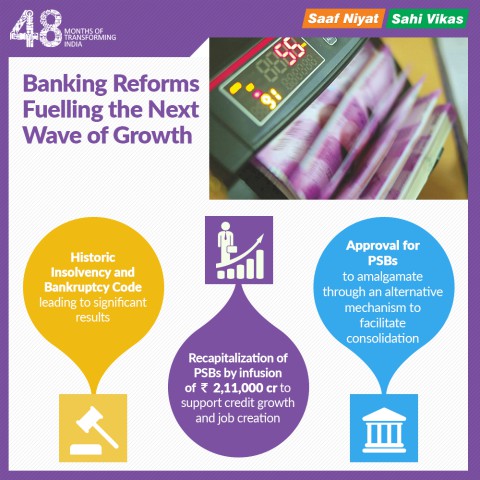

[orc]The BJP government published an infographic on the 48-months portal that makes three claims about the banking sector. This article is a fact check of the claims.

The BJP government published an infographic on the 48-months portal that makes three claims about the banking sector. This article is a fact check of the claims.

Has the ‘Insolvency and Bankruptcy Code (IBC)’ led to significant results?

The first claim is that ‘historic insolvency and bankruptcy code implemented leading to significant results’.

The annual report (2016-17) of the Ministry of Finance states that, ‘a Bankruptcy Law Reforms Committee was set up in August 2014 for providing an entrepreneur friendly legal bankruptcy framework for India meeting global standards for improving the ease of doing business with necessary judicial capacity. The Committee submitted its Report and draft bill in November 2015. Based on this, as well as public/stakeholder consultation, a bill by name “The Insolvency and Bankruptcy Code, 2015” was introduced in the Lok Sabha in December 2015. The Bill was referred to a Joint Committee of Parliament. The Joint Committee of Parliament submitted its report in April 2016. The Insolvency and Bankruptcy Code, 2016 was passed by Parliament on in May 2016 and published in the Official Gazette in May 2016.”

The annual report (2016-17) of the Ministry of Corporate Affairs (MoCA) states that ‘following the notification of The Insolvency and Bankruptcy code, 2016 (IBC), Government of India (Allocation of Business) rules, 1961 were amended and notified in August 2016 wherein MoCA was entrusted with the responsibility to administer the Code. The Code has been framed with the object to consolidate and amend the laws relating to reorganization and insolvency resolution of corporate persons, partnership firms and individuals in a time bound manner’.

The report also describes that the IBC proposes a framework to ensure:

- Early detection of stress in a business

- Initiation of the insolvency resolution process by debtor, financial creditor or operational creditor

- Timely revival of viable businesses

- Liquidation of unviable businesses

- Minimization of losses to all stakeholders

- Avoiding destruction of value of failed business’

The website of the Insolvency and Bankruptcy Board of India states that ‘the Insolvency and Bankruptcy Board of India was established in October, 2016 under the IBC. It is a key pillar of the ecosystem responsible for implementation of IBC that consolidates and amends the laws relating to reorganization and insolvency resolution of corporate persons, partnership firms and individuals in a time bound manner for maximization of the value of assets of such persons, to promote entrepreneurship, availability of credit and balance the interests of all the stakeholders.

It is a unique regulator: regulates a profession as well as processes. It has regulatory oversight over the Insolvency Professionals, Insolvency Professional Agencies, Insolvency Professional Entities and Information Utilities. It writes and enforces rules for processes, namely, corporate insolvency resolution, corporate liquidation, individual insolvency resolution and individual bankruptcy under the IBC. It has recently been tasked to promote the development of, and regulate, the working and practices of, insolvency professionals, insolvency professional agencies and information utilities and other institutions, in furtherance of the purposes of the IBC’.

The annual report (2017-18) of the Ministry of Finance states that ‘the referring of cases under IBC to the NCLT, the recapitalization of public sector banks, and the announcement of the plan for further consolidation among the public sector banks boosted the sentiments in the market’

As per latest data shared by the government in the Rajya Sabha in February 2019, a total of 1484 cases had been admitted for resolution under IBC as on 31st December 2018. Of these, 562 cases were filed by Financial Creditors (FCs), out of which 78 cases have been resolved till 31st December 2018 and an amount of Rs. 65,796 crores realized by FCs against admitted claim amount of Rs. 1,36,128 crores.

