A post is being widely shared on social media claiming that the GST slabs are going to vary according to the bill amount and it recommends shoppers get separate bills of Rs. 1000 for purchases above this amount to presumably attract no GST. Let us fact-check the claim made in the post.

Claim: GST rates vary based on the total billed amount on the purchases made.

Fact: GST rates are not based on the total billed amount on the purchases made. GST rates vary based on the type of product purchased and the rates for each product category are decided by the GST Council headed by the Union Finance Minister. Hence the claim made in the post is FALSE.

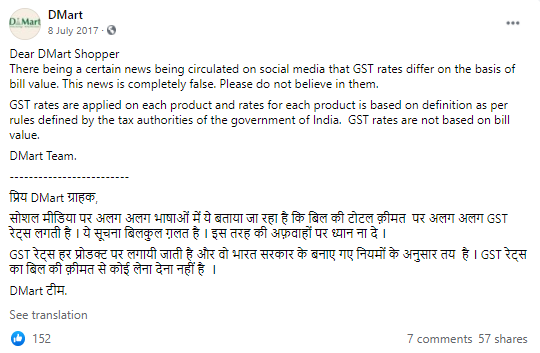

When we searched for news articles about shopping malls incurring GST based on bill values, we found none. However, when similar posts were made viral in 2017 too, D-Mart had published a denial on its Facebook page. This Facebook post says, GST rates are applied on each product and rates for each product are based on definition as per rules defined by the tax authorities of the government of India, and GST rates are not based on bill value.

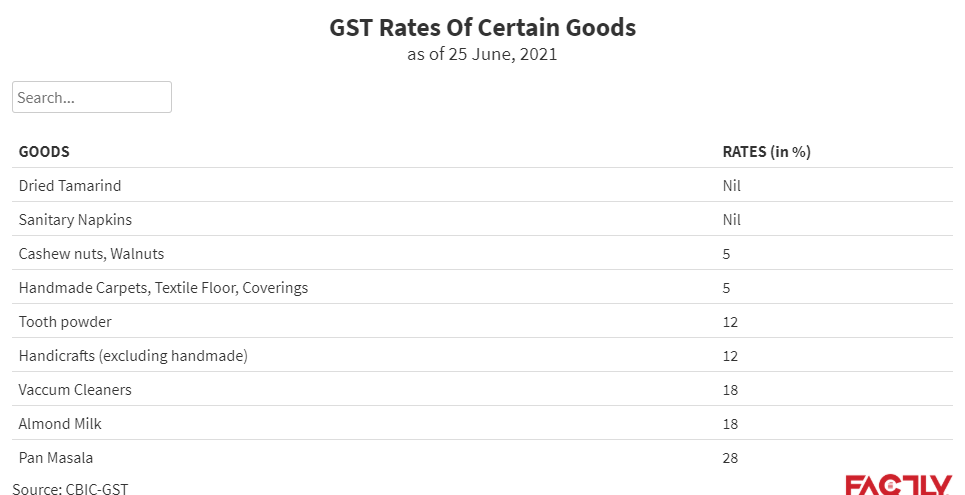

Ever since the onset of Goods and Services Tax (GST) on 01 July 2017, several such posts were going viral on social media. It must be noted that GST is not applied on the total bill amount, but on each product. GST is an indirect tax that customers must bear when they buy any goods or services, such as food, clothes, electronics, items of daily needs, transportation, travel, etc and there are few products that are not under the purview of GST like alcohol for human consumption and petroleum products.

To sum it up, GST is levied on the products purchased, not on total bill value.