One of the infographics put up by the current government on the 48-month portal makes certain claims about formalization of the economy leading to securing people’s rights, as part of a broader set of claims about eliminating corruption. Here is a Fact Check of these specific claims.

One of the infographics put up by the current government on the 48-month portal makes certain claims about formalization of the economy leading to securing people’s rights, as part of a broader set of claims about eliminating corruption. Here is a Fact Check of these specific claims.

Claim 1: Has number of ITRs filed increased substantially?

The first claim of the government is that the number of Income Tax Returns (ITRs) filed during financial year (FY) 2017-18 is 6.84 crore, a jump of 80.5% compared to FY 2013-14.

The taxpayer has to communicate the details of his taxable income/loss to the Income-tax Department. These details are communicated to the Income-tax Department in the form of return of income. More information about ITRs can be accessed from the Income Tax website.

The claim here pertains to the ITRs filed during the financial years of 2017-18 and 2013-14. A press release of the income tax department notes, ‘During FY 2017-18, 6.84 crore Income Tax Returns (ITRs) were filed with the Income Tax Department as compared to 5.43 crore ITRs filed during FY 2016-17, showing a growth of 26%. There has been a sustained increase in the number of ITRs filed in the last four financial years. As compared to 3.79 crore ITRs filed in FY 2013-14, the number of ITRs filed during F.Y. 2017-18 (6.84 crore) has increased by 80.5%.” These numbers can be corroborated from the income tax department website.

