In the last few years, the RBI issued multiple directions to simplify card transactions and give more control to consumers in terms of setting limits & accessing services. Here is an explainer of all those changes.

Reserve Bank of India (RBI) has been taking a number of initiatives to enhance the efficiency and safety of card-based payment systems. In this regard, various directives have been issued by the RBI, under the Payment and Settlements Systems Act 2007, on enhancing convenience, security and risk mitigation measures involving card transactions. Here is a brief look at the measures undertaken in the recent past.

Customers to have complete control of Transaction limits & services

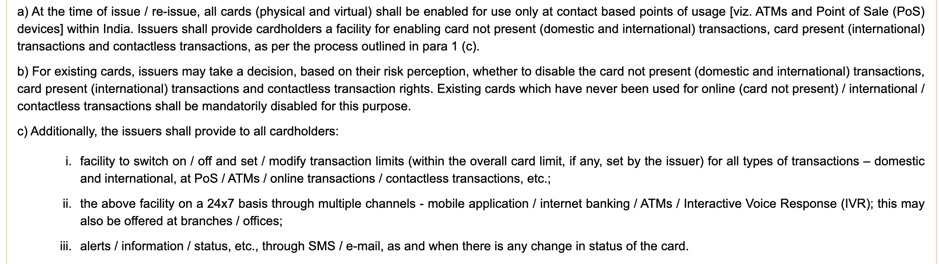

According to RBI’s directive issued on 15 January 2020, at the time of issuance/re-issuance of cards, all cards will be enabled only for domestic transactions at contact-based points of usage i.e. ATMs and Point of Sale (PoS). For online, contactless and international transactions, the new card users would have to get these services set up from the issuer and customers with existing cards would have the option to disable these services, depending on their risk perception.

A 24*7 facility to switch on/off and set/modify card transaction limits (within the overall card limit) for all types of transactions – international, domestic, PoS, ATMs, online or contactless transactions – would be available through multiple channels (mobile application, internet banking, ATMs, IVR, branch/offices).

Customer-friendly NEFT & RTGS transactions

In order to provide impetus to digital fund movement, the RBI waived off all processing charges and time-varying charges levied on banks for RTGS and NEFT system in a circular issued on 11 June 2019. Furthermore, the RBI instructed banks to not levy any charges from their savings bank account holders for online fund transfer done through NEFT system in another circular issued on 16 December 2019.

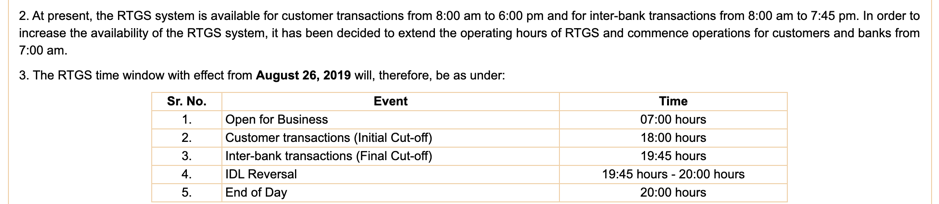

Around the same time, the RBI issued another circular on 06 December 2019 regarding availability of NEFT on a 24*7 basis (on all days, including holidays). Moreover, the RBI directed the availability of RTGS system to be extended in two circulars dated 21 August 2019 and 28 May 2019. Previously, the RTGS system was available from 8 am to 4:30 pm for customer transactions and 8 am to 7:45 pm for inter-bank transactions. The closing time for customer transactions was extended up to 6 pm and the opening time for both customer and inter-bank transactions was changed to 7 am.

Scrapping of 2-factor authentication for payments up to Rs. 2000

To foster innovative payment products and to enhance the convenience factor in card transactions, RBI issued instructions for relaxation of Additional Factor of Authentication (AFA) for payments up to Rs. 2000 in case of ‘card present transactions’ using Near Field Communication (NFC) contactless technology on 15 May 2015. The same relaxation was extended to ‘card not present’ transactions on 06 December 2016.

In both the cases, the customer’s consent is to be taken while making this solution available to them and the banks/card networks are to bear full responsibility in the event of any security breach in the authorised network.

Notifications & Alerts

In the interest of customer awareness and protection, the RBI has advised the banks (in various master circulars) to send SMS alert & emails to their customers about international, domestic, PoS, ATMs, online or contactless transactions. Additionally, to also provide necessary URLs and customer care numbers where additional information can be obtained. The banks are also encouraged to use social media to build awareness.

The RBI directives also advise the banks & card networks to educate the customer about the use and risk associated with different modes of card transactions, and also mechanisms for grievance redressal through multiple channels (website, phone banking, SMS, IVR, etc.).