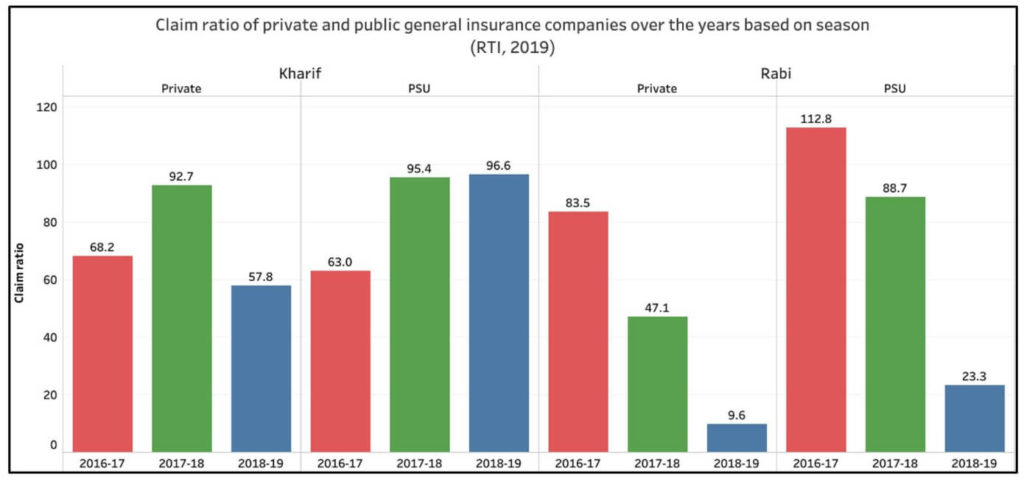

Claim ratio is greater for public companies as compared to private general insurance companies

In this context, claim ratio refers the percentage of estimated claim against gross premium. Claim ratio was observed to be greater for public insurance companies than that for the private insurance companies. It is also evident from the chart that claim ratio is greater for Rabi crops. The data for Rabi 2018-19 is provisional.

Claim ratio was found out to be the highest in 2016-17 for New India Assurance which is a public insurance company when it touched 259%. This was followed by TATA AIG General Insurance, a private insurance company, whose claim ratio was as high as 119%. Not far behind, Universal Sompo General Insurance was next in line with a claim ratio of 117%. In the following year, 2017-18, six insurance companies had a claim ratio of above 100%. These include three public companies- Agriculture Insurance Company, Oriental Insurance and National Insurance, and three private companies- ICICI Lombard General Insurance, IFFCO Tokio General Insurance and TATA AIG General Insurance. But in general, as noted in the chart above, the claim ratio for public companies is generally higher than the private companies.

Agriculture Insurance Company of India has the largest share in gross premium collected

In the year 2016-17, 87% of the premium was with only 7 insurance companies which include 2 public companies. In 2017-18, 89% of the premium was with 9 companies which also include four public companies except Oriental Insurance. In 2018-19, 94% of the premium was with 13 companies. Every year, Agriculture Insurance Company (AIC), a public sector insurance company, which covers the largest number of farmers in the world has been at the top with the maximum premium even though an annual decline in the premium amount is witnessed. In 2016-17, AIC’s share amounted to 42% of the total premium. In the consecutive years, this fell to 31% in 2017-18 and 26% in 2018-19. Similar is the case with other public insurance companies except Oriental Insurance. A general declining trend in premium share is observed between 2017-18 and 2018-19 for public companies.

Number of private insurance companies which have more than Rs. 1500 crore collected as premium is increasing every year

Among the private companies, ICICI Lombard General Insurance has consistently had premium above Rs. 2000 crores in each of the years from 2016-17 to 2018-19. (highest in 2017-18 and 2018-19 among private companies). Though the total amount of premium has increased annually, the share of premium for ICICI Lombard among all private companies has decreased from 21% in 2016-17 to 16% in 2018-19. This is because every year, more and more private insurance companies are crossing the Rs. 1500 crores mark in terms of premium collected. While only 2 companies had crossed the Rs. 1500 crore mark in 2016-17, in the subsequent year, 2017-18, 3 companies had crossed the mark. In 2018-19, a total of 7 private companies and 2 public companies have crossed the mark. HDFC Ergo General Insurance, Reliance General Insurance and Bajaj Allianz General Insurance are three other private companies who have managed to get premium above Rs. 1000 crores in each of the three years.

Government of India targets to cover at least 50% Gross Cropped Area under PMFBY

The government has set a target to cover a minimum of 50% of Gross Cropped Area under PMFBY. Various measures such as spreading awareness, providing aid to states to encourage them to adopt the scheme and reducing the premium rate for farmers have also been taken in order to attain the target.

Inadequate payments, delay in payment, unrealistic crop damage assessment, discrepancy in crop yield data are some of the shortcomings identified in the implementation. Meanwhile, as of 30 June 2019, 102 court cases have been filed by farmers and farmer organisations against insurance companies and governments for varied reasons including claim settlement.

The erratic weather conditions are only increasing by the day, impacting crop yields. Hence, it is necessary that the government addresses the issues faced by the farmers and resolve them immediately and ensure effective implementation of the scheme.

Featured Image: Implementation of PMFBY

1 Comment

Pingback: Part-3: Public & Private Insurance Companies in the implementation of PMFBY - Fact Checking Tools | Factbase.us