Claim: Historic insolvency and bankruptcy code leading to significant results.

Fact: The Insolvency and Bankruptcy Code, 2016 was passed by Parliament in May 2016 and was notified in the same month. In terms of the impact, it is still early days since a significant number of cases are pending. Hence the claim that the IBC was brought by the current government is TRUE while the impact remains UNVERIFIED.

Have PSBs been infused with 2,11,000 crore rupees?

The second claim is that ‘recapitalization of PSBs by infusion of 2,11,000 crore rupees to support credit growth and job creation’.

A response in Lok Sabha from January 2018 states that ‘Government announced Indra Dhanush plan for revamping Public Sector Banks (PSBs) in August 2015. The plan envisaged, infusion of capital in PSBs by the Government to the tune of Rs. 70,000 crores over a period of four financial years. Government has recently announced decision to further recapitalize PSBs to the tune of Rs. 2,11,000 crores, through recapitalization bonds of Rs. 1,35,000 crore and budgetary provision of Rs. 18,139 crores (the residual amount under Indra Dhanush plan) over two financial years, and the balance through capital raising by banks from the market. Government has so far infused capital of Rs. 59,435 crores in PSBs. Capital infusion is aimed at supplementing the achievement of regulatory capital norms by PSBs through their own efforts and, in addition, based on performance and potential, augmenting their growth capital. Government has announced that a differentiated approach would be followed, based on the strength of each bank’.

The annual report (2017-18) of the Ministry of Finance also states that ‘the Government thus announced its decision in October 2017 to recapitalize PSBs to essentially supplement the latter’s own efforts to adhere to the regulatory capital adequacy norms and to also enable increased credit offtake and catalyze faster economic growth. The announced recapitalization entails mobilization of capital, with maximum allocation in the current year, to the tune of Rs. 2,11,000 crores over the next two years, through budgetary provisions of Rs. 18,139 crores recapitalization bonds to the tune of Rs. 1,35,000 crores, and the balance through capital raising by banks from the market’.

Claim: Recapitalization of PSBs by infusion of 2,11,000 crore rupees to support credit growth and job creation.

Fact: The recapitalization of PSBs is planned by infusing Rs. 2,11,000 crores through budgetary provision, recapitalization bonds & raising capital from the market. Hence that part of the claim is TRUE. However, the impact of this on job creation & credit growth remains UNVERIFIED due to the lack of availability of data.

Is there an alternative mechanism to facilitate consolidation by PSBs?

The last claim is that ‘approval for PSBs to amalgamate through an alternative mechanism to facilitate consolidation’.

A response in Lok Sabha in January 2018 states that ‘the Banking Companies (Acquisition and Transfer of Undertakings) Acts of 1970 and 1980 provide that the Central Government, in consultation with the Reserve Bank of India, may make a scheme, for the amalgamation of any nationalized bank with any other nationalized bank or any other banking institution. Consolidation in Public Sector Banks (PSBs) has been discussed by various committees and their reports, viz., Narasimham Committee (1998), Indian Banks’ Association Report (2004), Planning Commission Report (2008), Leeladhar Committee (2008) and Nayak Committee (2014). These committees recommended encouragement and promotion of consolidation within PSBs through the merger and amalgamation route. Taking note of these recommendations, with a view to facilitate consolidation among the nationalized banks to create strong and competitive banks, Government has put in place an approval framework for proposals to amalgamate nationalized banks’.

In September 2018, it was approved that Bank of Baroda, Vijaya Bank and Dena Bank may consider amalgamation of the three banks through the Alternative Mechanism (AM).

Claim: Approval of PSBs to amalgamate through an alternative mechanism to facilitate consolidation.

Fact: With a view to facilitate consolidation among the nationalized banks to create strong and competitive banks, Government has put in place an approval framework for proposals to amalgamate nationalized banks. Hence, the claim is TRUE.

This story is part of a larger series on the 4-years of the Modi government. This series has been made possible with the flash grant of the International Fact Checking Network (IFCN). Read the rest of the stories in this series here