[orc]In an earlier article, we looked the actual expenditure by the government compared to estimates. In this piece, we look at some key departments namely Agriculture, Defence, Health & Family Welfare, Revenue, New & Renewable energy and the trend in actual expenditure Vs estimates.

In every Union Budget, the Government of India makes provision for the expenditure during the next financial year. In the earlier article, we learnt that the finance ministry makes these budget allocations based on the requests received from each of the ministries after due consultation.

A good portion of the expenditure goes into the different schemes sponsored and run by the central government. We did a detailed study of the estimated expenditure for 2017-18 and the actual expenditure on the central government schemes in the earlier article. We would now focus on the estimated expenditure for 2017-18 in some of the important departments/ministries and the actual figures for the year.

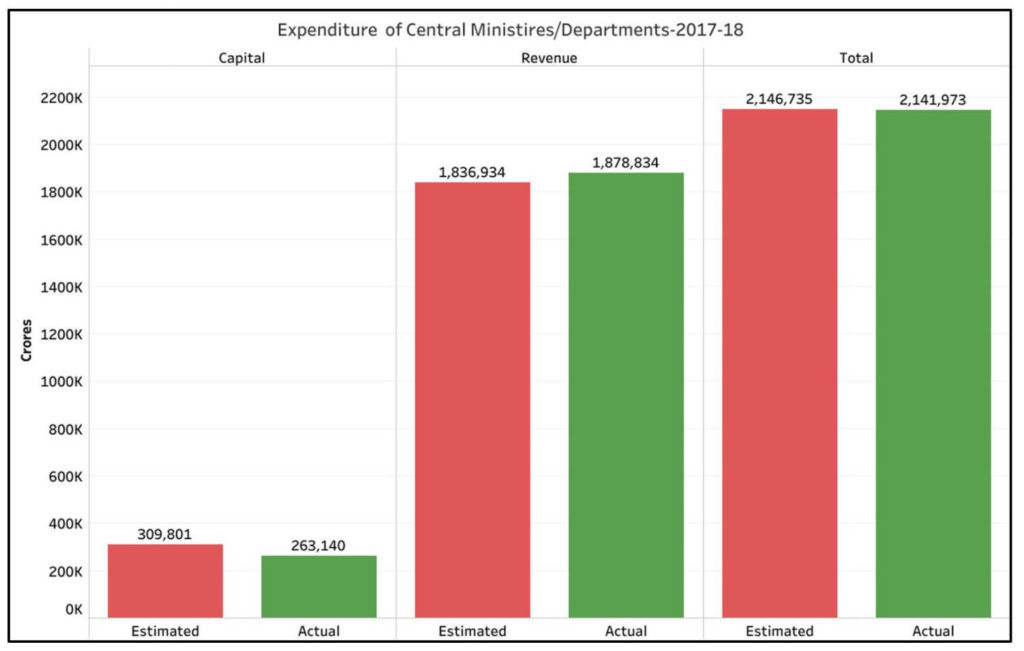

Actual Revenue expenditure is higher while Capital expenditure is lower than estimates

The estimated total expenditure of Ministries & Departments for 2017-18 was ₹ 21,46,734 crores, but the actual expenditure was marginally lower with ₹ 21,41,973 crores being spent. The actual Revenue expenditure was more i.e. ₹ 18,78,833 crores when compared to the estimate expenditure of ₹ 18,36,933 crores. However, the actual capital expenditure was lower at ₹ 2,63,139 crores compared to the estimated expenditure of ₹3,09,800 crores.

The expenditure on the schemes sponsored by central government and the central sector schemes form a major share of the central government’s expenditure, with the other two major heads being (i) Establishment Expenditure of the Centre (ii) Other Central Sector Expenditure.

We have covered in detail the estimates vs actuals for 2017-18 of the central government schemes in an earlier explainer article. Let us have a quick look at the estimates and actuals for the other two heads of expenditure.

