[orc]The government informed the Lok Sabha that it has decided to write off 21.5 lakh cases of IT arrears with average arrear amount of Rs 30. These cases account for 16% of all the pending cases with the IT department.

When the country is fiercely debating high profile bank loan defaulters and tax defaulters, it turns out that 16% of the tax-arrear cases pending with the Income Tax department are those with an outstanding demand of Rs 100 or less. The government informed the Lok Sabha recently that a decision has been taken to write off 21.54 lakh cases involving a total amount of about Rs.6.4 crore.

Cost of recovery more than the arrear amount

In 2012, a section of the media had reported that the Central Processing Centre (CPC) in Bangalore is sending notices for Income Tax arrears as small as Rs. 1/- , 4/- , 6/-. Following these reports, the finance ministry issued a clarification saying that the IT department had created a central repository of all demands and that in the interest of greater transparency, a communication has been sent to taxpayers about the existing arrears. The clarification made it clear that the communication was not a demand notice and any demand of less than Rs 100 is not enforced but is liable for adjustment against future refunds.

Now, the government has decided to write off these arrears. The government’s latest decision to write off all arrears of Rs 100 or less was apparently made to manage arrears and processing of refunds more efficiently. Such small arrears put a huge administrative burden of maintaining and servicing. The government also informed the Lok Sabha that the administrative cost of recovery of these low-value arrears would be more than the amount of arrear itself.

As of 31st December 2016, a total of 21.54 lakh cases involving a total amount of about Rs.6.4 crore were found to be of such low-demand arrears. These 21.54 lakh cases account for 16% of all the cases with the Income Tax Department as per the data shared by the government. The government hopes that this would have a significant positive impact on the process of arrear collection and management since 1/6th of the pending cases are now resolved.

More than 6.71 lakh crore locked up in Income Tax appeals

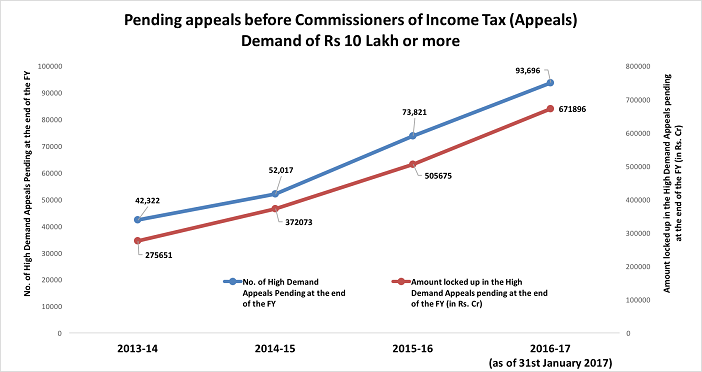

On the other hand, data shared by the government in the Lok Sabha indicates that as of 31st January 2017, a total of Rs 6.71 lakh crore is locked up in ‘high demand appeals’ pending before the Commissioners of Income Tax (Appeals) i.e., CIT (Appeals). As per CBDT, if the demand locked up in the appeal pending before the CIT (Appeals) is Rs. 10 Lakhs and above, it is categorized as high demand. In other words, less than 1% of all the pending appeals account for more than Rs 6.71 lakh crore in locked up amount. The locked up amount and the number of pending appeals has been increasing continuously. Between 2013-14 and 2016-17, the number of such pending appeals has more than doubled from 42322 to 93696. The amount locked up has also more than doubled from Rs 2.75 lakh crore to Rs 6.71 lakh crore.

On the other hand, appeals pending before CESTAT in case of Central Board of Customs & Excise, account for Rs 1.45 lakh crore in locked up amount as of 31st January 2017.

Featured Image: IT Write-offs