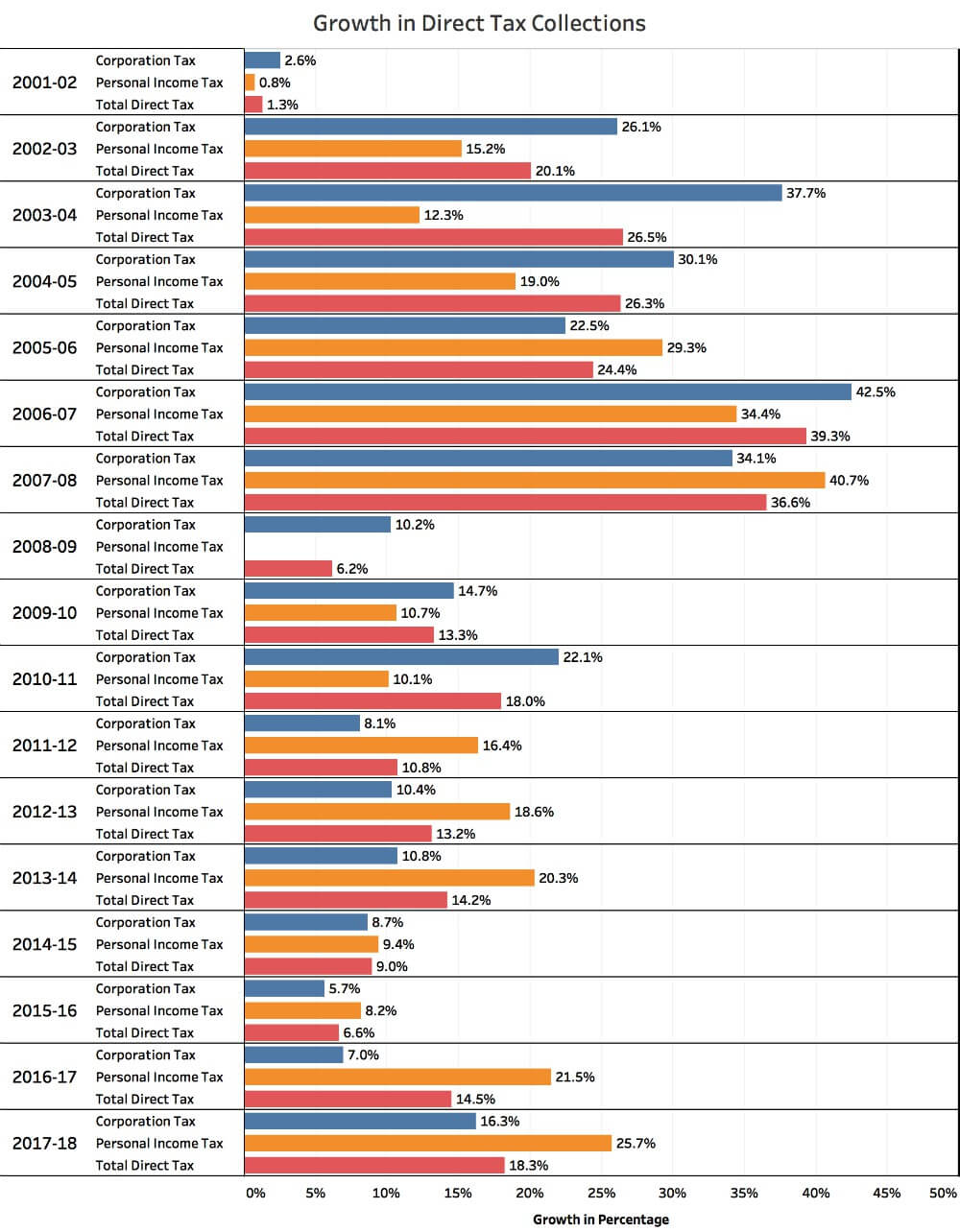

While the number of ITRs filed has increased substantially in the last few years, that is not reflected in the total direct tax collections. The growth in Corporate tax collection in the four years of the current government is about 43% while it was 85% during UPA-2. In the case of personal Income tax, the growth during the four years of the current government is around 81% while it was 102% during UPA-2. The current government looks set to overtake or match the performance of UPA-2 as far as personal Income tax is concerned. In terms of the total direct tax collections, the growth during the four years of the current government is 57% while it was 91% during UPA-2.

Claim: The number of ITRs filed during FY 2017-18 is 6.84 crore, a jump of 80.5% compared to FY 2013-14.

Fact: The number of ITRs filed have increased substantially over the last 4 financial years from 3.79 crores to 6.84 crores. Hence, the claim is TRUE. But the total direct tax collections have not increased proportionately.

Claim 2: Registered tax payers with GST

The second claim in the same infographic is that more than 1 crore taxpayers registered with GST, including 35 lakh new taxpayers. The annual report published by the Ministry of Finance verifies the claim that the number of taxpayers under the new GST regime is close to 1 crore. As per the annual report, the total number of taxpayers under GST was 98.35 lakh as of December 2017 out of which 34.22 lakh were new taxpayers.

The annual report also points out that ‘GST has aided in widening of the tax base, e.g., entire textile chain has now been brought under tax net. Further, a segment of land and real estate transactions has been brought into the tax net as “works contracts”, referring to housing that is being built.’ The widening of the tax base could be one of the reasons for the increase in the number of registered taxpayers under GST.

Claim: More than 1 crore taxpayers registered with GST, including 35 lakh new taxpayers.

Fact: As of December 2017, close to 1 crore taxpayers were registered under GST out of which 34.22 lakh were new. Hence the claim is TRUE

Claim 3: 50 lakh new bank accounts for workers

The third claim is that 50 lakh new bank accounts were opened for cashless, transparent transfer of wages, benefitting workers. Without clarity on what kind of bank accounts have been opened and where, it is difficult to verify this claim. The number of bank accounts opened under Jan Dhan is far more than 50 lakh. Hence this claim is vague and could not be verified.

Claim: 50 lakh new bank accounts opened for cashless, transparent transfer of wages, benefitting workers.

Fact: The claim is unclear and hence, UNVERIFIED

Claim 4: New registrations with EPFO & ESIC

The final claim of the infographic is that more than 1.01 crore additional workers enrolled with EPFO and more than 1.3 crore workers registered with ESIC post-demonetization.

The Employees’ Provident Fund came into existence with the promulgation of the Employees’ Provident Funds Ordinance on 15th November, 1951 to provide for the institution of provident funds for employees in factories and other establishments. The Act is now referred as the Employees’ Provident Funds & Miscellaneous Provisions Act, 1952. The Central Board of Trustees administers a contributory provident fund, pension scheme and an insurance scheme for the workforce engaged in the organized sector in India.

The Constitution of India under ‘Directive Principles of State Policy’ provides that the State shall within the limits of its economic capacity make effective provision for securing the right to work, to education and to public assistance in cases of unemployment, old-age, sickness & disablement and undeserved want. The EPF & MP Act, 1952 was enacted by Parliament and came into force with effect from 4th March,1952. A series of legislative interventions were made in this direction, including the Employees’ Provident Funds & Miscellaneous Provisions Act, 1952