The actual ‘Establishment Expenditure’ of the Centre is higher than the estimated expenditure for the year 2017-18, because the increase in the revenue expenditure by ₹ 35657 crores than estimated. The establishment expenditure includes salaries, medical expenses, wages, overtime allowances, foreign travel expenses, domestic travel expenses, office expenses, materials and supplies, publications, advertising and publicity, training, other administrative expenses, POL, cost of ration, clothing and tentage, professional services, rent rates and taxes, royalty, pensionary charges, rewards and minor works, motor vehicles, information technology etc.

| Establishment Expenditure of the Centre (2017-18) | |||

| Estimated | Actual | Difference | |

| Revenue | 431233.41 | 466891.28 | 35657.87 |

| Capital | 6304.19 | 6139.99 | -164.2 |

| Total | 437537.6 | 473031.27 | 35493.67 |

Even under the “Other Central Sector Expenditure”, the actual expenditure is higher than the Estimated expenditure for the year 2017-18. The actual revenue expenditure is in excess of ₹ 10,822 crores than the estimated. However, the actual capital expenditure was only 45% of the estimates. The actual capital spending is ₹ 5,754 crores compared to the estimated expenditure of ₹ 12,904 crores. The expenditure items under this head include provisions made for the Central expenditure on PSUs, autonomous bodies etc. and other expenditure not covered in the category of schemes or establishment expenditure.

| Other Central Sector Expenditure (2017-18) | |||

|---|---|---|---|

| Estimated | Actual | Difference | |

| Revenue | 606320.94 | 617143.26 | 10822.32 |

| Capital | 12904.21 | 5754.64 | -7149.57 |

| Total | 619225.15 | 622897.9 | 3672.75 |

It has to be noted that Capital expenditure relates to either creation of an asset or paying off a debt, whereas revenue expenditure is a current expenditure which includes administration costs and other expenditure. Under both the above mentioned heads, it can be observed that there is an excess amount spent on such revenue expenditure at the cost of lower spending on the allocation for capital expenditure.

The expenditure outlay in the Union Budget is spread across 100 Ministries/Departments. In this story, we look at the actual expenditure of few of the key Ministries/Departments compared to the estimates for 2017-18.

