A good credit score is a prerequisite to access credit from a bank or any financial institution. But who compiles your credit score, based on what factors? Here is a detailed explainer.

Lending money is fraught with risks. Whether it is loans or credit cards, banks & other financial institutions run the risk of the debtors defaulting on credit. In order to mitigate such situations, due diligence is exercised in evaluating the credit worthiness of the customer before extended any offer of loan or a credit card.

This process of evaluation is assisted by the services of Credit Information Companies (CIC), which assist the banks in determining the credit worthiness of the customers who applied for a loan or a credit card. The information by CICs helps in creating a Credit Report of customers. The Credit Report is a statement of the financial history of the customer, which can be used by banks or financial institutions to evaluate its customers and take a decision on their request.

Credit Information Company (CIC) is an independent third-party agency that collects financial data of individuals pertaining to their loans, credit cards and other related information and shares with its members, who generally happen to be banks and other financial institutions.

In this story, we explain what these Credit Information Companies are, their role and the services provided by them.

Credit Information Companies in India need to obtain license from RBI

The nature of the services provided by CICs entails them to be a key part of the decision-making process of the banks & NBFCs in their lending activities. Hence the credit information provided needs to be accurate and trustworthy. Therefore all the CICs in India are licensed by Reserve Bank of India (RBI) and are governed by the provisions under Credit Information Companies Regulation Act (CIC Act), 2005 and other RBI regulations and guidelines. This was further followed by Credit Information Companies, Regulations and Rules Act, 2006.

As per Section 2 of CIC Act , ‘Credit Information’ refers to any information relating to

- Amounts and nature of the loans or advances, amounts outstanding under credit cards and other credit facilities granted (or to be granted) by a Credit institution i.e. banks or financial institutions to any borrower.

- The type and nature of the security taken (or proposed to be taken) by the credit institutions from the borrower in relation to the credit facilities being provided.

- The guarantee furnished by a credit institution to its borrowers.

- The creditworthiness of any borrower

- Any other information which the RBI may consider it to be necessary to be included in the Credit Information.

This section of the act, further provides for the definition of a Credit Information Company

As per this definition, a Credit Information Company:

- Needs to be a company that was formed and registered under the Companies Act, 1956

- Is granted a Certificate of registration under sub-section (2) of Section 5, of CIC Act, 2005.

Section 3, of CIC Act, 2005 clearly prohibits any company from carrying out the business activity of credit information, without having the Certificate of Registration from RBI. Hence it is mandatory to apply and obtain for this certificate from RBI.

Application and Grant of Certification of Registration

Section 4 of CIC Act, 2005, specifies that any company which intends to start Credit Information business needs to apply for registration to the RBI as per the specified regulations. Even the existing companies that were dealing Credit Information at the time of enactment of the Act, were also required to apply for Certificate of Registration, nevertheless they were allowed to carry on with their business until receiving the certification or rejection from RBI.

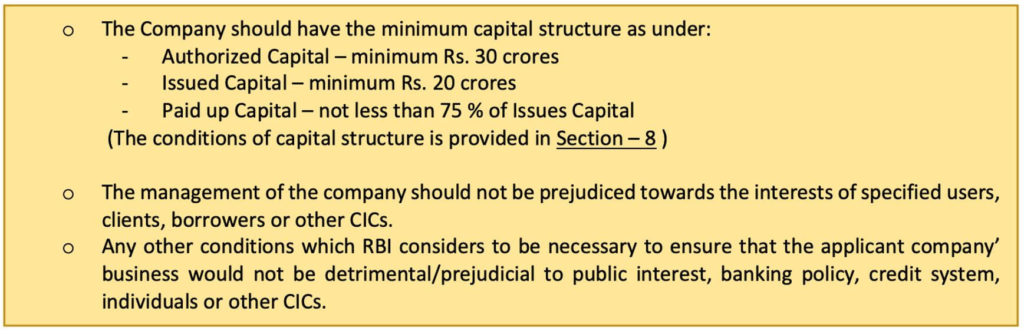

The conditions which needs to be satisfied by the companies to receive the Certification of Registration from RBI, are laid out in Section 5 of CIC Act, 2005.

Once an application for registration is filed, RBI can either grant a certificate of registration or reject it.

However, the applicant company is provided an opportunity to be heard, before a decision is made on rejecting the application.

RBI reserves the right to determine the number of Credit Information Companies that can be granted with the Certificates of Registration to carry out the business of Credit Information, by taking into consideration various factors like the available business of Credit Information, the scope of expansion of existing CICs etc.

Currently there are 4 authorized Credit Information Companies in India.

- Credit Information Bureau (India) Limited – CIBIL

- Equifax Credit Information Services Private Limited

- Experian Credit Information Company of India Private Limited

- CRIF High Mark Credit Information Services Private Limited

Furthermore, RBI has the right to cancel the Certificate of Registration of any CIC as per the conditions laid out in Section 6, of CIC Act 2005.