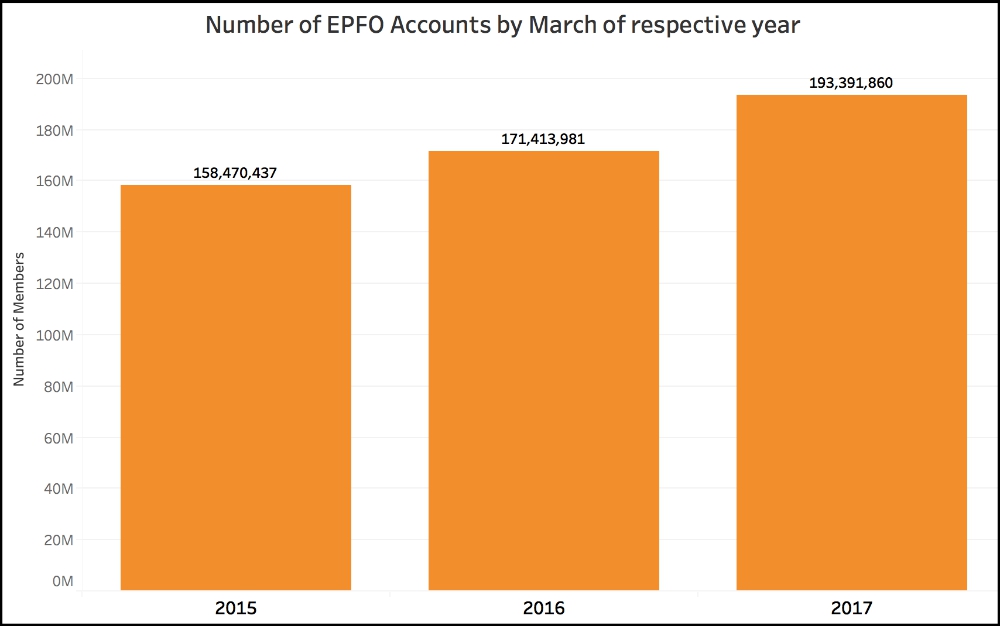

As per the data shared by the government in the Lok Sabha in July 2017, the number of accounts in EPFO was 17.14 crore as of March 2016 which increased to 19.33 crore in March 2017. The data also mentions that 1.01 crore employees were enrolled during the enrolment campaign held between 1st January 2017 and 30th June 2017.

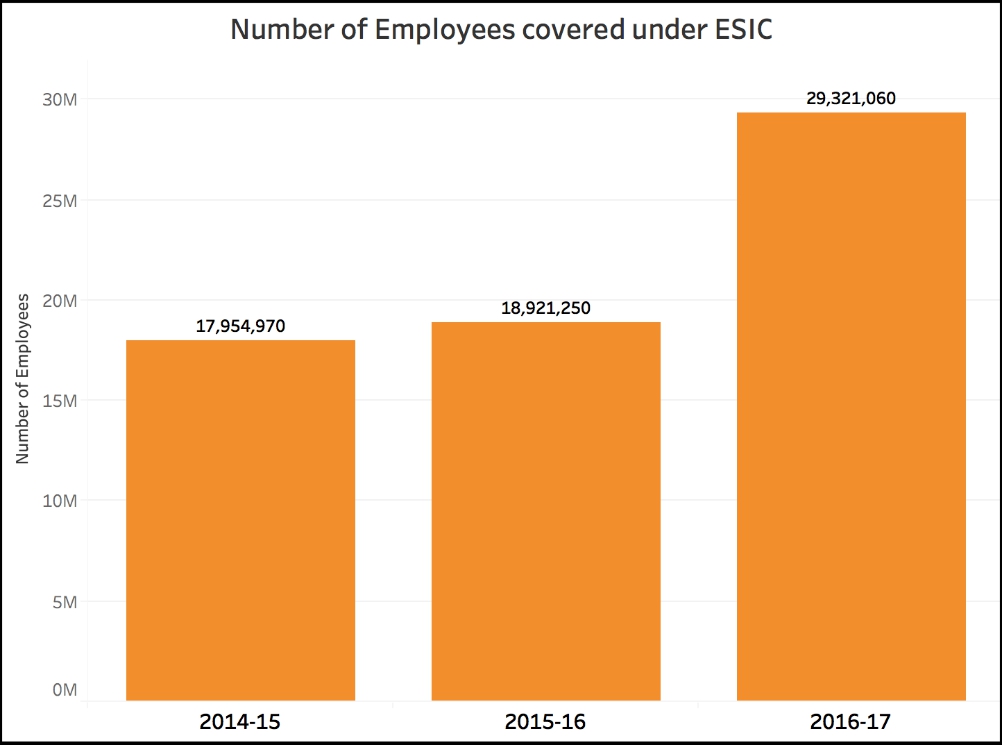

As per another answer given by the government in the Lok Sabha, 1.89 crore employees were covered under Employees’ State Insurance Corporation (ESIC) in 2015-16. This number increased to 2.93 crore during the year 2016-17, an increase of 1.04 crore compared to 2015-16.

Claim: More than 1.01 crore additional workers enrolled with EPFO and more than 1.3 crore workers registered with ESIC post-demonetization

Fact: 1.01 crore employees were enrolled into EPFO under the enrolment campaign, 2017 between 1st January 2017 and 30th June 2017. A new set of 1.03 crore people who came under the ambit of the ESIC between the years 2015-16 and 2016-17. Hence the claim is TRUE.

This story is part of a larger series on the 4-years of the Modi government. This series has been made possible with the flash grant of the International Fact Checking Network (IFCN). Read the rest of the stories in this series here.