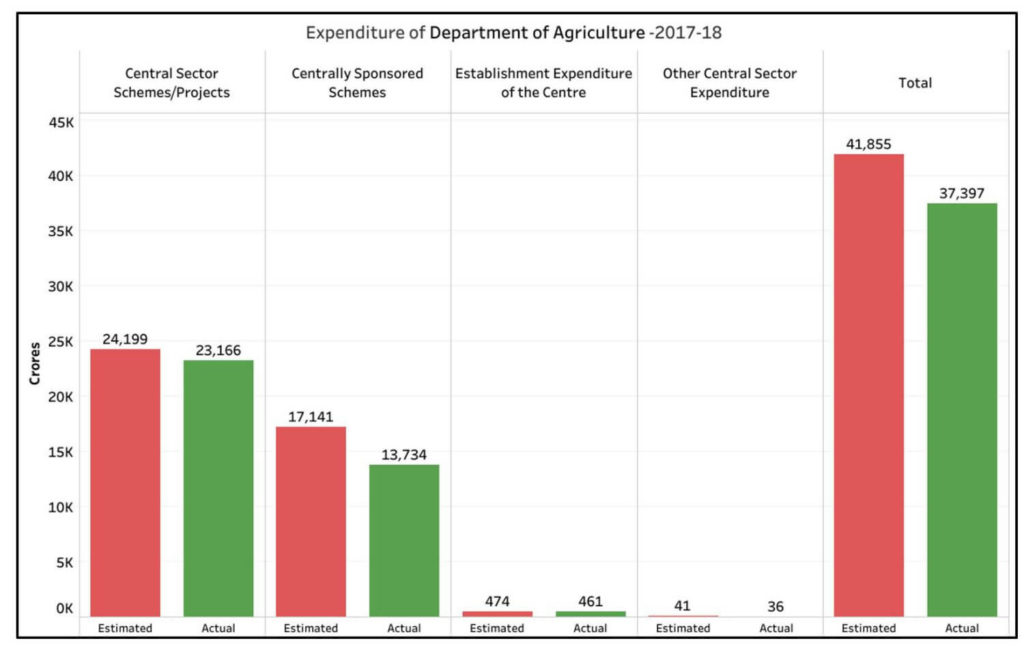

Department of Agriculture – Actual expenditure on Centrally sponsored schemes 19% less than the estimates

The total estimates of expenditure under “Department of Agriculture, Cooperation and Farmers’ Welfare ‘is ₹ 41,855 crores whereas the actual expenditure for 2017-18 is ₹ 37,396 crores i.e. nearly 10.65 % less than the estimate. The actual spending on Centrally sponsored schemes is 19% less than the estimated expenditure.

Central sponsored schemes like the Pradhan Mantri Krishi Sinchai Yojna (PMKSY), Rashtriya Krishi Vikas Yojna, National Food Security Mission, National Mission on Horticulture, National Project on Soil Health and Fertility, Integrated Scheme on Agriculture Marketing etc. are few the schemes whose actual expenditure for 2017-18 was less than the estimates.

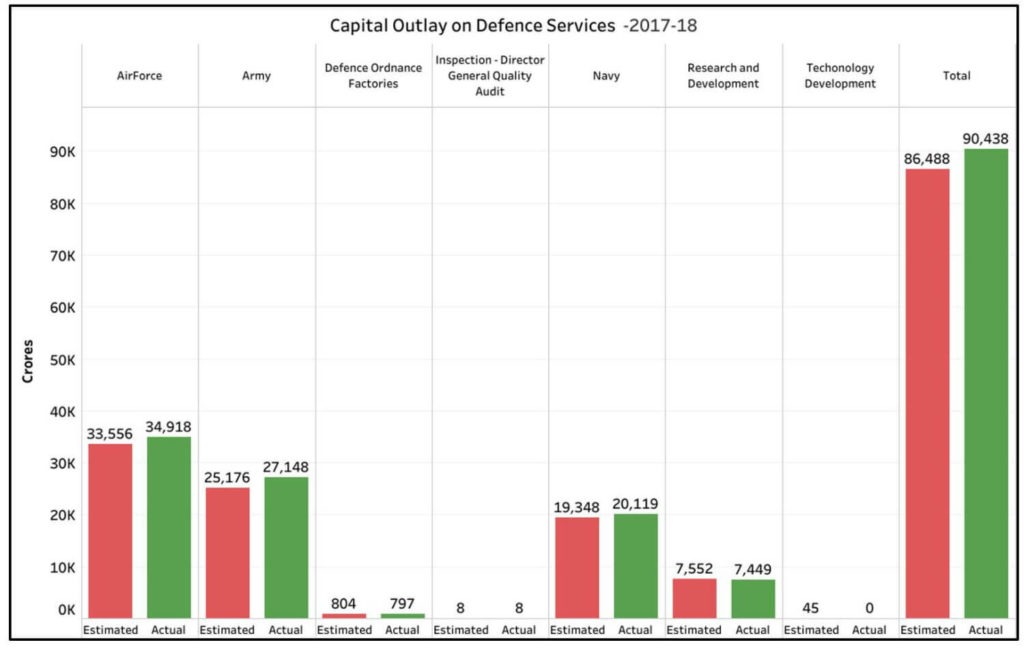

Ministry of Defence – Actual Capital Expenditure more than the estimates

The actual capital expenditure in the Ministry of Defence was higher than the estimates for 2017-18 across all the three services of Indian Armed Forces – Army, Navy and Airforce. However, the actual expenditure on other heads i.e. Ordinance Factories, R&D are less than the estimates. Although estimate allocation was done for Technology Development to the tune of ₹ 44.63 cores, there was no actual expenditure under this head. The total actual expenditure is ₹ 90,438.4 crores which is ₹ 3,950.39 crores more than the estimated numbers for 2017-18. Purchase of equipment and machinery is formed a major part of the capital outlay, followed by construction works.