CICs collect credit information and provide it to its members

Section 15 of CIC Act stipulates that it is compulsory for all the credit institutions (i.e. Banks, NBFCs and other Financial Institutions) become member of a Credit Information Company. The section further lays down the rules surrounding the membership with the CICs.

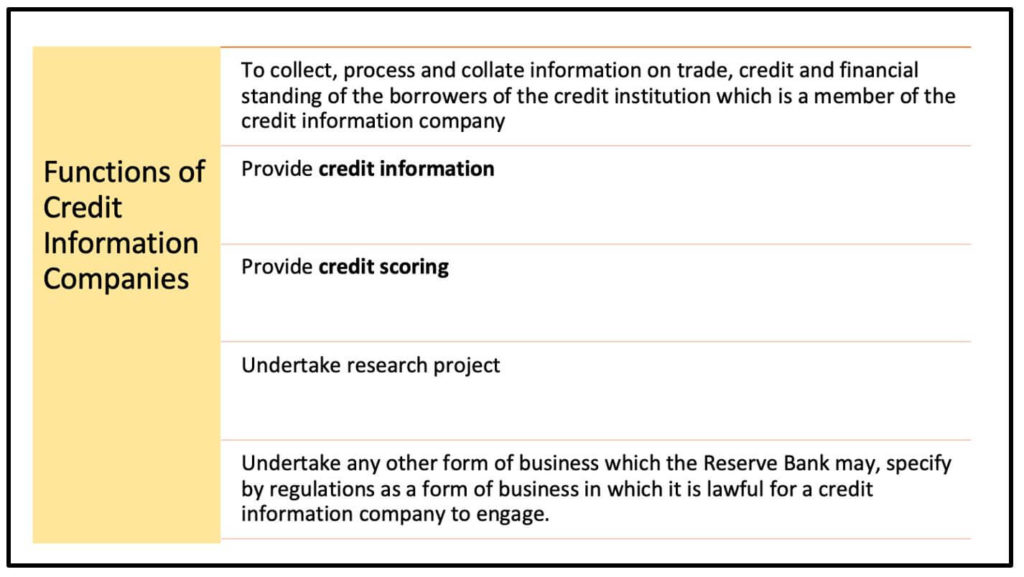

The defined functions of CICs as laid out in Section 14 include the following.

The Credit Information or Credit Rating can be provided to:

- its specified users

- to the specified users of any other credit information company

- or to any other credit information company being its member.

Other rules in the functioning of CICs include:

- CICs are restricted from engaging in other forms of business than those specified in CIC Act 2005.

- Can register Credit Institutions and other CICs as its members.

- Can charge fee to furnish information to a specified user. The limits on the charges that can be levied are determined by RBI.

One free report for individuals every year

Credit report plays a key role in the application for a loan or a credit card. The Credit institutions lay emphasis on the credit score to determine the extent of the credit and to draw up the terms and conditions based on the credit worthiness of the applicant.

Credit Instructions, which are required to be members of any of the CICs depend on the Credit Report provided by the CICs to extend loans. The report is provided based on the request received from the respective credit institution which is processing the loan/credit card request of the individual applicant.

A CIC can seek the assistance of other CIC, if the bank or NBFC relating to the financial history of the applicant is not their own member. CIC Act,2005 requires the CICs to come up with specific procedures to receive requests and provide information.

Apart from the member credit institutions, even individuals can check their credit scores. The CIC’s have their own process through which the individuals can apply for a credit report for a specified fee. CIBIL’s credit report is one such report. A good CIBIL score is considered as a prerequisite for a loan or procuring a Credit card.

As per the RBI’s notification issued in 2016, each customer/individual should be provided one base level consumer Credit Information Report (CIR) free of cost every year by each Credit Information Company (CIC). This report should beone free full credit report (FFCR) including credit score.

Customer Credit Information is provided security under CIC Act 2005

One of the prime apprehensions about Credit Information Companies is about the secrecy of customer information. However, this is safeguarded through the privacy principles in the CIC Act.

- Care ought to be exercised in respect to the collection of Credit Information. CIC’s obligation includes proper collection, recording and storage of the data along with ensuring that there is not theft or loss of such information. Credit Institutions also take up the ownership on accuracy and security of the data by providing the information to the CICs in the specified formats and by updating the information regularly.

- Security related procedures ought to be kept in place by both CICs and Credit Institutions. The employees are required to sign a declaration of fidelity and secrecy.

- Procedures need to be laid out in respect to disclosure of information.

- The Data collected needs to be – adequate, relevant and not excessive to the purpose.

- The usage of Data is limited to – specified user, complying with court order, borrower on basis of request, specified by RBI.

- The drawing of reports is limited to specific users.

All the CICs are required to develop procedures and controls that are in line with the privacy principles.

There have been instances earlier where in the Credit Institutions were involved in sharing the credit information with Fintech companies, whose platforms were being used by the Credit Institutions to reach out to customers and to process their requests. However, RBI has put curbs on this practice and have asked the Credit Institutions to refrain from this practice.

Featured Image: Credit Information Companies