[orc]The Fiscal Responsibility and Budget Management Act (FRBM) of 2003 and subsequent rules mandated the Central Government to disclose a statement of assets of the Central Government with every budget. It is observed that the Government Assets (Land, Office Equipment & Vehicles) decreased by 55% from 2013-14 to 2014-15, as per the asset registers presented during budget.

The Fiscal Responsibility and Budget Management Act (FRBM) of 2003 mandated significant changes to the disclosures made by the Central Government while presenting the annual budget. To ensure greater transparency in the fiscal operations, the Central Government is to publish a statement of assets with every budget in a prescribed format. The statement of assets for 2013-14 and 2014-15 indicate that government assets (Land, Office Equipment & Vehicles) have decreased by over 55%. Could this be a case of typographical error?

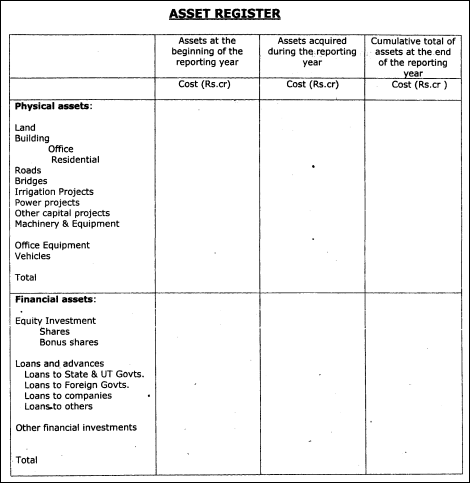

Statement of Assets

The statement of assets is to be submitted with every budget in a prescribed format. It has to include both physical and financial assets. Physical assets include Land, Buildings, Roads, Bridges, Irrigation Projects, Power Projects, Capital Projects, Machinery & Equipment, Office Equipment and Vehicles. Financial assets include Equity Investments, Loans & Advances and other Financial Investments.

The following rules have to followed while declaring the cost of these assets

- Only those assets above the threshold value of Rs 2 Lakh have to be recorded

- The disclosure statement does not include assets of Cabinet Secretariat, Central Police Organizations, Ministry of Defence, Departments of Space and Atomic Energy as per FRBM Rules

- Reporting year refers to the second year preceding the year for which the budget is presented. For e.g., the reporting year for the budget 2016-17 would be 2014-15.

- Variation between closing balance of previous year and opening balance of the reporting year is due to reconciliation.

- The Asset Register is to be prepared only for those assets owned by the Central Government and not autonomous bodies and public sector undertakings

- The Asset Register is expected to be completed in-house, without hiring any outside professionals.

- No assessment of current market value is required to be done.

- Similarly, no adjustment is to be done for depreciation of assets.

Cost of Land, Office Equipment & Vehicles reduce by 55%

A close look at the statement of assets made during the 2015-16 budget and 2016-17 budget reveals a reduction of 55% in the cost of Land, Office Equipment & Vehicles.

| Physical Asset | Total of Assets at the end of the Year 2013-14 in Rs Crore (Presented during 2015-16 Budget) | Total of Assets at the beginning of the Year 2014-15 in Rs Crore (Presented during 2016-17 Budget) |

|---|---|---|

| Land | 219404.46 | 130375.93 |

| Office Equipment | 40730.76 | 3693.61 |

| Vehicles | 43554.24 | 1768.69 |

| Office Buildings | 28809.14 | 28672.99 |

| Roads | 10255.86 | 10270.99 |

| Bridges | 11717.04 | 11734.04 |

| Irrigation Projects | 1415.54 | 1286.40 |

| Power Projects | 368.46 | 361.56 |

While it is entirely possible that slight variation could be because of reconciliation, the variance in case of Land, Office Equipment & Vehicles cannot be explained by reconciliation. In the case of Office Equipment & Vehicles, the variance was more than 10 times and 20 times respectively. The cost of Land decreased from 219404 crore at the end of 2013-14 to 130376 crore at the beginning of 2014-15. The cost of Office Equipment decreased from 40731 crore the end of 2013-14 to 3694 crore at the beginning of 2014-15. Similarly, the cost of Vehicles decreased from 43554 crore the end of 2013-14 to 1769 crore at the beginning of 2014-15. The variation in all the other physical assets was more or less within the reconciliation limits. It is to be noted that such wide variance was not observed between 2012-13 and 2013-14.

The media also highlighted this during the 2015-16 budget, that vehicles were worth more than roads, bridges and irrigation projects combined.

Could this be a case of typographical error or oversight? Only the government can answer this question.

Featured Image: [By Diego Delso], [CC BY 3.0]

1 Comment

Total of Assets at the end of the Year 2013-14 in Rs Crore (Presented during 2015-16 Budget) = This means Total Assets as on 31 march 2014 in Rs Crore as Presented on 28 Feb 2015.

Total of Assets at the beginning of the Year 2014-15 in Rs Crore (Presented during 2016-17 Budget) = This means Total Assets as on 1 April 2014-15 in Rs Crore as Presented on 29 Feb 2016.

Does this mean, what was accounted as 356255.5 crore Rs on 31 March 2014 and reported on 28 Feb 2015 was accounted as 188164.2 crore Rs on 1 April 2014 and reported on 29 Feb 2016. This means the valuation changed after one year.