Even in the case of revenue expenditure in the Ministry of Defence, for salaries, pensions etc., the actual expenditure is around ₹ 9340 crores more than the estimates for 2017-18.

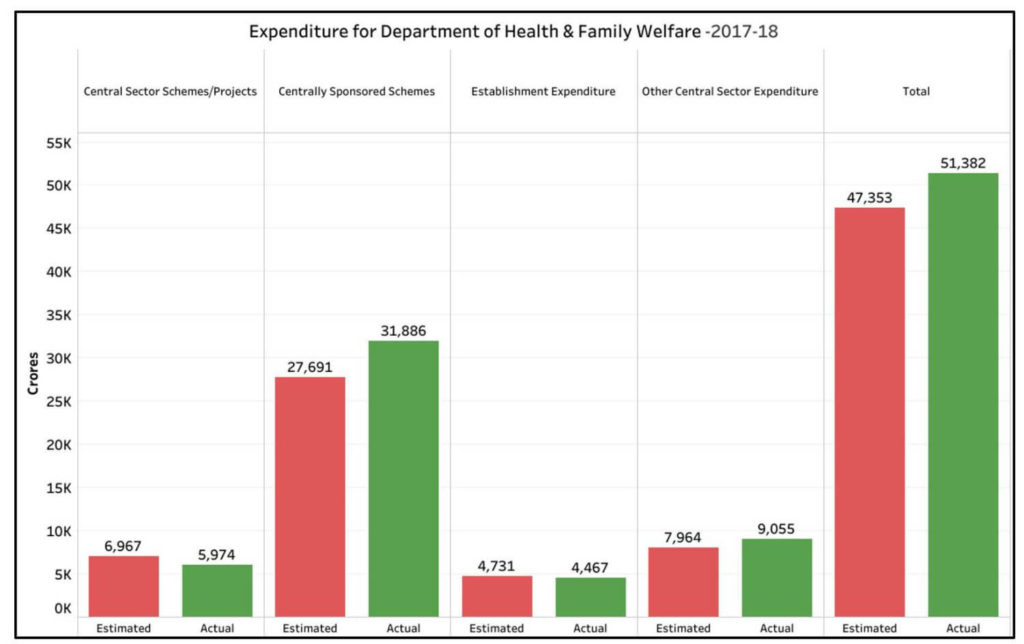

Department of Health and Family Welfare – Actual expenditure more than estimates under Centre’s support for Immunization and Pulse Polio program

The estimated expenditure for Department of Health and Family Welfare was ₹ 47,352 crores, however the actual expenditure is to the tune of ₹ 51,381 crores. While most of the heads under the department did not show much variance between the estimated expenditure and actual expenditure, the major difference was the excess actual expenditure under National Rural Health mission.

National Rural Health Mission (NRHM) is a Centrally sponsored Scheme focussed on improving the health conditions in the Rural areas. Under this mission, the Centre contributes for a Pool fund which includes programmes such as immunization, pulse polio programme, Iodine deficiency disorders control programme etc. The estimated expenditure for this pool fund was ₹ 4,566 crores, while the actual expenditure overshot the estimate by ₹3,073 crores (actual amount : ₹ 7640 crores). In other words, the actual expenditure on NRHM is 65% more than the estimates.

Department of Revenue: Excess actual expenditure due to GST Compensation Fund

The estimate of expenditure for Revenue Department in the Ministry of Finance for year 2017-18 was only ₹ 500 which was majorly towards the establishment expenditure of the Central Government. However during 2017-18 , the Central Government has implemented Goods & Services Tax. Hence, as a compensation to the states, ₹ 56,146 crores was transferred to Compensation for GST Fund.

