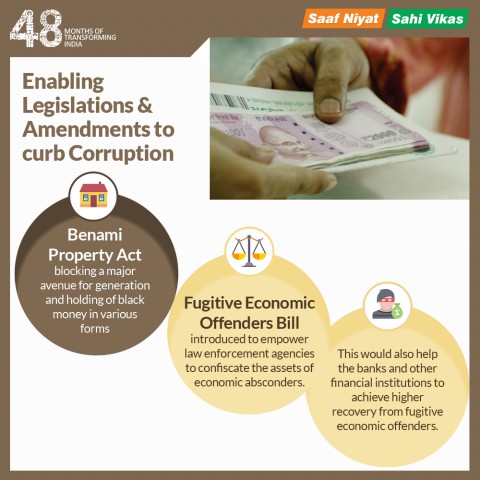

The BJP government published an infographic on the 48-months portal that makes three claims relating to the ‘Benami Property Act’ & ‘Fugitive Economic Offenders Bill’ This article is a fact check of the claims.

The BJP government published an infographic on the 48-months portal that makes three claims relating to the ‘Benami Property Act’ & ‘Fugitive Economic Offenders Bill’ This article is a fact check of the claims.

What is the Benami Property act?

The first claim is that the ‘Benami Property Act is aimed at blocking a major avenue for generation and holding of black money in various forms’.

The Benami Transactions (Prohibition) Amendment Act, 2016 was given assent by the President in August 2016. This act came into existence with amendment to a 28 year old law: The Benami Transactions (Prohibition) Act, 1988.

A ‘Benami Transaction’ is one where a property is purchased in the name of an individual who has not paid for it. The person who has rendered the necessary money for the said transaction is not named in the deal. However, this property is held for immediate or future benefit, direct or indirect, of the person who has provided its payment.

The amendments passed by the BJP government seek to do the following.

- Amend the definition of benami transactions

- Establish adjudicating authorities and an Appellate Tribunal to deal with benami transactions

- Specify the penalty for entering into benami transactions

The UPA in 2011 also introduced a bill to amend the 1988 act. The UPA bill sought to do the following.

- Prohibits benami transactions

- Provides that the Initiating Officer, the Approving Authority

- Provides penalty for entering into prohibited benami transactions and for furnishing any false documents in any proceeding under the bill

Though the bill was sent to the standing committee, it could not be passed during UPA-2 and was lapsed. It has to be noted that the original 1988 bill was not notified due to legal infirmities.

A response in Lok Sabha in March 2017 stated that ‘though the Benami Transactions (Prohibition) Act, 1988 has been on the statute book since more than 28 years, the same could not be made operational because of certain inherent defects. With a view to providing effective regime for prohibition of benami transactions, the said act was amended through the Benami Transactions (Prohibition) Amended Act, 2016. The amended law empowers the specified authorities to provisionally attach benami properties which can eventually be confiscated. Besides, if a person is found guilty of offence of benami transaction by the competent court, he shall be punishable with rigorous imprisonment for a term not less than one year but which may extend to 7 years and shall also be liable to fine which may extend to 25% of the fair market value of the property’.

As per a response in the Lok Sabha, till 31st December 2018, the IT department has identified more than 2000 benami transactions (including deposits in bank accounts, plots of land, flat and jewellery). The government also stated that provisional attachment of properties has been done in over 1800 cases and the value of properties under attachment is more than Rs. 6900 crores.

Claim: Benami Property act is aimed blocking a major avenue for generation and holding of black money in various forms.

Fact: The Benami Transactions (Prohibition) Amendment Act, 2016 came into effect from1st November, 2016 during the current government. As per the latest available data, over 2000 transactions has been identified. Hence the claim is TRUE. However, the UPA also tried amending the original 1988 act to rectify the legal defects and introduced a bill in 2011. It lapsed without the Lok Sabha passing the same.

What is the Fugitive Economic Offenders bill?

The second claim is that ‘fugitive economic offenders bill introduced to empower law enforcement agencies to confiscate the assets of economic absconders’.

The Fugitive Economic Offenders bill was introduced in the Lok Sabha in March, 2018. The Fugitive Economic Offenders Act was passed by the parliament in July 2018. The Bill provides for provisional attachment of properties, and subsequent confiscation if a person is declared an ‘Fugitive Economic Offender (FEO)’.

As per an analysis by PRS legislative research, the provisions of this bill are similar to the Criminal Procedure Code (CrPC), 1973, which also allows for attachment and confiscation of properties of absconders. Under the CrPC, the attached properties may be returned if the absconder appears within two years. This implies that properties will be finally confiscated only after two years of attachment. In contrast, under the FEO act, confiscation of properties will be final once a person is declared an FEO by the Special Court. Most of the procedural aspects under the FEO act (with a few exceptions) are similar to existing laws such as the CrPC and the Prevention of Money-Laundering Act (PMLA).

As per a response in the Rajya Sabha from December 2018, a total of 49 businessman wanted by Enforcement Directorate (ED) & the CBI in various cases are absconding from India.

A response in Lok Sabha from December 2018 states that ‘applications under Fugitive Economic Offenders Act, 2018 have been filed against 7 individuals in the Competent Court by Enforcement Directorate. No assets have been seized under Fugitive Economic Offenders Act, 2018. However, attachment and seizure of properties/assets valued at Rs. 14,461.1 crore have been made under PMLA, 2002 in respect of aforesaid 07 individuals’.

Claim: Fugitive Economic Offenders bill introduced to empower law enforcement agencies to confiscate the assets of economic absconders.

Fact: The Fugitive Economic Offenders Act was passed by the parliament in July 2018. Hence, the claim is TRUE. However, number of procedural aspects of this act are similar to some of the existing laws. Further, no assets have been seized so far under the new law though applications have been filed against 7 out of 49 individuals absconding from India.

Will the Fugitive Economic Offender bill help banks and other financial institutions?

The next related claim is that ‘the FEO bill will help the banks and other financial institutions to achieve higher recovery from fugitive economic offenders’. The claim is only an expectation and is still unproven.

Claim: FEO act would also help the banks and other financial institutions to achieve higher recovery from fugitive economic offenders

Fact: The Act is expected to help banks and other financial institutions to achieve higher recovery but the results are yet to be realized. The claim is only an expectation and is still unproven. Hence, the claim remains UNVERIFIED.

This story is part of a larger series on the 4-years of the Modi government. This series has been made possible with the flash grant of the International Fact Checking Network (IFCN). Read the rest of the stories in this series here