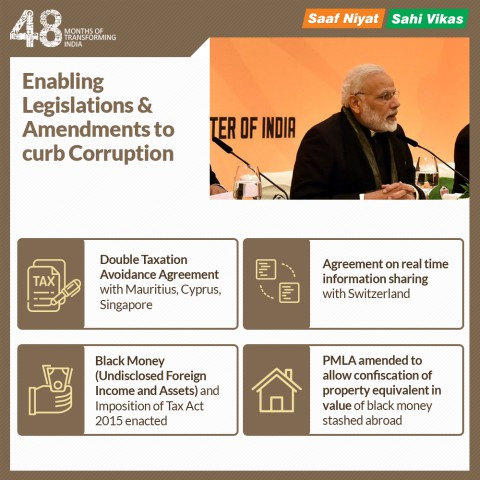

[orc]The BJP government published an infographic on the 48-months portal that makes four claims about enabling legislations to curb corruption. This article is a fact check of the claims.

The BJP government published an infographic on the 48-months portal that makes four claims about enabling legislations to curb corruption. This article is a fact check of the claims.

Has ‘Double Taxation Avoidance agreement’ been signed with 3 new countries?

The first claim is that ‘double taxation avoidance agreement signed with Mauritius, Cyprus, Singapore’.

The double taxation avoidance agreement (DTAA) is basically a treaty that is signed between two countries that lets the tax payers in these countries avoid being taxed twice in both the countries. India has these agreements with a number of countries including Australia, Canada, United States of America and the United Kingdom.

The website of the Income Tax department displays all the DTAAs that India has signed. Mauritius, Cyprus and Singapore are on that list along with tens of others. As per the Income Tax website, there are about 135 such agreements of varying nature.

The agreement with Mauritius states that ‘whereas the annexed Convention between the Government of the Republic of India and the Government of Mauritius for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and capital gains and for the encouragement of mutual trade and investment has come into force on the notification by both the Contracting States to each other on completion of the procedures required by their respective laws, as required by Article 28 of the said Convention’. This agreement was amended in August 2016 to make is more comprehensive.

The agreement with Cyprus states that ‘an agreement and protocol between the Government of the Republic of India and the Government of the Republic of Cyprus for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income as set out in the Annexure to this notification, was signed at Nicosia, Cyprus on the 18th day of November, 2016’.

The agreement with Singapore states that ‘whereas the annexed agreement between the Government of the Republic of India and the Government of the Republic of Singapore for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income has entered into force on 27th May, 1994 on the notification by both the Contracting States to each other of the completion of the procedures required by their respective laws, as required by the said Agreement’. This agreement has been amended in 2005, 2011 and most recently in 2017.

It can be seen from the agreements that DTAA is not new and have been signed by previous governments also. It is also evident that of the three countries mentioned the claim, only Cyprus is a new agreement and the other two are amendments to older agreements or protocols.

Claim: Double taxation avoidance agreement signed with Mauritius, Cyprus, Singapore

Fact: DTAA is not new and have been signed by previous governments also with a number of countries. As per the Income Tax website, there are 135 such agreements. It is also evident that, of the three countries mentioned the claim, only Cyprus is a new agreement and the other two are amendments to older agreements. Hence, the claim is MISLEADING.

Is there an agreement on real time information sharing with Switzerland?

The second claim is that ‘agreement on real time information sharing with Switzerland’.

A number of policy related MoUs have been signed with Switzerland. One of such agreements is the ‘Joint Declaration on Automatic Exchange of Information on Tax Matters – signed in November 2016’. This agreement allows for real time information sharing of the finances related to Indian nationals with bank accounts in Switzerland. Switzerland and India are among a list of 84 countries that share such information with other countries.

Switzerland shared its information with 36 countries, while India shared it with 58 as per the 2018 OECD report on this issue. The report of the OECD committee further states that ‘in 2014, the Global Forum on Transparency and Exchange of Information for Tax Purposes (the Global Forum) adopted the Standard for Automatic Exchange of Financial Account Information in Tax Matters (the AEOI Standard), developed by the OECD working with G20 countries. To deliver a level playing field, the Global Forum launched a commitment process under which 100 jurisdictions committed to implement the AEOI Standard in time to commence exchanges in 2017 or 2018’. It is thus clear that the real time information agreement that was signed with Switzerland is part of a larger global initiative and the adoption of the standard developed the OECD.

Claim: Agreement on real time information sharing with Switzerland

Fact: Joint Declaration on Automatic Exchange of Information on Tax Matters was signed in November 2016 with Switzerland. Hence, the claim is TRUE. However, real time information agreement that was signed with Switzerland is part of a larger global initiative and the adoption of the standard developed the OECD.

Have the ‘Black Money and Imposition of tax act’ been enacted?

The third claim is that ‘black money (undisclosed foreign income and assets) and imposition of tax Act 2015 enacted’.

This act was made to deal with the problem of the Black money that is undisclosed foreign income and assets, the procedure for dealing with such income and assets and to provide for imposition of tax on any undisclosed foreign income and asset held outside India. The Act came into force from April 2016.

One of the press releases by the government also states that ‘the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Rules 2015 have been framed and notified in July 2015. The rules specify the form and manner in which declaration of undisclosed foreign asset is to be made. Rules also provide the method of determination of fair market value of different types of assets e.g., bullion, jewellery, artistic work, shares and securities, immovable property, bank account etc’.

Claim: Black money (undisclosed foreign income and assets) and imposition of tax Act 2015 enacted.

Fact: The Undisclosed Foreign Income and Assets (Imposition of Tax) Bill, 2015 has been enacted and the subsequent rules have also been issued. Hence, the claim is TRUE.

Has the PMLA been amended?

The fourth claim is that ‘PMLA amended to allow confiscation of property equivalent in value of black money stashed abroad’.

A response in Lok Sabha from July 2017 provides details about the PMLA. ‘The Prevention of Money Laundering Act (PMLA), 2002 was enforced in India with effect from July 2005. 2260 cases have been registered under the PMLA during the last ten years. Out of these prosecution have been filed in 370 cases and 02 persons in 02 cases have been convicted for the offence of money laundering. Amendments were carried out from time to time to widen the scope of PMLA, expand the definition of Proceeds of Crime, etc’. The response also details the amendments made to the act are as follows:

- In 2009, a large number of Schedule Offences were introduced under the Schedule appended to PMLA.

- In 2013, the offences under Part ‘B’ were shifted to Part ‘A’ of the Schedule. Thus the monetary threshold was actually done away with. The offence of money laundering has been made stand alone. The confiscation is no longer contingent upon conviction in schedule offence. Rather, the Special Court, after conclusion of money laundering trial, if finds that offence of money laundering has been committed, it shall order for confiscation.

- In 2015 the definition of Proceeds of Crime (POC) was further expanded to enable the Directorate to attach equivalent value of property in India of the accused, if the accused has transferred the POCs out of India.

- Section 132 of Customs Act regarding false declaration, etc. was introduced under Part B of the Schedule with monetary threshold of Rs 1 Crore. Section 51 of the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 was also included under part-C of the schedule appended to PMLA

Claim: PMLA amended to allow confiscation of property equivalent in value of black money stashed abroad

Fact: In 2015, the definition of Proceeds of Crime (POC) was further expanded to enable the Directorate to attach equivalent value of property in India of the accused, if the accused has transferred the POCs out of India. Hence, the claim is TRUE.

This story is part of a larger series on the 4-years of the Modi government. This series has been made possible with the flash grant of the International Fact Checking Network (IFCN). Read the rest of the stories in this series here