Therefore the actual total expenditure of Department of Revenue for the year 2017-18 was ₹ 58,117 crores due to the transfer of money to the GST compensation fund.

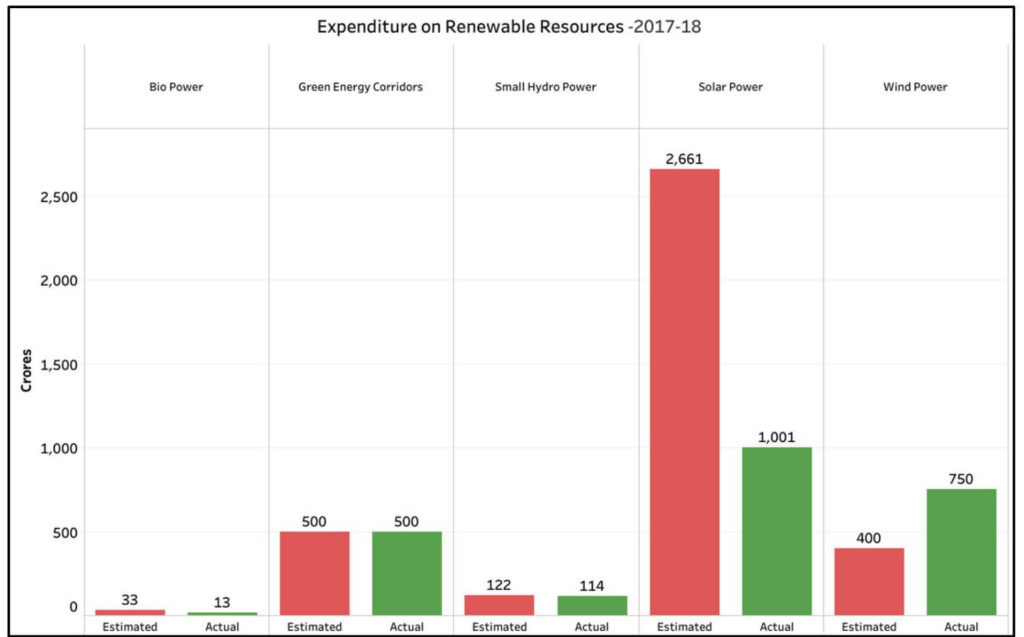

Ministry of New and Renewable Energy- Actual expenditure less than estimates for Solar Energy under Central Sector Schemes

Investment into New and renewable Energy resources is a critical aspect for National development through securing energy security. Non-renewable resources are not only running out but are also harmful for the environment. Hence the focus of any progressive nation is to find alternate and sustainable energy sources. Solar Energy, Wind Energy, Hydro power and other green alternatives are classified as renewable energy sources.

As a step in the right direction, Central Government has estimated an expenditure of ₹ 5472 crores. However, the actual expenditure by the department for 2017-18 is only ₹ 3644 crores. The difference between the estimate and actual is due to lower expenditure in the case of solar energy under Central Sector Scheme of Grid Interactive Renewable Power. The estimate expenditure was ₹ 2661 crores while the actual expenditure for 2017-18 is ₹ 1001 crores i.e. only 37.63% of the estimated expenditure.

Increase in revenue and administrative expenditure at cost of Govt schemes and Capital estimates

The departments highlighted in the article are among the 100 different departments for which the Union budget allocates funds in the budget. These departments had larger variance between the estimates and actuals. Few of the departments did not utilise the funds allocated as part of budget 2017-18 with the actual numbers being lower than estimates. Few other department have incurred a greater expenditure than what was estimated. A common trend among most of such department is the excess of revenue expenditure especially administrative expenses. This in turn has effected the designated expenditure for capital expenditure and in few cases also impacted the funds for central schemes.